Solar installations on commercial properties can provide additional revenue streams through solar roof leases and net metering or selling excess electricity back to the grid, which positively impact the financial performance of commercial properties—and move the needle on valuation.

High interest rates and the slow return of workers to office buildings have pushed several areas of the US commercial real estate sector into a period that threatens distress. Since 2020, foreclosures have been on the rise, reaching $20.5 billion in value in Q2 2024.1

Under these circumstances, solar installation and the income it generates can be critical pieces of material information needed to obtain an appropriate valuation. This valuation is essential whether the goal is to avoid foreclosure, prepare the property for sale, or achieve any other financial objectives.

The roof of a building isn’t just a structural necessity, but can also serve as a valuable asset that can enhance rentable square footage and generate additional revenue streams through rooftop solar. While the technology and market has evolved and lowered the bar for entry into solar, there are still some critical differences and factors to consider when assessing solar implementation.

THE UPWARD TRAJECTORY FOR COMMERCIAL SOLAR

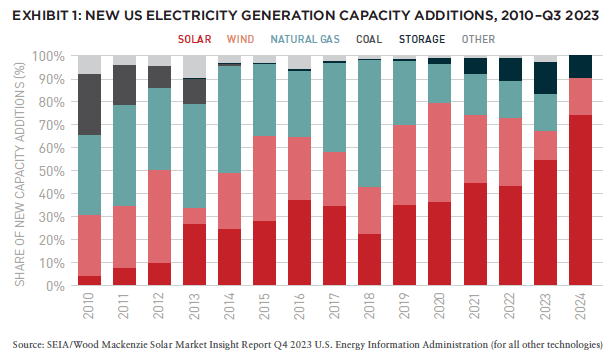

Driven primarily by economics, solar continues to be the incremental market share winner in new electricity generation installations, now accounting for more than 50% of all new capacity, according to the Solar Energy Industries Association (SEIA).2

After seeing a record year in 2023 with 33GW of new solar installations in the US, SEIA is forecasting the US solar capacity to grow approximately 14% per year over the next five years.3

This impressive growth is largely driven by the decline in solar prices, down over 90% in the past decade alone. Solar panel prices are at all-time lows while sustainability awareness is at all-time highs.

These factors have strengthened the value proposition for solar, with several commercial building owners like Apple, Prologis, First Industrial, Bain Capital, Digital Realty, and Federal demonstrating how to implement alternative energy generation at an institutional scale.4

REITS, WAREHOUSES, INDUSTRIALS, AND DATA CENTERS LEAD

The passage of the Inflation Reduction Act in 2021 substantially improved economics for asset owners, and has driven solar adoption across the real estate spectrum by increasing the base Investment Tax Credit to 30% (with adders up to 60%) and creating the ability to transfer tax credits for cash considerations.

Assets with significant roof space, such industrial and logistics warehouses and buildings; or assets with outsized power demand, such as data centers, have the most to benefit from solar implementation. Solar is already growing rapidly to meet the needs of Big Tech’s power-hungry data centers.5 REITs as an asset class are also early winners as the transferability of tax credits allows them for the first time to reap financial benefit from tax credits as this historically tax-exempt asset class can exchange credits for cash.6

REITS AFTER THE IRA

The ability for REITs to utilize the solar tax credit is a key benefit of the IRA. For example, Section 6418 of the IRA allows for the transferability of tax credits (e.g., ITC, PTC, or other credits) from the owner to another taxpayer in exchange for cash. Key to this is that the cash payment will not be included in the gross income of the original recipient.

In essence, the IRA allows—for the first time—the easy transfer of credits from the solar owner to another entity. This ultimately allows REITs to monetize the ITC by transferring the credit to any taxable entity, even unrelated ones. Moreover, any proceeds from the transfer do not count against the 75% gross income requirement for REIT.

DIRECT OWNERSHIP CAPTURES MAXIMUM

Solar installations on commercial properties—such as office buildings, warehouses, factories, shopping centers, parking lots, and large multifamily buildings—can often benefit from net metering or by selling excess electricity back to the grid, boosting site economics by reducing electricity costs.

Through a typical ownership structure, the owner is the off-taker and replaces all or a portion of the site’s power demand with solar. The owner pays for the system and retains 100% of the economics and benefits, which improve over time as electricity prices increase.

Furthermore, commercial properties may also benefit from marketing advantages and increased market competitiveness by promoting their renewable energy initiatives, which can attract environmentally conscious tenants or customers, potentially reducing turnover and elevating occupancy rates. Tenants are often requesting solar as a requisite for signing a lease.7 With the introduction of ESG, sustainability, and net-zero mandates, it’s now common to see the presence of solar to be “table stakes” for acquisitions.

SOLAR LEASES GENERATE HIGHER NOI

In addition to reducing operating costs, solar can also increase property value by increasing net operating income through solar leases.

Solar leases, where the real estate owner receives a lease payment from a third-party system owner who sells power to the occupants or grid, is another common way real estate owners have been transitioning to solar. These leases can be counted as rental income, like any other property lease, and involves zero direct capital expenditures for the building owner while gaining a long-term income stream.

These leases are typically fixed rates for more than twenty years and can often be backed by a state-supported solar program, significantly reducing default risk and offering property owners long-term certainty.

PPAS LOWER OPERATING EXPENSES

Yet another common way to add solar is through a Power Purchase Agreement (PPA), a structure where again, a third party owns and operates the solar system but instead of paying rent, they provide the site with solar power at a discount to the retail rate.

Solar systems are typically designed to either fit the physical capacity of the roof or the on-site load, whichever is the limiting factor. A properly sized system can eliminate a significant portion of a building’s electrical bill, drastically reducing the site’s operating costs and accordingly increasing the property value for owners.

For example, a 100,000-square-foot building in New Jersey is estimated to net its owner between $90,000 to $120,000 per year in annual savings through a PPA. At a 5% cap rate, the asset owner would see a value increase of $2 million with no capital investment. Property owners who combine the site lease with a PPA can “have their cake and eat it too” by locking in a lower price for electricity while receiving long-term lease payments.

An office complex in the Bay Area achieved an optimum, zero capital expenditure solar structure with a hybrid PPA structure, offsetting 90% of the property’s electricity use, reducing tenant electric rates by 10%, adding $1.8 million in additional revenue for a $1 million increase in valuation.

SOLAR CAN BE A VALUATION DIFFERENCE-MAKER

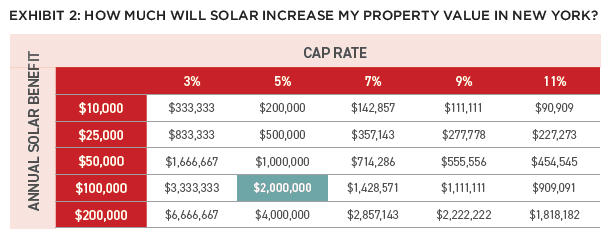

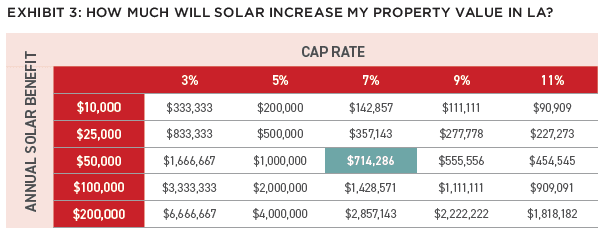

A building’s value per square foot or stabilization metrics are better when solar is deployed. Exactly how much better is very project dependent, but similar to how a new rental lease is valued, the concept of cap rates comes in handy for calculating the range of outcomes.

According to a 2024 cap rate report from CBRE, the average cap rate for an industrial property in the New York metro area is in the 5% range while the average cap rate for an office in Los Angeles is in the 7% range.8 In the case of a metro New York industrial property, a building with a 125,000-square-foot roof may net $100,000 in annual lease payments, which would see the asset’s value increase by $2 million at today’s rates.

Likewise, a 60,000-square-foot roof in Los Angeles may net $50,000 per year in savings via a PPA, which would increase the property’s value by over $700,000.

Over the last two years, many real estate sectors have seen a more than 2% increase in cap rate, resulting in a significant decrease in real estate value. Adding another income stream through solar can make a big difference. If rent in industrial buildings is around $10 per square foot, then the $0.50 to $1 that solar adds can really move the needle. Particularly in an environment of interest rate increases, additional solar income can make the difference between being able to refinance the building or losing it in foreclosure.

HOW TO GET STARTED ON YOUR SOLAR JOURNEY

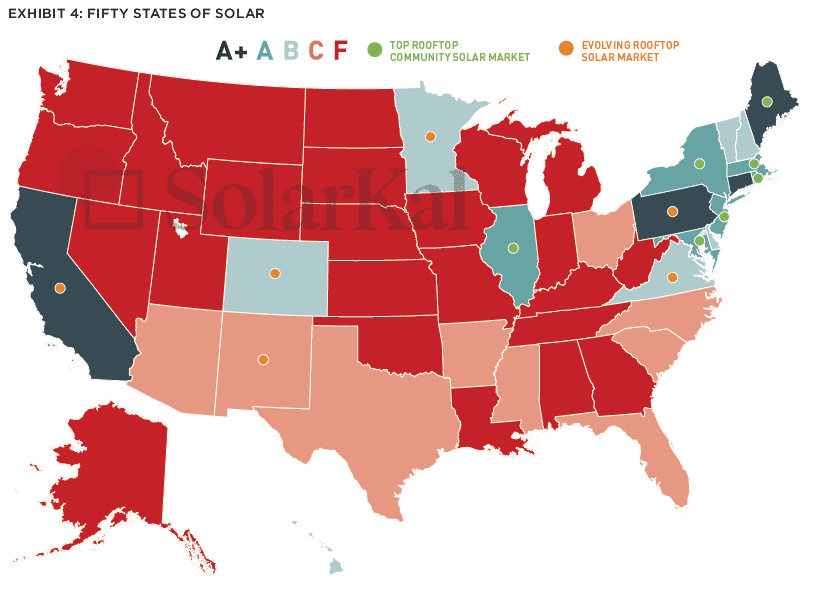

The complexities of the US electric system, with each of the fifty states having their own public utility commissions, can create challenges for foreign investors since certain states are more solar-friendly than others. The first step to making solar a valuation game-changer is to determine which properties in a portfolio have the best solar income potential.

Exhibit 4 illustrates a starting point for identifying the premier and evolving rooftop community solar markets nationwide. The higher the rating, the better the opportunity to turn solar potential into solar revenue. The ratings are based on four key criteria: incentives, electricity rates, net metering rules, and solar irradiation. Let’s dive deeper into each one.

Incentives include state rebates, solar renewable energy certificates, community solar programs, and more. In New York, for example, it’s important to monitor the ever-evolving upfront rebates, while in Illinois, a thriving community solar program is opening up solar for large industrial buildings across the state.

Energy rates are another vital piece of the solar economics puzzle. If a state has high energy rates, commercial solar projects become more attractive since lowering a building’s electric bill is often the main way to repay a solar investment. States such as Pennsylvania, where solar has historically had longer payback periods, have recently seen commercial energy rate hikes, resulting in shorter payback periods and a higher solar rating.

Net metering rules are also important and vary by state and utility. Net metering rules determine how much a utility will pay for solar power sent to the grid. States like California have moved from traditional net metering to net billing, which greatly impacts the economics of solar installations.

Lastly, each state is graded on solar irradiation, or the amount of sun it receives, as determined by longitude. The more sun, the better. But just because a site gets a lot of sun doesn’t guarantee it’s good for commercial solar systems. Florida, for instance, may be the Sunshine State with great solar irradiance, but it lacks the incentives to get commercial projects to pencil.

All of this said, just because a building is in a “tough” solar state doesn’t mean it’s not doable. Looking at the state level is only a starting point for analysis. In some cases, utility-specific programs can vary widely within states and certain parts of a market may be eligible for extra federal incentives. Close evaluation of each property, its site-specific economics, and its owner’s revenue and sustainability requirements determine whether the property is a solid solar opportunity or not.

BRIGHT FUTURE

In summary, solar panels not only reduce operational costs but also increase the marketability, resilience, and long-term value of commercial properties. These benefits contribute to a higher property valuation, making solar a smart investment for property owners. Breaking it down with a portfolio-wide feasibility and economics analysis is a great first step. Working with a reputable, vendor-agnostic US solar advisory firm will help pinpoint your best opportunities to turn your solar potential into solar revenue.

NEW: SUMMIT #16

NOTE FROM THE EDITOR: ISSUE #16

Benjamin van Loon, CAE | AFIRE

GLOBAL CONSUMPTION: APAC DATA CENTER INVESTMENT STRATEGIES IN THE AGE OF DIGITIZATION

Michelle Lee, Eugene Seo, and Wayne Teo | CapitaLand Investment

DISTINCT VERTICALS: AI IS CHANGING THE REAL ESTATE INDUSTRY ON TWO DISTINCT PATHS

Daniel Carr and Andrew Peng | Alpaca Real Estate

DIVERGING FORTUNES: ARE COMPARISONS BETWEEN OFFICE AND RETAIL STILL WARRANTED?

Brian Biggs, CFA and Ashton Sein | Grosvenor

OCCUPYING FORCE: INSTITUTIONAL OFFICE PROPERTIES FEELING THE PAIN

Nolan Eyre, Scot Bommarito, and William Maher | RCLCO Fund Advisors

VALUE-ADD VS. CORE: COMPARING CORE AND NON-CORE STRATEGIES WITH NEW DATA

Yizhuo (Wilson) Ding | Related Midwest and Jacques Gordon, PhD | MIT Center for Real Estate

FAVORABLE CONDITIONS: STRUCTURAL CHANGES TO THE MARKET FAVOR NONBANK CRE LENDERS

Mark Fitzgerald, CFA, CAIA, and Jeff Fastov | Affinius Capital

INFRASTRUCTURE VIEWPOINT: INTEREST RATE CHANGES COULD UNLOCK NEW INFRASTRUCTURE INVESTMENTS

Tania Tsoneva | CBRE Investment Management

MISSING MIDDLE: WORKFORCE AND AFFORDABLE HOUSING IN THE US

Jack Robinson, PhD and Morgan Zollinger | Bridge Investment Group

NARROW SPACES: CHOKED STRAITS AND IMPLICATIONS FOR GDP, INFLATION, AND CRE

Stewart Rubin and Dakota Firenze | New York Life Real Estate Investors

OPCO-PROPCO OPPORTUNITY: EMERGING MODELS AND THE KEYS TO STRUCTURING PARTNERSHIPS

Paul Stanton | PTB and Donal Warde | TF Cornerstone

TRANSFORMING LUXURY: UNLOCKING VALUE IN LUXURY HOSPITALITY REAL ESTATE

Alia Peragallo | Beach Enclave and AFIRE Mentorship Fellow, 2024

SOLAR VALUATION: IS SOLAR ENERGY A VALUATION GAME-CHANGER?

David Wei and Michael Conway | SolarKal

GROUND LEVEL: THE CASE FOR GROUND LEASES AND LONG-TERM CAPITAL

Shaun Libou | Raymond James

LEGAL UPDATE / DRIVING FORCE: UNDERSTANDING SYNDICATED LOANS AND MULTI-TIERED FINANCING

Gary A. Goodman, Gregory Fennell, and Jon E. Linder | Dentons

LEGAL UPDATE / ENHANCED PROTECTION: LEVERAGING THE SAFETY ACT FOR ENHANCED LIABILITY PROTECTION IN REAL ESTATE

Andrew J. Weiner, Brian E. Finch, Aimee P. Ghosh, Samantha Sharma, and Sarah Hartman | Pillsbury

+ EDITOR’S NOTE

+ ALL ARTICLES

+ PAST ISSUES

+ LEADERSHIP

+ POLICIES

+ GUIDELINES

+ MEDIA KIT

+ CONTACT

—

NOTES

1.Peter Grant (July 29, 2024). WSJ. “Surge in Commercial-Property Foreclosures Suggests Bottom Is Near.” https://www.wsj.com/real-estate/commercial/surge-in-commercial-property-foreclosures-suggests-bottom-is-near-247bb689

2. Press Release (March 6, 2024).”Solar Installations Skyrocket in 2023 in Record-Setting First Full Year of Inflation Reduction Act.” https://www.seia.org/news/solar-installations-skyrocket-2023-record-setting-first-full-year-inflation-reduction-act

3. SEIA Q4 Report (December 7, 2023). “Solar Market Insight Report Q4 2023.” https://www.seia.org/research-resources/solar-market-insight-report-q4-2023

4. 2022 Solar Means Business Report. https://www.solarmeansbusiness.com/

5. Spencer Kimball and Gabriel Cortes (June 19, 2024).“Solar Is Growing Faster than Any Electricity Source as Big Tech Seeks Clean Energy for Data Centers.” https://www.cnbc.com/2024/06/19/solar-is-growing-faster-than-any-energy-source-as-clean-power-for-data-centers.html

6. Matthew A. McDonald and Jeffrey M. Bruns (August 17, 2022). “The US Inflation Reduction Act, Solar and REITs.” Insights. Mayer Brown. https://www.mayerbrown.com/en/insights/publications/2022/08/the-us-inflation-reduction-act-solar-and-reits

7. “ESG in Commercial Real Estate,” Colliers 2023. https://www.colliers.com/en-be/news/202306-esg-in-commercial-real-estate-15-things-you-need-to-know

8. Survey Report (July 26, 2023), “US Cap Rate Survey 2023.” Insights. https://www.cbre.com/insights/reports/us-cap-rate-survey-h1-2023

—

ABOUT THE AUTHORS

David Wei is Vice President of Finance and Operations, and Michael Conway is Project Delivery Manager at SolarKal.

—

THIS ISSUE OF SUMMIT JOURNAL IS GENEROUSLY SPONSORED BY

Leverage the only investment management suite that automates complex processes and ensures transparency from investor to asset operations, integrating investment and debt management, capital raising, investment, financial, and operational metrics through a branded investor portal. Learn more.