For e-commerce property investors, the past decade was outstanding, but even as market dynamics are slowing industrial’s momentum, market fundamentals remain sound.

For e-commerce property investors, the past decade was outstanding—and the future bodes well, too.

From 2010 to 2021, demand for US industrial space grew by 24%, while supply grew only by 18%. That imbalance continued in 2022. Now, market dynamics are slowing industrial’s momentum, but market fundamentals remain sound.

While inflation, rising interest rates, and fears of recession have dampened short-term expectations, the economy continues to be strong. In JLL’s Q3 2022, gross domestic product exceeded expectations with a 2.6% annualized growth rate. Consumer spending continued, albeit at a slowing rate, and businesses continued to invest in equipment and intellectual property— signaling a vote of confidence in their long-term prospects. Private investment in real estate contracted, however, in response to higher interest rates.

Still rare in the United States, these buildings feature multiple levels of warehouse space, each with loading docks and truck courts connected by ramps. For users who need to move goods through their facilities quickly, multi-story design offers greater utilization than mezzanine structures. While development costs tend to be relatively high for these well-located and innovative structures, occupiers who value proximity to customers are willing to pay top-of-market rents.

Warehouse and distribution real estate has enjoyed a long period of continuous expansion and a pandemic-driven surge in activity that rising interest rates will likely temper. Before the COVID-19 pandemic emerged, industrial vacancy rates were more or less stable as a steady flow of tenant requirements were met with new supply. However, the pandemic dramatically accelerated the growth of e-commerce in 2020 as consumers shifted to online shopping to avoid exposure.

The sharp growth in online shopping, resulting from stay-at-home orders, sent shock waves across global supply chains and sparked demand for e-commerce warehouse and logistics space. Distributors and third-party logistics companies (3PLs) expanded their distribution networks into urban infill markets to meet consumer demand not only for the products themselves, but also for fast deliveries. Extreme shipping delays and product shortages further increased demand for warehouse space as retailers and suppliers invested in additional inventory to avoid lengthy delays for product and potential lost sales.

As demand for space surged, it became obvious that supply of industrial real estate was not keeping up with demand. Competition for warehouse space became increasingly fierce, while COVID-related construction delays and material shortages slowed delivery of new warehouse product. Retail to industrial conversions have alleviated pain points as companies re-structure their supply chain strategy.

Competition for space translated into above-average rent growth, which is always good news for property investors. Over the last five years, a competitive leasing environment accelerated US industrial rent growth by 47%. US markets with the highest asking rents include New York City, Mid-Peninsula, Silicon Valley, Long Island, and Los Angeles.

In Q3 2022, industrial property vacancy fell to an all-time low of 3.3% in the sector’s seventh consecutive quarter of declining vacancy. Nine markets across the US achieved vacancy rates under 2%, and the Savannah, Inland Empire, and Los Angeles markets had posted vacancy rates under 1%. The historical low vacancy rate helped contributed to lofty rents of $8.45 per SF in Q3, marking a 25% year-over-year increase.

GROWING E-COMMERCE DEMAND

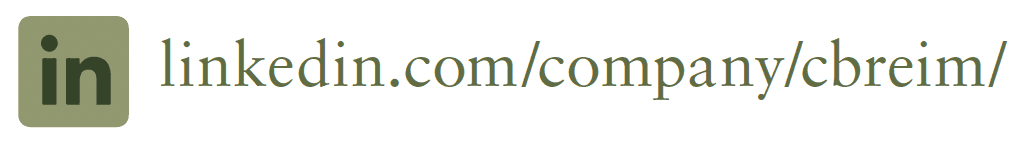

E-commerce may have abated from its 2021 peak, but it will continue to be a major driver of industrial real estate demand. Online shopping constitutes approximately 13% of US retail sales at present, and US e-commerce sales are projected to grow by 50% by 2025. In a 2021 JLL survey, global logistics professionals anticipated by a large margin that the growth of e-commerce and last-mile logistics—covering that last distance between a warehouse and the customer—would drive their future demand for warehouse space.

Key urban submarkets have seen a rise in the construction of mezzanine and multistory warehouses where land and building availability is scarce. Another trend that has emerged is adaptive re-use conversions, especially in the last-mile delivery space. In fact, more than half of all e-commerce requirements are for urban logistics locations to keep pace with online shopping demand. In established urban logistics markets, rents have seen a 27% weighted average in year-over-year growth while the average vacancy in established urban logistics markets is 2%.

