The logistics sector was the winner of the pandemic recession—but is its rise built to last?

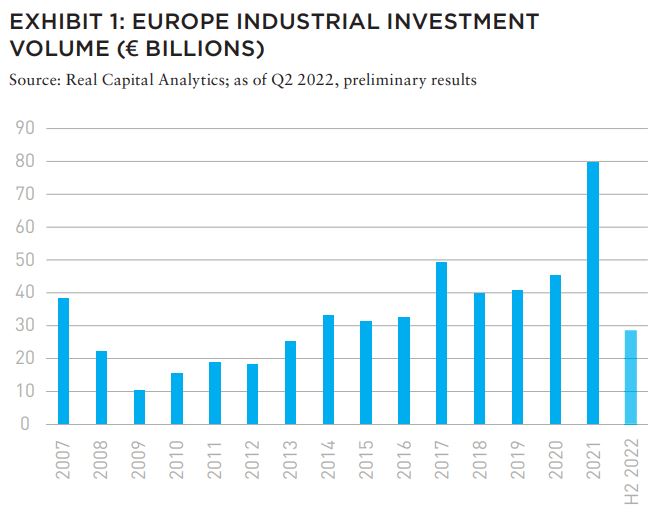

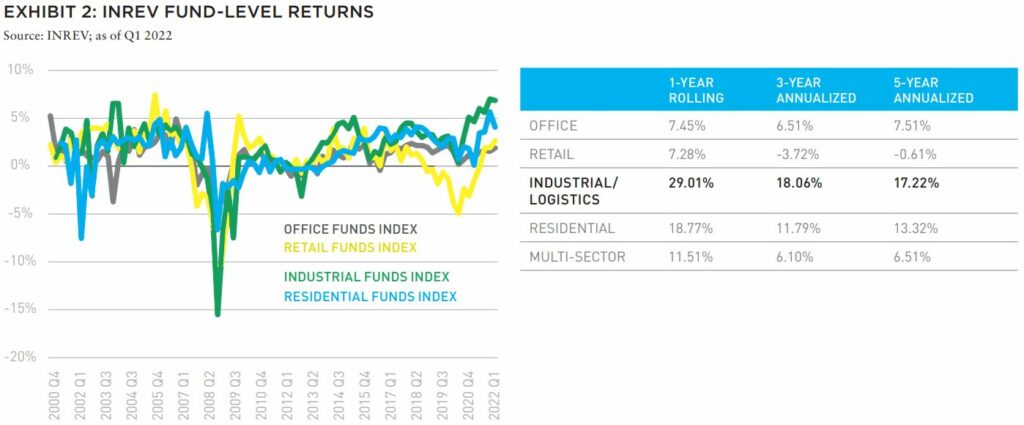

The logistics sector has come out of the COVID-19 recession more sought-after than ever. The European logistics sector had an outstanding 2021: investment volumes reached record levels, almost doubling year-on-year (Exhibit 1); yields continued to decline to historic lows with transacted cap rates recorded 60 BPS below the office sector. As a result, INREV fund-level logistics returns has posted a five-year annualized return of 17.2% (Exhibit 2). This outperformed all other sectors, including residential (13.3%) and office (7.5%).

Macroeconomic and geopolitical developments since the start of 2022, however, represent headwinds to last year’s bullish outlook. The situation in Ukraine disrupted global recovery and international trade, which had already taken a big hit from the pandemic. Shifting consumer spending from retail towards services and deteriorating household purchasing power due to high inflation levels have slowed down the pandemic-driven e-commerce boost. Furthermore, given historically low logistics property yields, the rise in real government yields since the start of this year implies repricing risk for the sector.

Despite these near-term headwinds, however, the European logistics sector’s secular long-term demand drivers persist. As further yield compression is unlikely in the current environment, future returns will be driven by rental growth. Supply fundamentals are healthy with the European logistics vacancy rate at 3.3% in Q1 2022, an all-time low.1 Development costs are rising amid spiking construction costs and higher interest rates, slowing down new supply. Long-term demand drivers remain in place, supported by an even greater importance on near-shoring of supply chains after Russia’s invasion of Ukraine. As a result, rental growth in the logistics sector is expected to outperform other property sectors in Europe. Understanding logistics’ long-term demand trends is therefore more important than ever.

