Urbanization, digitalization, and demographics are the key trends to watch for understanding the future of logistics real estate.

The global pandemic has forever altered the logistics real estate landscape. Supply chain decisions have become more holistic, more data-driven, and more urgent than ever.

Underlying this shift are the same forces of urbanization, digitalization, and demographics that have changed the way we live, work, and shop over the past few decades. The future of the supply chain and its concurrent effect on retail will determine demand for logistics real estate for years to come. So what are the trends driving demand for logistics real estate in a post-pandemic world?

ECONOMIC GROWTH NOW REQUIRES MORE LOGISTICS REAL ESTATE THAN IN THE PAST

Consumption has advanced as the primary driver of demand on the global level. Retail sales have a higher correlation with logistics demand growth than do drivers of the past—namely, manufacturing and trade. In addition, changes in how we consume are further amplifying this shift, because e-commerce is more space intensive.

AT THE SAME TIME, TECHNOLOGY AND DEMOGRAPHICS ARE TRANSFORMING RETAIL

Demographic trends, the rapid pace of technological change, and COVID-19 have transformed how we live, and evolved our notions of what is possible, driving an evolution in retail and boosting logistics demand. Millennials—digital natives who now comprise 23% of the global population1—have entered higher income brackets and are a primary target for retailers. At the same time, dual-income households continue to rise.2

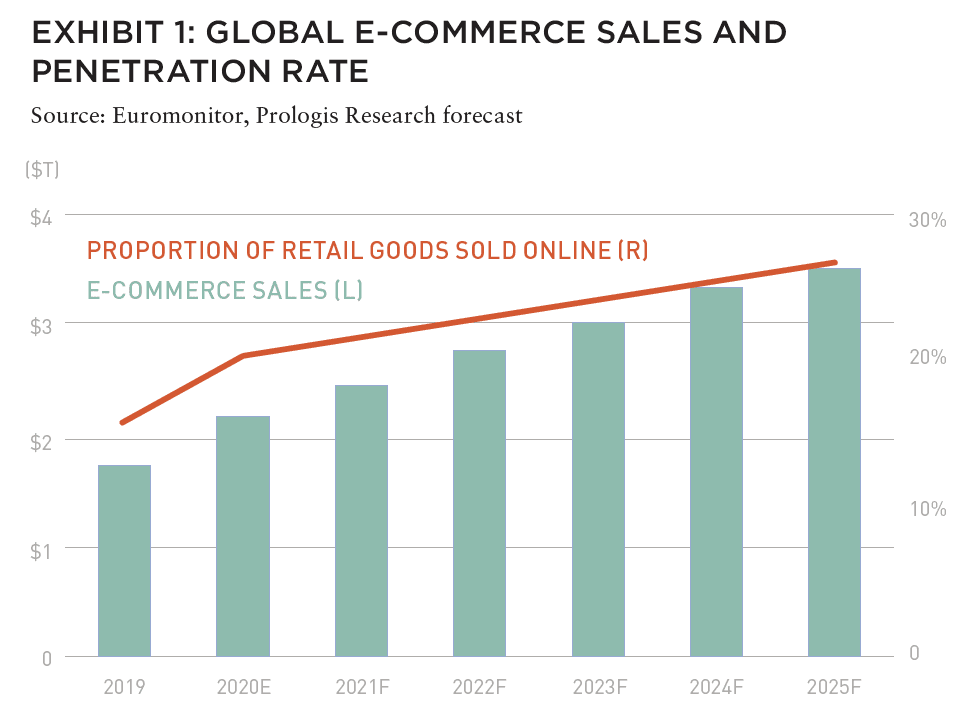

The internet as a platform for commerce continues to expand around the world; over the past decade, about 2 billion people gained internet access.3 Consumer expectations have increased in a permanent way, favoring convenience, choice, reliability, and immediacy. Naturally, the combination of new digital options and a desire for convenience have propelled the adoption of e-commerce. E-commerce as a proportion of retail goods sold globally grew to nearly 20% in 2020, from about 4% in 2011.4

