THE MOST DISRUPTIVE AND POTENTIALLY DANGEROUS PANDEMIC IN MORE THAN 100 YEARS HAS THROWN THE ENTIRE REAL ESTATE SECTOR INTO UNCERTAINTY

The emergence of the most disruptive and potentially dangerous pandemic in more than 100 years has thrown the entire real estate sector into a state of uncertainty. Both the utility and value of the global real estate market has experienced an unprecedented shock in the beginning of 2020.

The current disruption in the markets is causing real estate professionals to question which direction the industry goes after the community has weathered this dislocation. Does the way people consume and transact real estate fundamentally change because of the impacts of COVID-19? If so, do trends like software adoption, automation, and remote work accelerate in the next decade?

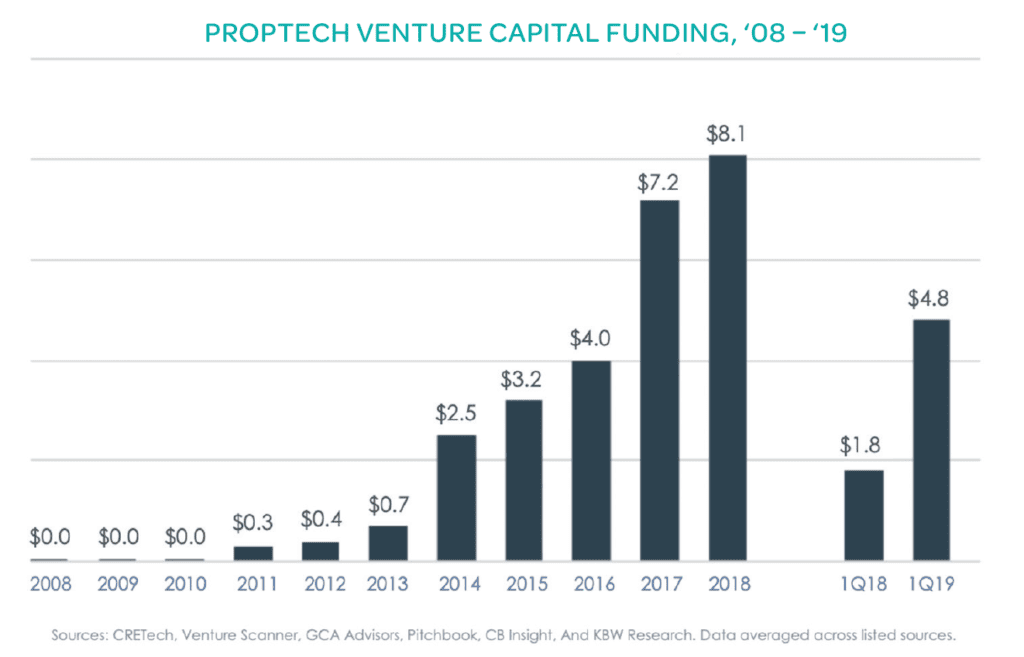

Many real estate investors who previously focused exclusively on brick and mortar are considering investing in PropTech companies, which are looking to imbue technology into real estate processes to make the life of the professional executing these tasks more efficient and pleasant. Technology companies such as VTS, for example, help facilitate communication between the leasing broker and the landlord, and also provide insights into key lease dates for the landlord. These Software as a Service (SaaS) companies charge landlords a subscription fee to use the software. SaaS businesses, and software marketplaces such as Airbnb, are typically funded with venture capital equity.

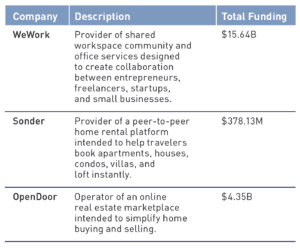

Additionally, in the last decade, a staggering amount has been deployed into tech-enabled real estate businesses such as WeWork, Sonder, and Opendoor, which manage and operate physical real estate. How should these businesses be categorized? Are they merely old-fashioned real estate businesses in a shiny new candy wrapper, or is there something new and innovative about how they operate?