ACCELERATION OF E-COMMERCE

The rise of e-commerce has resulted in more complex global supply chains. Logistics now has more diverse space requirements than before. New necessities include e-fulfilment centers and parcel hubs, as well as sorting and delivery centers of varied sizes and locations. Facilities must be able to handle a greater product variety, easy returns, higher sales volatility, and lower space efficiency of parcel shipping.

The pandemic hastened ten years of e-commerce adoption into just a few months.2 Even though some of the boost proved to be transitory, there are lasting impacts on consumer preferences. Lockdowns expanded online penetration of new product categories, such as online groceries and home improvement products. The pandemic also forced adoption by older age cohorts: 70% of Baby Boomers who bought groceries online in France from mid-March to mid-April 2020 were first-time buyers.3 As a result, global e-commerce sales continued to rise in 2021, reaching US$3.1 trillion by the end of the year, marking an approximately 140% increase in five years. Global online penetration rose from 9% in 2016 to 20% in 2021.4 CBRE estimates that annual global ecommerce sales will rise by USD 2.2 trillion to USD 5.2 trillion by 2026 which will require 160-200 million SF of additional e-commerce dedicated logistics space.5

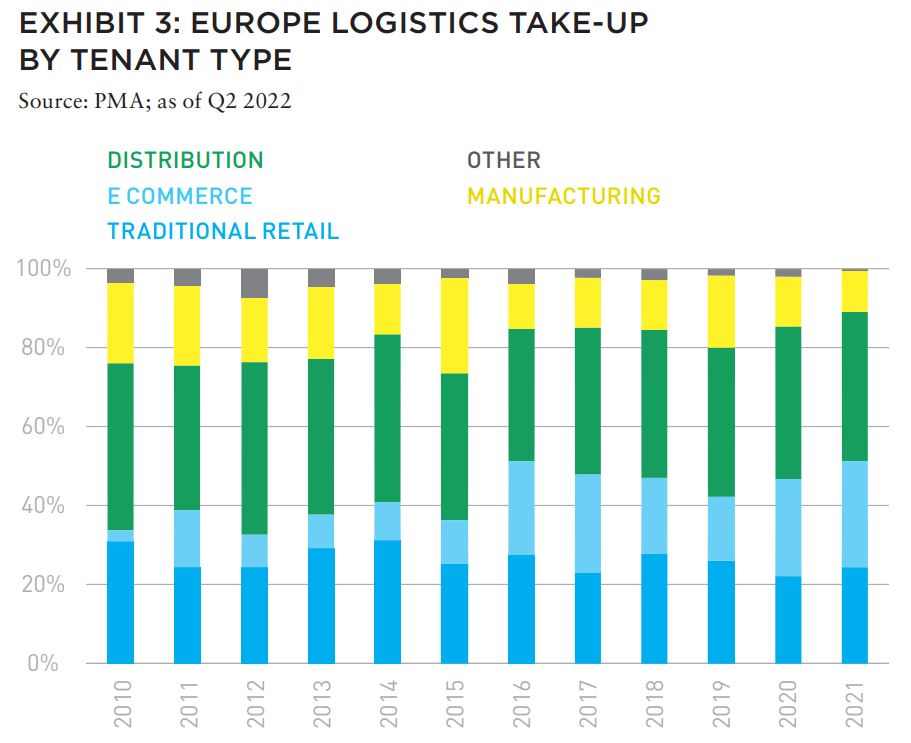

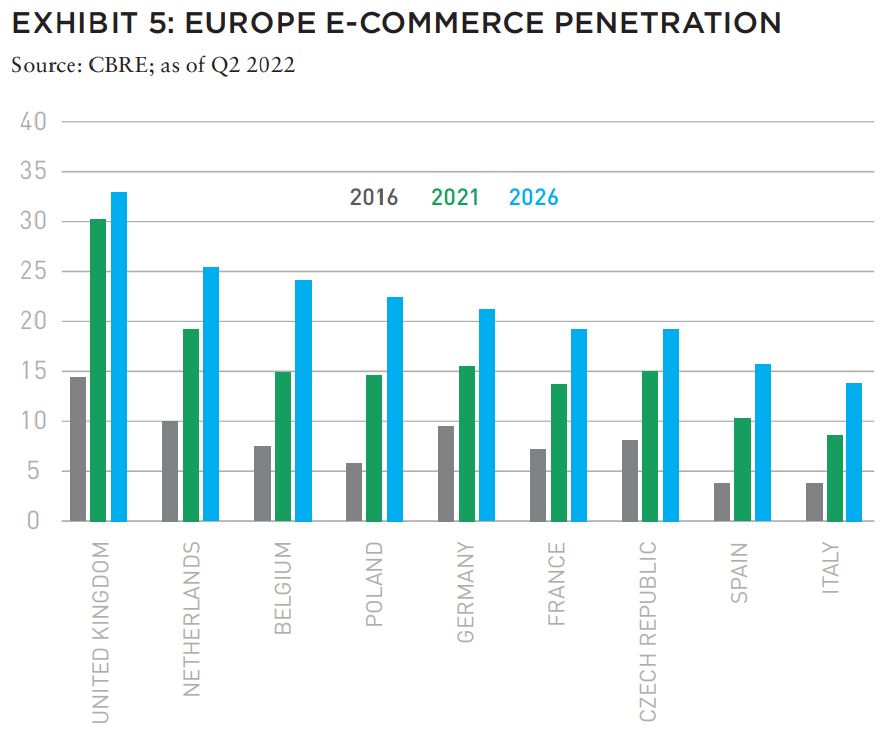

The pandemic marked a tipping point in Europe’s e-commerce adoption (16.3%),6 which has typically lagged the US (approx. 20%) and Asia Pacific regions (South Korea >40%; China >25%).7 Across Europe, divergent e-commerce penetration offers many different opportunities (Exhibit 3). Most European countries are below the e-commerce penetration rates seen in Asia, and therefore would need more logistics space. Advanced ecommerce markets such as the UK and the Netherlands have been forerunners at the adoption of innovative solutions such as instant grocery delivery. Given that online penetration has exceeded a certain threshold with the help of the pandemic, online shopping will grow faster in lagging countries and new solutions will be more easily adopted going forward.

