With Brexit and pandemic resolutions coming into focus, pricing disparities could dissipate based on improved cross-border liquidity and cap rate compression in the London office market.

Because the global real estate industry is so interconnected, what happens in one part of the world often affects what happens elsewhere. In particular, the UK’s 2016 vote to leave the European Union (Brexit) created economic and financial uncertainty that permeated into commercial real estate capital markets, particularly London’s office market.

London, historically a top destination for foreign capital, saw a decline in liquidity owing to reductions in cross-border deal volumes as investors fretted over the economic implications of the vote. Liquidity, especially cross-border liquidity, was further impaired by the COVID-19 pandemic and its ensuing travel restrictions and economic impact. As cross-border liquidity has eroded, London office pricing has diverged from its European peers and cap rate spreads have risen to levels higher than those seen during the Great Financial Crisis (GFC). Now, with Brexit and pandemic resolutions coming into focus, this pricing disparity could dissipate owing to improved cross-border liquidity and cap rate compression in the London office market.

BREXIT AND ITS AFTERMATH

The 2016 vote for the UK to leave the EU resulted in heightened economic uncertainty as trade deals would need to be established and the future of the financial industry’s access to Europe was called into question. The heightened uncertainty had a profound effect on London commercial real estate capital markets as liquidity eroded rapidly. This situation was then exacerbated by the COVID-19 pandemic and resultant recession.