These companies seek to leverage technology in various parts of their business, streamline manual processes, and focus on user experience to surpass traditional real estate returns. These businesses “grow” by expanding their square footage and bringing more physical users into that space either on a subscription basis, such as co-working, or a single transaction, such as I-Buying. Growing square footage supply has historically been done either by using balance sheet capital to acquire square footage or through management agreements.

Recent demand shocks created by the impact of COVID-19 in the hospitality, office, and retail sectors have left some of these companies with empty spaces. Companies that raised large amounts of venture capital equity have been forced to make deep personnel cuts to try to weather the storm.

For both business models, these startups raised a bulk of their capital from venture investors that have historically financed high-growth, high-margin software businesses and have the highest return expectations. This puts moderate-growth and capital-intensive tech-enabled real estate companies in a tough position when they receive capital from similar investors on similar terms. As we saw in the last decade, one of two scenarios have occurred:

- The founding teams found themselves highly diluted before they could achieve scale, or;

- The firms that have sought to retain ownership have found themselves raising at extremely and unsustainably high valuations that may outpace their actual growth milestones.

For these real estate companies, neither scenario is ideal for their founders, teams, customers, or investors. Fortunately, there is a solution that involves you, the reader, to mitigate these conflicts in the next decade.

THE NEW WAVE OF THE PROPCO/OPCO STRUCTURE

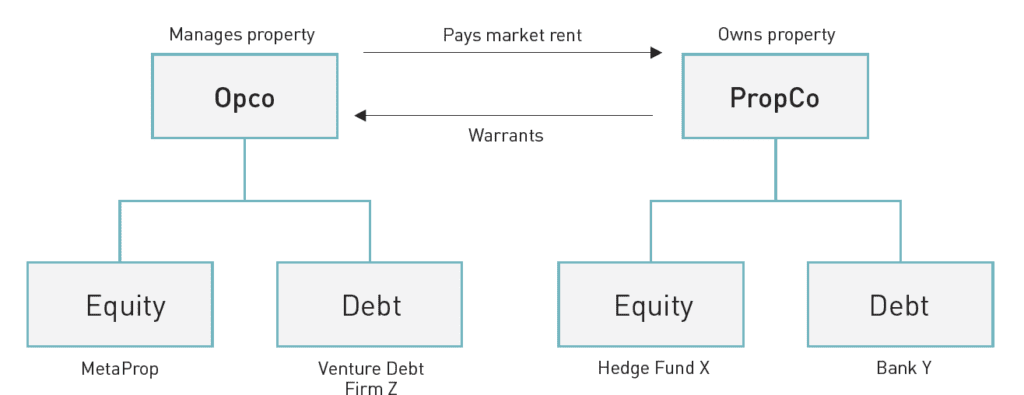

Businesses leading the way towards this solution are already actively separating their capital expenditure for the physical real estate from capital for their technology, brand, and people. This is commonly known as property company/operating company (PropCo/OpCo). In this structure, often used in the hotel industry, the PropCo owns the real estate asset, while the OpCo manages the real estate asset for its particular business model and pays market rent to the PropCo. For example, the vast majority of Four Seasons hotels around the world are managed by Four Seasons and owned by independent real estate investors.

There are three primary reasons the PropCo/Opco structure allows for scale:

- More favorable financing terms for the PropCo allows for cheaper capital, which leads to higher operating margins for the OpCo. The real estate can also be used as collateral which improves its creditworthiness.

- Increased access to capital allows for more inventory, at cost.

- The PropCo purchases the real estate that the OpCo can operate quickly with increased autonomy.

ALIGNING INVESTOR INCENTIVES ALLOWS FOR SUSTAINABLE GROWTH

With a PropCo/Opco financing structure, we can more adequately align risk-return profiles and incentive structures for entrepreneurs, venture capitalists, and traditional real estate investors within these types of companies.

