Life sciences real estate has been a “hot” property type for the past decade—and even more since the pandemic. Will all the capital targeting the space be placed where it needs to go?

Life sciences real estate (LSRE) has been a “hot” property type for the past decade or so, and interest has accelerated with the advent of the COVID-19 pandemic. The sector benefits from strong demand drivers with limited new supply (compared to demand), although new developers and investors are entering the space. Returns have been strong and capital is likely to flow to life sciences real estate for the foreseeable future.

At the same time, the sector is relatively small and concentrated in just a few markets. In this article, we examine the main attributes of success in LSRE—and explore whether all of the capital targeting the space will successfully find a home.

STRONG DEMAND DRIVERS

LSRE demand comes from companies involved in providing products and services for the healthcare sector. In particular, life sciences companies are focused on the development and commercialization of new drugs and medical devices.

The sector benefits from advances in (and the convergence of) technology and medicine, changes in the delivery of healthcare—including highly targeted therapies—and an aging population that requires additional healthcare services. Significant capital sources, including the National Institute of Health (NIH), venture capital, and corporate funding, support the industry’s high R&D costs.

Advances in technology have accelerated the pace of change in biological research, leading to more companies with greater research funding. Emblematic of this rapid change is that the cost of DNA sequencing is decreasing at a rate faster than Moore’s Law.1 For example, it cost US$3 billion to map the first human genome in 2003. By 2019, it was less than US$1,000—and within a decade or less, the cost could be less than US$100. The result is an acceleration in the growth of emerging platform technologies, such as messenger RNA (mRNA), which was used to develop the Moderna and Pfizer/BioNTech COVID-19 vaccines. That is just one of the many advances that will likely spur new investments and drive demand for additional life sciences space.

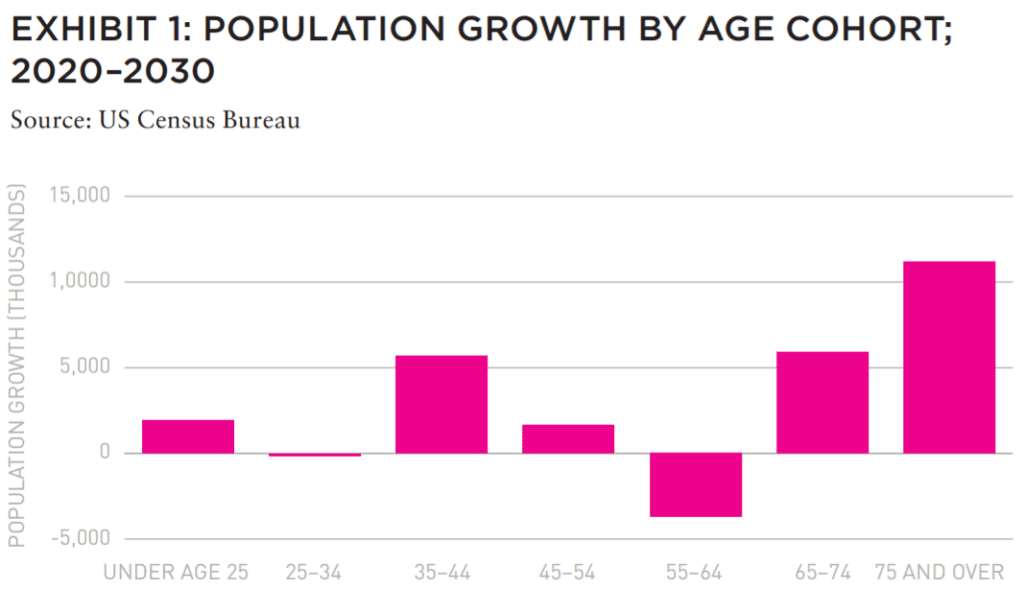

America’s aging population will also drive increasing consumption of health services. The population cohort of those aged 70+ and 80+ made up 11.1% and 3.9% of the US population (36.1 million and 12.8 million people, respectively) in 2020, respectively. Those figures are projected to increase to 14.4% and 5.3% (50.5 million and 18.6 million) by 2030, representing annual growth rates of 2.7% and 2.8%, respectively, significantly outpacing general US population growth of 0.8%. As the elderly populations grows, so will the prevalence of chronic health conditions that require some kind of medication.

