If history is a guide, the time to invest in hotels is when things look bleak. This appears to be one of those times.

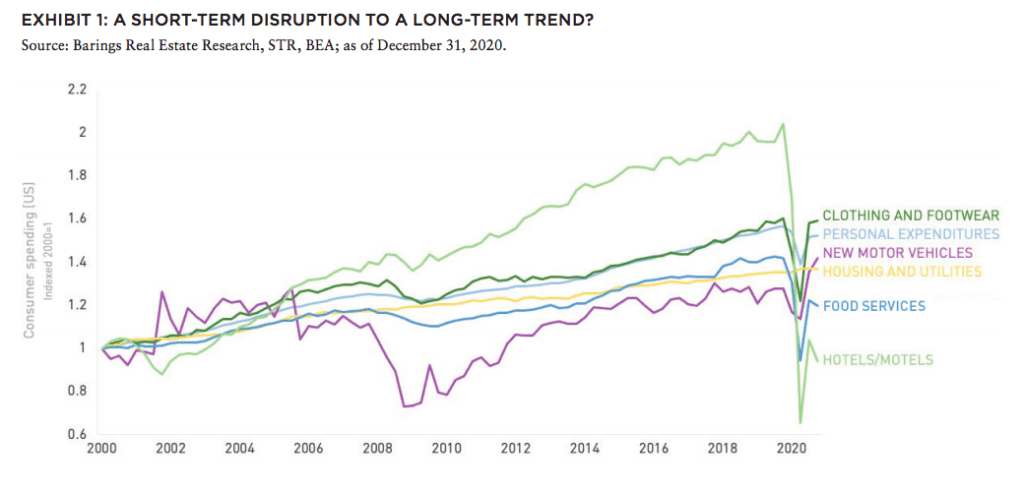

Hotels and retail properties have borne much of the global pandemic’s brunt since the spring of 2020 with COVID-19 ravaging the US economy and dramatically altering consumer behaviors.

And while the challenges facing the retail sector are as much about structural change as they are about cyclical weakness, the story is notably different in the hotel sector, which remains underpinned by long-term structural growth drivers.

That doesn’t mean the picture for hotels has been rosy. In fact, as a result of the global pandemic, US hotels saw their largest-ever decline in demand in 2020—with revenue per available room (RevPAR) down approximately 47.5% compared to 2019.[1] And even this striking statistic doesn’t tell the full story, as it wasn’t until March 2020 that the virus started to truly weigh on demand in the US.

The impact has also been uneven. Upper-upscale hotels have been hit particularly hard— with year-over-year RevPAR down roughly 62%. The fall has been even more dramatic for properties in gateway urban cities with large exposures to international travel, as well as convention business.

While there are some similarities to prior periods of crisis, the comparable impact following both the 9/11 attacks (-10.4%) and the Great Financial Crisis (-16.8%) pale in comparison to what we have witnessed from COVID over the last year. Perhaps the most obvious drivers of this are the duration of the pandemic and its global nature, which have resulted in an unprecedented drop in travel of all types.

WHERE THERE IS CRISIS, THERE IS OPPORTUNITY

Even with all of this doom and gloom, if we use past cycles as a guide, there will be opportunities emerging in the wake of the pandemic. Today, these opportunities are beginning to come into view.

The key to capitalizing on them will be to understand where the underlying structural trends, in place long before COVID, will intersect with the coming cyclical recovery—which will inevitably be uneven across the hotel sector and tied to factors such as location and property attributes.

LONG-TERM TAILWINDS

If we zoom out from the current crisis, we can see the long-term trend toward more experiential leisure—taking the trip rather than buying the jewelry, for instance. This a powerful force that cuts across today’s largest population cohorts—most notably, Gen Z, millennials and baby boomers. While COVID has interrupted this trend for the time being, there is reason to believe that lodging will continue to gain wallet share as a percentage of consumer spending. Indeed, as the millennial and Gen Z cohorts enter their prime earning years, much of their leisure spend is likely to go toward travel. Similarly, the last wave of baby boomers will enter their retirement years over the next decade, likely also spurring growth in travel spend.

A MULTI-SPEED RECOVERY

In order for this structural trend to resume, an inflection point will need to be reached cyclically. And in order for that to happen, people need to feel that it is reasonably safe to travel. The question, then, is: When will this happen?

The answer is complicated, but it seems reasonably clear that two things are true: (1) there is broad, pent-up demand across all traveler groups—from consumer to corporate; and (2) different segments of the market are likely to recover on notably different timelines.

For instance, as a greater and greater percentage of the population is vaccinated over the coming months, drive-to leisure destinations are likely to be among the first to rebound. Even destinations requiring only short-haul flights should begin to rebound sooner than later, with consumers viewing them as safer than long-haul journeys.