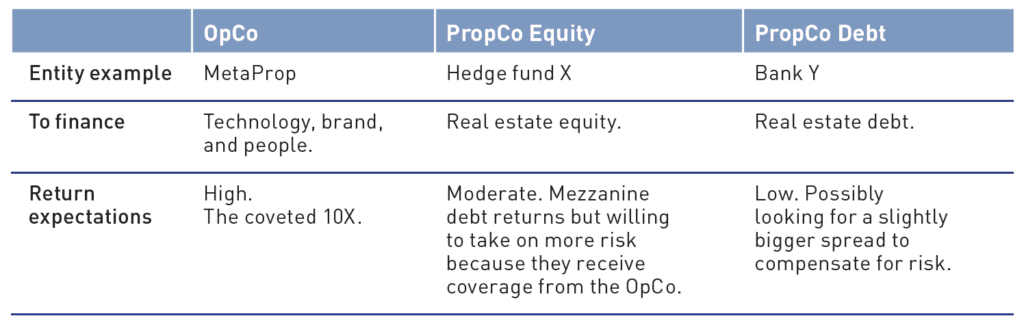

The PropCo is best financed more similarly to a real estate company, with a bank for the debt and a real estate investment firm for the equity. The OpCo is best financed more similarly to a software company by venture capitalists and venture debt for the technology, brand, and people. Below is an example of how the PropCo/OpCo would be financed:

The PropCo is commonly established as a warehouse line, with an LTV of 75%. On occasion, the OpCo will be required to invest up to 10% of the equity for the warehouse line, in order to have skin in the game. However, deals will be structured with varying degrees of OpCo financial participation. In exchange for taking the risk on an operator with unproven credit, the equity provider typically receives a varying level of warrant coverage in the OpCo. The debt provider will often receive a similar but lower level of warrant coverage than the equity provider.

With this model, each investor is aligned at a projected risk/ return threshold that makes sense for their respective business model. The OpCo’s balance sheet does not become burdened with expensive and dilutive venture capital. The company can raise one-tenth of the amount of equity capital as previously required, and therefore deliver early-stage venture capitalists a 10x return without having to carry multi-billion-dollar valuations. If the OpCo fails, the venture capitalist has limited their downside and not risked too large an allocation of that particular fund. Venture capital general partners and limited partners have a higher expectation of failure amongst a handful of companies within any given fund’s portfolio. That is why most early stage venture capitalists will invest in 30-40 companies per fund.

The PropCo equity investor can obtain mezzanine debt-type returns from the cash flow associated with the real estate, along with upside equity warrant coverage in the operating business to sweeten the deal. Although the equity is still subordinated to the bank’s credit, the PropCo investor can potentially enjoy a mezzanine debt type return while maintaining a first lien position on the asset itself. On the credit side, large banks can leverage their low cost of capital to lend to these companies at attractive rates. As the banks will often require a financial guarantee from the PropCo equity investor, the bank can access enhanced debt returns while limiting downside risk, and potentially achieve significant upside through equity warrant coverage.

CONSIDER CREATING NEW VEHICLES TO FINANCE THESE COMPANIES

Real estate shocks such as that brought by COVID-19 drastically expedite the need for innovation. As current tech-enabled real estate businesses grow and new ones emerge, the demand for more flexible and creative funding sources will only increase. Unfortunately, the current risk-return profiles for the majority of real estate investors prevent maverick operating companies from accessing appropriate capital. As an LP or GP, this presents an opportunity to carve out a certain portion of an existing fund for or spin up an entirely new creative platform to finance PropCo/OpCo deals. For those active in the PropTech space, we are very excited for this new era of properly aligning incentives within the capital stack in order to more efficiently scale these types of business models.

—

ABOUT THE AUTHORS

Zach Aarons is Co-Founder and General Partner, and Safi Aziz is a Senior Associate for MetaProp, a New York-based venture capital firm focused on the real estate technology industry.

THIS ARTICLE ORIGINALLY APPEARED IN SUMMIT (SPRING 2020)

—