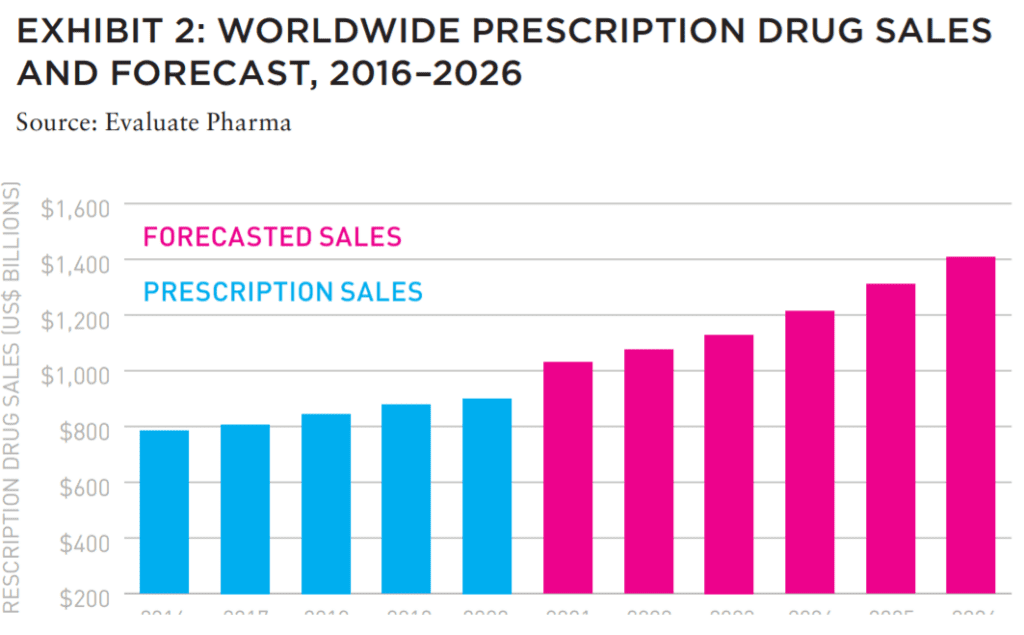

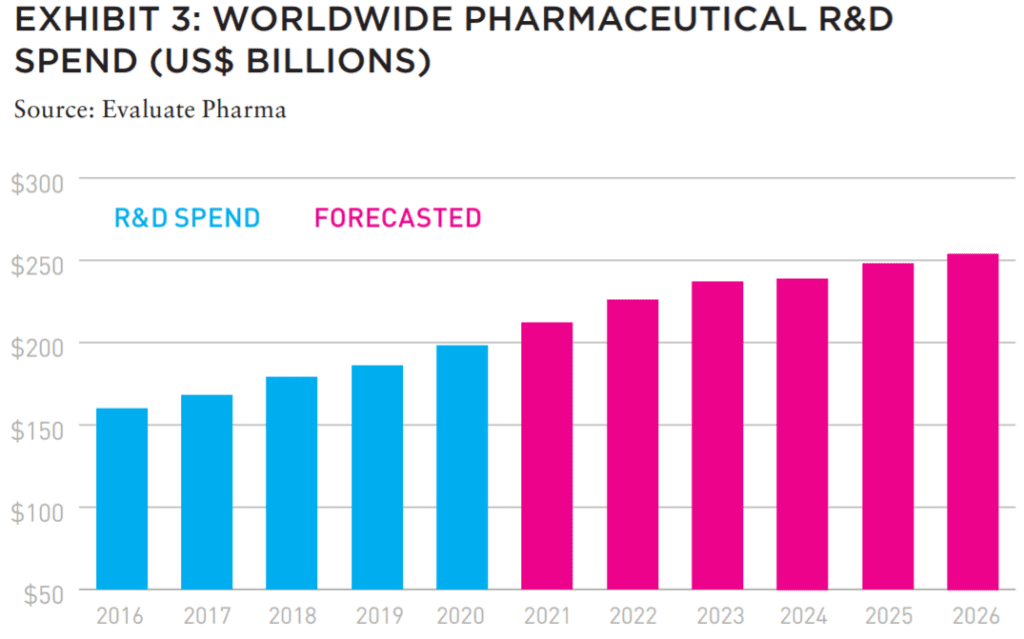

Healthcare products account for more than half of the life sciences industry revenue, and the increasing medical needs of the aging US population drives demand for pharmaceuticals. Worldwide drug sales have grown at a compound annual growth rate (CAGR) of 3.5% over the past five years (through 2020), outpacing GDP growth of 1.5% over the same time period. As shown in Exhibit 2, drug sales growth is expected to accelerate going forward, with overall sales projected to grow to US$1.4 trillion by 2026, a CAGR of approximately 7.7%.2 Future sales will require significant research and development costs in order to develop new drugs and medical products. Worldwide pharmaceutical R&D spend is forecast to grow at an annualized rate of 4.2% between 2020 and 2026 (See Exhibit 3).

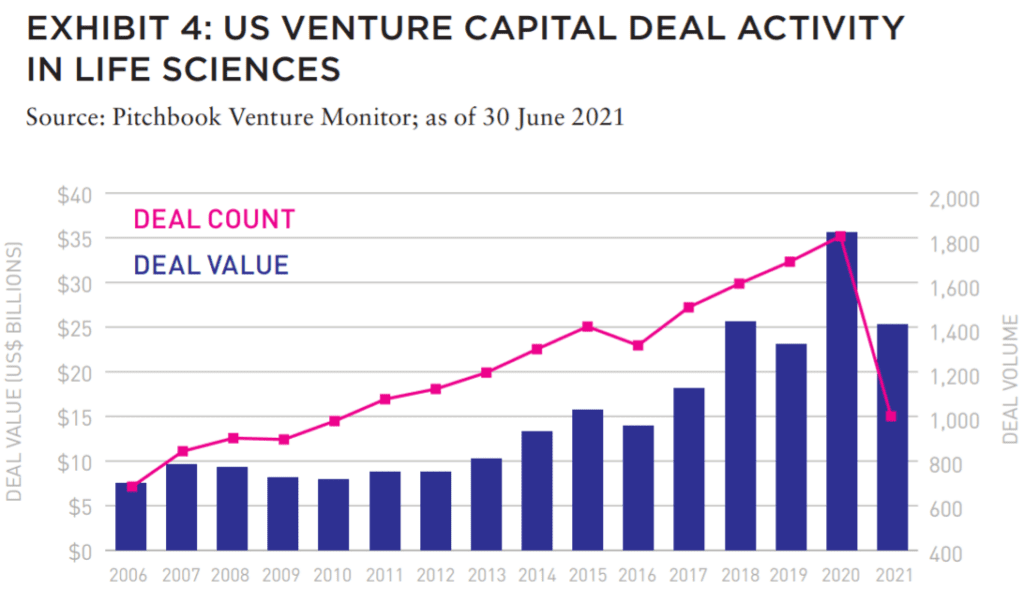

This outsized growth has brought a substantial influx of capital from both public and private sectors. Life sciences venture funding flowed at a historic pace in 2020, and 2021 is on pace to set an all-time high for both deal volume and capital raised (Exhibit 4).

SPECIALIZED KNOWLEDGE REQUIRED

Investment in life sciences real estate requires a deep understanding of the sector and specialized knowledge regarding tenants and operations. Expertise in lab design and implementation is crucial, creating a barrier to entry for traditional office operators trying to develop or convert existing office space into lab space. Some of the additional physical requirements include increased building ventilation systems, cleanrooms, more plumbing capacity throughout the building, higher power capacity, and higher floor-to-floor heights.

Another important reason for specialized knowledge is one of the asset type’s greatest value drivers: reusability. Freshly delivered life sciences space has an average use-life of around fifteen years before renovation is required, while the average lease term is only around 7–10 years—creating ample room for second-generation leases at a high net effective rent, for a fraction of the upfront TI requirements. However, tenant build outs must be designed to offer the greatest flexibility for second (and later) generation tenants.