In fact, we are already seeing this. A southwest Florida beachfront resort in Barings Real Estate’s portfolio, for instance, has maintained occupancy at more than 60% in recent months, and the asset itself has generated significant positive cash flow over the last year—even in the face of the pandemic.

These trends favor resort destinations such as Napa Valley, the desert Southwest, and south Florida, as well as select urban areas with strong leisure demand, such as Tampa and Los Angeles. Interestingly, the “work-from-anywhere” trend has also driven demand to these and similar locations, as workers with location flexibility have been attracted by resort-style amenities and warmer climates.

On the flip side, corporate travel will be slower to come back. The widely recognized success of the great work-from-home experiment will inevitably leave businesses hesitant to immediately return to pre-COVID levels of travel spend. That said, the pentup demand for travel in corporate America is palpable. After little to no in-person meetings for a year or more, salespeople and executives across all major industries are clamoring for face time. Indeed, the hypothesis that business travel is dead likely looks far too pessimistic. At Barings, while we estimate that 2021 corporate (transient) travel spend will likely only reach 30% of 2019 levels, we expect that to accelerate in the back half of 2021, getting back to 70% and 90% of 2019 levels in 2022 and 2023, respectively.

Some areas of the market will inevitably remain challenged for several years. For instance, we expect the convention business to only get back to 50% and 80% of 2019 levels in 2022 and 2023, respectively. But even here, for large organizations such as the American Medical Association, for example, the pent-up demand to get back to in-person, annual meetings will be strong.

INVESTING IN THE DIFFERENT PHASES OF RECOVERY

Given the multi-speed trajectory that different segments of the hotel market appear to be on, it’s reasonable to anticipate that the opportunity for investors in hotels will come in phases as well.

Initially, opportunities are likely to emerge from properties that face some sort of distress. The collapse in market demand and associated temporary hotel closures have resulted in negative cash flows and operating losses for the owners of certain properties. Additionally, borrowers who had been given lifelines in the form of short-term forbearance measures will, in many cases, see those expire soon.

ALSO IN SUMMIT (SPRING 2021)

GREAT LAKES / Tightening the Belts: How are shorthand labels like the “Sun Belt” and the “Rust Belt” shaping investment decisions? Should they?

AFIRE | Gunnar Branson and Benjamin van Loon

SOCIAL ISSUES / The Great Real Estate Reset: A data-driven initiative to remake how and what we build.

Brookings | Christopher Coes, Jennifer S. Vey, and Tracy Hadden Loh

SOCIAL ISSUES / Confronting the Myth: The events of the past year have driven businesses to confront racial inequity, but some still shy away from the challenges needed to make real progress.

Alfred Dewitt Ard Consulting | Shumeca Pickett

INDUSTRY OUTLOOK / CRE Prospects Post-COVID-19: How is commercial real estate set to perform in the post-COVID world?

Aegon Asset Management | Martha Peyton

HOSPITALITY / Time to Check In: If history is a guide, the time to invest in hotels is when things look bleak. This appears to be one of those times.

Barings Real Estate | Jim O’Shaughnessy

HOSPITALITY / Hoteling 2.0: The pandemic has impacted the hospitality, but a growing wave of non-traditional investors has shown heightened interest in the evolving industry.

JLL Hotels & Hospitality Group | Gilda Perez-Alvarado

RESIDENTIAL / Safe as Houses?: The future of residential investments is all about demographics—and the forces behind them.

American Realty Advisors | Sabrina Unger

RESIDENTIAL / Housing for Goldilocks : The pandemic highlights the advantages of single-family and appears to have accelerated migration to less dense, more affordable areas.

GTIS | Eliot Heher and Robert Sun

DATA CENTERS / Data Centers, Stage Center: Data center investments have proven resilient in periods of volatility—and they’re only going to become more essential and important into the future.

Principal Real Estate Investors | Bob Wobschall

CLIMATE CHANGE (WHITE PAPER) / Rather Than the Flood: A comprehensive look at climate-induced water disasters and their potential impact on CRE in the US.

New York Life Real Estate Investors | Stewart Rubin and Dakota Firenze

LOGISTICS / Reforging the Supply Chain: The only way to deliver on the service promises of a booming logistics sector requires a complete reimagination of the supply chain.

Stockbridge | David Egan

DEBT AND LEVERAGE / Leveraging Control: Though leverage is an important part of capital funding, it’s important to ask LPs if (and how) they should take control of their real estate leverage.