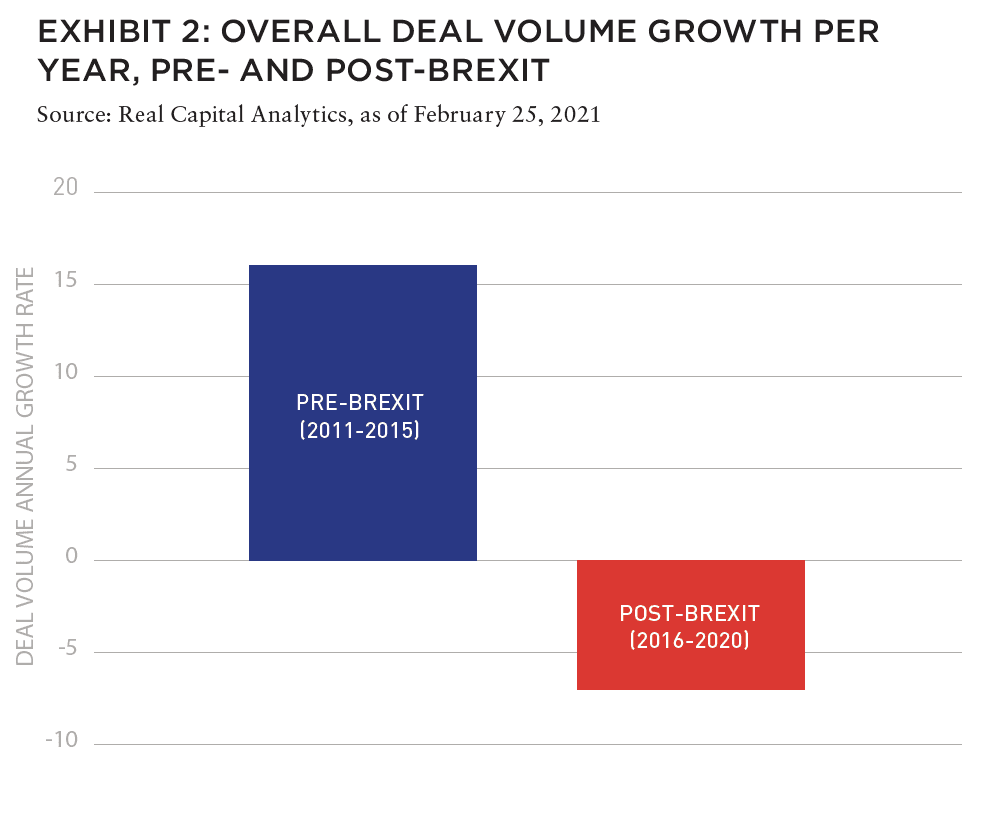

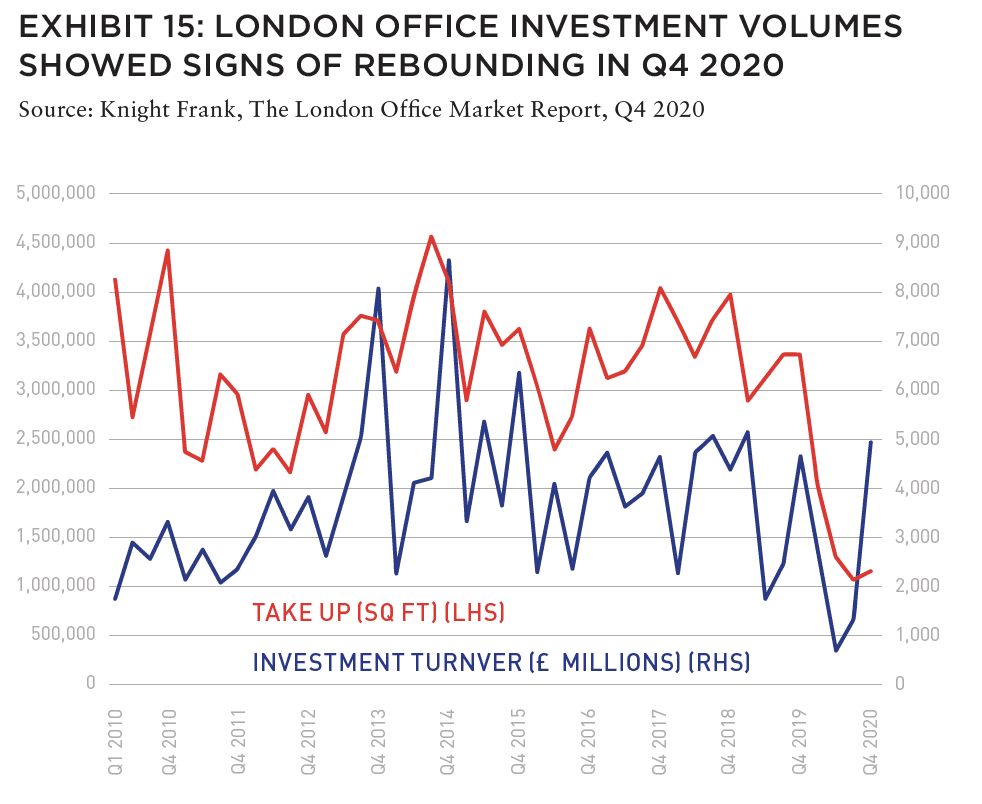

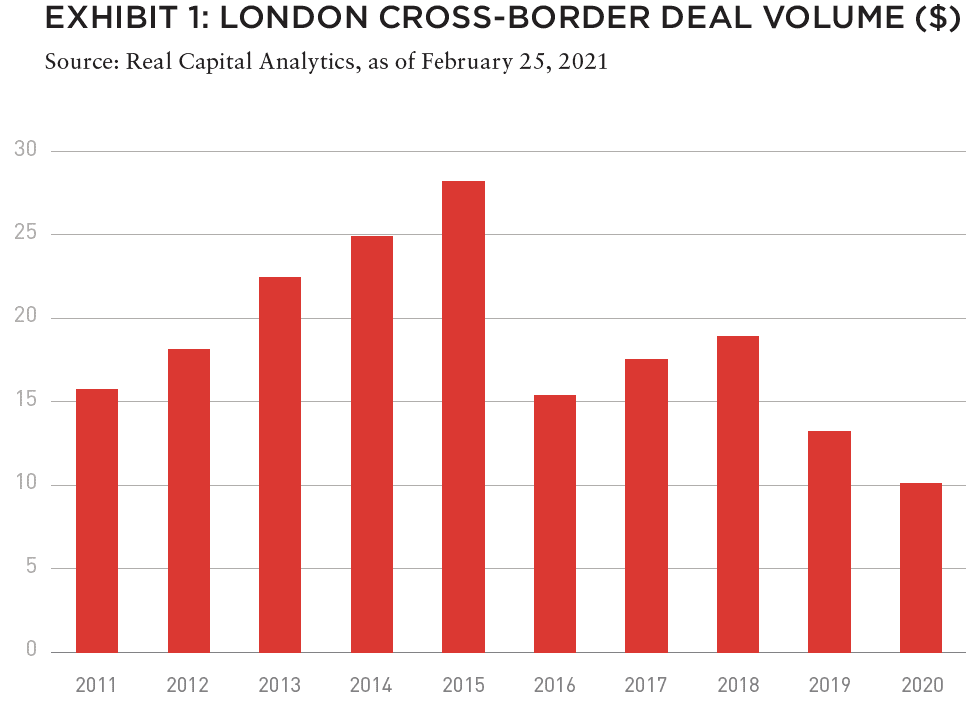

Prior to the Brexit vote, commercial real estate deal volume was growing steadily at a rate of 15.4% per year from 2011–15, reaching a peak of US$43 billion. Volume fell sharply in 2016 in response to the vote, measuring just US$24 billion, and has averaged an annual decline of 7.4% per year from 2016–20, with 2020 seeing just US$15 billion in deal volume, owing in part to the pandemic.1

The decline was particularly stark in cross-border deal flows, which historically comprise 65% of total London deal volume.2 Cross-border deal volume in 2020 was 64% lower than its 2015 peak and at its lowest levels since the GFC.