Additionally, relationships are key in the life science space, particularly in attracting tenants. LSRE is typically mission-critical space for most tenants, who therefore place a premium on leasing space from a reliable operator. Relationships are even more crucial in speculative developments, which must cater to a wide array of tenants, and build-to-suit projects, where the tenant will rely on an established operator.

Evaluating the credit quality of the tenant also requires specialized knowledge. Life science tenants range from start-ups to growth companies to established, publicly traded pharmaceutical companies. Many of the start-up and growth companies are cash flow negative with a limited history, making the understanding of products and financial backers key to underwriting tenant credit.

PREFERRED MARKETS

Life sciences tenants have concentrated in cities with an educated workforce, access to key industry scientists, highly ranked schools, a sizeable high-tech workforce, and access to funding. The top three life sciences markets are Boston, San Francisco, and San Diego, which comprise more than half of all life sciences space in the US. These cities provide access to quality graduates in biological and biomedical sciences as well as PhD-level candidates from nearby academic institutions and hospitals. Other markets with significant life sciences sectors include New Jersey, Philadelphia, and Washington, DC, while markets such as Raleigh/Durham and Seattle could develop sizable life sciences clusters over the next decade.

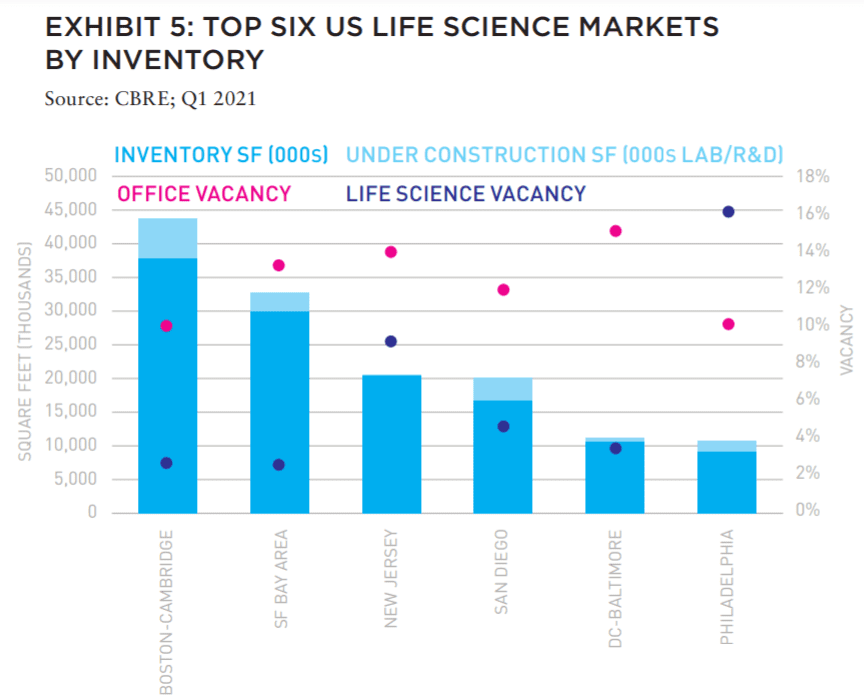

Market fundamentals for life sciences and lab space are attractive, both historically and expected going forward. While life sciences inventory is still a fraction of traditional office inventory, at approximately 4% of office inventory, LSRE makes up more than 10% of office inventory in Boston, New Jersey, and San Diego. Vacancy rates in the top life sciences markets are well below office vacancy rates (with the exception of Philadelphia), as shown in Exhibit 5. Rental rate growth has nearly averaged double digits over the past five years, significantly outpacing rental rate growth across most other property types. With demand expected to outstrip supply for the short and intermediate term, Green Street forecasts that LSRE NOI growth will outpace both gateway office and commercial real estate over the long term.3

