Two years after offices closed in the US due to the COVID pandemic, the debate over the long-term future of the office continues. What should office investment look like going forward?

Two years after offices closed in the US due to the COVID pandemic, the debate over the long-term future of the office continues. What should office investment look like going forward? During the second half of 2021, COVID variants postponed an unofficial return to work for many workers leaving current physical occupancy still less than half of what it was before the pandemic.

And yet the office sector is not obsolete.

APAC and the EMEA are host to plenty of cities where office workers have returned en masse following vaccination programs. And across the US, office transactions in the fourth quarter of 2021 reached $52 billion, the second strongest quarter on record, pointing to ample transactional liquidity.1

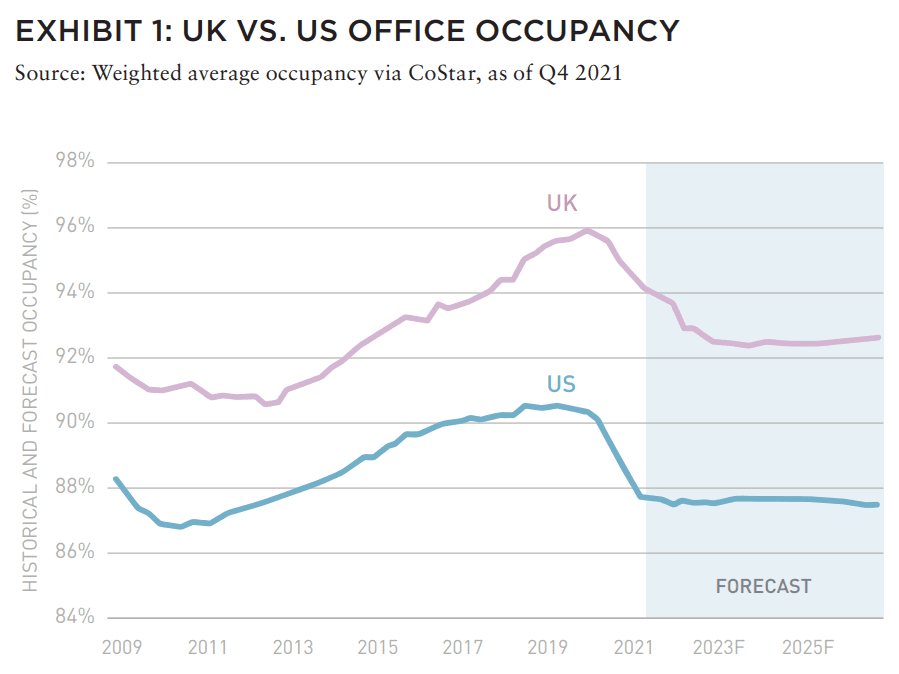

Investors should nonetheless be cautious proceeding in a post-COVID era. Unlike in Europe and the UK, the US had an oversupply of commodity space facing functional obsolescence even before the pandemic (Exhibit 1). Investing in office in the current market environment will likely require a higher degree of precision than during prior cycles. For example, Barings’ approach is to target areas with a predominance of scientific, technology, education, and/or mathematical (STEM) employment sectors in a location. In addition to clusters of STEM tenancy, local amenities and building characteristics should also be considered. Given an estimated US$2.8 trillion of US office properties, creating a framework for selectivity is a practical necessity for prospective investors in the “post-pandemic” era.2

OFFICE STILL MATTERS, BUT MORE SO IN CERTAIN CITIES

The office sector is still a significant component of most institutional investor real estate portfolios; 30% of the gross asset value (GAV) of the institutionally owned NCREIF Property Index is office. In 2021, there was US$144 billion in office property trades, up 62% from 2020 and in line with 2015–19 annual average of US$143 billion.3 Boston, Manhattan, San Jose, Seattle, and Dallas were the top five most active transaction markets in 2021 and are perennially within the top ten.

Those who have followed the evolution of major metropolitan areas over the past quarter century recognize that, as global economic output has been increasingly knowledge- and services-oriented, clustering (also known less colloquially as agglomeration) factors more into the location decisions of businesses and residents. The benefits of clustering are essentially related to economies of scale and reducing the frictional costs of production. It is no coincidence that each of the aforementioned places that led in office transactions also host world-renowned, thought-leading firms and institutions of higher learning.