LONDON OFFICE PRICING

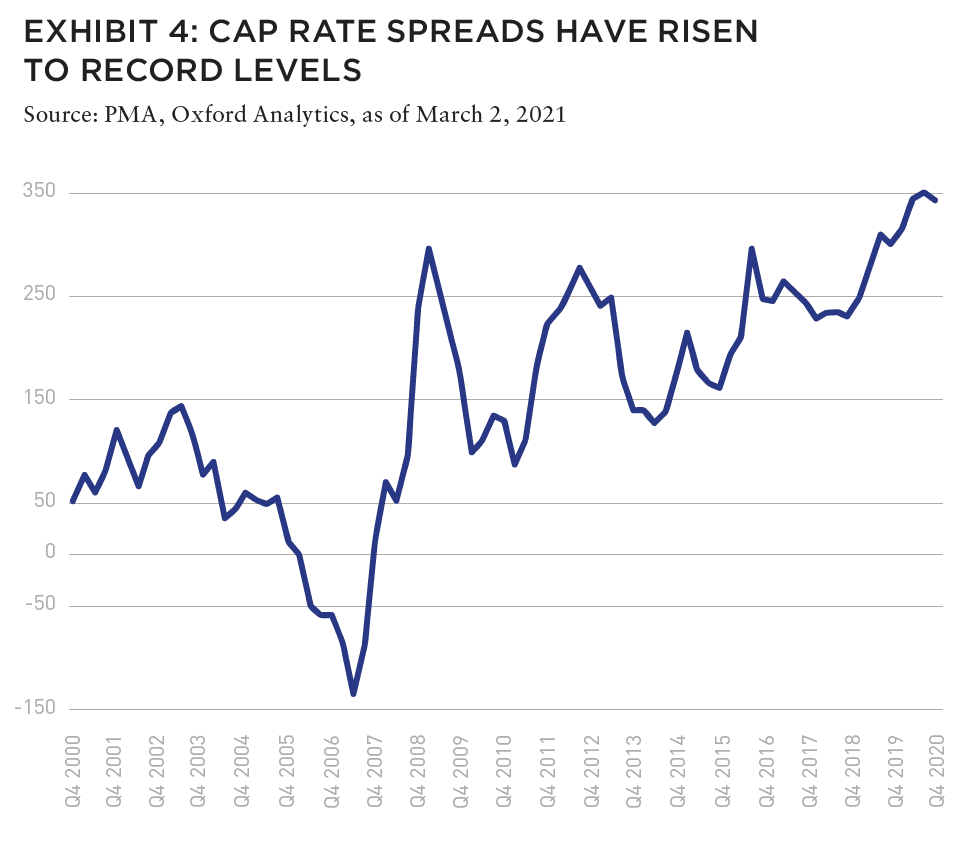

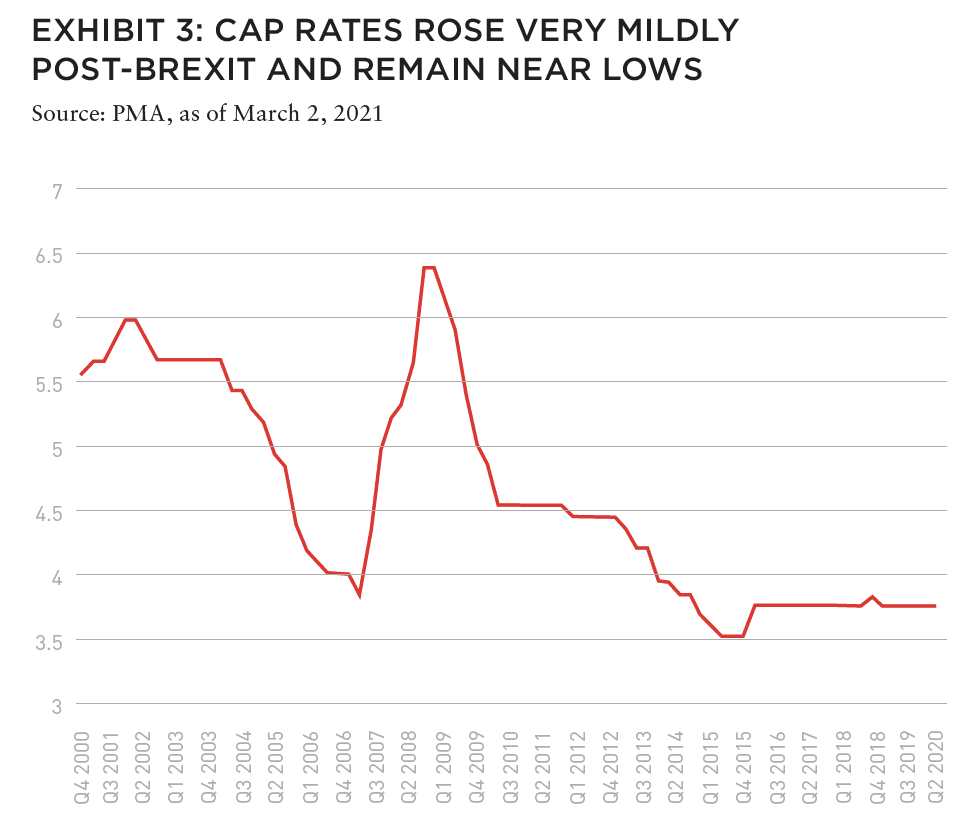

The liquidity decline has had a notable effect on London office pricing, though nominal cap rates mask the effect. Data from Property Market Analysis LLP (PMA) shows that London office cap rates have held steady at 3.7% since the start of 2016 and have only registered a 20 BPS increase since the Brexit decision. However, during this time, interest rates have fallen substantially, from just under 2% on the ten-year gilt to 0.27% as of the fourth quarter of 2020, per Oxford Economics.3 This means risk premiums have widened substantially, as cap rate spreads have measured near 350 BPS in the wake of the pandemic. Cap rate spreads are at their highest level in this data series history, around 100 BPS higher than their previous peaks in the wake of the GFC, and 160 BPS above their average level during the pre-Brexit GFC recovery.

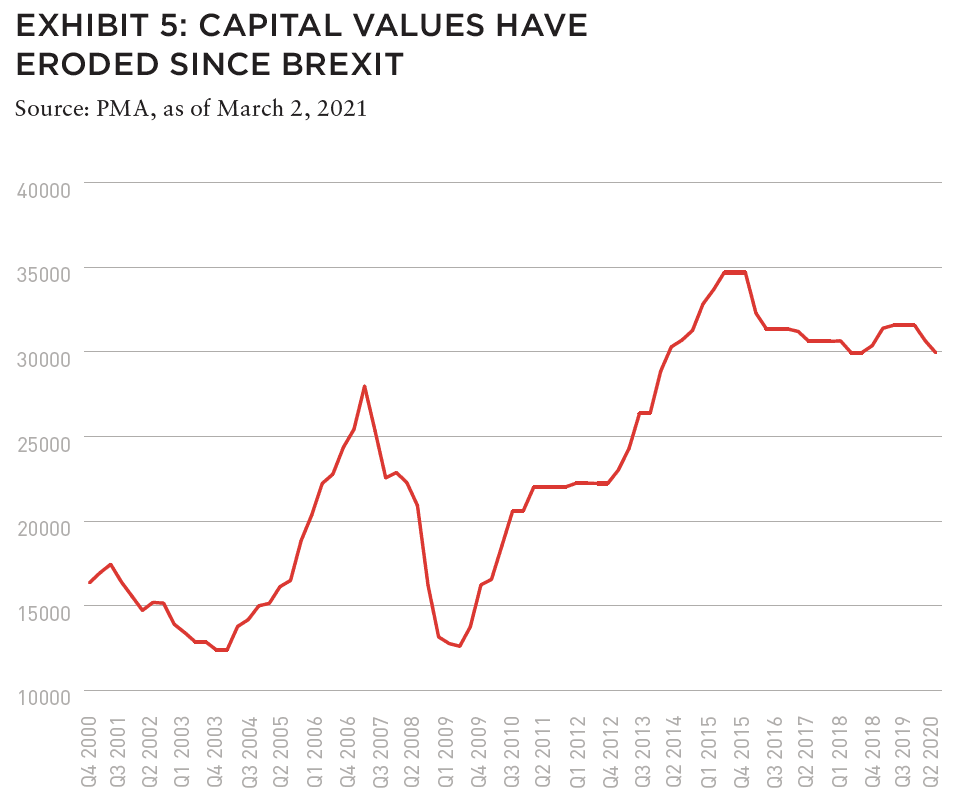

The erosion in pricing is more clearly reflected in prime capital values, which saw sharp growth following the GFC and again after the European debt crisis, averaging year-over-year growth of 13% from Q1 2011 until Q2 2016. Prime capital values peaked at €34,698 PSM in the second quarter of 2016 leading into the Brexit referendum and have been declining since. Prime capital values have fallen 13.7% from their pre-Brexit peak and 5.1% from a year ago to €29,955 PSM.

The rise in cap rate spreads and decline in prime capital values highlight the discount London office has traded at in the wake of the economic uncertainty created by and Brexit compounded by the COVID-19 pandemic and recession. However, with a Brexit trade deal agreed to and vaccination underway, this uncertainty may soon lift, potentially resulting in appreciation.