INVESTMENT CONSIDERATIONS

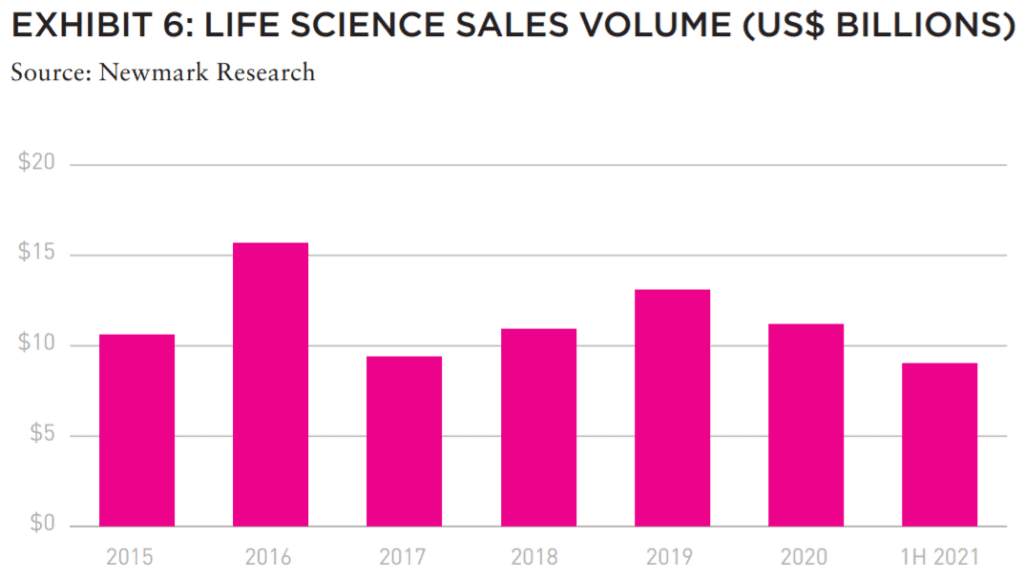

The growth of the life sciences industry coupled with a limited new supply has attracted the attention of commercial real estate investors. While sales activity has been relatively stable over the past six years (with the exception of 2016 and 2019), investor interest coming out of the pandemic has led to record volume so far in 2021. Transaction volume through June totaled US$9.0 billion (Exhibit 6), on track to exceed the prior peak in 2016 when Blackstone took Biomed Realty Trust private.

LSRE cap rates have decreased from 8.6% in 2010 to 6.1%, a record low, according to Real Capital Analytics. Cap rates for the sector have historically tracked office cap rates but are now approximately 40 BPS lower, reflecting declining investor interest in traditional office and increasing investor interest in life sciences. Relative to industrial and multifamily, two more in-demand property types, life sciences cap rates remain between 30 to 110 BPS above these property types, respectively. Despite a lower cap rate than traditional office, LSRE cash flows are expected to be higher, as compared to traditional office, LSRE typically has higher tenant renewal rates and lower tenant improvement costs.