Famed urban economist Ed Glaeser refuted the proclamation that “cities are dead” even as most cities were still under pandemic lockdowns that seemed disproportionately harder on those inhabiting urban cores relative to those in the suburbs.4 Despite COVID, the advantages of clustering still far outweigh its inconveniences. The World Bank’s measure of global urbanization rose in 2020 as it has each year since 1960, when the time series starts. In other words, if cities are not dead, then neither is the office.

However, one cannot dismiss how deeply the pandemic has changed tenant demand preferences, at least over the next several years. Office vacancy is at its highest in a decade, as of Q4 2021.5 While early forecasts expected that a broad-scale return to the office would bring vacancy down from its current cyclical high, recent baseline expectations are for vacancy to remain at elevated levels over the next several years. While a handful of firms and even municipal governments have called their employees back to their offices full-time, most are generally allowing for flexible—if ambiguous—hybrid work arrangements. Whether or not one believes that tenant preferences will normalize to their pre-pandemic state eventually, a strategy founded upon that conviction would seem speculative at this point. As investors, we need to identify properties and locations that are relevant today.

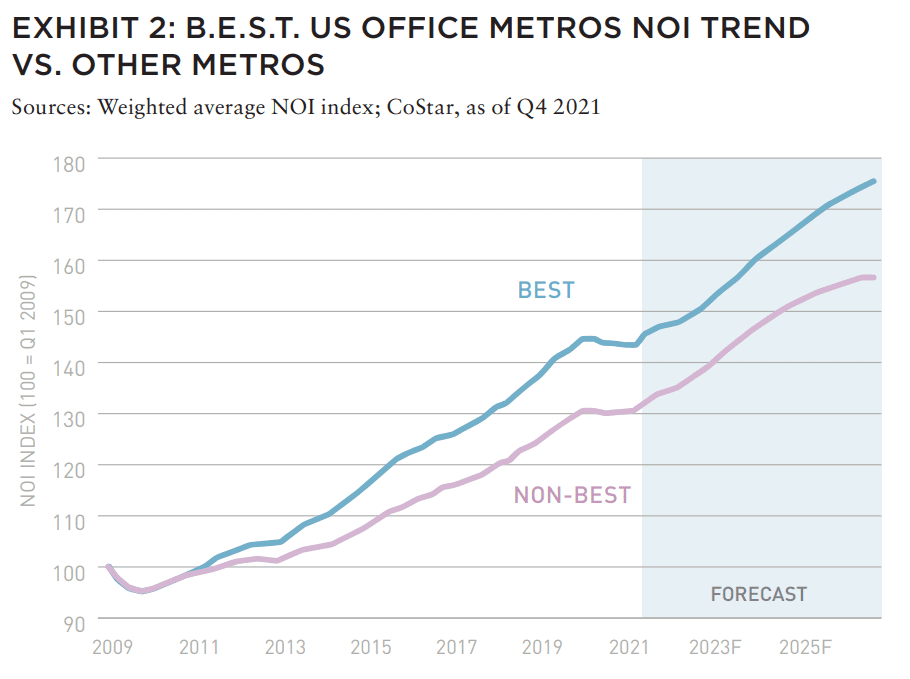

Screening by educational attainment and the proportion of STEM employment results in a set of metro areas that demonstrate persistent and sizeable unlevered total return outperformance of 53 BPS since 1994, driven by more favorable fundamentals (Exhibit 2). At Barings, we refers to these sixteen metro areas as the B.E.S.T. (Barings Education, Science, and Technology) metro areas. By focusing almost exclusively on these geographies, we greatly increase our chance of identifying the right office investments for the post-pandemic era.

GETTING LOCAL

That this curated set of metro areas is already highly investible and deeply institutional is not incidental. The aggregate gross property values for these combined office markets total US$1.8 trillion out of an estimated US$2.8 trillion of total value.5 A significant proportion of office properties even in these outperforming metros could underperform. The selection framework detailed here is meaningfully more granular.