LONDON VS. EUROPE

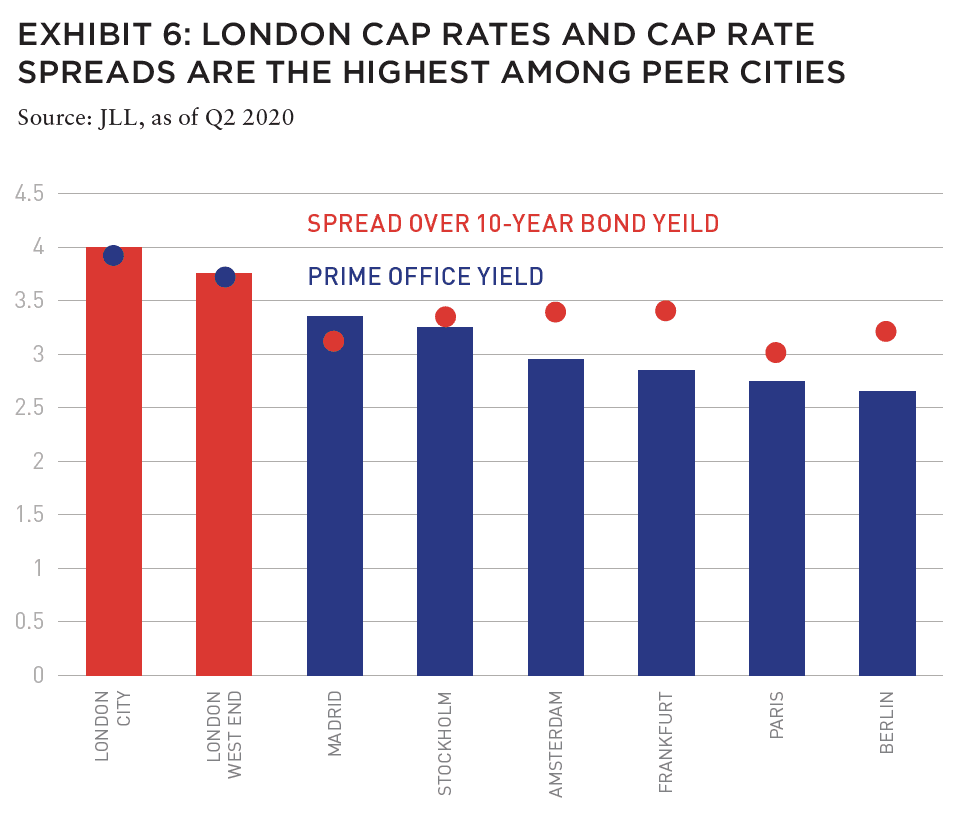

London office pricing is not only currently attractive relative to its historical basis, but also when compared to its peer set in Europe. Nominal cap rates in the city of London and West End are higher than in Madrid, Stockholm, Amsterdam, Frankfurt, Paris, and Berlin, measuring 4% and 3.75% respectively, per JLL. The next highest cap rate is 3.35% in Madrid, and cap rates in Amsterdam, Frankfurt, Paris, and Berlin are all below 3%. While negative rates from the European Central Bank compared to 0% interest rates set by the Bank of England are partially responsible for the lower nominal cap rates in other prime European cities, London office cap rate spreads are higher than any of its European peers, and they offer a higher risk premium for investors.

ALSO IN THIS ISSUE (SUMMER 2021)

NOTE FROM THE EDITOR / The Housing Issue

AFIRE | Benjamin van Loon

INVESTOR SENTIMENT / Shining Through Darkness

The 2021 AFIRE International Investor Survey underscores a sense of calculated optimism for CRE investment in the year ahead.

AFIRE | Gunnar Branson

ECONOMY / Revisiting Inflation

For commercial real estate investors, inflation fears are real— but are they rational?

Aegon Asset Management | Martha Peyton, PhD

DEURBANIZATION / Herd Community

Uncertainty surrounding remote work and politics suggest a wide range of potential outcomes for big cities, which may upend the long-running megatrend toward urbanization.

Green Street | Dave Bragg and Jared Giles

HOUSING / How to Rebuild

Could an idea to “bring back” New York after the pandemic work in other cities?

Aria | Joshua Benaim

HOUSING / Single Family, Multiple Questions

Institutional ownership in single-family rentals accounts for less than 5% of the segment, but answers to key questions could change start to change that balance.

Berkshire Residential Investments | Gleb Nechayev, CRE

HOUSING / Institutionalizing Single Family

Over the past two decades, the single-family rental industry has evolved into an institutional-caliber asset class—so where is the sector going next?

Tricon Residential | Jonathan Ellenzweig

HOUSING / Build-to-Rent Boom

The future is bright for build-to-rent and institutional investors are increasingly looking at investing in this sector.

Squire Patton Boggs | John Thomas and Stacy Krumin

OFFICE / Recovering the Office

While most agree that the office sector has a difficult road ahead, there is less consensus about future demand in the sector. What are the indicators investors should be tracking?

Barings Real Estate | Phillip Conner and Ryan Ma

OFFICE / London Calling

With Brexit and pandemic resolutions coming into focus, pricing disparities could dissipate based on improved cross-border liquidity and cap rate compression in the London office market.

Madison International Realty | Christopher Muoio

LOGISTICS / Supply Change

Urbanization, digitalization, and demographics are the key trends to watch for understanding the future of logistics real estate.

Prologis | Melinda McLaughlin and Heather Belfor

CLIMATE / Accounting for Environmental Risk

When it comes to guards against environmental risk, Boston, Indianapolis, Minneapolis, and Portland are some of the most prepared US cities. What makes them different?

Yardi Matrix | Paul Fiorilla, Claire Anhalt, and Maddie Harper

ESG / Putting People First

Though “impact investing” is no longer totally distinct from investing in general, investors still have a lot of work to do for fulfilling the social and governance aspects of ESG expectations.

Grosvenor Americas | Lauren Krause and Brian Biggs

MULTIFAMILY / Influencing Multifamily

As we come out of the pandemic to a new economy, it seems likely that the creator economy will continue to grow. This will have a major impact on the multifamily sector.

citizenM Hotels | Ernest Lee

TALENT AND RECRUITMENT / Enhancing Life Sciences

As the global life sciences sector continues to grow in real estate, highly specialized skills and experience will be the keys to success.

Sheffield Haworth | Max Shepherd and Jannah Babasa

EDUCATION / Real Estate Education Goes Global

The evolution of global real estate education over the past three decades will be integral to developing a rich pipeline of talent for the future of commercial real estate.

