The US market shows stability as a preferred global destination for investment with allocations up 6% from 2022, relative to a 5% decline in European investment.

For more than thirty years, the AFIRE International Investor Survey has gathered the opinions of AFIRE members, comprised of 180 institutional investors, pension funds, asset managers, and other leading global organizations from nearly two dozen countries with approximately US$3 trillion AUM.

The results of this annual process produce this benchmark report; a useful tool for understanding the goals, challenges, and long-term thinking underscoring the international view of commercial real estate opportunities in the US.

As in 2022, AFIRE has conducted this survey with the PwC LLP research team, guided by the AFIRE Research Committee, providing a snapshot of broad, institutional thinking at a given point in time: early 2023.

Acknowledging that opinions can shift rapidly, AFIRE has made all efforts to adapt this survey and meet the needs of our changed real estate environment— an age of economic uncertainty, heightened risk, shifting opportunity, and necessary innovation.

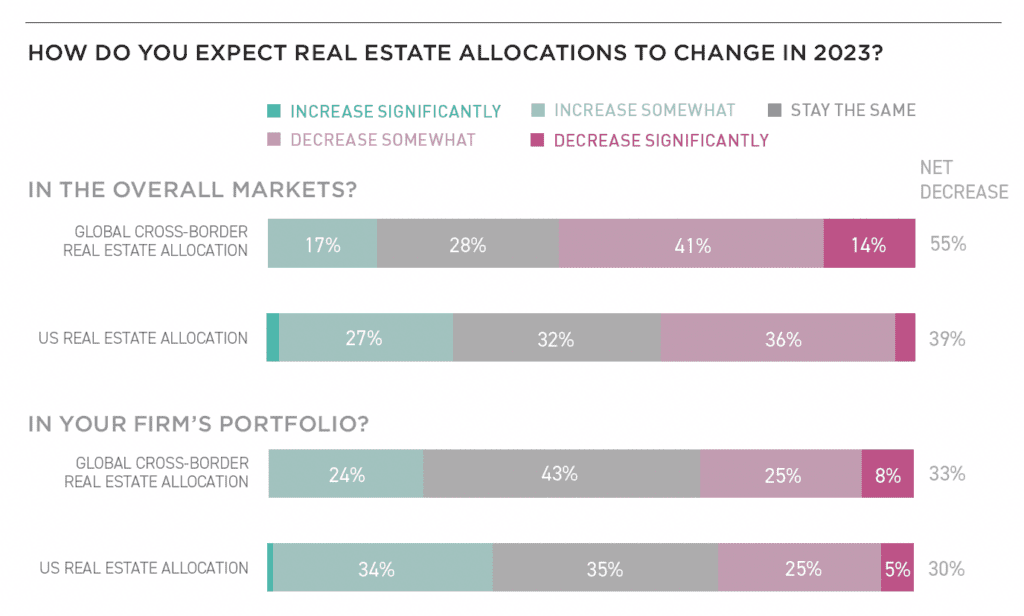

With continued interest rate increases and the alarming bank failures in the first few months of this year, opinions may have become more negative since this we asked questions in January. However, compared to other regions, the US remains attractive for cross border investment. Global real estate allocations marginally increased from 2022 compared to European investmentSignificant changes brought by the pandemic are impacting investor preferences and approach to risk. There is growing uncertainty about the future of office, ESG’s effect on valuation, housing affordability and the dramatic decline in debt availability.

