ALTOGETHER, THE 8-9% UNLEVERED CRE PERFORMANCE RULE OF THUMB MIGHT WELL PROVE TO BE TOO OPTIMISTIC FOR THE LONG-TERM PERIOD AHEAD.

Expectations for long-term investment performance among asset classes are the drivers of asset allocation. Historical performance is often used to anchor expectations. For US commercial real estate (CRE), history suggests an 8–9% unlevered total return over the long term. However, developments in recent quarters suggest that such an assumption may prove to be unwarranted even before considering the impact of the coronavirus. At the same time, since all asset types will confront the same changes in the investment environment, the competitive position of US CRE may well retain its relative attractiveness.

LONG-TERM PERFORMANCE COMPOSITION

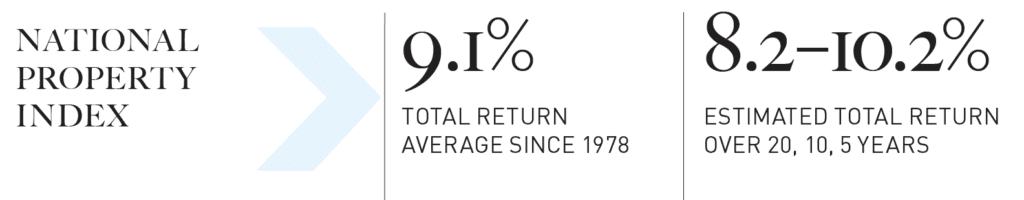

A typical rule of thumb estimates US CRE investment returns at an unlevered 8-9% per year. This estimate is supported by history which shows NCREIF Property Index (NPI) total return averaging 9.1% since its 1978 inception.1 Shorter period total returns also support the estimate with 20-year, 15-year, 10-year and 5-year total returns ranging from 8.2% to 10.2%.1 Is this rule of thumb a good bet looking forward over the long term? Before deciding, consider how the drivers of investment performance are changing, not only for US CRE, but for all asset classes as well.

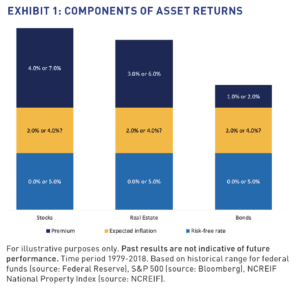

All US asset types compete for investment commitments against the most basic, available, and riskless alternative…US Treasury. In times of distress, investors flock to the Treasury with confidence that the US government stands behind its debt no matter how dire the situation. Short-term debt is cash-like and its return can be represented by the overnight federal funds yield. The yield on federal funds is managed by the US Federal Reserve (Fed) and set by its Federal Open Market Committee several times every year.2 We can deem it as the economy’s “real” rate of interest and the risk-free component of asset returns in Exhibit 1.

Investors with longer investment horizons must consider inflation. Inflation expectations, along with prospects for the real rate, set an opportunity cost for all investments beyond very short-term Treasury’s. The extra return potential on risky investments is the spread or premium over expected inflation and the expected real rate.

