This article appears in Summit Journal (Summer 2020) | Download PDF

UNDERSTANDING NEW CHANGES IN TENANT DEMAND, ECONOMICS, AND PUBLIC HEALTH WILL BE CRITICAL TO THE FUTURE OF COMMERCIAL REAL ESTATE INVESTING.

All real estate investors are focused on the potential paths for the global economy and commercial real estate (CRE) over the quarters ahead. Some are focusing on stressed tenants, shrinking rent collections, uncertain property values, and surviving through the distress. Others are examining their dry powder and trolling for investment opportunities.

For both types of investors, weighing the potential paths forward requires addressing three challenges: (1) the coronavirus, (2) the economy, and (3) tenant demand.

In addressing each challenge, investors can begin to realign their strategies and rightsize their portfolios to respond to the “new normal.”

CHALLENGE ONE: THE CORONAVIRUS

The first challenge in forming expectations is to make assumptions about future COVID-19 contagion. Despite the end of government-mandated lockdowns and some slowing in the pace of new cases, there is no evidence that the coronavirus would peter out quickly on its own. Some are hoping that warmer weather in the northern hemisphere will slow transmission but there is a risk of a new wave of cases in the fall. Ultimately, beating the virus may require effective vaccines alongside wide dissemination of those vaccines around the world. In the meantime, economies will need to adapt.

Optimistic investors might conclude that advanced economies will adapt quickly and effectively to allow economic recovery to take hold. In this view, social distancing, hand washing, and face masks will simply be embedded in everyday life with consumers paying less and less attention to the virus. Optimists will see investment opportunities emerge from recovery and the process of adaptation. Some property sectors will benefit more than others.

Pessimists might be skeptical of quick recovery and rapid adaptation. For pessimists, continuing flare-ups in the number of virus cases and associated stories of suffering will slow adaptation and stall economic recovery. Consumers will stay home even without lockdown requirements until the virus recedes from daily headlines. Some employees will be afraid to return to work, fearing that they might be exposed to the virus. Other employees will be unable to return to work because of childcare and eldercare needs. In this environment, pessimistic investors might look for opportunity in distressed assets when and if pricing drops enough to be attractive.

CHALLENGE TWO: THE ECONOMY

The second challenge in forming expectations is to make assumptions about economic growth prospects. The best case envisions a V-shaped recovery starting in the second half of 2020. This view interprets the COVID-19 crash as a short-lived disaster that ends as the shock effect dissipates and adaptation gets underway. Pent-up demand propels a rebound with most businesses reopening, most employees returning, and most consumers opening their wallets to spend. Relief from lockdowns encourages partying a la the Roaring Twenties. In this scenario, monetary and fi scal policy responses can be deemed successful. Consumers are hoping for a V-shape; 78% of April’s 21 million newly unemployed people expect their woe to be temporary.¹

Alternatively, a more sober case envisions a U-shaped recovery, where a rebound occurs only after a more prolonged period of recession. In this view, the COVID-19 shock produced damage to the economy that will take time to resolve. Hospitality, travel, entertainment, and restaurants will recover slowly, with some establishments gone for good and some sectors permanently reduced.