Geographically, property markets are comprised of submarkets whose delineations are drawn along terrain markers such as major roads. The sixteen BEST markets contain 480 distinct submarkets. We filter close to 95% of submarkets and cover the remaining 5%, amounting to about two dozen submarkets.

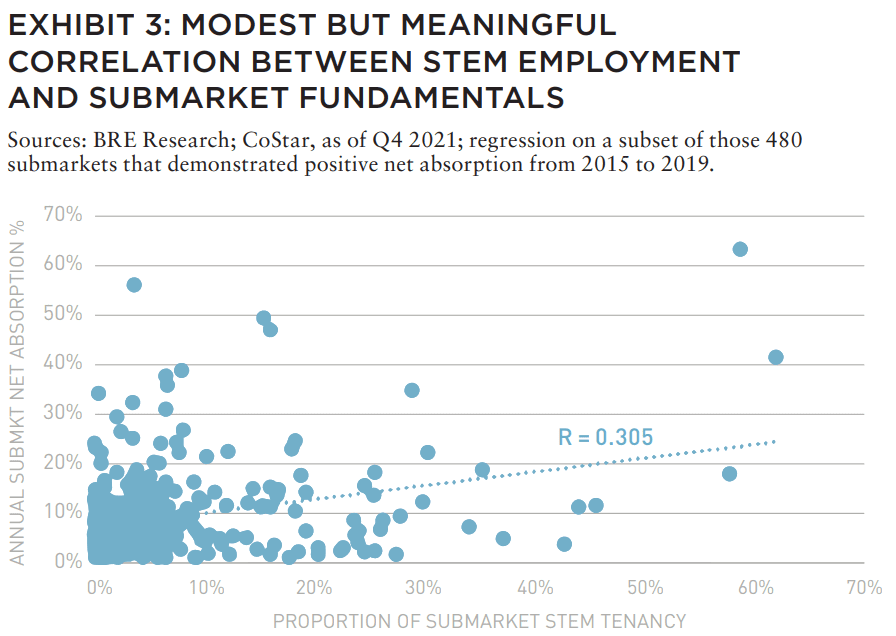

A high percentage of STEM tenancy in and of itself is not necessarily a reliable indicator that a submarket has performed or will perform better than a submarket with low STEM tenancy. We have found only modest correlation between proportion of STEM tenancy within a given submarket pre-pandemic and the annual rate of historical net absorption (R = 0.305, Exhibit 3). Certain submarkets are geographically diffuse and/or may have a large inventory of existing, aged stock—all of which can be factors associated with weak performance. Atlanta’s Central Perimeter submarket is an example. Despite having a sizeable share of STEM tenancy, submarket vacancy pre-pandemic was five percentage points above the metro average, and Central Perimeter’s rate of net absorption was flat from 2015 to 2019, despite little in the way of new construction.6 The predominance of office towers— many past the thirty-year mark—dispersed across a terrain with low walkability means the Central Perimeter is unlikely to attract dynamic STEM tenants who place a premium on clustering. Additionally, the area is likely to struggle with unfavorable supply and demand fundamentals at least for the remainder of the post-COVID cycle.