Georgetown University | Julian Josephs, FRICS

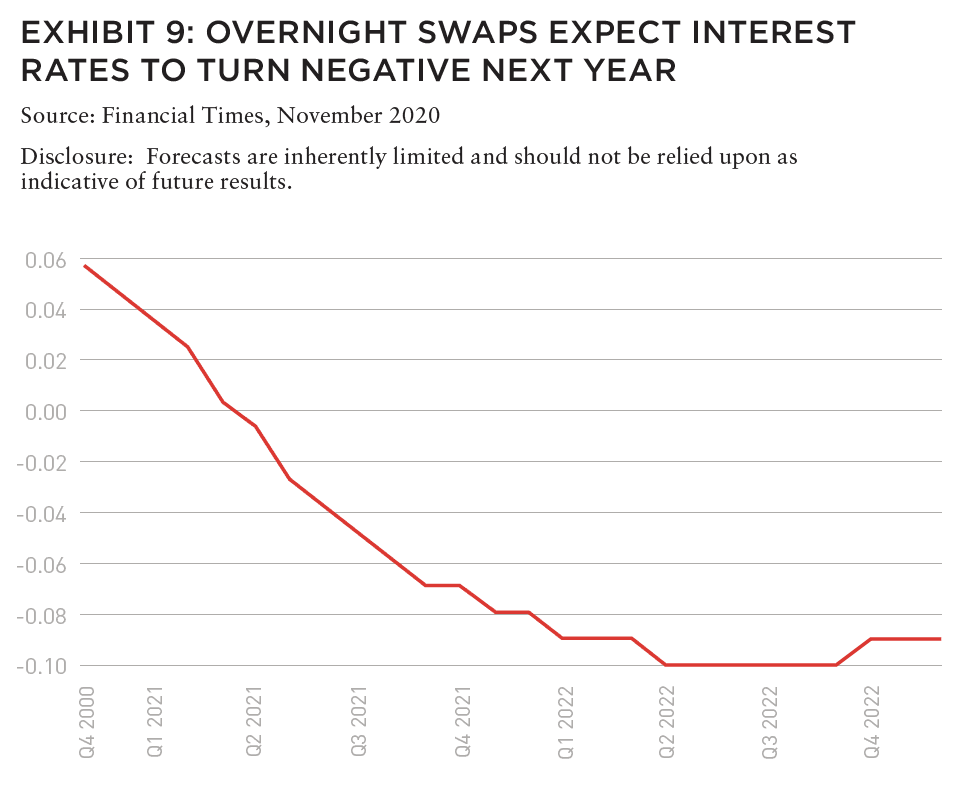

A PMA analysis of European and UK commercial real estate pricing relative to their historical averages since 2000 illustrated a divergence in relative value and further highlights the potential opportunity in the London office market. European commercial real estate pricing is currently 0.5 standard deviations more expensive than its historical average. The last time European commercial real estate pricing measured at this relative level was prior to the GFC in 2006–07. Meanwhile, UK commercial real estate pricing is currently trading at a discount relative to its historical pricing, measuring 0.25 standard deviations below average, having risen consistently since 2015, when they measured 0.5 standard deviations more expensive than average prior to the Brexit referendum.

London office pricing on nominal, cap rate spread and historical relative value basis is currently more attractive than the other prime European markets. And while London office pricing is currently attractive owing to its higher cap rates and cap rate spreads relative to other European prime cities, this fact becomes more compelling as its timing coincides with two catalysts that could reduce the uncertainty surrounding the market and establish the conditions for cap rate compression.

The first catalyst is the resolution to Brexit, as a trade agreement was reached between the UK and the EU in December 20204 with some final outstanding issues scheduled to be resolved in the spring of 2021. Madison believes the Brexit referendum was likely the initial driver of cap rate spreads widening in London as it created uncertainty over the nation’s economic outlook and the city’s financial sector. However, Bank of England Governor Andrew Bailey noted that the financial sector only lost between 5,000 and 7,000 jobs as a result of Brexit, “substantially less…than the sorts of numbers that were being talked about after the referendum.”5 In our view the majority of Brexit risk appears to have passed alleviating one of the drivers of cap rate spread expansion.

OPPORTUNITY AND RISKS

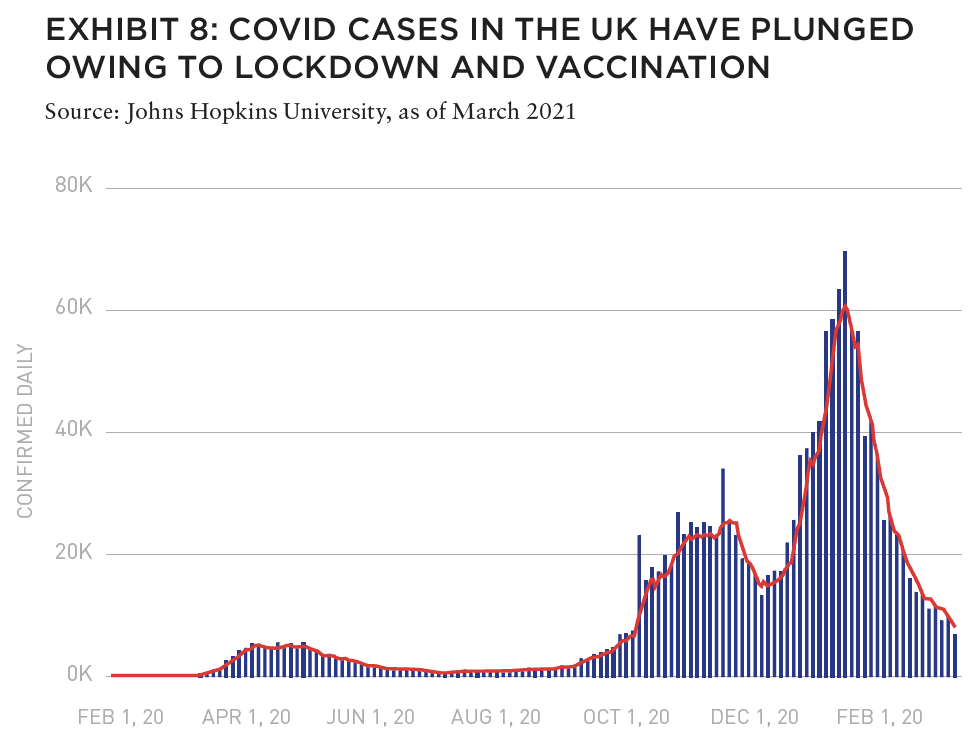

Improvements have been made in containing the COVID-19 pandemic in he UK since January 2021 when daily case counts peaked.6 Vaccination rates have continued to rise since, resulting in declining case counts even as Prime Minister Boris Johnson has taken the initial steps on his reopening program, with the current stated goal for all economic restrictions to be removed by the end of June 2021.

The Office of Budget Responsibility is projecting 4% GDP growth this year as restrictions impact the first half of growth and 7.3% GDP growth in 2022 when the economy will surpass its pre-pandemic peak.7