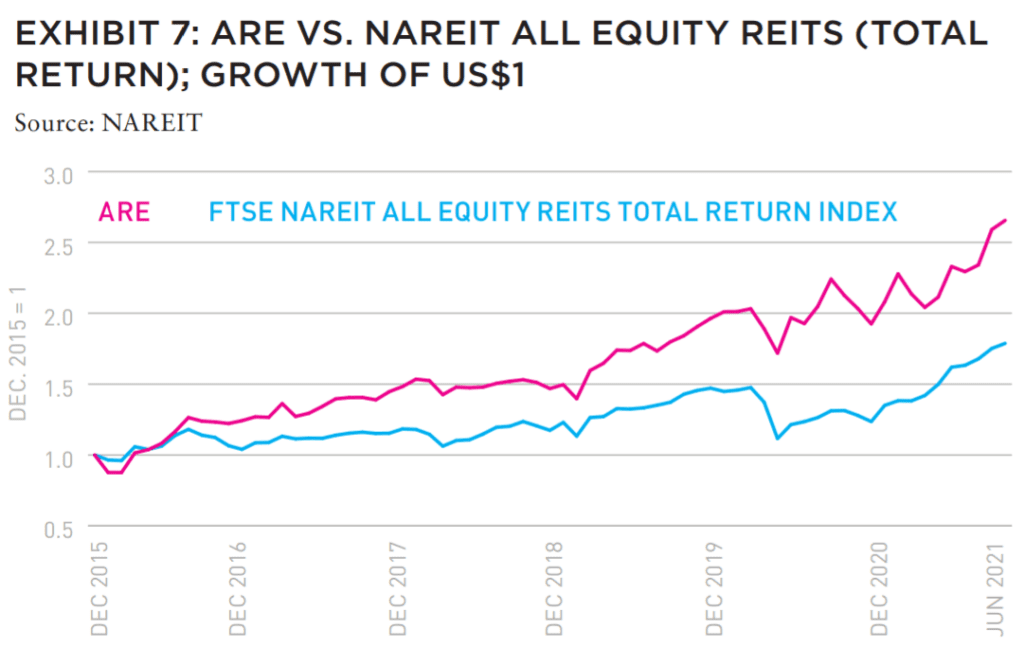

Investment returns in the private market are difficult to track as life sciences makes up a small component of major real estate return indices such as NPI and NFI-ODCE.4 However, the performance of the one LSRE REIT that is publicly trade—Alexandria Real Estate Equities (ARE)—compared to the overall REIT benchmark shows clear outperformance over the past 5+ years (Exhibit 7).

Investing in LSRE is not a risk-free proposition. As discussed above, many life sciences companies have little or no revenue, and they are therefore reliant on positive research results to have continued access to capital. As a small sector, new supply is always a risk, particularly in the current environment when high general office vacancy rates may lead to an increase in conversions. Finally, the biotech and pharmaceutical industries are highly regulated and dependent on government agencies for both drug approvals and pricing power.

WHAT’S NEXT FOR LSRE

Investor interest in life sciences real estate is robust, leading to rich pricing and record low cap rates and high transaction volumes. New entrants have entered the market to capitalize on the strong investor interest, contributing to an increase in supply. However, the strong demand drivers should continue to lead to absorption keeping pace with supply. Cap rates are at record lows, but that is the case with most real estate sectors.

Life sciences real estate is priced at spreads that are similar to other property types with strong demand drivers and keen investor interest. Strong demand for space from biotech and other companies should continue to drive rent growth and total returns despite the low cap rates. Although the overall size of the sector is limited, institutional investors that can develop relationships with operators with expertise in the right markets should continue to find opportunities and generate attractive returns.

—

ABOUT THE AUTHORS

William Maher is Director of Strategy & Research; Ben Maslan is Managing Director; and Cecilia Galliani is Vice President for RCLCO Fund Advisors (RFA). RFA is an affiliate of RCLCO (formerly Robert Charles Lesser & Co.), which has been the “first call” for real estate developers, investors, the public sector, and non-real estate companies and organizations seeking strategic and tactical advice regarding property investment, planning, and development since 1967.

—

NOTES

RFA aims to improve the institutional real estate investment model by providing customized and aligned consulting and advisory solutions to LP investors, facilitating partnerships that generate greater LP control and transparency, and driving long-term objectives in allocation, access, diversification and performance with greater fee effectiveness. RFA was established in 2011 and has been an SEC Registered Investment Advisor since 2014.

1 Moore’s law is the observation that the number of transistors in a dense integrated circuit (IC) doubles about every two years.

2 Evaluate Pharma, “World Preview 2021, Outlook to 2026,” Evaluate Pharma, July 2021, https://info.evaluate.com/rs/607-YGS-364/images/WorldPreviewReport_Final_2021.pdf

3 Green Street, s.v. “Life Sciences Insights,” Accessed July 15, 2021.

4 National Council of Real Estate Investment Fiduciaries, s.v. “Property Index, Accessed July 15, 2021; National Council of Real Estate Investment Fiduciaries, s.v. “Fund Index, Open End Diversified Core Equity,” Accessed July 15, 2021.

ALSO IN THIS ISSUE (FALL 2021)

NOTE FROM THE EDITOR / GROUPTHINK VS. GROUP COLLABORATION

AFIRE | Benjamin van Loon

MID-YEAR SURVEY / CHECKING THE PULSE

No matter your age or experience, 2021 has shaped up to be a year that no one can forget. Findings from the AFIRE 2021 Mid-Year Pulse Survey detail a cautious road ahead.