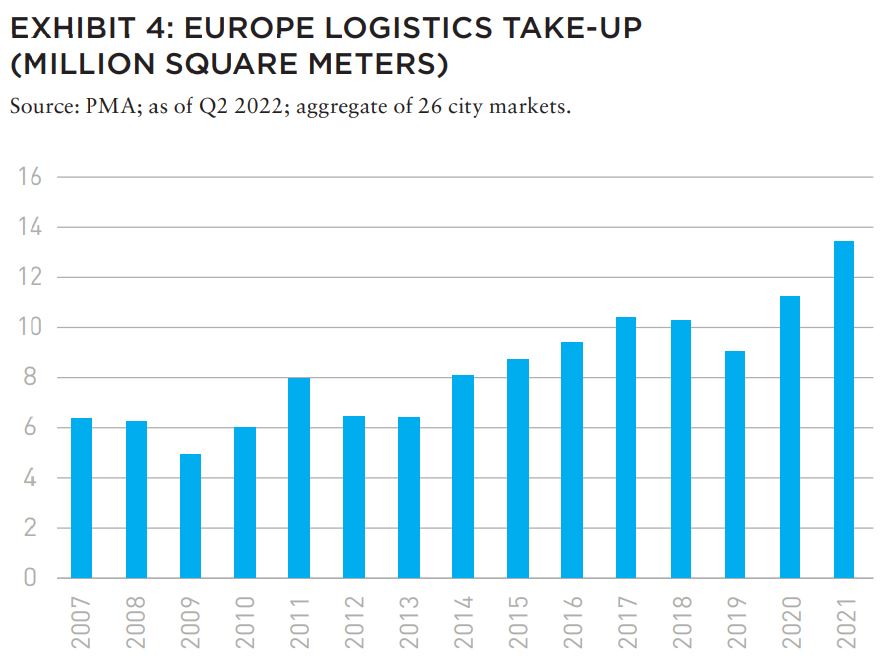

The impact of e-commerce demand is visible on logistics leasing activity. E-commerce share in take-up doubled in 2016 and remained high ever since making up around a quarter of overall logistics demand (Exhibit 4). The pandemic has proved this relationship even stronger. Despite significant downturn in industrial production and international trade, logistics take-up in Europe increased concurrently with the fast rebound of e-commerce sales driven by lockdowns and pent-up demand (Exhibit 5).

INCREASED IMPORTANCE OF URBAN LOCATIONS

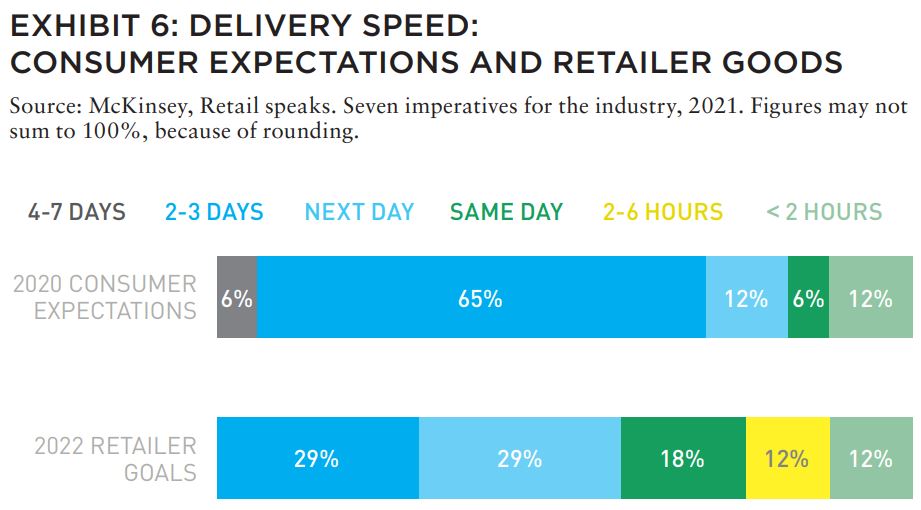

Demand for urban logistics space will rise as delivery times continue to compress. Fast and reliable delivery provides a significant competitive advantage to retailers.8 A survey published in March 2021 shows that retailers have ambitious delivery targets for the near future exceeding what consumers are currently asking for (Exhibit 6). Improvements in delivery speed will require significant supply chain investment towards end-consumers.

A social focus on sustainability and new technologies will also reinforce the trend towards urban logistics. An MIT study found that adding an urban fulfilment center in a given market cut transportation emissions in half compared to out-of-town distribution.9 Moreover, cities offer wider opportunities for the use of electric vehicles, autonomous vehicles, drones, and green delivery options, such as bike couriers.

Dense European cities have scarce available land and many zoning restrictions, and so will require innovative approaches to logistics. There are a few viable solutions to accommodate more industrial space within densely populated cities. Multi-story warehousing, already used in Asia, may become more popular in Europe if the necessity for last-mile facilities and land values remain high. (New vertical last-mile logistics hubs include G Park London Docklands and Paris Air2 Logistique.) Alternatively, mixed-use buildings with logistics included may provide a compromise that opens up new locations.