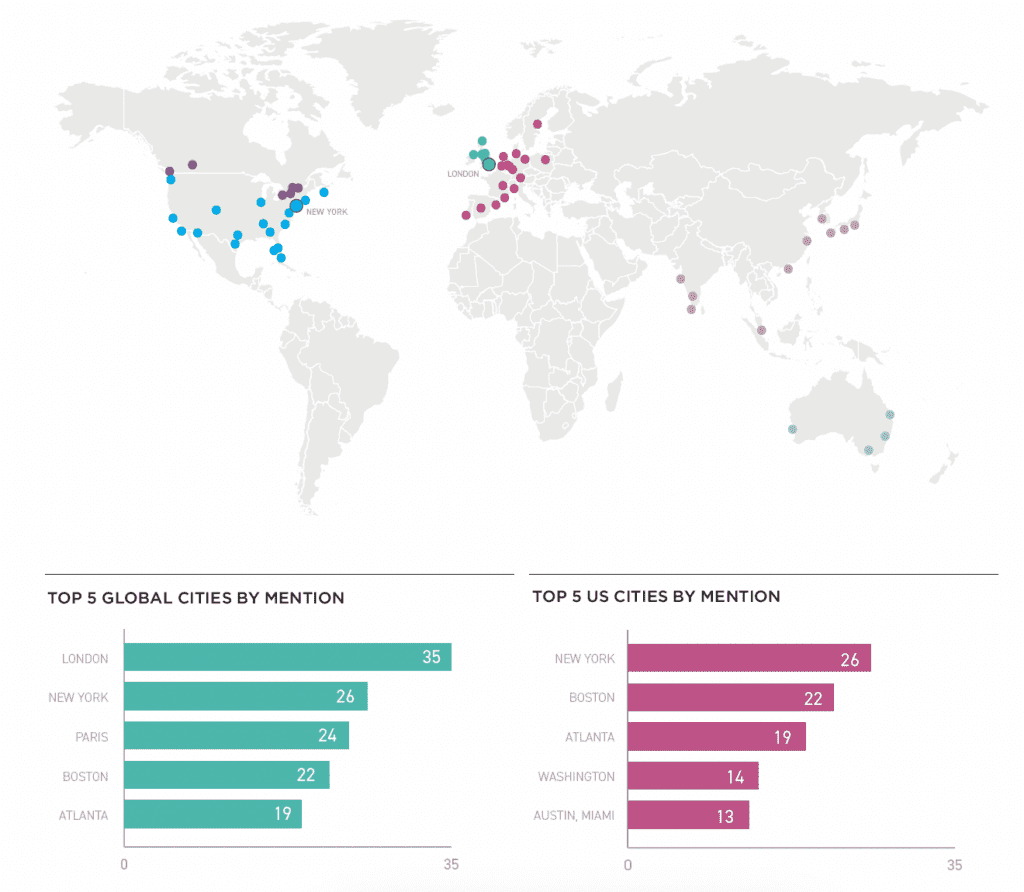

As the crisis of the pandemic continued to subside in late 2022 and into early 2023, New York regained top US spot for investment in 2023. The last time it held this ranking was in early 2020, before the pandemic. As such, New York displaces previous top three cities from past several years: Atlanta, Austin, and Boston. While it remains to be seen if this indicates a renewed faith in gateway markets, secondary and tertiary market trends continue to be key to the broader US market. Internationally, London remains the top global city for planned investment.

Collectively, these and other findings reported here illustrate how the future of office, affordable financing, and heightened sustainability/ESG issues will be key in shaping future success in US commercial real estate.. Even before the fall of Silicon Valley Bank and Credit Suisse, four in ten investors forecast market decline in US real estate allocation for 2023, rising to over half holding this view for global investment.

AFIRE members, by definition, focus on long term, even multi-generational investments. An intense focus on emerging and future trends is essential. The pressure to anticipate and understand a fast changing landscape is tremendous as investors make decisions today that inform performance for years or decades to come.