AFIRE | Gunnar Branson and Benjamin van Loon

CLIMATE CHANGE / REASSESSING CLIMATE RISK

The commercial real estate industry may not yet fully grasp the actual relationship between climate risk and asset pricing and value. But the knowledge is coming fast.

York University | Jim Clayton

University of Reading | Steven Devaney and Jorn Van de Wetering

Kinston University | Sarah Sayce

UNEP FI | Matthew Ulterino

NON-TRADITIONAL / THE ALLURE OF SPECIALTY SECTORS

Real estate investments have historically coalesced around common property types—but it may make sense for investors to reconsider specialty property sectors in the post-COVID world.

Invesco Real Estate | David Wertheim

NON-TRADITIONAL / NON-TRADITIONAL IS GOING MAINSTREAM

The mainstreaming of nontraditional property types is well on its way within institutional investing, which will materially broaden the real estate investment universe.

Principal Real Estate Investors | Indraneel Karlekar, PhD

DIGITAL INFRASTRUCTURE / DIVERSIFYING INTO DIGITAL

As investors look for sustainable sources of inflation-protected yield, real estate investment is increasingly blurring into a wider range of “digital” real asset investment strategies.

AECOM Capital | Warren Wachsberger, Josh Katzin, and Corbett Kruse

LIFE SCIENCES / TAPPING INTO BIOTECH

Over the past two decades, the single-family rental industry haLife sciences real estate has been a “hot” property type for the past decade—and even more since the pandemic. Will all the capital targeting the space be placed where it needs to go?

RCLCO | William Maher, Ben Maslan, and Cecilia Galliani

ESG + CLIMATE CHANGE / HIGH-WATER MARKS

Interest and excellence in ESG performance is becoming increasingly critical to portfolio strategy. So with sea levels on the rise, how can portfolios stay above water?

Barings Real Estate | Jerry Speltz

ESG + NET-ZERO / VALUING NET-ZERO

With more tenants focusing on environmental targets, the burden to reduce direct emissions places increased pressure on investors, who are at a pivotal moment in ESG strategy.

JLL | Lori Mabardi, Emily Chadwick, and Eric Enloe

ESG + FAMILY OFFICE / FAMILY OFFICES AND ESG

As sustainable investing continues to grow in popularity, family offices have taken note—and understanding ESG targets and regulations will be key for longterm performance.

Squire Patton Boggs | Kate Pennartz and Rebekah Singh

DEBT / WHY DEBT, WHY NOW?

Debt funds remain a comparatively small part of the real estate investment market, but they have been gaining in prominence in recent years.

USAA Real Estate | Karen Martinus, Mark Fitzgerald, CFA, and Will McIntosh, PhD

MIGRATION / MIGRATION IN REAL TIME

As the public health situation started to improve in early 2021 and the economy reopened, did migration flows change too—and what if we are able to answer this in real time?

Berkshire Residential Investments | Gleb Nechayev

StratoDem Analytics | Michael Clawar

URBANISM / DOWNTOWN DISRUPTION

The pandemic-driven changes to downtown areas and central business districts is changing the geography of institutional investment. What else changes because of this?

Drexel University | Bruce Katz

FBT Project Finance Advisors + Right2Win Cities | Frances Kern Mennone

WORK-FROM-HOME / CHOOSING FLEXIBILITY

Employees are increasingly demanding flexibility and choice for where (and when) they work. What strategies can landlords implement to adapt?

Union Investment Real Estate | Tal Peri

TALENT AND RECRUITMENT / TALENT PARITY

To be better prepared for future risks, firms need diverse talent. So is the goal of 50% female representation achievable in global real estate investment and asset management firms?

Sheffield Haworth | Isabel Ruiz

CLIMATE CHANGE / PREDICTING THE CLIMATE FUTURE

We are all invested in the cities, assets, and infrastructure of tomorrow, even if we might not live to see the ten largest cities in 2100. But understanding climate change can get us closer.

Climate Core Capital | Rajeev Ranade and Owen Woolcock