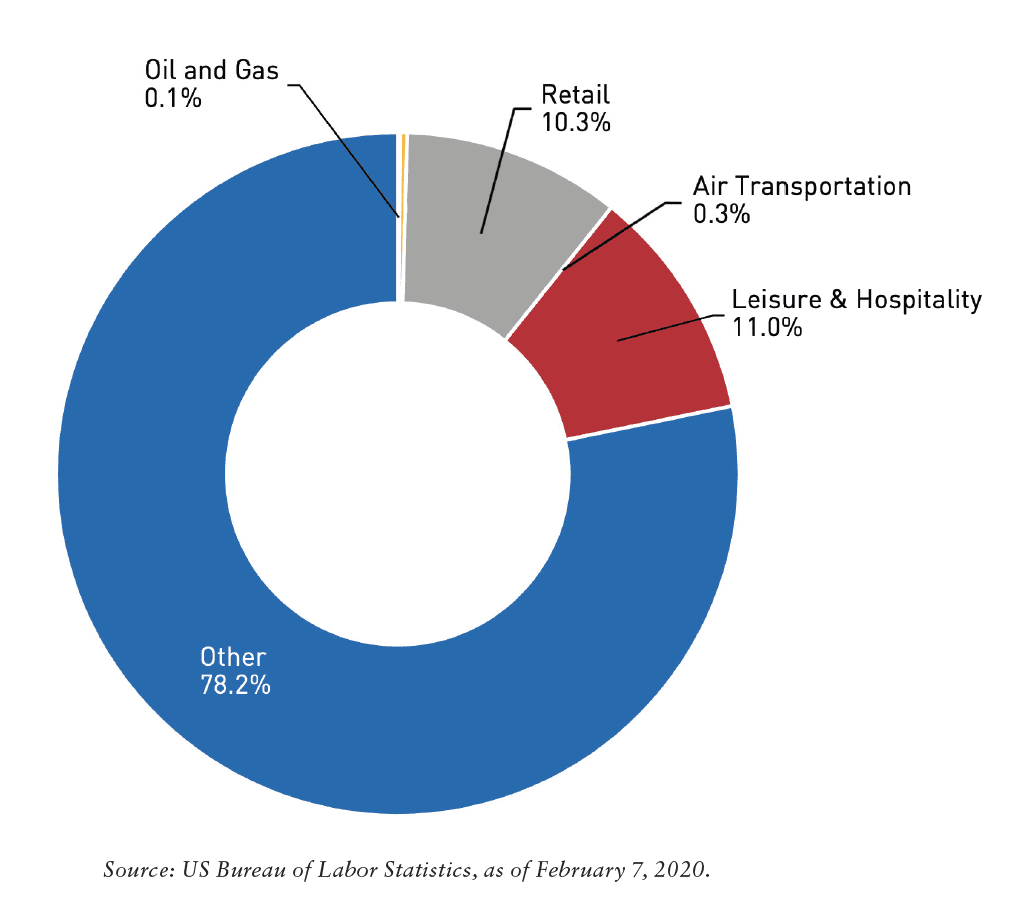

The debacle in oil-producing locations adds to the distress on top of global economic weakness. Damage to consumers, both lost income and wealth, as well as lost confidence in personal safety, will also take time to repair. In the interim, consumers will hold back. Further doses of fiscal policy could help to truncate the belly of the U-shape and speed a turnaround. As shown in Exhibit 1, the proportion of US employment in distressed sectors comprised 22% of total nonagricultural jobs at the end of 2019. These sectors include retail (15.7 million jobs); leisure and hospitality, including restaurants (16.8 million jobs); air transportation (508,000 jobs); and oil and gas extraction (158,000 jobs).² The negative short-term prospects of these sectors illustrate the magnitude of their drag on the economy.

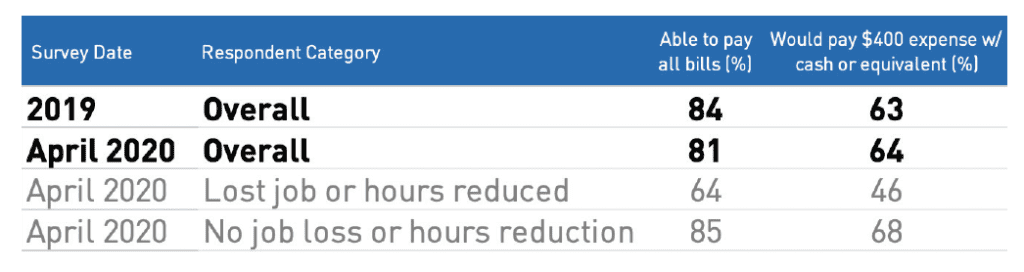

Another view envisions a very pessimistic L-shape, wherein economic growth fails to rebound for a very prolonged period. Here, the 2020’s will be a lost decade, with the COVID-19 shock marking the beginning of economic restructuring, and probable political restructuring, as well. In this scenario, consumers remain traumatized for a long time much like the frugal Depression generation of the 1920’s and 1930’s. Spending growth will be mediocre at best as households bulk up savings recognizing how little cushion they had going into the crisis. This lack of resources is shown in the most recent US Federal Reserve report (Exhibit 2) on household economic well-being surveyed late in 2019 and in the first week of April 2020 after the March COVID-19 crisis took hold.

The report shows that 63% of adults surveyed in 2019 could confidently cover an unexpected US$400 expense with cash or credit. But in the first week of April 2020, 13% of respondents had lost their jobs in March, and 6% had hours reduced. Of these respondents, only 46% could confidently cover an unexpected US$400 expense. With April delivering the loss of another 21 million jobs, financial precariousness most certainly mushroomed. Without a strong economic rebound, the political environment might well deteriorate into a raucous tug-of-war over the need to address the vulnerabilities revealed by the virus.³