FOCUS ON ESG PERFORMANCE

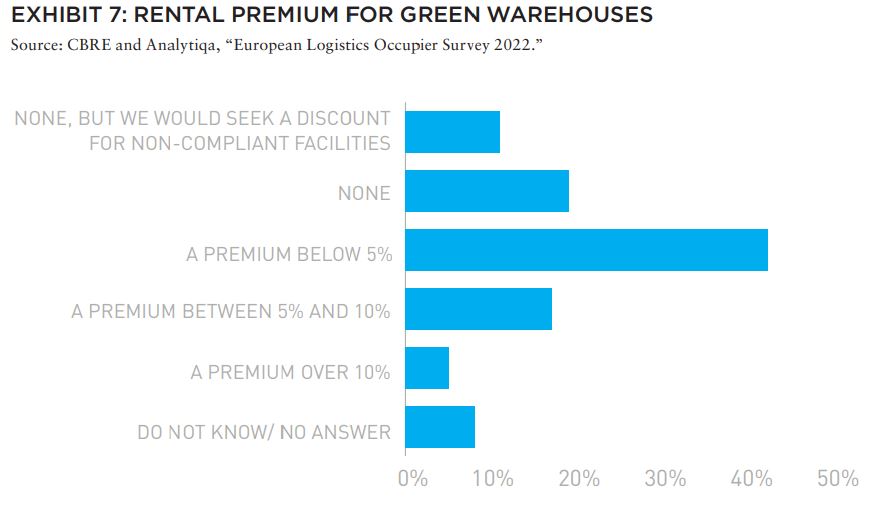

Strong demand for ESG performance will lead to green building rental premiums. This is especially true in Europe: the region has stringent regulations, higher consumer sensitivity, and ambitious corporate sustainability targets. According to a survey published in June 2022, 78% of occupiers have a net-zero target.10 Consequently, occupiers’ value considerations for space is affected by properties’ green qualifications: 63% of survey respondents stated that they are willing to pay a premium for a green-certified property, whereas 11% said they would ask for a discount if the facility does not have a green certification (Exhibit 7).

Future-proofing assets to meet ESG expectations will require a holistic approach. Other parts of the supply chain will need to be transformed to make them more sustainable. For example, delivery vehicles are expected to electrify rapidly as more low-emissions zones are introduced in Europe. Similarly, there are efforts to decarbonize freight transport by using hydrogen as a fuel. In Germany, the government is supporting a company called Clean Logistics that converts heavy diesel trucks to hybrid hydrogen power. Warehouses will need to accommodate new requirements that come with these changes. For example, charging points for electric vehicles or easy access to hydrogen filling stations could become essential.

SHIFTING NEEDS IN SUPPLY CHAINS

Vulnerabilities of global supply chains were laid bare by the disruptions caused by the COVID-19 pandemic and have now been amplified by the war in Ukraine. The automobile sector alone was forecast to lose US$210 billion in revenue due to semiconductor shortages in 2021.11 A McKinsey study has shown there have been more frequent and severe supply shocks in recent years: disruptions lasting a month or more now occur every 3.7 years on average. As a result, companies may lose more than 40% of a year’s profits every decade.12

After the invasion of Ukraine, companies are thus under pressure to improve the resilience of their supply chains through reshoring/near-shoring and to hold higher inventory levels closer to the centers of production or consumption. In Europe, Green Street estimates a modest change away from just-in-time would require 5-10% more industrial space.13 Some early examples of supply chain diversification are evident in semiconductor manufacturing in Europe.

Against the backdrop of rising labour and transportation costs, logistics building costs (rent and service charges) are constrained representing less than 10% of total operating costs.14 This increases the rationale for re-shoring/near-shoring and could present opportunities for Central and Eastern European countries once the geopolitical tensions are resolved. With accelerating automation, this trend could mitigate challenges of higher wages and tight labor supply, and thus spread across additional regions in Europe.

—

The authors describe the demand drivers for logistics in post-pandemic Europe, arguing that higher demand from tenants leads to higher rental rate growth since value appreciation is unlikely to come from further cap rate compression.

The authors’ focus on the changing nature of logistics based on today’s complex supply chains resulting from an increase in overall consumption as well as an acceleration in adoption of e-commerce. These changes will alter the type of industrial real estate that users require, targeting urban locations and buildings that satisfy ESG criteria. The same trends supporting higher demand are certainly also prevalent in North America though not necessarily at the same levels.