In dense markets where space and land are severely constrained, developers are getting creative. Some are repurposing older, smaller, and less functionally sophisticated industrial spaces into last-mile logistics facilities or space for fleet and vehicle storage. Others are converting underutilized retail or office space into logistics facilities. In a few unique locations, some creative developers are building multi-story warehouses.

AGING INVENTORY AND THE INCREASED DEMAND FOR MODERN WAREHOUSE FACILITIES

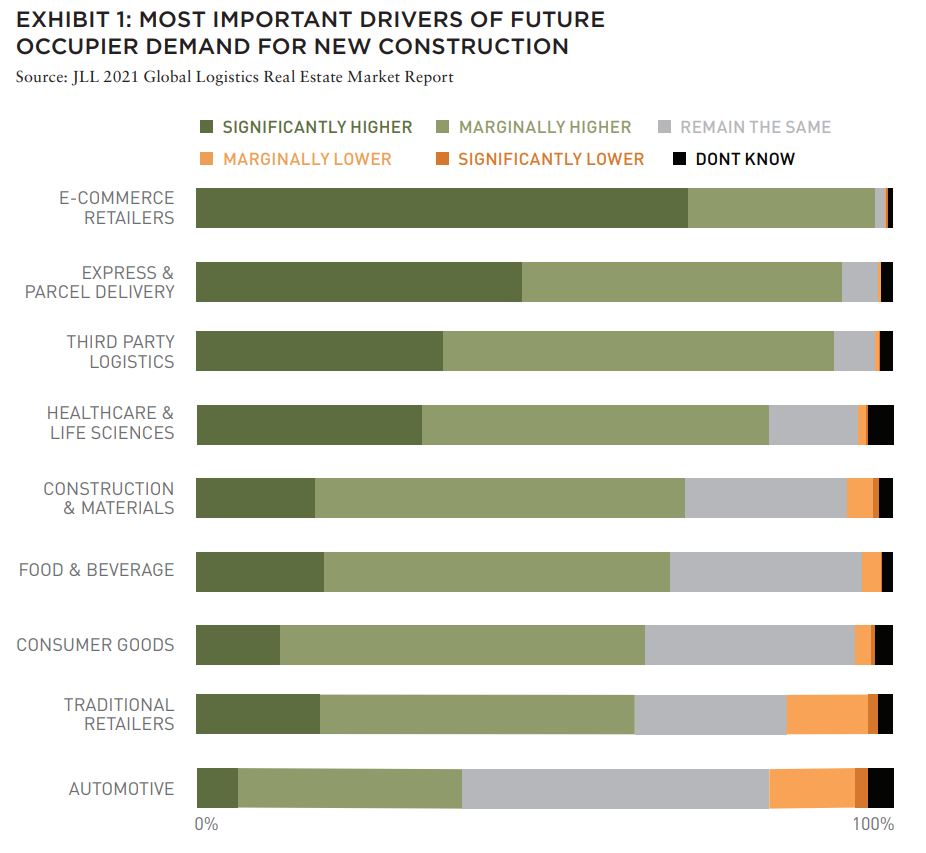

A closer look at the industrial supply-demand imbalance reveals that aging inventory is part of the problem. Facilities that might have been considered dated, yet functional, just a few years ago have quickly become functionally obsolete amidst demand for state-of-the-art facilities that can support today’s logistics processes.

Leading distributors and 3PLs have invested heavily in warehouse technologies and innovative design to attract labor, and to move goods in and out of the facility at a much faster rate than seen before. Their modern facilities provide higher ceiling heights to accommodate mezzanine structures and high inventory stacking, plentiful docks, and large-radius trailer parking. To help attract and retain in-demand talent, some operators want the kinds of amenities more often seen in office buildings.

In contrast, the average age of US industrial product is around 42 years old, and older industrial buildings typically have lower ceiling heights, fewer dock doors, and less trailer parking than newer facilities. Older-generation buildings— those built more than 20 years ago—account for 75% of the total industrial inventory. Sun Belt cities such as Las Vegas, Charleston, Inland Empire, and Austin have younger buildings on average and a larger inventory of modern product built in conjunction with recent population growth. Similarly, some of the oldest assets are located in old manufacturing towns such as New York, Pittsburgh, and Cleveland.