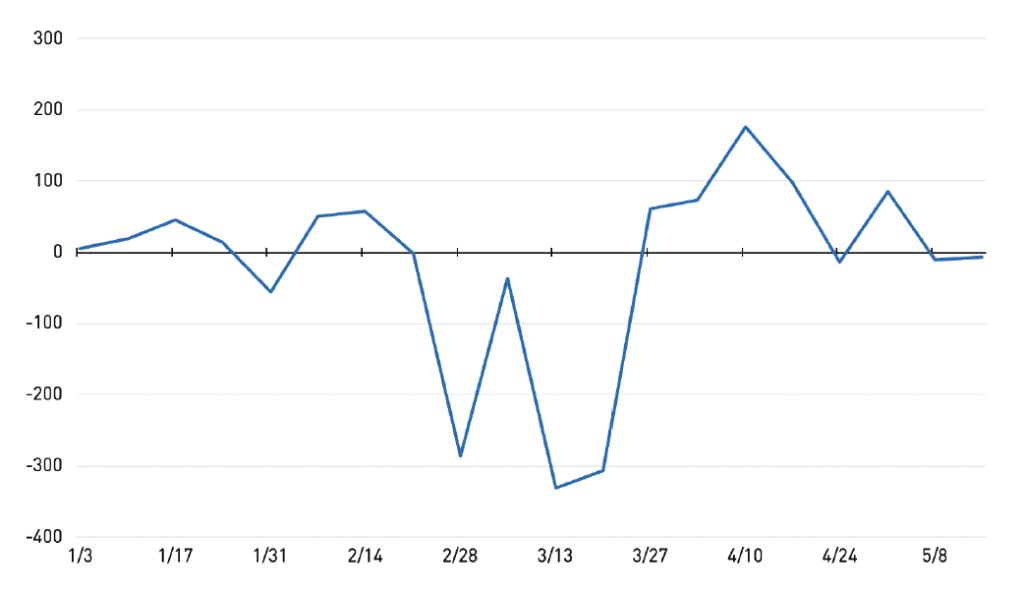

Finally, a W-shaped recovery scenario is another alternative. Here, economic growth will gyrate in response to fl are-ups in the virus and ratcheting economic ups and downs. Some sectors will need to downsize through a process of trial and error as domestic and global demand may not return to pre-COVID-19 levels before financial resources are depleted. Employment will rebound but then recede as rightsizing is approached. Businesses will need to adapt to more employees working from home, more attention to employee childcare needs, and demands to provide better physical arrangement of office space, including improved ventilation. Some attention might be paid to addressing virus-related vulnerabilities, but generally positive economic growth expectations will discourage enthusiasm for political upheaval. The gyrations in the stock market since the beginning of 2020 (Exhibit 3) illustrate the market’s mood swings, which portray somewhat of a W shape.⁴

Source: Federal Reserve Bank of St. Louis. As of June 18, 2020.

CHALLENGE THREE: TENANT DEMAND

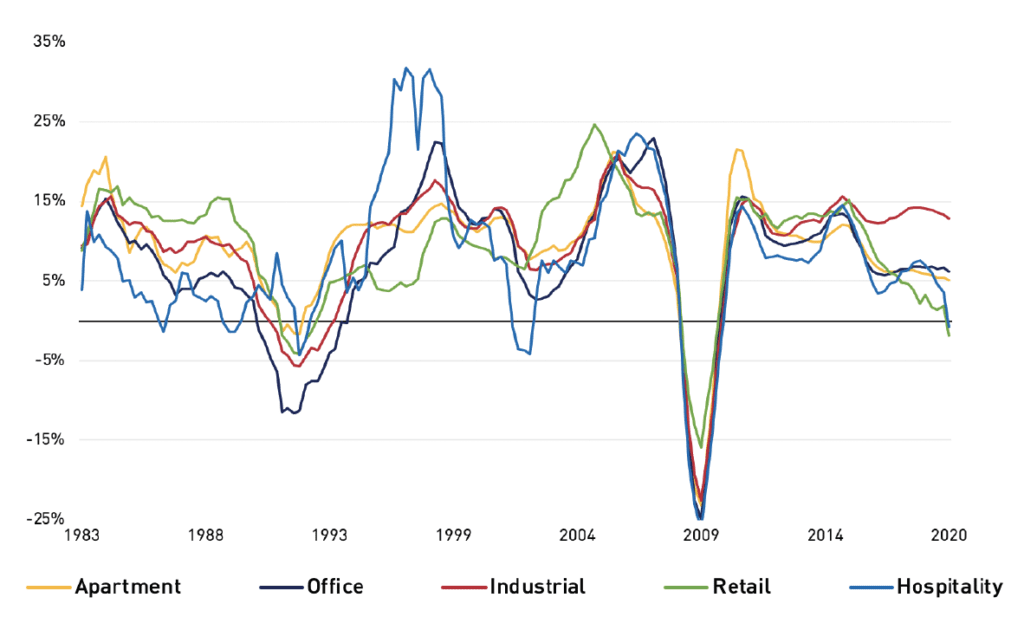

Under all scenarios—V, U, L, and W—tenant demand will evolve, leaving all sectors with the need to rightsize their stocks by repositioning, repurposing, or divesting excesses. The most challenged CRE sectors are hospitality and retail. Investment returns in these property sectors were already stressed before COVID-19 took hold (Exhibit 4).