COVID-19 AND STAY-AT-HOME ORDERS PULLED E-COMMERCE ADOPTION FORWARD, PROMPTING SUPPLY CHAIN INVESTMENTS THAT WILL YIELD FUTURE GROWTH

Globally, e-commerce penetration increased at an outsized rate of 390 BPS in 2020 due to the pandemic, equal to roughly five years of adoption (see Exhibit 1). Senior populations and other late adopters, as well as retailers, overcame barriers to online shopping out of necessity. Given pandemic-related constraints on services and brick-and-mortar spending, it is possible that e-commerce growth will temporarily slow once vaccines are distributed broadly and consumers relish the novelty of in-person shopping, travel, and entertainment. However, before COVID-19, a structural shift in retail was already in play.

E-commerce penetration will likely continue to rise due to the following reasons:

• Consumers’ habits are “sticky” once barriers to adoption are overcome.

• Innovation and supply chain investments made during or in the wake of the pandemic should increase competitiveness of online options. This is especially true for segments with low e-commerce penetration prior to the pandemic, such as grocery and home improvement.

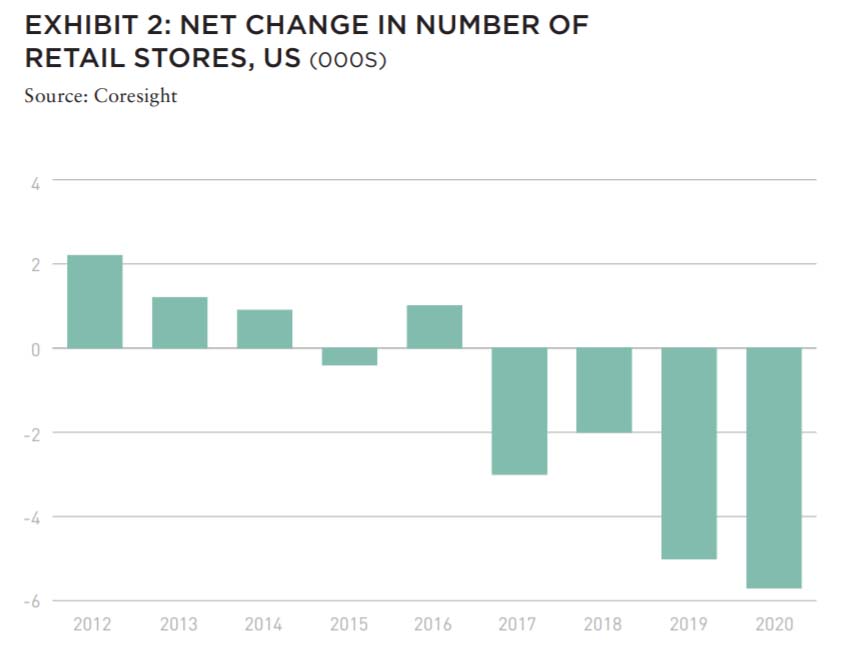

• The challenges faced by brick-and-mortar retailers in the near term should mitigate future competition for consumers. More than 15,000 US retail outlets were permanently closed between 2017 and 2020 on net (see Exhibit 2).5

Still, in order to compete, brick-and-mortar retail will need to meet the same demands for convenience and reliability as offered by online shopping. Options to buy online and pick-up in store could drive traffic and sales post-pandemic, but would put increased pressure on store inventories, necessitating a rapid replenishment operation close to stores to keep shelves stocked.

Online order fulfillment requires more than three times the logistics space of brick-and-mortar6 because:

• All inventory is stored within a warehouse.

• Digital storefronts offer greater product variety.

• Higher volatility in sales patterns necessitates deeper inventory levels.

• Parcel shipping requires more space than shipping pallets.

• Many e-fulfillment operations include value-add activities such as assembly and reverse logistics.