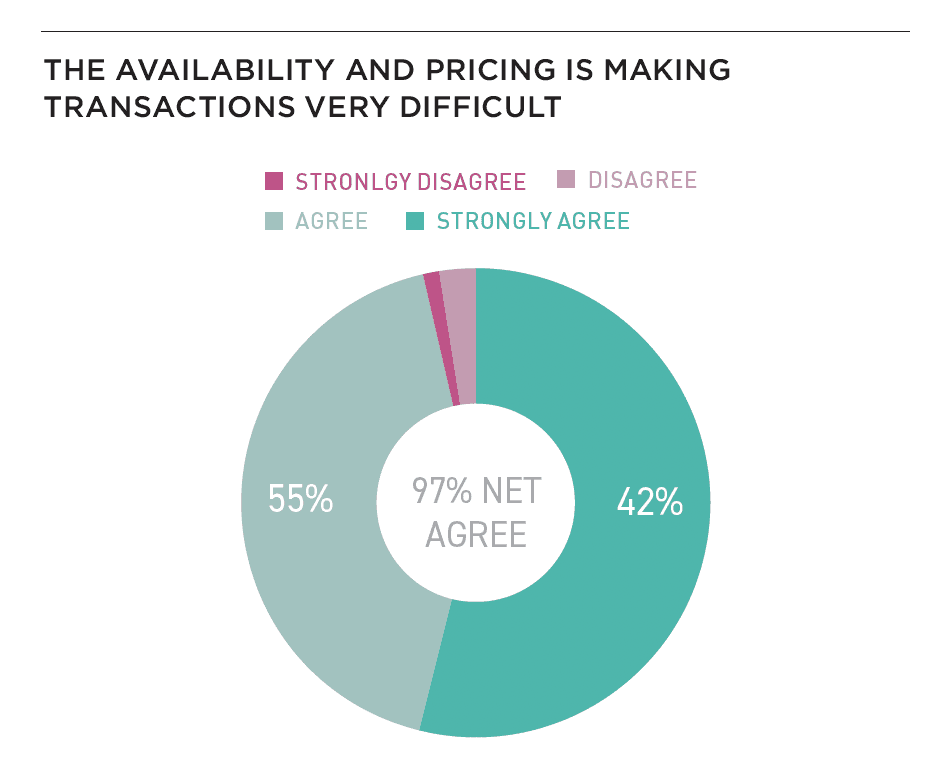

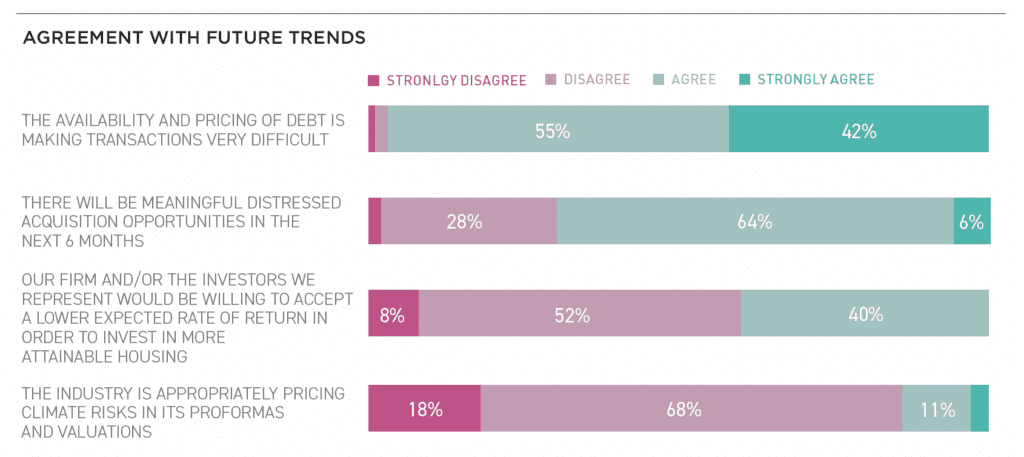

The current unsettled economy dominates current thinking for investors, with access to availability and pricing of debt making transactions very difficult (97%). Over half think it will be 7–12 months before the US Federal Reserve halts interest rate rises, with half also believing US interest rates will not begin to decline for at least another year.

Practically all respondents (97%) agree that the availability and pricing of debt is impeding transactions, while 70% anticipate meaningful distressed acquisition opportunities in the next six months.

A clear majority (86%) of investors believe that the industry is not pricing climate risks into proformas and valuations, with just one in seven agreeing that climate risks are priced appropriately.

In the coming years, it is likely that considerations concerning preferred asset types, geographical markets, and other hard and soft factors will be upended as the investment ecosystem incorporates increasingly sophisticated tools to account for these increasingly heightened risks.

While survey data of recent years has pointed to the growth of secondary and tertiary markets, this year’s survey sees a resurgence of gateway markets.

Globally, London remains the top global city for planned investment in 2023, with New York regaining pole position (from sixth) within the US. Boston (22%), Atlanta (19%), and Washington (14%) round out the top four US cities.

Investor support for multifamily has been a continuing trend, and in this year’s survey some 40% agree they would be willing to accept a lower expected rate of return in order to invest in more attainable housing.