Source: NPI-NCREIF As of March 31, 2020. Past results are not indicative of future performance.

THE HOSPITALITY SECTOR will be challenged to adapt to prolonged COVID-19 fears, even after the virus is vanquished. Higher standards of housekeeping will be required to reestablish customer confidence, and this will raise costs of operations. Additionally, the sector is ripe for rightsizing, as businesses will have learned from COVID-19 lockdowns that travel is less necessary than previously thought. The most attractive opportunities for the sector will likely be in high quality hotel locations with limited supply. Locations with very abundant supply will shed some excess, which might offer opportunity for repurposing perhaps to apartments.

THE NEED FOR THE RETAIL SECTOR to rightsize is enormous and has been understood long before COVID-19. The NCREIF Property Index (NPI), a US commercial real estate benchmark, reports negative appreciation return for retail properties for the last two to three calendar years depending on retail property type. In addition, total return for the retail sector has underperformed industrial, apartment, and office sectors for each of the last three calendar years. The woes of retail reflect an accumulation of space that has become excess due to growing e-commerce sales and relocation of population leaving some trade areas over-supplied. The COVID-19 crisis has accelerated the negative impact of these structural forces on the retail sector. The strongest sub-sector of retail is the neighborhood center segment, which includes the grocery and pharmacy chains that serve local households. But even these centers are threatened by the possibility that more consumers will become attached to online purchases of these necessities, even after the lockdowns. Investors might consider looking for the best neighborhood centers and opportunity for repurposing failed centers of other types.

THE OFFICE SECTOR also faces challenges and will need to adapt to evolving tenant needs as social distancing prevents a return to pre-COVID-19 density of use. Additionally, the sector will need to rightsize to the needs of a smaller GDP that will take time to recover. In the near-term, more intense housekeeping will increase operational costs. Over time, space configuration and mechanical needs will evolve to provide safer spaces with better ventilation. Work-from-home experience will likely encourage more remote work and less need for office space. More space per employee, combined with fewer employees in the office, will offset each other, but to an unknowable degree. The best investment opportunities should likely remain in more walkable locations, but not necessarily in the densest locations.

THE INDUSTRIAL SECTOR appears to be a winner both through the lockdown and throughout the last decade. Loss in retail has translated into gain in industrial, as sales have shifted from brick-and-mortar space to e-commerce. Yet, after accumulated inventories of goods are absorbed, industrial space demand may ebb, reflecting the shrunken US economy and diminished trade. Over time, the economy will recover to its former size and industrial space demand will rebound, justifying investment in industrial properties as pricing allows.

THE APARTMENT SECTOR also appears to be a winner. While apartment construction has exceeded demand in selected metros over recent quarters, availability of more affordable units has remained very tight, and rent growth has been ample. Some erosion in occupancy and rent for more affordable units will likely accompany the COVID-19 recession, but it will be cushioned by very tight supply. New Class A construction will take some time to be absorbed and concessions will likely be material. Patient investors may find some distressed opportunities within the Class A universe. Opportunity in the more affordable universe will be difficult to source but probably more worthwhile.

—

ABOUT THE AUTHOR

Martha Peyton, Ph.D, CRE, is Managing Director of Real Assets Applied Research for Aegon Asset Management Real Assets, the real assets investment center for Aegon Asset Management, a leading global investment manager with US$395 billion in assets under management/advisement as of December 31, 2019.

NOTES

1. US Bureau of Labor Statistics, “The Employment Situation,” BLS (June 5, 2020). Note: Job losses peaked at 20.7 million in April followed by a gain of 2.5 million jobs in May; bls.gov/news.release/pdf/empsit.pdf

2. US Bureau of Labor Statistics, “The Employment Situation,” BLS (February 7, 2020); bls.gov/news.release/pdf/empsit.pdf

3. US Federal Reserve Board, “Report on the Economic Well-Being of US Households in 2019,” US Federal Reserve (May 14, 2020); federalreserve.gov/publications/files/2019-report-economic-well-being-us-households-202005.pdf

4. Federal Reserve Bank of St. Louis (June 18, 2020).

—