Taken together, this intensity of use generates substantial incremental demand as a greater proportion of retail goods are sold online. The forecasted share shift alone (holding sales constant) should drive the need for an incremental 125 million SF/11.6 million SM of logistics space or more per year through 2025 in the US and Europe alone.7

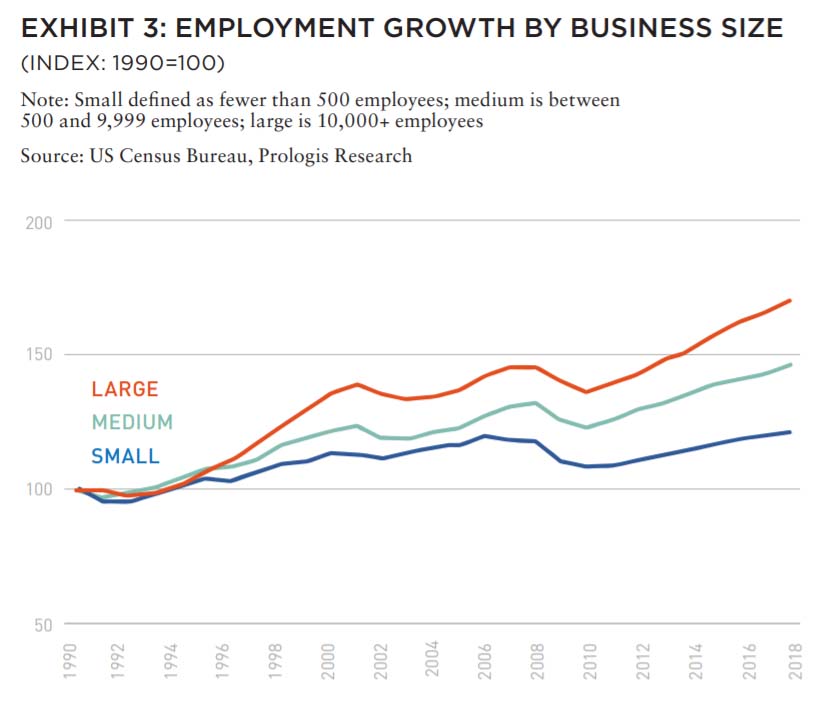

Leveraging data and technology in retailing and supply chain management creates a competitive advantage that can help companies more efficiently scale and globalize operations. Rising consumer classes across the world have increased the growth opportunity for companies able to successfully establish their operations in new locations.