With many older buildings becoming functionally obsolete, these buildings will be torn down, recycled, or rebuilt to be more effi cient over the next decade. And over the next cycle, older-generation buildings will be reimagined to accommodate new users with electric vehicle parking, higher clear heights, increased truck radius maneuvering and other modern features, as well as new space configurations to better suit future distribution models.

ADAPTIVE REUSE AND REPLACEMENT CONVERSION PROJECTS

In the absence of available land, industrial developers and users are looking to adaptive reuse and replacement to create new stock. Candidates for adaptive reuse typically include distressed malls and big-box stores. Their large floorplates, high ceilings and massive parking lots are beneficial features for e-commerce distribution and fulfillment, and these retail locations typically provide multiple points of access to major thoroughfares. While several adaptive reuse projects have been initiated in the United States, zoning obstacles, expensive alterations, and other issues often create barriers to entry for adaptive reuse.

In contrast, demolishing and replacing existing structures is far more common in the United States. Replacement projects originate from many different types of former use, with site size, proximity to major highways and zoning being the most important aspects of the properties. Unsurprisingly, strong replacement conversion activity has been occurring some of the highest rent markets in the country, including Los Angeles and New York City, where demand is strong enough to justify the development costs.

MULTI-STORY DEVELOPMENTS EMERGING IN SELECT MARKETS

While occupiers have been driving net absorption to high levels, the number-one constraint on delivery of new product is a lack of land. Developers have been struggling to secure suitable development land and planning approvals. Scarcity has inspired creative solutions, such as multi-story warehouses that have popped up in select densely populated areas with high land values, including New York City, Seattle, and the San Francisco Bay.

Still rare in the United States, these buildings feature multiple levels of warehouse space, each with loading docks and truck courts connected by ramps. For users who need to move goods through their facilities quickly, multi-story design offers greater utilization than mezzanine structures. While development costs tend to be relatively high for these well-located and innovative structures, occupiers who value proximity to customers are willing to pay top-of-market rents.

New multi-story warehouses offer tenants sizable buildings embedded in the urban core that, unlike many older buildings, can accommodate modern warehouse automation systems. However, multi-story warehouse development projects are costly and complex, given building codes and the structural support required to bear heavy loads. What makes them economically feasible is the high cost of land in urban markets, and the fact that transportation is the biggest cost in supply chains—a close-in site means lower delivery costs.

LOOKING AHEAD

As 2022 came to a close, annual absorption of industrial space is expected to exceed 400 millionSF—a large number, second only to the historic 2021 levels. Preleasing remained strong for projects under construction, but activity fell 11.2% year-over-year in Q3 2022 as 138.2 million SF of new industrial product came online in the US. Those deliveries represent a 27% increase from the previous quarter, which might explain the decline in preleasing.

Following the Federal Reserve’s latest interest rate hike, industrial transactions slowed notably in the Q3 2022. However, year-to-date transactions volume was still higher year-over-year than in 2021 because of the strong start to 2022.

On the investment front, rising rates have led to widespread repricing of transactions. Swaths of institutional investors are waiting on the sidelines for greater clarity about cost of capital. Investor interest in Class B assets and industrial assets with pending lease expirations is highest, given the shorter path to get to positive leverage. Lenders have become more selective regarding transactions of scale, and buyer interest is greatest for transactions valued at less than US$100 million.

Despite these trends, long-term occupier—and investor— demand is projected to persist. Alongside urban logistics activity will be the continuing growth of mega-box developments in key logistics markets outside the high-density areas. Offering high clear-height ceilings, as well as trailer and vehicle parking, these facilities are essential to companies with broad distribution networks. Availability of labor continues to be a key component of these mega-sites and will continue to play a significant factor in where companies decide to relocate.

Investor competition for exposure to logistics real estate, combined with the dynamics of net-zero interest rates, pushed liquidity to record levels in recent years. Since the start of 2021, roughly US$208 billion in capital has flowed into the sector. Despite geopolitical turmoil and three rounds of rate hikes by the federal reserve, transaction volume eclipsed $64 billion through the first half of 2022.

Yields for industrial assets have generally risen between 75 and 100 basis points from 120 days ago amid the broad-based repricing of transactions across the capital markets. In addition to the repricing of assets is the impact on land valuations, as prospective buyers begin to underwrite slower rent growth. While industrial asset values have come down, they remain high by historic standards.