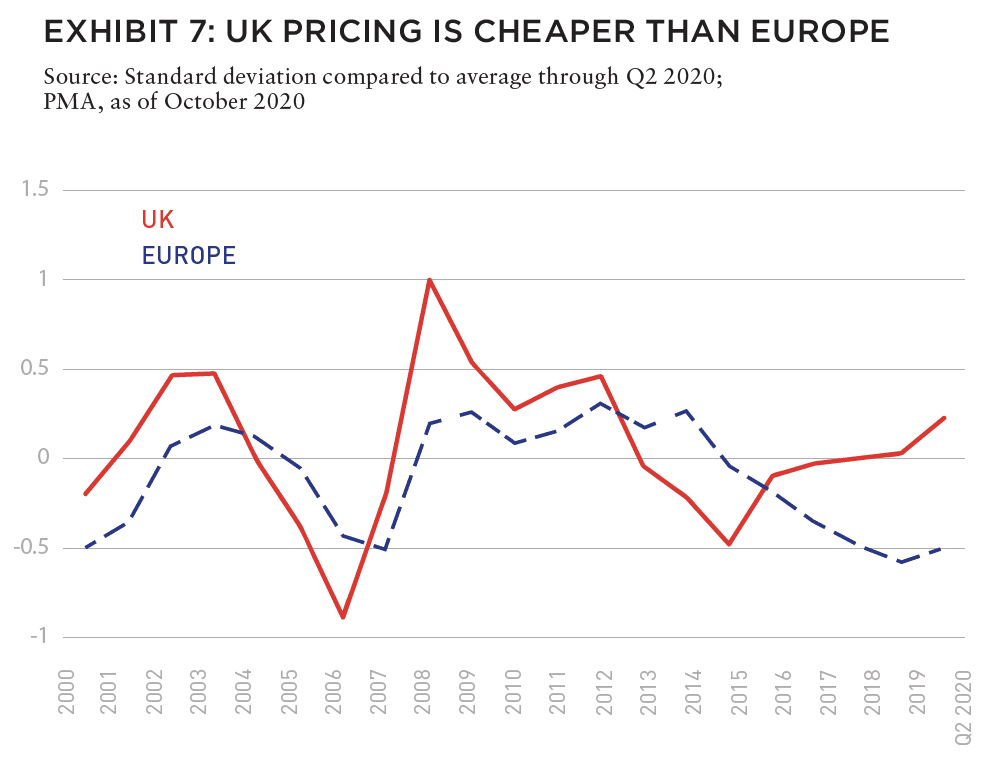

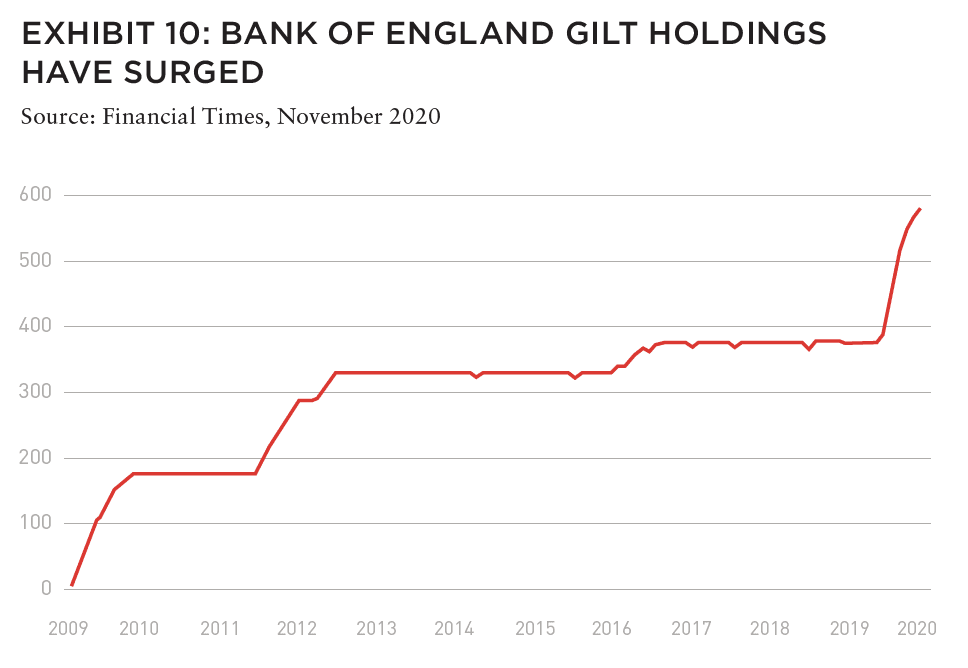

Assuming that the economy remains on a path to return to normalcy and growth, and that Brexit and related fi nancial shocks are mostly completed, two drivers of cap rate expansion would be alleviated, which could lead to spread compression. Interest rates, meanwhile, are poised to remain low for some time. The Bank of England has taken signifi cant easing measures, and now owns 44% of the gilt market, double the proportion of the Federal Reserve in the US.8 Additionally, overnight swaps are pricing in negative interest rates next year as the Bank of England has told banks to prepare for negative interest rates as they could become a necessary policy tool pointing to monetary policy remaining loose for some time.9

As uncertainty and risk subsides from the UK office market, liquidity could improve, especially once non-UK-based investors can travel freely to the country again, and cap rate spreads will revert towards their long-term average and European peers. Coupled with monetary policy that is poised to remain accommodative, Madison believes this will result in declining cap rates for London office assets.