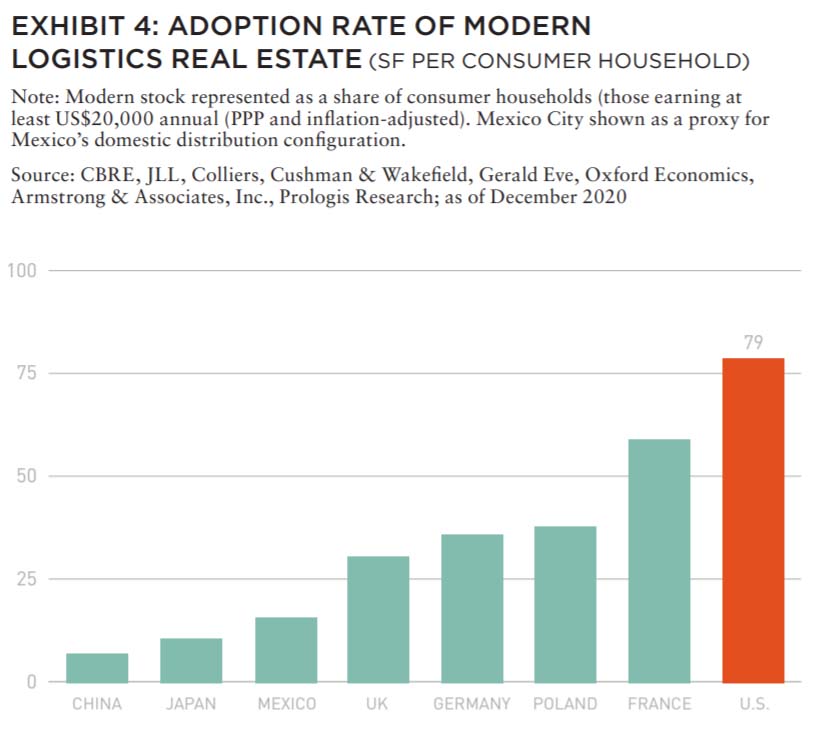

As businesses cross borders, they bring logistics real estate requirements and supply chain best practices, driving the need for modern logistics facilities. Large companies, which tend to have more robust financial and technological resources, have grown at a faster rate than medium- and small-sized companies, which often do not have the same ability to deploy best practices and take advantage of growth in other geographies (see Exhibit 3). On average, the adoption rate of modern logistics is about 35 SF per consumer household today (see Exhibit 4). A rise in that ratio to 40–50 SF by 2030 would yield the need for 3–4 billion SF/278.7371.6 million SM in the world’s largest logistics markets.8

SUPPLY CHAIN DISRUPTIONS HAVE PUNCTUATED THE NEED FOR RESILIENCE

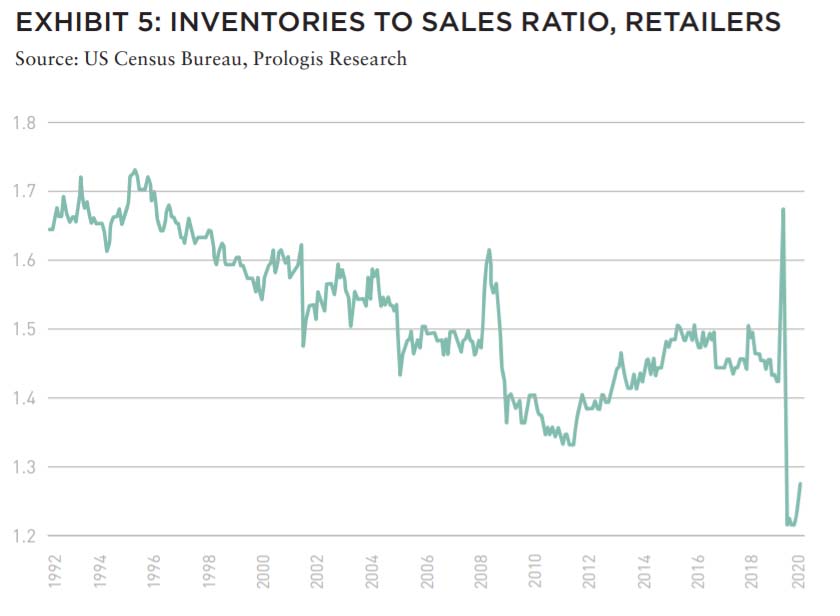

For decades, supply chains have been moving to globalize, take advantage of cost differentials, and streamline to a just-in-time model in order to reduce inventory carry costs (see Exhibit 5). At the same time, disruptions have extended beyond natural disasters, congestion, and labor disputes to include major trade renegotiations and a global pandemic. The supply chain risks that have been exposed include:

• Minimal on-hand inventory, which leads to stock-outs when consumer demand shifts quickly.

• Single source of origin and low supply chain visibility, which together limit the ability to source goods when disruptions hit.

• Long lead times and trade bottlenecks, which prevent goods from getting to end consumers as quickly as they are needed.