The discussion on the evolution of the type of logistics facilities leaves the reader curious about exactly what type of requirements need to be fulfilled. Are there “must-haves” that future industrial buildings will need in order to get leased at any price?

While the Authors concede that further cap rate compression is unlikely to support future value increases, it would be worthwhile to also examine the possibility of rising interest rates decreasing values despite higher demand. If logistics demand is driven largely by consumer demand for goods, how sensitive is rental rate growth to a recession? Is it likely to be less so than for other asset classes? Is some of the increase in demand for consumer goods based on consumers adjusting to a lockdown lifestyle and therefore could that be transient?

Lastly, it would be worthwhile to discuss the ability of new supply to keep up with the projected demand. Foreign investors, in particular, are less well positioned to understand the local nuances of geography and planning administrations on supporting or hindering the development of new supply

Peter Grey-Wolf

Vice President, Wealthcap

Editorial Board Member, Summit Journal

ABOUT THE AUTHORS

Megan Walters, PhD is Global Head of Research and Hugues Braconnier is Head of Logistics for Allianz Real Estate. Additional contributors include Gizem Bartu, Clemens Ernst, and Luke Latham.

—

EXPLORE THE LATEST ISSUE

CAPITAL MARKETS PULSE

Through the rest of this year, investors forecast challenges for global capital, but thoughtful investors are forging ahead.

Gunnar Branson and Benjamin van Loon | AFIRE

ON/OFF SWITCH

While the market rarely sends clear investing signals, current market conditions are replete with clues, but as timing for corrections is difficult, a move to risk-off strategies could be useful.

Joseph L. Pagliari | University of Chicago

MOBILE ZONING

Mobile information technology has upended US land use regulation, and the ramifications of this technological upheaval are finally coming into view.

Robert Seldin | Madison Highland Live Work Lofts

GET SMART

As buildings become increasingly technologized, especially after the pandemic, cyber-attacks can put entire properties at risk and require a firmwide security approach.

Noëlle Brisson and Michael Savoie | CyberReady, LLC

HEDGE TRIMMING

The rapid rise in consumer prices has rekindled the old debate about whether commercial real estate provides a long-term hedge against inflation (hint: look at multifamily).

Gleb Nechayev, CRE | Berkshire Residential Investments

THE NEW SCIENCE

While the real estate industry has long understood the need for data, it still struggles with connecting information to decision making. New strides in data science could change that.

Brian Biggs and Ashton Sein | Grosvenor

BRACE FOR IMPACT

The practice and expectations of investing across all industries is undergoing major upheaval and the key to stability will mean looking beyond profit for profit’s sake.

Michael Cooper and Richard Florida | Dream Unlimited Corporation

TRANSITION PLANS

Forecasts about the future of the office sector are often wildly conflicting, but the looming high tide of generational leadership transitions could change the script.

Sabrina Unger and Britteni Lupe | American Realty Advisors

WHAT DRIVES LOGISTICS?

The logistics sector was the winner of the pandemic recession—but is its rise built to last?

Hugues Braconnier and Dr. Megan Walters | Allianz Real Estate

RENEWED PURPOSE

From retail to office to abandoned factories and warehouses, owners of real estate are rethinking—and reinventing—the future of their investments.

John Thomas and Stacey Krumin | Squire Patton Boggs

DATABASICS

Data centers have become an increasingly institutionalized property class over the past several years, but finding success in the sector depends on talent and expertise.

Max Shepherd, Jannah Babasa, and Isabel Ruiz Halter | Sheffield Haworth

COOPERATIVE INVESTMENT

As insurance costs of residential and commercial spiral out of control, a 1400-year-old tradition is poised to offer long-term, sustainable growth for real estate investments.

Ishmam Ahmed | Georgetown University & AFIRE

DOMESTIC MIGRATION TRENDS

Dive into the report to understand if and how COVID impacted domestic migration patterns on a state, city, and zip code level.

Ethan Chernofsky | Placer.ai

UP FRONT

How does the Consumer Price Index account for the cost of housing?