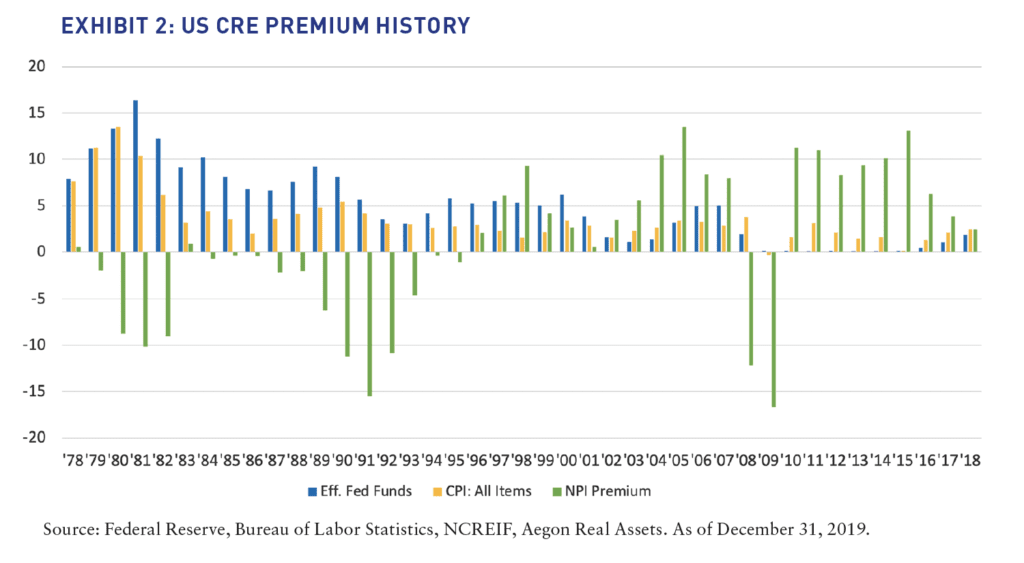

Decomposing the since-inception performance of US CRE along these lines shows a puzzling result. For more than a few years since its inception, NPI total returns offered no premium over the real rate and inflation. The shortfalls were most prevalent during the years before 1995 when CRE was considered to be an exceptional inflation hedge and when expected inflation was well in excess of the inflation that materialized (Exhibit 2). The tax shelter provided by CRE in the 1980s contributed as well. In that environment, investors were satisfied with the tax shelter and covering their inflation fears even with no premium above that.

After 1995, inflation expectations were more in line with reality. From 1995 to 2019, inflation averaged 2.2% and the real rate averaged 2.5%. Additionally, tax law changed eliminating much of the sheltering power of property ownership. Over the period, the CRE spread above inflation and the real rate averaged 4.9%. In contrast, from 1979 to 1995, inflation averaged 5.3% and the real rate averaged 8.5% as the Fed responded to its mandate to manage both inflation and employment growth. During that period, the CRE premium was negative. The lesson contained in this history is clear: Be careful when using history to craft expectations!

LOOKING FORWARD

Using the 1995-2019 history as a guide suggests that US CRE can again attain the 8-9% total return. With the historical 2.2% inflation rate and 2.5% real rate, the NPI premium would need to be roughly 4%, a spread indicated by its history. In addition, this historical period includes both the 2001 and 2008 recessions suggesting that a 2008-like virus recession in 2020-21 would not derail the long-term averages going forward. But, let’s be careful; counting on this simple calculation based on historical averages might well bring disappointment.

Inflation averaging 2.2% could be too high for the years ahead. The Fed is projecting a 2% inflation rate for the longterm beyond 2022, but sub-2% has persisted through most of the last ten years suggesting some downside risk for the years ahead.3 This is especially likely because the relationship between inflation and unemployment rates has disconnected from its historical pattern, making inflation forecasting highly uncertain.

Moreover, tepid inflation has helped the Fed to keep the federal funds yield very low which helps to keep borrowing secured by CRE very attractive. After holding at essentially zero from 2010 through 2015, the Fed tightened incrementally to reach 2.5% at the end of 2018. In 2019, easing to 1.75% was implemented in response to weakening global growth and unpredictable US trade policies. At the same time, several central banks abroad are maintaining negative rates also in response to weak global growth. The Fed’s projections were calling for little to no change in 2020 but the economic threat associated with the coronavirus has prompted the Fed to cut the funds rate back to the zero bound. Longer term, a 2.5% average was projected but with a considerable range of possibility around it.3 Since 2.5% appears to be the very peak of this cycle and since the federal funds rate is back to zero, it seems implausible that 2.5% will be the long-term average!

In sum, the historical 2.2% inflation and 2.5% real rate foundation for CRE investment performance may prove to be unreliable. Instead, the long-term opportunity cost of holding CRE and other risky assets may be lower than now expected, perhaps close to the pre-virus readings of a 1.5% inflation rate and a 1.75% real rate.

A lower opportunity cost maintained over the long term combined with recovery from virus-related economic slowing will attract stronger capital flows than a higher opportunity cost and could thereby compress CRE cap rates further down from where they are now. This would bolster property values until a new equilibrium is established.