INCORPORATING “STREET LEVEL” OBSERVATIONS

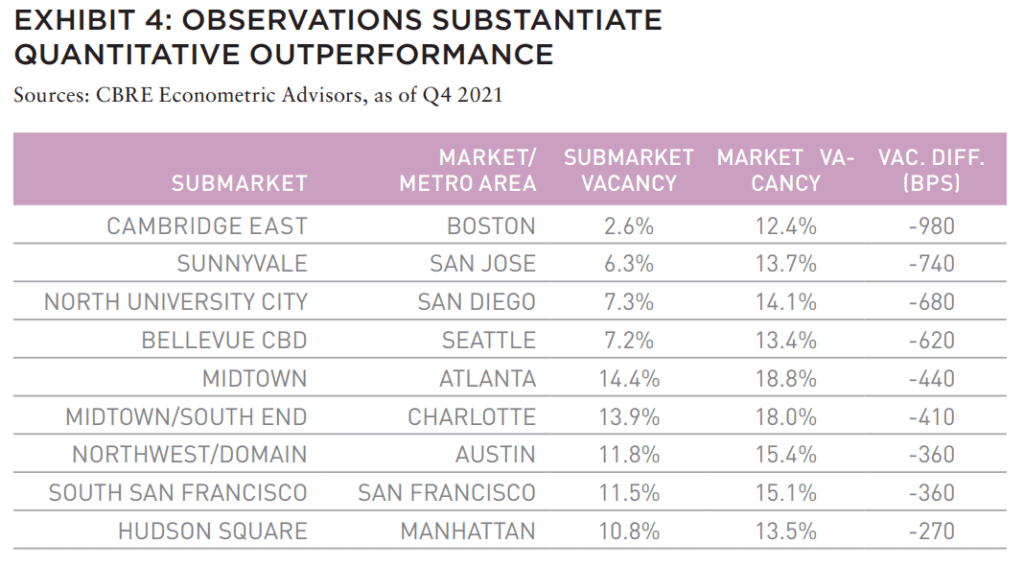

You do not have to be an urban economist to understand the appeal of neighborhoods such as East Cambridge in Massachusetts; Hudson Yards in New York; the Domain in Austin; Downtown Bellevue, Washington; Sunnyvale, San Jose; and Charlotte’s South End—to name a handful. It is not only the predominance of STEM tenancy combined with shops and restaurants that actually make people want to be in these areas, even though business and living costs are relatively steep. “Street-level” observations suggest that these areas should benefit from greater office tenant demand, and the data largely bears that out (Exhibit 4).

Factors that make a neighborhood or submarket desirable to live and work in likely make it attractive from an investment perspective, as well. When Barings analyzed the top fifty large submarkets ranked by historical and forecast fundamentals, we found that 28 submarkets had all of the three following characteristics:

• Concentration of STEM tenancy: 5% or more of tenants across the submarket were in STEM sectors

• Concentration of amenities: Recreational, cultural, social, educational institutions including the presence of one or more universities, museums, sports stadiums, and entertainment districts

• Above average apartment and office development activity: while new supply is an investment risk, the prevalence of active development is more often indicative of clustering and “place-making”

These submarket characteristics are fairly intuitive. However, the process of setting up quantitative screens and criteria weights is a more involved and time-consuming process. However, this process is increasingly necessary in an era of rising risk premiums for office. Taken individually, these criteria are useful, but when combined, they yield potent investment insights.

Furthermore, criteria filters around building characteristics including flexible floorplates, collaborative spaces, and substantive ESG implementation can aid in the property selection process. Importantly, determining the balance of criteria and the correct thresholds require the interaction and input of portfolio and asset management in addition to the acquisition teams’ insights.

LOOKING AHEAD

There were moments over the past two years when many of us sequestered in our residences wondered if we would ever return to an office building again during our lifetimes. Looking back, we can more deeply appreciate at least some of the reasons offices have existed for hundreds of years. The office workspace at its best enables the cultivation and enhancement of corporate culture, fosters innovation and productivity through collaboration, and helps to attract and retain talent especially among younger workers.

Today those justifications resonate more meaningfully following an extended period of pandemic-imposed isolation. Whatever you may believe about the office long-term, it remains an investible property type today, especially as income yields in other property types have reached once unimaginable lows. Having said that, investing in the office sector after COVID without establishing a rigorously selective framework likely paves a path to disappointment – if not outright failure.

—

The authors raise one of real estate’s central questions from the pandemic—how our relationship to the office has changed and what it means for investment strategy. Their insights speak to the even larger issue of changing space use patterns across sectors and the spatial distribution of activity within and across metropolitan areas. While the vagaries of the pandemic have delayed experimentation with hybrid working models, the authors emphasize the fundamental value of colocation as an input to long term innovation and firm performance; in other words, firms that brings people together intentionally will outperform.

The criteria for market selection emphasized in this paper focus on industry clustering and the enhancement to economic productivity from co-location. These are likely top-of-mind for executives, economists, and city officials depending on diversified tax revenue streams. The other side of equation includes myriad factors that will also be determinative of office market and submarket competitiveness. Among them, the quality of the transportation infrastructure, labor market dynamics, and local tax efficiency are two standouts. As our understanding of the post-pandemic office evolves, further incorporating these drivers into analyses will prove efficacious. As one example, early data suggest greater transportation autonomy and lower dependence on public transit are correlated with higher office occupancy, independent of a market’s industry concentration.