REMOTE WORK AND ASSET SELECTION

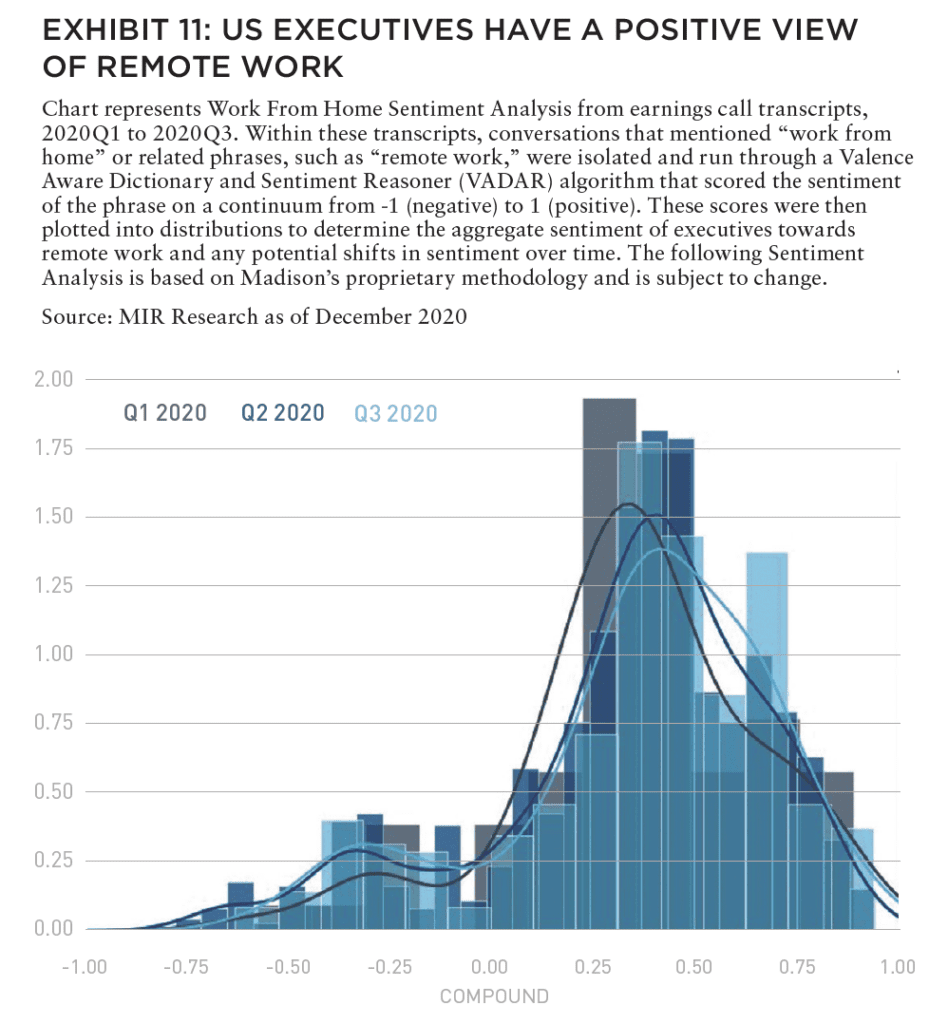

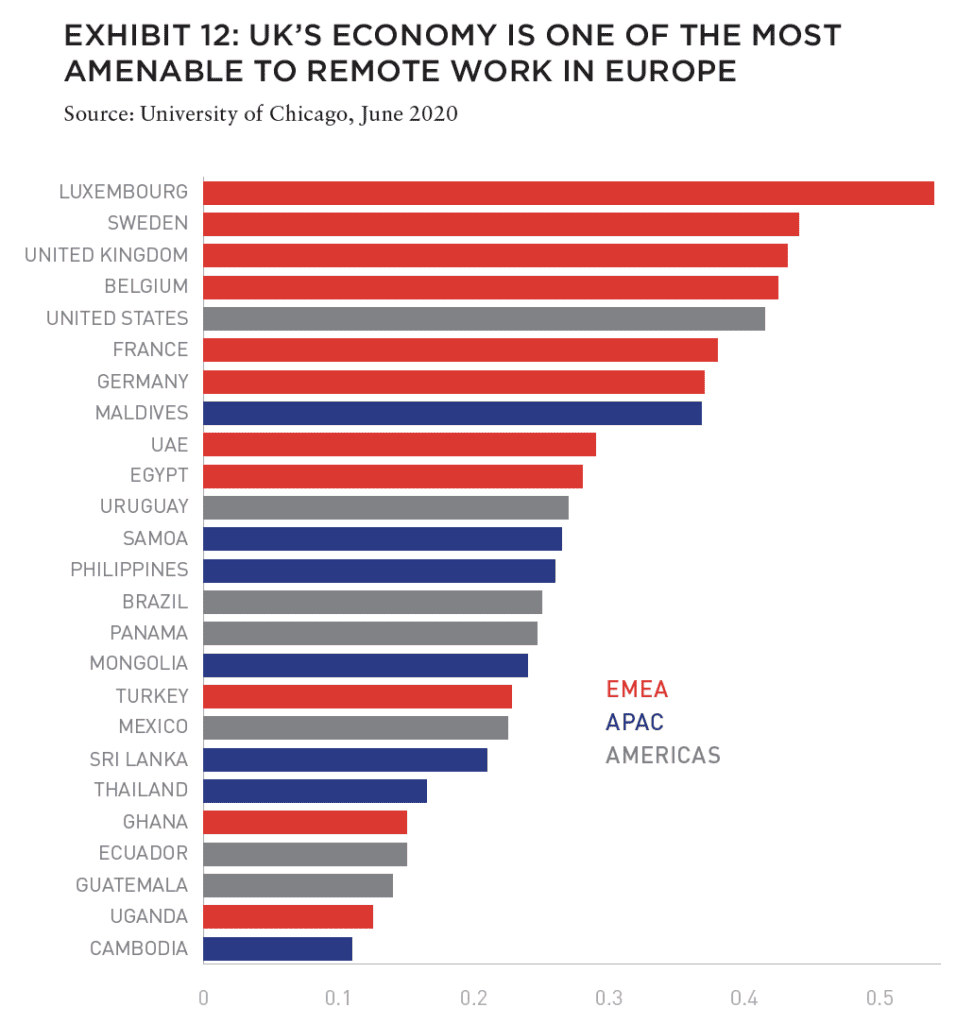

One risk to this thesis is the sector facing a structural repricing owing to the proliferation of remote work, which became a more common practice during the pandemic. Madison Research has shown through sentiment analysis of earnings transcripts that US executives have a positive view of work from home. The UK’s economic construction is also conducive to remote work with one analysis showing it trailing only Luxembourg and Sweden globally in the proportion of occupations able to work from home.

Should remote work remain widespread, we believe London office asset pricing should be more insulated than its European peers owing to its higher nominal cap rates and cap rate spreads.

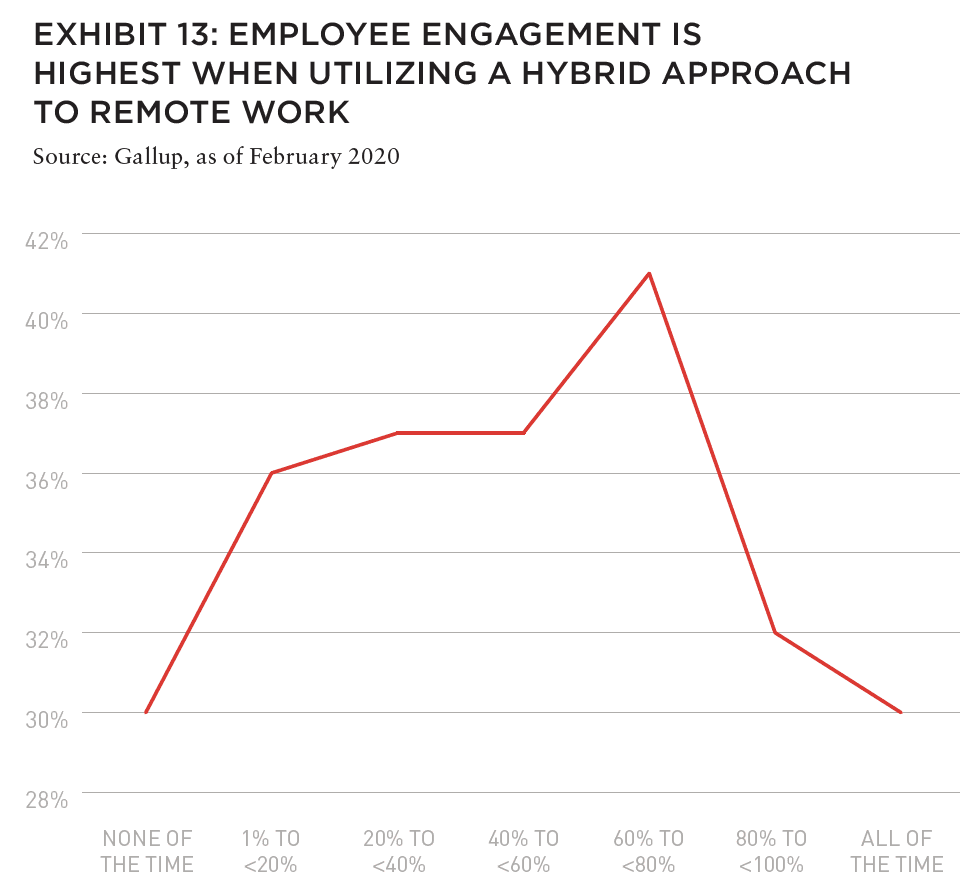

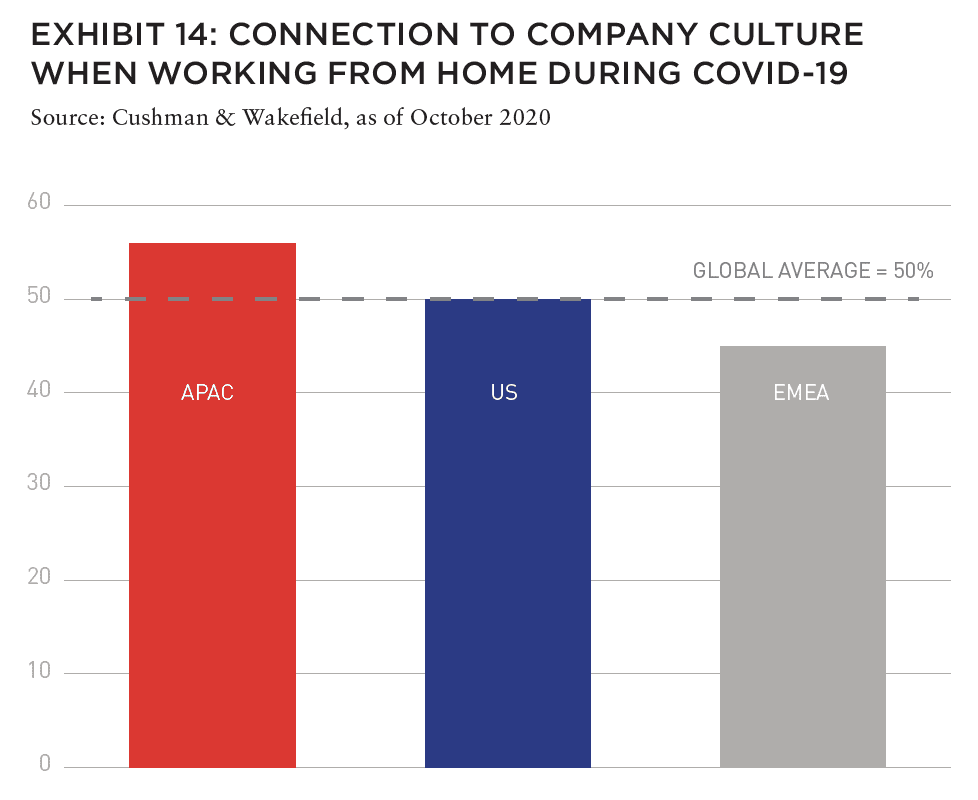

We believe that, going forward, employers are more likely to utilize flexible working arrangements and maintain a physical office space, as opposed to going fully remote en masse. Data show that employees still desire the ability to utilize an office and are most engaged when utilizing a hybrid model that allows them to work from home a few days a week. While working fully remote during the pandemic, nearly half of employees struggled to connect with company culture, felt they weren’t learning, and did not have a sense of well-being, per a recent Cushman & Wakefield study. Cushman & Wakefield found that every fi rm in their study still utilized a physical office in some form.

The risk presented by remote work to office fundamentals can be further mitigated through asset selection. Madison believes that generational office assets with long weighted average lease terms and strong credit tenancy face lower risks to near-term occupancy and cash flows from remote work. This is evidenced by Hines UK’s pre-let at The Grain House in the West End, which Knight Frank notes stemmed from a shortage of what they refer to as “best-in-class space.” Additionally, American Express renewed their 131,000 SF lease in Belgrave House and Netflix leased 87,000 SF in the Copyright Building. Furthermore, 56% of new construction is pre-let, highlighting the persistent demand for quality space.10 Lower quality assets, or those with substantial space to release, may face risks from reduced space needs of tenants as employers adapt to hybrid models.

Madison believes that London office assets, particularly those with long WALTs and strong credit profiles, could see value appreciation in the coming years as cap rates compress and liquidity improves in the wake of a Brexit resolution, and the end of the COVID-19 pandemic and recession, while interest rates are poised to remain low for the foreseeable future. We believe this provides a compelling potential opportunity for investors to capitalize on reduced commercial real estate in a top global destination for capital.

—

ABOUT THE AUTHOR

Christopher Muoio is Vice President, Data and Research at Madison International Realty, a real estate investment firm committed to excellence in providing capital, equity monetizations and recapitalizations.

—

NOTES

1. Real Capital Analytics, rcanalytics.com as of 2/25/21

2. Real Capital Analytics, rcanalytics.com as of 2/25/21

3. Oxford Economics, oxfordeconomics.com as of 3/2/21

4. “Agreements reached between the United Kingdom of Great Britain and Northern Ireland and the European Union.”Gov.UK. December 24, 2020. Accessed June 22, 2021. gov.uk/government/publications/agreements-reached-between-the-united-kingdom-of-great-britain-and-northern-ireland-and-the-european-union

5. “UK has lost up to 7,000 financial services jobs due to Brexit, BoE says.” Reuters. January 6, 2021. Accessed June 22, 2021. reuters.com/article/us-britain-boe-bailey-jobs/uk-has-lost-up-to-7000-financial-services-jobs-due-to-brexit-boe-says-idUSKBN29B1XE

6. Johns Hopkins University, jhu.edu as of March 2021

7. Strauss, Delphine. “OBR Pains Brighter Picture for UK Economy.” Financial Times. March 3, 2021. Accessed June 22, 2021. ft.com/content/ec9b58a5-fa69-422d-91bf-7cbc0799926d

8. Stubbington, Tommy. “Bank of England Faces New Doubts Over the Potency of Buying Bonds.” Financial Times. November 2, 2020. Accessed June 22, 2021.

9. Nelson, Eshe. “The Bank of England Tells Banks to Prepare for Negative Interest Rates.” New York Times. Accessed June 22, 2021. https://www.nytimes.com/2021/02/04/ business/bank-of-england-negative-interest-rates.html

10. “The London Office Market Report Q4 2020.” Knight Frank. Accessed June 22, 2021. knightfrank.com/research/report-library/the-london-office-market-report-q4-2020-7863.aspx