David Wessel and Sophia Campbell | The Brookings Institution

NOTES

1 “Industrial Insights: Frugal Consumer = Slower Ecommerce Growth,” Green Street, updated July 2022; greenstreet.com.

2 “How COVID-19 is Changing Consumer Behavior—Now and Forever,” McKinsey & Company, updated 2020, mckinsey.com/industries/retail/our-insights/how-covid-19-ischanging-consumer-behavior-now-and-forever.

3 “Share of First-Time Buyers Online Since the Confinement in France 2020,” Statista, updated July 5, 2021, statista.com/statistics/1111384/online-grocery-shoppingcoronavirus-generations-population-france/.

4 “Global E-commerce Outlook 2022,” CBRE, updated 2022, cbre.com/insights/reports/ global-e-commerce-outlook-2022.

5 Europe refers to simple average of nine countries covered by CBRE forecasts, data as of Q2 2022.

6 “Global E-commerce Outlook 2022,” CBRE, updated 2022, cbre.com/insights/reports/ global-e-commerce-outlook-2022.

7 Europe refers to simple average of nine countries covered by CBRE forecasts.

8 “Consumer Insights Pulse Survey,” PWC, updated June 2021, pwc.com/gx/en/industries/ consumer-markets/consumer-insights-survey/archive/consumer-insights-survey-2021. html. Note: Consumer survey published in in June 2021 finds fast and reliable delivery ranked as the most important attribute of online shopping globally (41% of respondents).

9 “Retail Carbon Footprints: Measuring Impacts from Real Estate and Technology,” MIT Real Estate Innovation Lab, updated 2020, realestateinnovationlab.mit.edu/research_ article/retail-carbon-footprints-measuring-impacts-from-real-estate-and-technology/.

10 “European Logistics Occupier Survey 2022,” CBRE and Analytiqa, updated June 2022, analytiqa.com/research/reports/european-logistics-occupier-survey-2022/.

11 “Shortages Related to Semiconductors to Cost the Auto Industry $210 Billion in Revenues This Year, Says New AlixPartners Forecast,” AlixPartners, updated September 23, 2021, alixpartners.com/media-center/press-releases/press-release-shortages-relatedto-semiconductors-to-cost-the-auto-industry-210-billion-in-revenues-this-year-says-newalixpartners-forecast/.

12 “Risk, Resilience, and Rebalancing in Global Value Chains, “ McKinsey & Company, updated August 6, 2020, mckinsey.com/business-functions/operations/our-insights/riskresilience-and-rebalancing-in-global-value-chains.

13 “Industrial: Supply Chain Disruption Beneficiary,” Green Street, updated November 18, 2021.

14 “European Logistics Occupier Survey 2022,” CBRE and Analytiqa, updated June 2022.

THIS ISSUE OF SUMMIT JOURNAL IS PROUDLY SUPPORTED BY

Aegon Asset Management is an active global investor that manages and advises on assets of $328 billion* for global pension plans, public funds, insurance companies, banks, wealth managers, family offices, and foundations. Aegon AM’s Real Assets platform focuses on delivering yield-oriented and total return solutions spanning the risk/return spectrum.

With an over 35-year history and $25 billion* in AUM/AUA, the Real Assets business is built on a cycle-tested platform, deep and broad market access, and long-term relationships.

Our real assets debt and equity strategies seek to deliver strong relative value and returns through a research-intensive process. The process encompasses thoughtful top-down research and intelligent bottom-up analysis deployed by an experienced multidisciplined team of over 110 investment professionals.*

Each capability is underpinned by dedicated, in-house support and service teams including applied research, engineering and environmental, valuation, accounting, client service, legal and risk management.

*As of June 30, 2022. The assets under management/advisement described herein incorporates the entities within Aegon Asset Management brand as well as the following affiliates: Aegon Asset Management Holding B.V., Aegon Asset Management Spain, and joint-venture participations in Aegon Industrial Fund Management Co. LTD, La Banque Postale Asset Management SA, and Pelargos Capital BV.