For many major metropolitan areas, the data show a robust return to leisure and hospitality activities, with sold-out concert and sports venues and rebounding dinner reservation activity. The return to office is a laggard. This divergence underlines that health concerns are not the sole of consideration of employees. Instead, the emergence of new hybrid models of work will reflect a bending to post-pandemic realities, including a more intentional role for the office that will drive utilization and sector performance.

Sam Chandan, PhD, FRICS, FRSPH

Editorial Board Member, Summit Journal

Professor of Finance and Director, Stern Center for Real Estate Finance, New York University, Stern School of Business

—

ABOUT THE AUTHORS

Dags Chen, CFA, is Head of US Real Estate Research and Strategy; Ryan Ma is Managing Director of Research and Strategy; and Ryan LaRue is Director of Innovation and Portfolio Strategy for Barings Real Estate, a global real estate platform with extensive capabilities across both debt and equity strategies.

—

NOTES

1 Real Capital Analytics, rcanalytics.com, accessed January 30, 2022.

2 CoStar, costar.com, accessed February 2022.

3 Real Capital Analytics, rcanalytics.com, accessed January 30, 2022.

4 James Pethokoukis, “The Future of the American City: My Long-Read Q&A with Ed Glaeser,” American Enterprise Institute, updated September 14, 2021, aei.org/economics/the-future-of-the-american-city-my-long-read-qa-with-ed-glaeser/, accessed April 29, 2022.

5 CoStar, costar.com, accessed February 28, 2022.

6 CBRE Econometric Advisors, cbre-ea.com, accessed December 31, 2021.

EXPLORE THE FULL ISSUE (SPRING 2022)

MARCHING BACKWARDS INTO THE FUTURE

The new 2022 AFIRE International Investor Survey Report reveals future institutional investment trends as the pandemic transformed how we live, work, and play.

Gunnar Branson and Benjamin van Loon | AFIRE

CITIES THAT WORK

What is it that makes London, Stockholm, Berlin, Amsterdam, and Paris the top European cities for office investment? And what could this mean for other global cities?

Dr. Megan Walters | Allianz Real Estate

SURVEY SURFEIT

Be careful about advice you hear from surveys— it will not always play out as expected.

Jim Costello | MSCI Real Estate

NEW WORKING AGE

Outside of WWI and II, the US working age population has never declined. As of 2021, that statement is no longer true.

Stewart Rubin and Dakota Firenze | New York Life Real Estate Investors

SELECTIVE FRAMEWORK

Two years after offices closed due to the COVID pandemic, the debate over the longterm future of the office continues. What should office investment look like going forward?

Dags Chen, CFA; Ryan Ma, CFA; and Ryan LaRue | Barings Real Estate

GARDEN VIEW

US garden apartment investments are offering outsized return potential –but access remains a challenge.

Martha Peyton, PhD | Aegon Asset Management

SINGLE-FAMILY DEMAND

As an increasingly popular asset class for institutional investors, single-family rentals are supported by strong future demand drivers to propel sector outperformance.

Daniel Manware | Nuveen Real Estate

ESSENTIAL HOUSING

The US is in the middle of one of the biggest housing crises that the country has ever seen. It needs a more resilient approach to housing.

Todd Williams | Grubb Properties

LODGING TAKES THE LEAD

As a labor-intensive and service oriented asset class, hospitality is uniquely positioned to be a leader in advancing sustainability goals for investors.

Charlotte Kang, Geraldine Guichardo, Lori Mabardi, and Emily Chadwick | JLL

CARRY ON, CARRY OVER

While continuation vehicles were once viewed as a signal of delay or failure, market sentiment is rapidly changing.

Max LaVictoire and Ashley Anderson | Hodes Weill & Associates

RENEWING ETHICS

A note from AFIRE’s Ethics Chair on the need for maximizing ethics in an age where globalization is under threat.

El Rosenheim | Profimex