Heading into 2023, some port-centric and port-adjacent markets could see an uptick in short-term leasing activity to accommodate holiday inventory stocking; Q3 2022 saw a record-breaking volume of new construction groundbreakings, bringing the total amount of industrial product under construction to 633.8 million SF. Coupled with tepid preleasing rates, the vacancy rate is expected to increase as new product comes online. Rental rate growth is expected to continue upward, but at a slower pace.

Despite concerns about rising costs of capital, upward pressure on cap rates and fears of recession, the industrial property sector as a whole remains in good shape. Demand for logistics real estate, including e-commerce distribution and fulfillment, will become less intense as supply keeps pace with demand again. That is good news for occupiers and investors alike, as a less frenetic marketplace means more opportunities in 2023.

ABOUT THE AUTHORS

Mehtab Randhawa is Senior Director of Research for JLL, a leading professional services firm that specializes in real estate and investment management.

—

EXPLORE THE LATEST ISSUE

MAKE SUSTAINABILITY REAL

With the case for sustainability already well-established, how can (and should) real estate continue to lead?

Gunnar Branson | AFIRE

RETURN GENERATION POTENTIAL

In addition to offering inflation protection and lower volatility, real estate also offers something that other asset classes can’t: the opportunity to invest in tangible, positive change.

Shane Taylor | CBRE Investment Management

CATCH A FALLING *R

The future path of long-term interest rates in the US and why it matters.

Alexis Crow, PhD | PwC

TIDAL PATTERNS

Amidst myriad global economic and geopolitical uncertainties, US commercial real estate has an even greater challenge ahead: demographics.

Martha S. Peyton and Caitlin Ritter | Aegon Asset Management

WORKPLACE VALUES

The sooner we can recognize that values have come down collectively—even beyond the office sector—the sooner we can move forward to capitalizing on new opportunities.

Dags Chen, CFA | Barings Real Estate

OFFICE GAMES

Even as the US office sector has lagged other property types, there could be an important (and valuable) difference of office performance based on property age and market.

William Maher and Scot Bommarito | RCLCO

EMISSION CRITICAL

Workers spending less time in the office post-pandemic may seem negative for the office sector, but a four-day workweek can be a boon for some office property owners.

Kevin Fagan, Xiaodi Li, and Natalie Ambrosio Preudhomme | Moody’s

MOVING TARGETS

A close-in look at twenty major US metros and thousands of properties shows how the overall impact of rising expense loads have narrowed NOI margins. Investors should take note.

Gleb Nechayev, CRE and Webster Hughes, PhD | Berkshire Residential Investments

SAND STATES

In the wake of the Great FinancialCrisis, certain metros in the Sand States suffered disproportionally. It may not be as bad this time.

Stewart Rubin and Dakota Firenze | New York Life Real Estate Investors

STORM WARNING

Not all storms are the same, and some are so tragic that they force a moment of universal recalibration. Hurricane Ian was one of those storms—but what does that mean for real estate?

Rajeev Ranade and Owen Woolcock | Climate Core Capital

PACIFIC THEATER

The Asia-Pacific region is already home to some of the world’s largest economies and now set to lead global economic growth. What’s moving the needle now for the APAC region?

Simon Treacy and Yu Jin Ow | CapitaLand Investment

STABLE SPACE

For e-commerce property investors, the past decade was outstanding, but even as market dynamics are slowing industrial’s momentum, market fundamentals remain sound.

Mehta Randhawa | JLL

—

THIS ISSUE OF SUMMIT JOURNAL IS PROUDLY SUPPORTED BY

Our focus on delivering results is driven by our values, entrepreneurial spirit and our clients’ diverse needs. Together, our team specializes in holistic real assets solutions within and across five real assets investment categories, with a distinct approach to driving performance and long-term value.

CBRE Investment Management is a leading global real assets investment management firm with $143.9 billion in assets under management as of September 30, 2022, operating in more than 30 offices and 20 countries around the world. Through its investor-operator culture, the firm seeks to deliver sustainable investment solutions across real assets categories, geographies, risk profiles and execution formats so that its clients, people and communities thrive.

CBRE Investment Management is an independently operated affiliate of CBRE Group, Inc. (NYSE:CBRE), the world’s largest commercial real estate services and investment firm (based on 2021 revenue). CBRE has more than 105,000 employees (excluding Turner & Townsend employees) serving clients in more than 100 countries. CBRE Investment Management harnesses CBRE’s data and market insights, investment sourcing and other resources for the benefit of its clients. For more information, please visit cbreim.com.