Real estate sentiment remains generally positive in the US and Canada, aside from retail

AFIRE recently partnered with the Royal Institution of Chartered Surveyors (RICS), a professional body promoting and enforcing the highest international standards in the valuation, management and development of land, real estate, construction, and infrastructure, to collaborate on research for the organization’s quarterly North America Commercial Property Monitor – part of RICS’ Global Commercial Property Monitors, which serve as leading indicators of conditions in commercial property occupier and investor markets around the world.

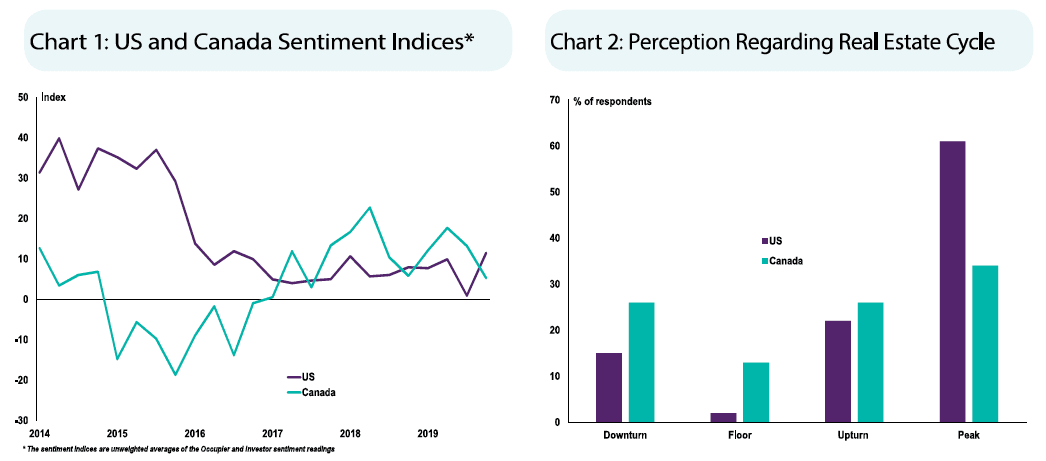

The Q4 2019 North America Commercial Property Monitor, just released (available for download here and below), shows the key metrics capturing sentiment amongst occupiers and investors to be a little firmer in the US than in the previous three-month period. The improvement is being driven strong readings for the industrials/logistics sector and a modest uplift in the feedback around offices; the negative mood around particularly secondary retail space shows little sign of easing. For Canada, at an aggregate level the headline measures of sentiment, while still positive, are less so than in Q3.

This picture is broadly reflected in charts which suggests that around 17% of respondents from the US and 40% from Canada, view their market as being in a “downturn” phase or “at the bottom” of the real estate cycle; the respective figures for the third quarter were 35% and just over 40%. Anecdotal evidence suggests the improved readings for the US may, at least in part, reflect better news regarding the trade outlook.

Disaggregating to city level, a set of relevant charts (3 to 8) capture the feedback from respondents for New York and Toronto. In terms of the outlook for the former over the next twelve months, the multifamily sector is anticipated to deliver the strongest return with capital values projected to rise by more than 3% supported by further gains in rental values despite new legislation curbing landlords flexibility in this area. This is followed by industrials/logistics, a trend visible across the US. For Toronto (where multifamily is not included in the questionnaire), it is unsurprisingly industrials/logistics which is forecast to be the best performer aided by a lack of availability of good quality and well located space.

Meanwhile, international investors appear particularly predisposed to deploying capital in the UK over the next twelve months following the decisive outcome to the British general election which also provided a clearer mandate on delivering Brexit. The other two destinations heavily cited by respondents are the US and Japan. In a separate question ranking the riskiness of the the global macro environment for commercial real estate investment, around three-fifths were just above the mid point on a one-to-six scale with a further 15% just below.

Click here or below to access the rest of the report: