Institutional ownership in single-family rentals (SFRs) accounts for less than 5% of the segment, but answers to key questions could start to change that balance.

The single-family rental (SFR) market emerged as a rapidly growing segment for institutional real estate investment in the aftermath of the housing bust and the Great Recession of 2008 and 2009. And while institutional ownership in SFR still accounts for less than 5% of the total unit count in the segment, it is expected to continue expanding as more private and publicly traded owners/operators enter this space in the next few years.

This article addresses ten key questions institutional investors should consider regarding the relative size of this segment nationally and across major markets, including means to understand aggregate supply/demand balance, typical resident and unit profiles, and demographic tailwinds supporting the outlook.

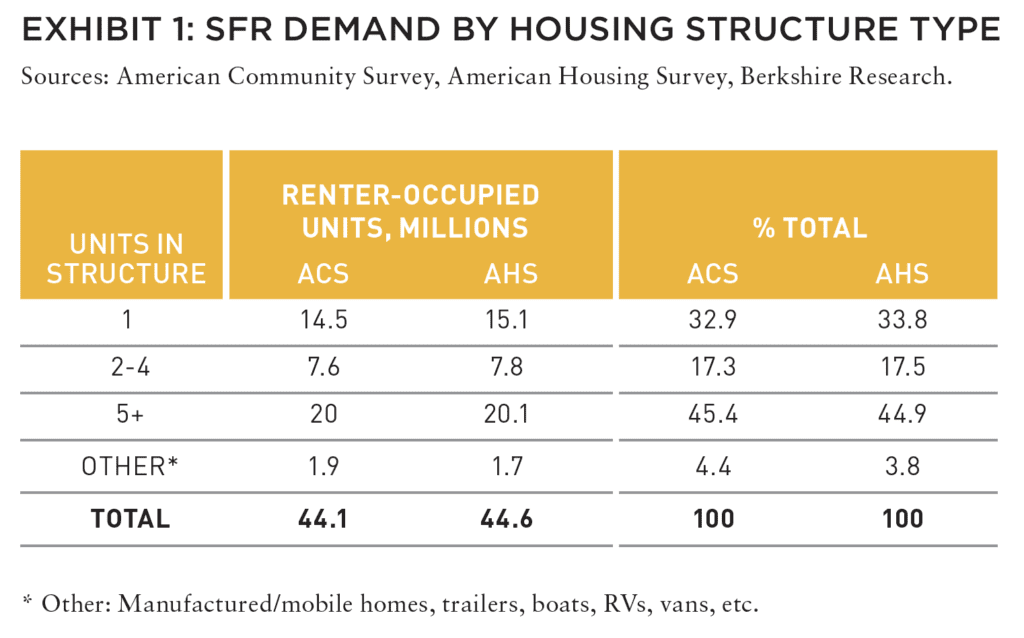

HOW LARGE IS SFR DEMAND NATIONALLY?

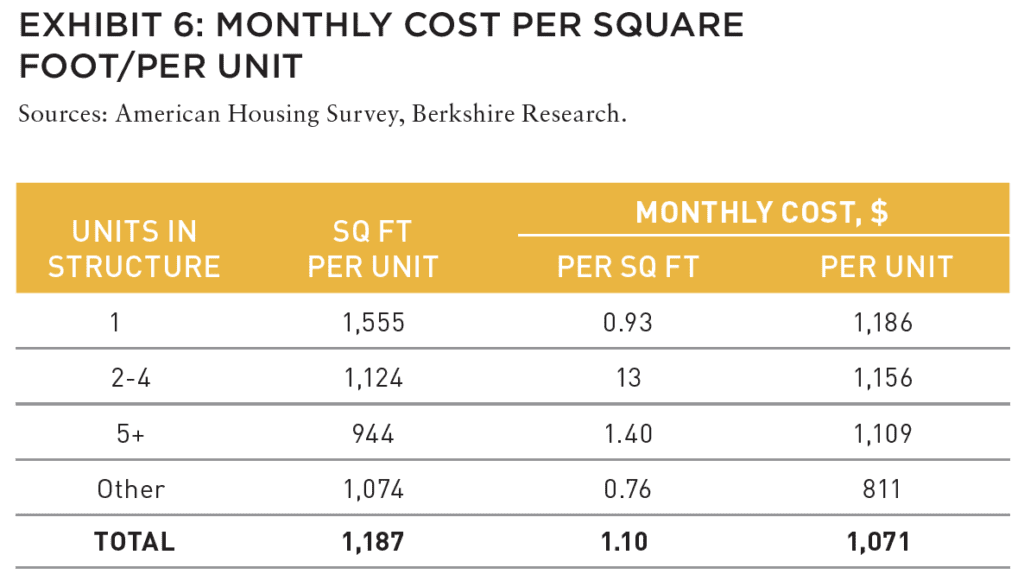

SFR demand is estimated to be between 14.5 and 15.1 million units, or 32.9%–33.8% of total rental demand. From the perspective of residential mortgage lending, however, the segment also includes small multifamily properties (2–4 units per structure), which are estimated to capture another 7.6–7.8 million renters, or 17.3%–17.5% of the total demand. The estimated market value of today’s SFR market is about US$4.5 trillion, and about US$6.5 trillion if including rental properties with 2–4 units.

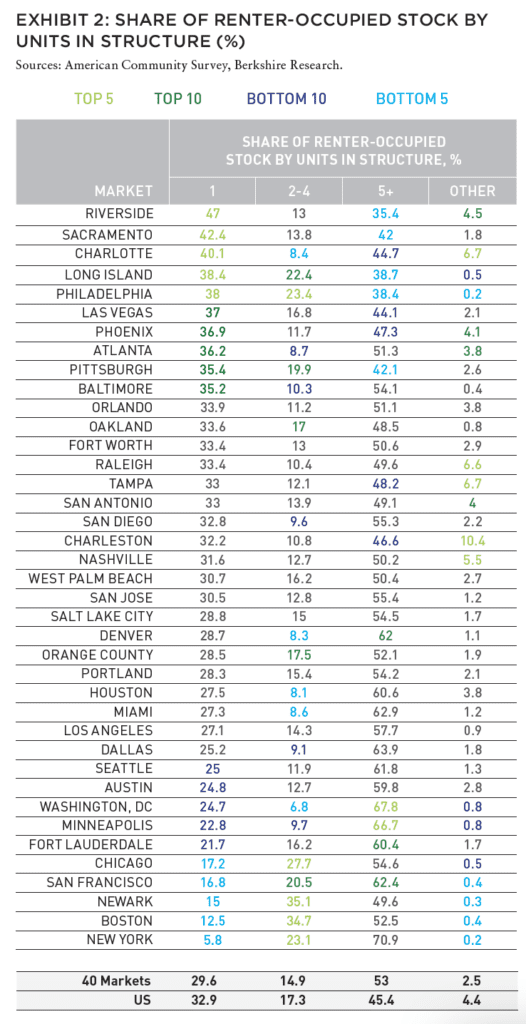

HOW DOES THE SHARE OF SFR DEMAND VARY ACROSS MARKETS?

The composition of rental demand varies widely across the country. Across major markets, the SFR share of rental demand ranges from less than 6% in New York to 47% in Riverside, California (Inland Empire). At the same time, the share of rental demand accounted for by properties with 2–4 units are among the highest in the most mature markets (especially on the East Coast) where it is about 35% in Newark and Boston, in contrast to Washington, DC, where it is less than 7%; or Houston, Denver, Charlotte, or Miami, where it is under 9%.

HOW MUCH HAS NATIONAL SFR DEMAND CHANGED OVER TIME?

The SFR share of the national rental demand has averaged 33.5% over the last forty years and is estimated to be slightly above that figure now.

SFR demand fluctuates substantially with the housing cycle: its share dropped to about 31% in 2005 as homeownership peaked, but then soared to almost 40% in 2015 as homeownership was near its bottom. This is not surprising considering that most of the segment is owned by individual investors who try to sell such properties when home prices are high and buy when prices are low. In contrast, the share of rental demand accounted for by properties with 2–4 units has been largely trending down since the 1980’s as many properties were lost to obsolescence or demolition.

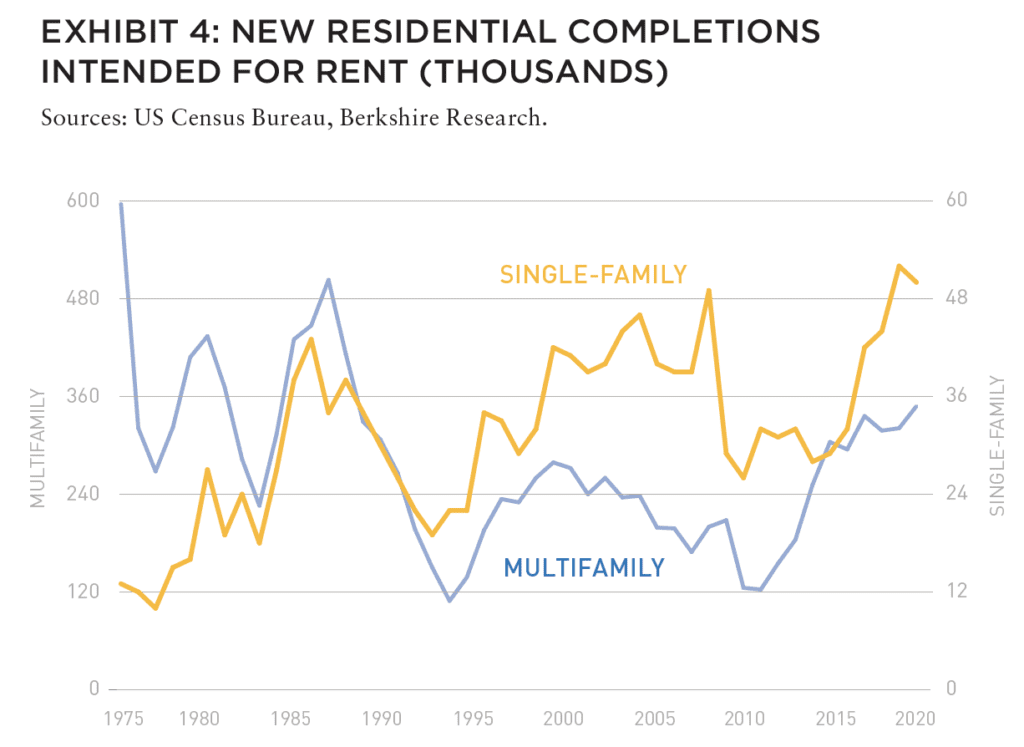

HOW MANY NEW SFR UNITS ARE BEING BUILT EACH YEAR AND HOW MANY ARE BEING CONVERTED FROM OWNER-OCCUPIED TO RENTER-OCCUPIED?

While SFR is the second largest rental demand segment after multifamily with five or more units, its annual volumes of new construction are relatively low. For example, over the last thirty years, completions of single-family homes for rent averaged just 35,000 units per year (about 0.3% of the existing inventory), compared to 260,000 units (1.7% of the inventory) for apartments. In fact, new SFR construction is basically just replacing inventory lost annually to demolitions in this segment. However, this does not mean that SFR supply is staying constant, as hundreds of thousands of single-family homes are being converted each year from being owner-occupied or vacant-for-sale to being renter-occupied or vacant for rent (although the opposite also takes place depending on housing market conditions).

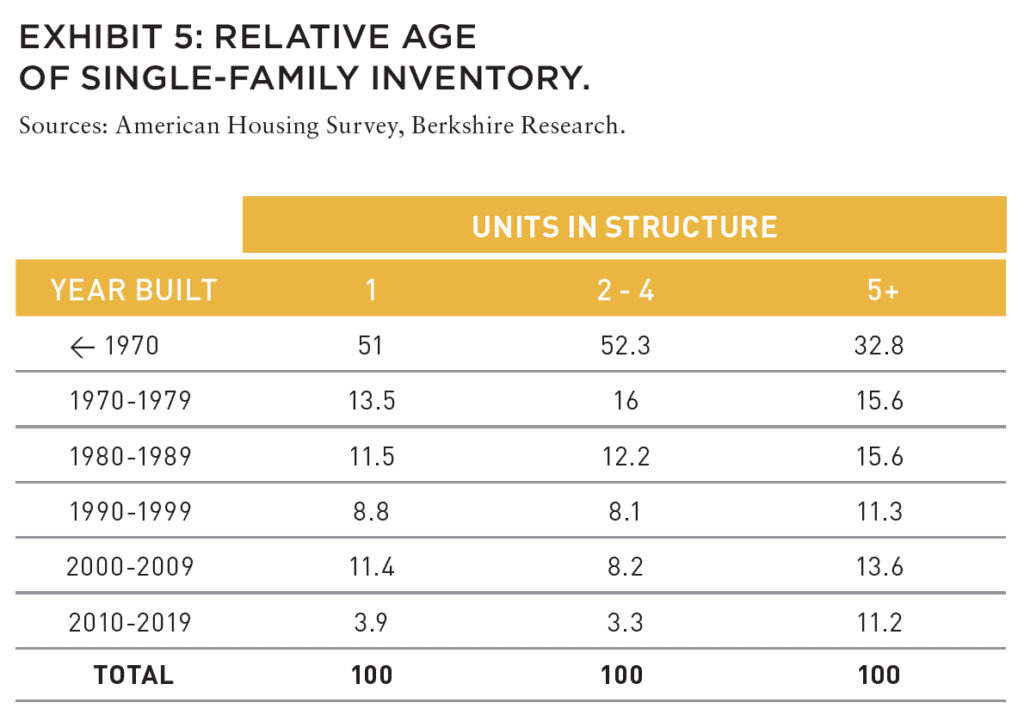

HOW DOES THE DISTRIBUTION OF SFR BY YEAR BUILT COMPARE TO APARTMENTS?

SFR inventory is much older relative to apartments, with the median year built for detached SFR of 1967 compared to 1981 for rental multifamily with five or more units. The rapidly aging SFR stock is also contributing to the wide supply/demand imbalance in the sector as thousands of such units are lost to obsolescence each year. As a result, SFR replacement demand rate is also higher relative to apartments.

HOW DO SFR UNITS AND APARTMENTS COMPARE IN TERMS OF RESIDENT PROFILE?

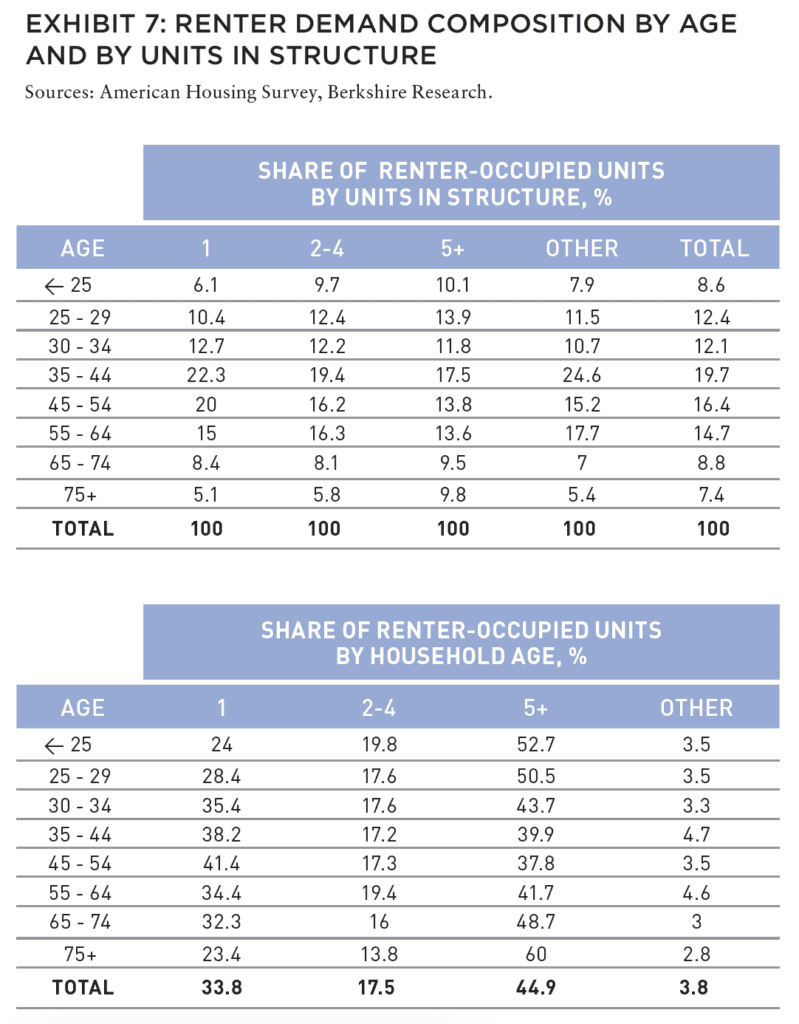

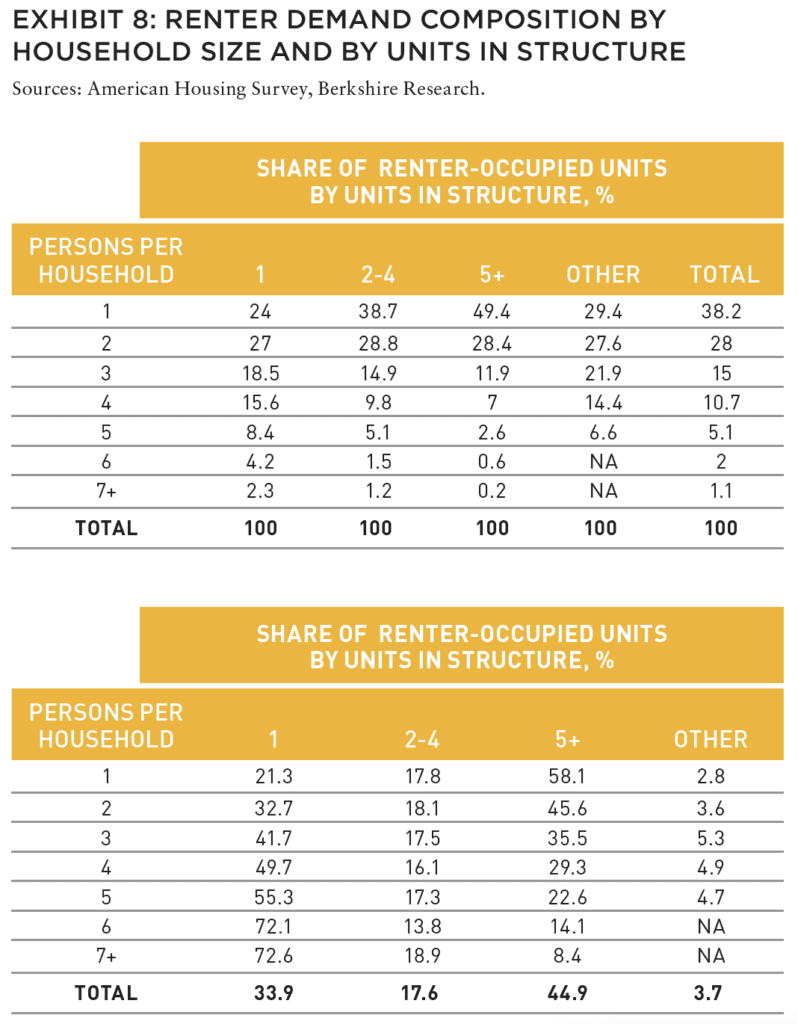

Given a notably larger square footage of an SFR house relative to a typical apartment, it is not surprising that the segment derives much of its demand from families with children. For example, more than 41% of renters aged 45–54 chose to live in single-family homes compared to the 38% with a preference for apartments. In contrast, more than half of renters age 25–29 rent apartments compared to about 28% residing in single-family homes.

As a result, households in prime family age groups (35–64) account for 57% of SFR demand, compared to 45% of demand for apartments (five or more units in structure). However, it is important to recognize that while households under the age of 35 and households over the age of 65 do have higher propensities to rent apartments, these groups do rent single-family homes as well, just as many middle-aged households rent apartments.

DO SFRS COMPETE WITH APARTMENTS?

While SFRs and apartments appeal to different age demographics and household sizes, there is a tangible overlap between the two segments in terms of demand they end up capturing. About 30% of renters under the age of 35, and households with one to three people, live in single-family homes while about 40% of renters age 35–64, and 25% of renter households with four people, live in apartments. In other words, the two segments can and often do compete for significant portions of rental demand. The degree to which SFR and apartments compete does vary across markets, however. The higher the share of rental demand already captured by single-family homes in a market, the greater the competitive pressure on apartment demand, and vice versa.

Another reason SFR competes with apartments is that while each segment does operate under its own set of real estate fundamentals, both are closely linked to broader housing market dynamics and share common drivers such as relative affordability of homebuying or household income. Rents in the two segments tend to be closely connected across markets over longer time periods. Considering that SFR and apartment properties share and directly compete for a significant portion of demand, they also impact each other from the supply side. In a market where combined SFR and apartment supply is too high relative to the overall number of rental households, both segments are likely to have elevated vacancy rates, and vice versa.

WHAT IS THE CURRENT SFR SUPPLY/DEMAND BALANCE?

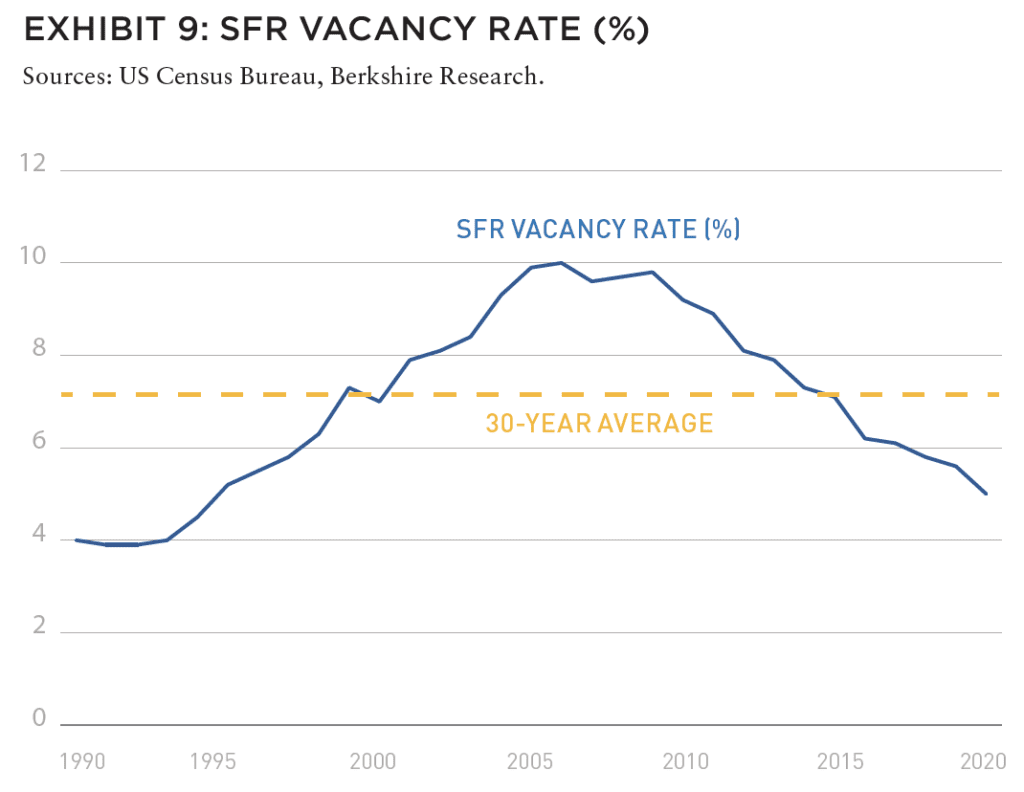

The SFR segment remains extremely tight by historical standards. As Exhibit 9 shows, SFR vacancy rates dropped to 5% in 2020, the lowest level since the early 1990’s, and about 200 BPS below the long-term historical average. This implies an SFR supply shortage of more than 300,000 units—a deficit that will take years to close through new SFR construction at the current pace.

THE HOUSING SECTION

ALSO IN THIS ISSUE (SUMMER 2021)

NOTE FROM THE EDITOR / The Housing Issue

AFIRE | Benjamin van Loon

INVESTOR SENTIMENT / Shining Through Darkness

The 2021 AFIRE International Investor Survey underscores a sense of calculated optimism for CRE investment in the year ahead.

AFIRE | Gunnar Branson

ECONOMY / Revisiting Inflation

For commercial real estate investors, inflation fears are real— but are they rational?

Aegon Asset Management | Martha Peyton, PhD

DEURBANIZATION / Herd Community

Uncertainty surrounding remote work and politics suggest a wide range of potential outcomes for big cities, which may upend the long-running megatrend toward urbanization.

Green Street | Dave Bragg and Jared Giles

HOUSING / How to Rebuild

Could an idea to “bring back” New York after the pandemic work in other cities?

Aria | Joshua Benaim

HOUSING / Single Family, Multiple Questions

Institutional ownership in single-family rentals accounts for less than 5% of the segment, but answers to key questions could change start to change that balance.

Berkshire Residential Investments | Gleb Nechayev, CRE

HOUSING / Institutionalizing Single Family

Over the past two decades, the single-family rental industry has evolved into an institutional-caliber asset class—so where is the sector going next?

Tricon Residential | Jonathan Ellenzweig

HOUSING / Build-to-Rent Boom

The future is bright for build-to-rent and institutional investors are increasingly looking at investing in this sector.

Squire Patton Boggs | John Thomas and Stacy Krumin

OFFICE / Recovering the Office

While most agree that the office sector has a difficult road ahead, there is less consensus about future demand in the sector. What are the indicators investors should be tracking?

Barings Real Estate | Phillip Conner and Ryan Ma

OFFICE / London Calling

With Brexit and pandemic resolutions coming into focus, pricing disparities could dissipate based on improved cross-border liquidity and cap rate compression in the London office market.

Madison International Realty | Christopher Muoio

LOGISTICS / Supply Change

Urbanization, digitalization, and demographics are the key trends to watch for understanding the future of logistics real estate.

Prologis | Melinda McLaughlin and Heather Belfor

CLIMATE / Accounting for Environmental Risk

When it comes to guards against environmental risk, Boston, Indianapolis, Minneapolis, and Portland are some of the most prepared US cities. What makes them different?

Yardi Matrix | Paul Fiorilla, Claire Anhalt, and Maddie Harper

ESG / Putting People First

Though “impact investing” is no longer totally distinct from investing in general, investors still have a lot of work to do for fulfilling the social and governance aspects of ESG expectations.

Grosvenor Americas | Lauren Krause and Brian Biggs

MULTIFAMILY / Influencing Multifamily

As we come out of the pandemic to a new economy, it seems likely that the creator economy will continue to grow. This will have a major impact on the multifamily sector.

citizenM Hotels | Ernest Lee

TALENT / Enhancing Life Sciences

As the global life sciences sector continues to grow in real estate, highly specialized skills and experience will be the keys to success.

Sheffield Haworth | Max Shepherd and Jannah Babasa

EDUCATION / Real Estate Education Goes Global

The evolution of global real estate education over the past three decades will be integral to developing a rich pipeline of talent for the future of commercial real estate.

Georgetown University | Julian Josephs, FRICS

The aggregate SFR supply shortage is only part of the story, however. There is a major disconnect between the current distribution of renter households by size relative to the distribution of existing rental inventory by the number of bedrooms. As of 2019, renter households with four or more people accounted for 19% of the total, whereas rental units with four or more bedrooms accounted for about 8%. The current distribution of the rental inventory by the number of bedrooms relative to the composition of underlying demand makes the existing SFR supply deficit even more severe.

HOW WILL CHANGING AGE DEMOGRAPHICS IMPACT SFR DEMAND GOING FORWARD?

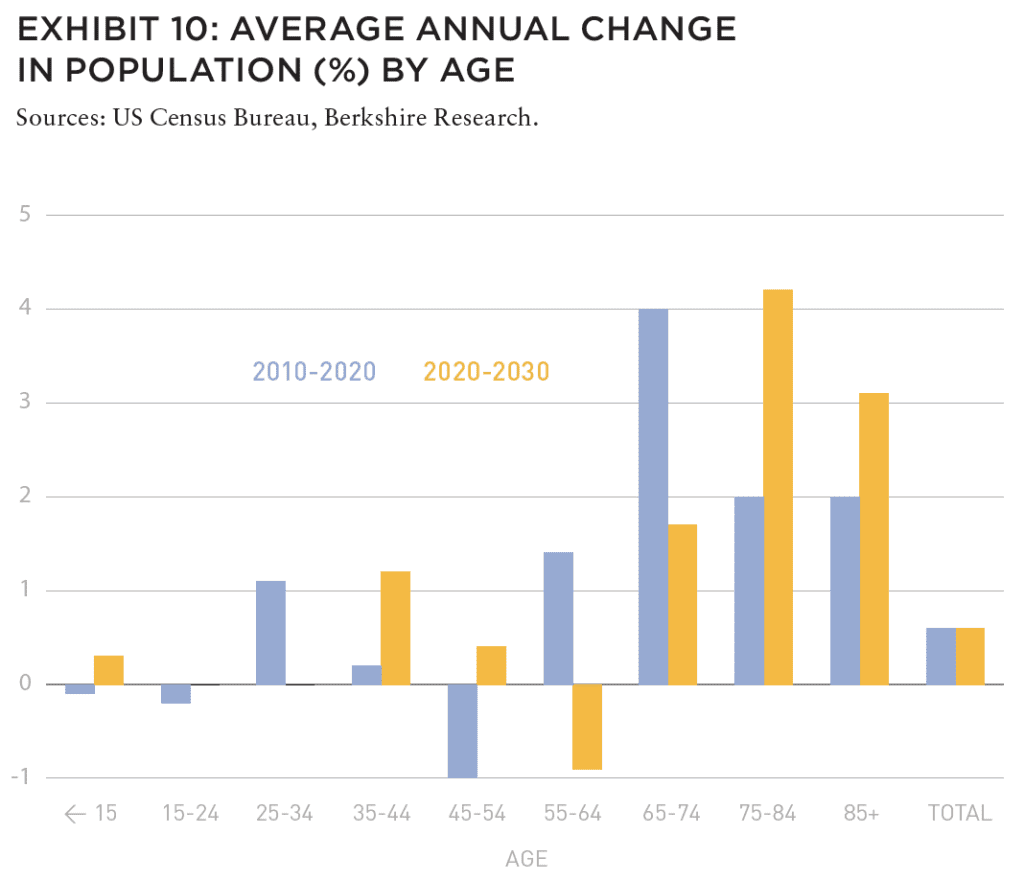

The shifting age composition of the US population should benefit SFR demand in this decade more as compared to the last one. As discussed earlier, household cohorts with higher propensity to rent single-family (rather than apartments) fall within 35–64 years of age. The latest projections indicate that in contrast to the last decade (2010–2020), there will be much stronger growth in the population aged 35–44 (accelerating to more than 1% per year) and 45–54 (turning positive). At the same time, growth in population age 55–64 is expected to turn negative, but this decline will be more than offset by the two other age groups.

In total, population age 35–64 should increase by 360,000 per year in this decade as compared to about 220,000 per year from 2010–2020. Moreover, in this decade, growth in the 36–64 age range will be driven primarily by the population aged 35–44 (who are more likely to rent) as compared to those aged 55-64 the last decade.

From a purely demographic perspective, the shifting age composition in this decade will also benefit SFR demand more than multifamily, which will face a headwind of a slight decline in population age 25–34.

SFR is a major part of the US rental housing market that will continue to attract large capital. Understanding its fundamental drivers, cyclical and structural trends, as well as its links to other housing segments, multifamily in particular, will be key in developing viable long-term strategies for institutional investment.

—

ABOUT THE AUTHOR

Gleb Nechayev, CRE, is Head of Research and Chief Economist at Berkshire Residential Investments, a people-focused investment management company known for its vertically integrated organization and experience in US residential real estate.

—

NOTES

This material is for informational purposes only and is not intended to, and does not constitute financial advice, investment management services, an offer of financial products or to enter into any contract or investment agreement.