RCLCO Fund Advisors | William Maher and Ben Maslan

DEVELOPMENT / Recasting Risk and Return: The investment community can have an active role in economic recovery—but it will require recasting the traditional risk/return framework.

Standard REI | Shubrhra Jha

CORPORATE TRANSPARENCY ACT / Transparency Rules: Non-US-based investors face the disclosure regime of the Corporate Transparency Act. What do you need to know?

Pillsbury | Andrew Weiner

PENSIONS (WHITE PAPER) / Rising Pressures: The latest joint, in-depth report from Praedium and SitusAMC looks at rising fiscal pressures on state and local governments.

Praedium Group and SitusAMC Insights | Russell Appel, Peter Muoio, and Cory Loviglio | SitusAMC Insights

TALENT AND HR / Plugging the Skills Gap: Several trends are forcing change in the global commercial real estate industry, driving demand for new skills. How is the industry responding?

Sheffield Haworth | Max Shepherd

ESG / Operationalizing the Sustainability Agenda: During a time of unprecedented disruption, how should businesses approach the “new metrics” ESG of performance?

AccountAbility | Sunil A. Misser

These factors have resulted in a liquidity crunch—or a need for near-term capital—that looks likely to present opportunities for investors willing to assume some of the recovery risk. Each transaction will be structured uniquely to its own situation, but opportunities are beginning to emerge across various parts of the capital structure—and at various points on the risk/potential return spectrum, including:

• Structured debt: Typically structured as high loan-to-value mezzanine debt, this type of instrument is being used to help owners and borrowers bridge short-term (12- to 36-month) liquidity needs.

• Preferred equity: Similar to structured debt, these investments enable asset owners to fund short-term operating and CapEx needs while retaining most of the upside coming from medium-term asset price appreciation. For investors, the opportunity is to potentially earn an attractive yield on an impaired but otherwise high-quality asset—and to potentially gain exposure to asset price appreciation.

• Asset purchases or assuming debt from distressed holders: For various reasons, asset owners or the holders of debt may look to sell in the current environment. This can present opportunities for investors or managers with some appetite for risk and deep, in-house hotel asset management capabilities, to take over ownership (or responsibility for the debt) and actively manage the asset to recovery.

Many of the properties facing short-term distress are the same ones that look set to benefit from the long-term structural growth in experiential leisure from baby boomers, millennials and Gen Z. By providing capital in the current environment, investors can potentially earn an attractive return, and they can help these properties to keep the proverbial (or in some cases, literal) lights on, in the form of amenities that remain open, and a staff that remains employed. Some of these properties, especially on the debt side, include so-called “trophy” assets, for which opportunities to invest have traditionally been few and far between.

In addition to the near-term need for capital, a likely second “investible” phase of the recovery will come from markets that showed strong demographic tailwinds before COVID, but which were particularly hard-hit by the pandemic. Markets such as Nashville, Orange County, and Atlanta may offer particularly compelling opportunities due to severe COVID-related RevPAR declines.

TIME TO CHECK IN?

Many institutional investors are under-allocated to hotels. This is likely due to the heightened cyclicality of the sector, and the relatively small percentage that hotels represent in the most followed private real estate indexes, most notably the NCREIF benchmark, which today has an exposure to hotels of only 0.3%.[2]

If history is a guide, the time to invest in hotels is when things look bleak. This appears to be one of those times. Understandably, investors may be cautious allocating capital to this space given the cyclical challenges that COVID has introduced. As in every real estate sector, prudent risk management is absolutely critical to long-term success. To capture potential opportunity while also managing risk, investors may want to consider:

• Diversifying hotel exposure across geographies and points in the capital structure to avoid being overly concentrated in any one or two segments of the market.

• Investing with managers with cycle-tested asset management capabilities. This factor is as important in hotels as any real estate sector given the many value-creation levers to potentially exercise, from restructuring contracts to choosing new brands or property managers.

• Entering investments armed with adequate liquidity and a broad enough time horizon to adapt to potential changes in the industry recovery pattern.

The COVID crisis has left much destruction in its wake—and hit the hotel sector particularly hard. For investors willing to provide hotels with a bridge to recovery, the current period of weakness may ultimately prove to be an attractive entry point.

—

ABOUT THE AUTHOR

Jim O’Shaughnessy is a Managing Director and Hotel Group Leader at Barings Real Estate, a $354+ billion global financial services firm dedicated to meeting the evolving investment and capital needs of our clients and customers.

NOTES

1. “STR: US Hotel Performance for December 2020,” Smith Travel Research, 20 January 2020, str.com/press-release/str-us-hotel-performance-december-2020

2 National Council of Real Estate Investment Fiduciaries, as of Q4 2020. ncreif.org/