HIGHER INVENTORIES ADD RESILIENCE AND AMPLIFY THE NEED FOR LOGISTICS REAL ESTATE

The shift from just-in-time to just-in-case supply chains could drive inventories up by more than 5-10%. In the US, Prologis Research estimates this shift could create 57–114 million SF/5.310.6 million SM of additional logistics demand per year over the next five years without accounting for a rise in sales.9

Maintaining production bases close to destination markets shortens production lead times for businesses and provides protection against lost revenue, lost customers, and higher supply chain costs. However, wages are cost-prohibitive for largescale reshoring to the US and much of Europe. Multinational corporations have pursued near-shoring instead, establishing production facilities in markets adjacent to end consumers such as Mexico, and Central and Eastern Europe. Still, the bulk of consumer goods production and upstream supply chain operations will likely remain in Asia, home to half of the world’s middle class, with attractive labor pools and industrial infrastructure, particularly in China.10 This strategy has a dual benefit as the rise of China’s consumer class has led to a transformation of its supply chains—originally configured for exports, today they are being designed to serve domestic consumption.

USERS OF LOGISTICS REAL ESTATE ARE NOW MORE WILLING TO PAY HIGHER RENTS

This is in part because rent does not represent a large share of supply chain costs (only about 5%).11 More importantly, supply chains are increasingly viewed holistically and used as a competitive advantage. For most users, the revenue generation benefits from being able to meet consumer demands for product availability, choice, and delivery speed likely greatly outweigh the additional real estate costs. Locating closer to consumers reduces transportation costs, which account for about 50% of supply chain costs.12 A recent study by MIT on carbon emissions revealed that adding an urban fulfillment center can cut transportation emissions (and therefore costs) by half, compared to out-of-town distribution.13

ALSO IN THIS ISSUE (SUMMER 2021)

NOTE FROM THE EDITOR / The Housing Issue

AFIRE | Benjamin van Loon

INVESTOR SENTIMENT / Shining Through Darkness

The 2021 AFIRE International Investor Survey underscores a sense of calculated optimism for CRE investment in the year ahead.

AFIRE | Gunnar Branson

ECONOMY / Revisiting Inflation

For commercial real estate investors, inflation fears are real— but are they rational?

Aegon Asset Management | Martha Peyton, PhD

DEURBANIZATION / Herd Community

Uncertainty surrounding remote work and politics suggest a wide range of potential outcomes for big cities, which may upend the long-running megatrend toward urbanization.

Green Street | Dave Bragg and Jared Giles

HOUSING / How to Rebuild

Could an idea to “bring back” New York after the pandemic work in other cities?

Aria | Joshua Benaim

HOUSING / Single Family, Multiple Questions

Institutional ownership in single-family rentals accounts for less than 5% of the segment, but answers to key questions could change start to change that balance.

Berkshire Residential Investments | Gleb Nechayev, CRE

HOUSING / Institutionalizing Single Family

Over the past two decades, the single-family rental industry has evolved into an institutional-caliber asset class—so where is the sector going next?

Tricon Residential | Jonathan Ellenzweig

HOUSING / Build-to-Rent Boom

The future is bright for build-to-rent and institutional investors are increasingly looking at investing in this sector.

Squire Patton Boggs | John Thomas and Stacy Krumin

OFFICE / Recovering the Office

While most agree that the office sector has a difficult road ahead, there is less consensus about future demand in the sector. What are the indicators investors should be tracking?

Barings Real Estate | Phillip Conner and Ryan Ma

OFFICE / London Calling

With Brexit and pandemic resolutions coming into focus, pricing disparities could dissipate based on improved cross-border liquidity and cap rate compression in the London office market.

Madison International Realty | Christopher Muoio

LOGISTICS / Supply Change

Urbanization, digitalization, and demographics are the key trends to watch for understanding the future of logistics real estate.

Prologis | Melinda McLaughlin and Heather Belfor

CLIMATE / Accounting for Environmental Risk

When it comes to guards against environmental risk, Boston, Indianapolis, Minneapolis, and Portland are some of the most prepared US cities. What makes them different?

Yardi Matrix | Paul Fiorilla, Claire Anhalt, and Maddie Harper

ESG / Putting People First

Though “impact investing” is no longer totally distinct from investing in general, investors still have a lot of work to do for fulfilling the social and governance aspects of ESG expectations.