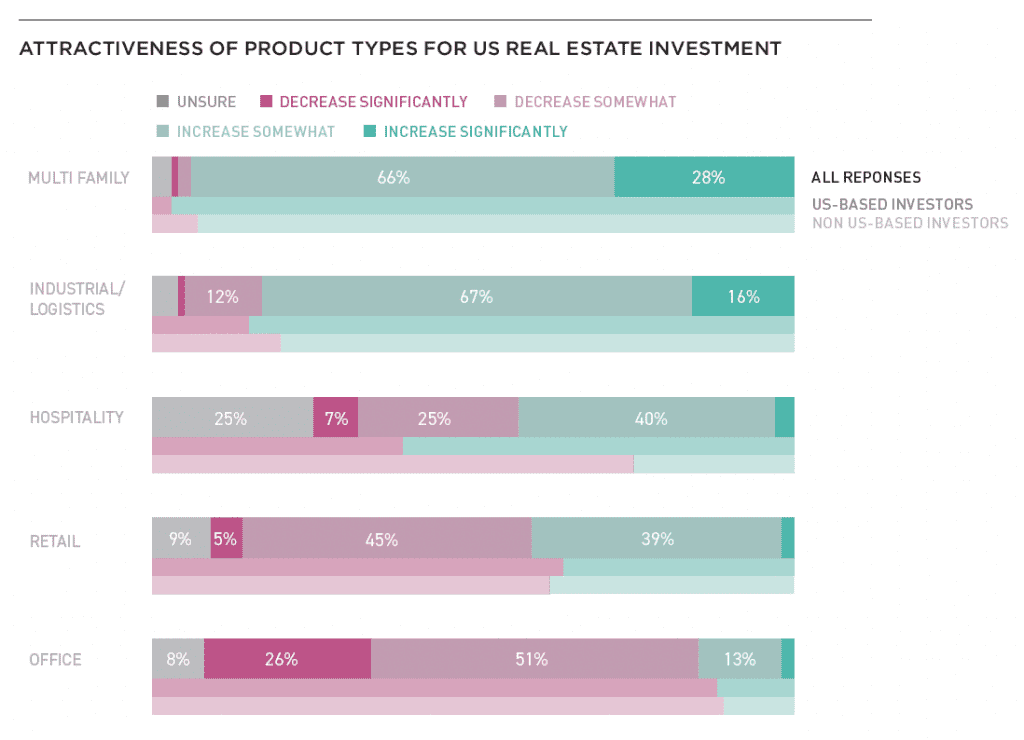

With this increasing focus on attainable housing as a backdrop, respondents were asked to identify their most favored property types for 2023. Investors identified multifamily and industrial to be the most attractive, with 94% of investors seeing the property type as attractive or very attractive as a product type for US real estate investment.

With Americans again on the move and travel rebounding, investors view hospitality as a top three attractive destination for investment, with US investors in particular showing greater inclination (61%) over non-US investors (25%).

As lending and capital financing sees continued headwinds, essentially all (97%) investor respondents agree that the availability and pricing of debt is impeding transactions.