The Fed is projecting a 1.9% rate of growth over the longer-term,3 which is slightly below the 2.3% posted for 2019.4 Consider that the average between 1995 and 2019 was 2.5% or roughly 30% stronger!5 Slowing population growth and weak productivity improvements have contributed to the growth slowdown, along with demographic shifts as younger less experienced workers replace more productive retiring workers. A virus-recession will further constrain the average but less so if it is short-lived.

Any upside to current growth expectations will require quick economic recovery, plus faster population growth and/or a surge in productivity growth. Neither is on the horizon except for a modest boost in productivity as millennial workers mature. 2019 population growth was the slowest in over 100 years.6 and investment spending generally, and on research and development, has been mediocre.4 Technology may deliver a surprise boost in productivity in the years ahead but, it is not on the horizon now.

Lackluster economic growth will have a moderating effect on property net operating income (NOI) growth which could slow capital appreciation despite any future cap rate compression. As a result, the historical premium on CRE might well fall short of its 5% historical average. Note than the premium has been declining to roughly 2.4% since reaching a cycle peak of 13.1% in 2015. (Exhibit 2)

CRE PREMIUM UPSIDE STILL POSSIBLE

Erosion in the long-term premium could be offset, however, if CRE supply additions adjust rapidly to weaker long-term economic growth bolstering NOI growth. Supply responsiveness to evolving market conditions has been evident in recent years in the tepid pace of office construction in the face of densification and in the minuscule addition to the stock of regional malls in the face of online shopping.

In addition, remember that the NPI is a proxy for CRE investment performance not an inventory. The NPI is a collection of portfolios managed by the investment entities that contribute to NCREIF. Over time, those portfolios evolve both in terms of geography and sector. For example, the number of NPI properties located in the Midwest declined from 15% in 2007 to 12% in 2019, while those in the West increased from 33% to 37%. The number of industrial properties increased from 38% in 2007 to 43% in 2019, while the number of office properties declined from 24% to 18%.1

Investor portfolios also evolve through acquisition of property types outside of traditional apartment, industrial, office, and retail. Non-traditional property types include self-storage, student housing, lab space, senior housing, and manufacturing housing among others. Non-traditional property types can boost investment performance, but are not now captured in the NPI. Compositional changes such as these loosen the relationship between the CRE premium and macroeconomic growth. Such ongoing portfolio adjustments offer opportunity for a stronger CRE premium than otherwise.

HEDGING YOUR BETS

Altogether, the 8-9% unlevered CRE performance rule of thumb might well prove to be too optimistic for the long-term period ahead even in the absence of a coronavirus recession in 2020. Achieving that rule of thumb would require quick economic recovery, plus long-term supply constraints and compositional adjustments in portfolios to offset sub-2% inflation and tepid longterm economic growth. But, the relative attractiveness of US CRE to investors might be unaffected because returns for all asset types will be influenced by the same macro level forces. This implies that competitiveness across asset types will be determined by the speed and ease with which each asset type adjusts to the future. As always, investors are advised to hedge their bets through portfolio diversification and to monitor the evolution of investment performance drivers with care.

—

ABOUT THE AUTHOR

Martha Peyton is Managing Director of Applied Research for Aegon Real Assets US. Aegon Real Assets US is an indirect wholly owned subsidiary of Aegon N.V.; is a US-based investment adviser registered with the Securities and Exchange Commission (SEC); and part of Aegon Asset Management, the global investment management brand of Aegon Group.

NOTES

1. National Council of Real Estate Investment Fiduciaries. As of December 31, 2019.

2. Board of Governors of the Federal Reserve System. As of January 29, 2020.

3. Board of Governors of the Federal Reserve System. Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents, under their individual assumptions of projected appropriate monetary policy, December 2019.

4. Bureau of Economic Analysis. Gross Domestic Product, Fourth Quarter and Year 2019 (Advance Estimate), January 30, 2020.

5. Bureau of Economic Analysis. Real Gross Domestic Product, Percent Change from Year Ago, Annual. January 30, 2020.

6. US Census Bureau. December 23, 2019.

THIS ARTICLE ORIGINALLY APPEARED IN SUMMIT (SPRING 2020)

—