Grosvenor Americas | Lauren Krause and Brian Biggs

MULTIFAMILY / Influencing Multifamily

As we come out of the pandemic to a new economy, it seems likely that the creator economy will continue to grow. This will have a major impact on the multifamily sector.

citizenM Hotels | Ernest Lee

TALENT AND RECRUITMENT / Enhancing Life Sciences

As the global life sciences sector continues to grow in real estate, highly specialized skills and experience will be the keys to success.

Sheffield Haworth | Max Shepherd and Jannah Babasa

EDUCATION / Real Estate Education Goes Global

The evolution of global real estate education over the past three decades will be integral to developing a rich pipeline of talent for the future of commercial real estate.

Georgetown University | Julian Josephs, FRICS

URBANIZATION AND RISING CONSUMER EXPECTATIONS WILL CONTINUE TO INCREASE THE BENEFITS OF AN URBAN LOCATION

The world’s urban population doubled over the past thirty years and is forecast to double again during the next thirty years14 with major implications on consumption, transportation, and land use. Whether to the shelves or doorstep, consumers have been conditioned to expect more.

Densifying consumption centers will produce larger revenue opportunities while rising consumer expectations and congestion will produce larger challenges for global supply chains. Logistics real estate in locations close to end consumers offers the ability to reach homes and retail outlets quickly and realize transportation cost savings—key sources of competitive advantage today and in the future.

Demographic, economic, and technological mega-trends will continue to drive the future of retail and supply chain planning. While the pandemic may have accelerated e-commerce adoption, it has also changed how organizations approach their supply chain operations. Combined with structural drivers, including more companies leveraging logistics real estate in urban settings as a competitive advantage, these trends raise the long-term growth rate of logistics real estate demand through the next decade and beyond.

—

ABOUT THE AUTHORS

Melinda McLaughlin is Senior Vice President of Research and Heather Belfor is Director and Head of US Research for Prologis, the global leader in logistics real estate with a focus on highbarrier, high-growth markets.

—

NOTES

1. United Nations. Accessed June 22, 2021. un.org/en/

2. UNESCO Institute for Statistics. June 22, 2021. uis.unesco.org

3. International Telecommunication Union, World Telecommunication/ICT Development Report and database. Accessed June 22, 2021. itu.int/en/Pages/default.aspx

4. Prologis Research. Euromonitor. prologis.com

5. Coresight Research. Accessed June 22, 2021. coresight.com

6. “COVID-19 Special Report #6: Accelerated Retail Evolution Could Bolster Demand for Well-Located Logistics Space.” Prologis. June 2020. prologis.com/logisticsindustry-research/covid-19-special-report-6-accelerated-retail-evolution-could-bolster

7. “COVID-19 Special Report #5: Supply Chain Shifts Poised to Generate Substantial New Demand.” Prologis. May 2020. prologis.com/logistics-industry-research/ covid-19-special-report-5-supply-chain-shifts-poised-generate

8. “Consumer household forecast.” Oxford Economics. Accessed June 22, 2021. oxfordeconomics.com

9. “COVID-19 Special Report #5: Supply Chain Shifts Poised to Generate Substantial New Demand.” Prologis. May 2020. prologis.com/logistics-industry-research/ covid-19-special-report-5-supply-chain-shifts-poised-generate

10. World Economic Forum. weforum.org

11. Deloitte. deloitte.com/us/en.html AT Kearney. kearney.com IMS Worldwide. imsw.com Prologis Research. prologis.com/about/logistics-industry-research

12. Deloitte. deloitte.com/us/en.html AT Kearney. kearney.com IMS Worldwide. imsw.com Prologis Research. prologis.com/about/logistics-industry-research

13. “Logistics Real Estate and E-commerce Lower the Carbon Footprint of Retail.” Prologis. January 2021. Accessed June 22, 2021. prologis.com/logistics-industryresearch/logistics-real-estate-and-e-commerce-lower-carbon-footprint-retail

14. “World Urbanization Prospects: 2018 Revision.” United Nations. Accessed June 22, 2021. un.org/en/67