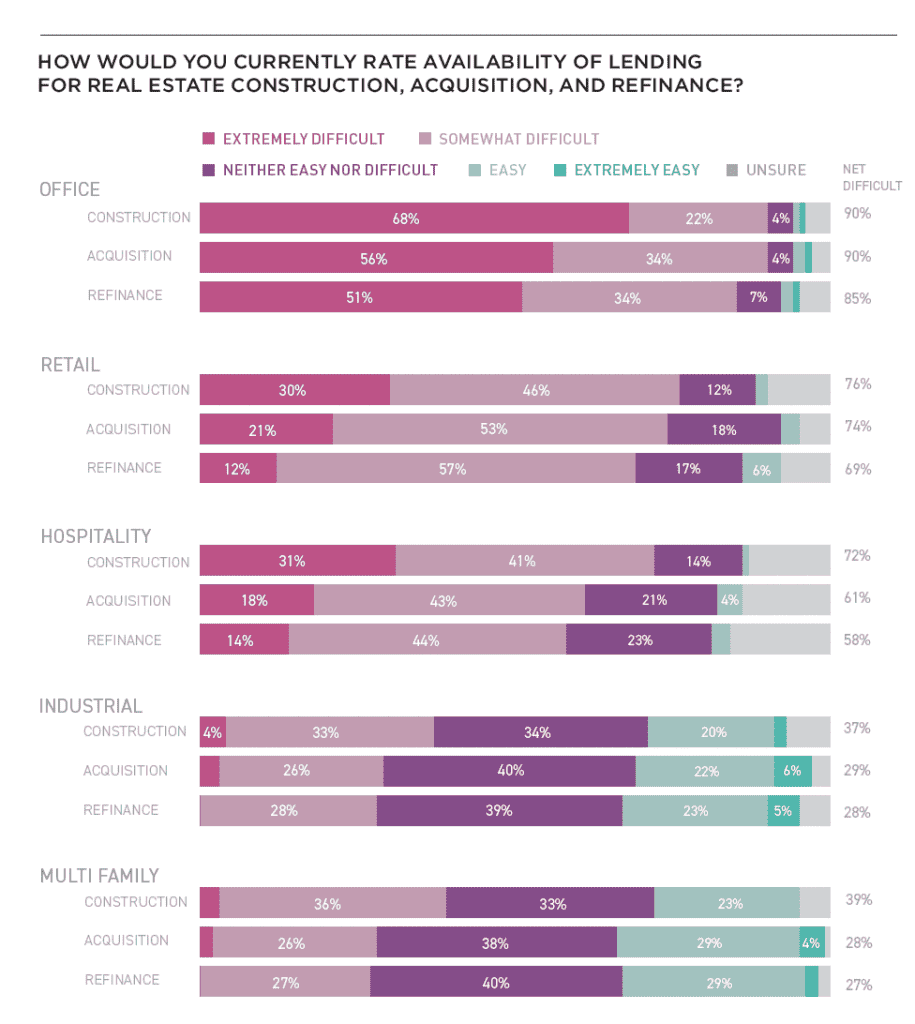

US based investors are more optimistic (64%) than non-US investors (58%) towards overall expectations of lending for real estate, with meaningfully high optimism among US investors (61%) versus non-US investors (35%) for lending from non-institutional, non-bank lenders. Availability for lending for construction for office ranked most difficult (90%), likewise for acquisition (90%), and refinance (85%).

CLICK HERE TO DOWNLOAD THE FULL AFIRE PULSE SURVEY REPORT

EXLORE THE FULL ISSUE

ALSO IN THIS ISSUE

AFIRE INTERNATIONAL INVESTOR SURVEY: Q1 2023 PULSE REPORT

Gunnar Branson and Benjamin van Loon | AFIRE

VALUATION CHALLENGE: SOLVING THE CRISIS IN COMMERCIAL REAL ESTATE VALUATION

Matt Pomeroy, MAI and Jackie Bowie | Chatham Financial

CONVERSION CALCULATOR: LEGAL OR NOT, A DYNAMIC CITY WILL CONVERT UNUSED OFFICES

Jim Costello | MSCI Real Assets

UNDERWRITING ROADBLOCKS: CAN THE HOSPITALITY MODEL OF UNDERWRITING SAVE OFFICE VALUES?

Joshua Harris, PhD | Lakemont Group & Fordham University

VACANT SPACE: OFFICE-USING JOBS AND DEMAND INCONGRUITY

Stewart Rubin and Dakota Firenze | New York Life Real Estate Investors

HIKING TRAILS: SHOULD INVESTORS CONSIDER ALLOCATIONS TO FLOATING-RATE DEBT?

Dags Chen, CFA | Barings Real Estate

RECESSION PREPPING: HOW VULNERABLE ARE COMMERCIAL MORTGAGE INVESTMENTS

Martha Peyton, PhD | Aegon Asset Management

MEASURING GENTRIFICATION: USING DATA SCIENCE TO PREDICT THE IMPACTS OF GENTRIFICATION

Ron Bekkerman | Cherre + Donal Warde | Tenney 110 + Maxime C. Cohen | McGill University

THE FUTURE IS EUROPEAN: THEMES FROM THE OLD WORLD SHAPING US MARKETS

Brian Klinksiek | LaSalle Investment Management

CULTURE SHOCK: THE CHALLENGE AND IMPORTANCE OF TRANSLATING ESG ACROSS BORDERS

AFIRE ESG Committee

FINE TUNING: GLOBAL REACH AND LOCAL EXPERTISE CAN CREATE UNIFIED REAL ESTATE EXPERIENCES

Mark Zettl | JLL

ACCESSING SUCCES: EXPLORING DIVERSITY TRENDS IN REAL ESTATE TALENT

Zoe Huges | NAREIM

RESCUE CAPITAL: RESPONDING TO THE NEW REAL ESTATE REALITY

Andrew Weiner and Joshua M. R. Becker | Pillsbury

CONVEX CURVES: A REMINDER ON PRICE CONVEXIVITY AND CAP-RATE VOLATILITY

Joseph Pagliari, PhD, CFA, CPA | University of Chicago

IN MEMORIAM: ANDREA MARIE CHEGUT, PhD, MIT

—

ABOUT THE AUTHORS

Gunnar Branson is CEO and Benjamin van Loon is Managing Director and Editor-in-Chief of AFIRE.

—