Anticipated moves on interest rates at central banks could unlock capital and support the closing of a strong pipeline of infrastructure investments.

Mixed economic data in the first quarter of 2024 meant the financial markets remained volatile and the much-expected rate relief was delayed—at least for now.

Inflation has proved to be much stickier—especially in the US—and geopolitical turmoil keeps the downside risk elevated. Inflation is generally expected moderate but remain at the target levels for central banks uplifted by the costs of deglobalization and the energy transition.

In a structurally high inflationary environment, there is a potential for strong earnings growth and recurrent dividend yield for most infrastructure sectors.

The fragile outlook calls for balanced and diversified infrastructure portfolios with a preference for themes benefitting from structural tailwinds, such as power utilities and data centers, considering the upswing in power demand to fuel power-intensive AI applications. Renewable power is another sector which should benefit from data center owners and tenants seeking contracts for green electricity.

DIMINISHING PRESSURE ON VALUATIONS

Retail started oversupplied post-GFC, and the increase of available space per capita, in conjunction with the move to online shopping, eroded returns in the sector.

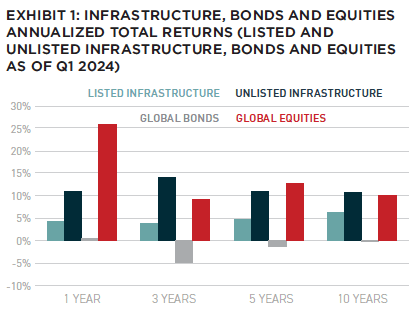

In Q1 2024, financial markets priced in slower and more delayed interest rate cuts compared to the more positive expectations at the end of last year. There is still consensus that we have reached peak rates and central banks in Europe and the United States will start easing their monetary stance abating the pressure on capital values from rising discount rates. Combined with recurrent income yield, total unlisted infrastructure returns remain firmly in positive territory (Exhibit 1).

By sector, transport and network utilities contributed the most to Q1 returns, according to EDHECinfra.1 This is likely attributed to resilient transport volumes and the gradual re-adjustment of regulated earnings to higher funding costs and inflation.

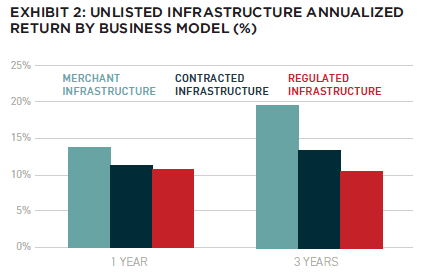

In Europe, power prices declined significantly as gas inventories were above seasonal levels. With lower power prices, unlisted merchant infrastructure has started to crest after several abnormally high quarters. Contracted infrastructure—with availability-based, mostly CPI-based revenues, and regulated infrastructure—have remained more stable over time (Exhibit 2).

The recovery of listed infrastructure that started in Q4 2023 continues, though at a slower pace. The defensive characteristics of listed infrastructure were tested extensively by macroeconomic headwinds over the preceding two years. A sense of calm is prevailing now.

Moderating inflation and stabilizing interest rates are positive for infrastructure stock prices.

The rebound in listed infrastructure indices was more broad-based by sector and region in comparison with the public equity markets which continued to be dominated by gains in US-concentrated Big Tech stocks.

The need-for-power story improved market sentiment for power and integrated utilities. A commodity price rally and solid earnings supported listed midstream companies.

A DRAG ON INFRASTRUCTURE FUNDRAISING

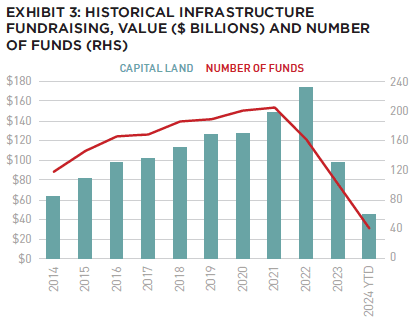

Infrastructure funds raised just over $40 billion to date in 2024 as the slowdown in fundraising continued almost halfway through the year (Exhibit 3). High interest rates and challenges in selling assets have affected fundraising activity.

More certainty on asset valuations is needed for investment activity to rebound and unlock liquidity by institutional investors for the rest of the year. According to Infralogic, the second quarter of 2024 looks promising with forty-six strategies looking to raise $72 billion by the end of June.

Consolidation and ever-rising fund sizes continue to be major themes in the asset class. The top ten funds in the market account for 34% of all capital being sought. The buyout of infrastructure managers is on an upswing. The race to the top for the major players continues and at the same time, multi-asset or private equity managers seek exposure to the relatively stable infrastructure industry.

For independent asset managers, the buyout route is a way to gain access to larger distribution channels and tap high net-worth and affluent investors as the private market universe expands with new long-term investment formats.

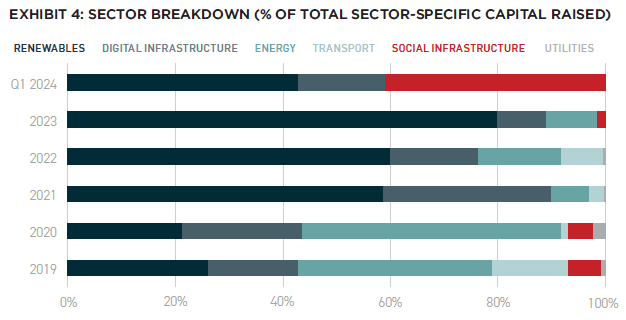

Structural tailwinds and geopolitical tensions explain the sectoral and geographic preferences in infrastructure fundraising. Analyzing capital raised for sector-specific strategies (Exhibit 4), renewable energy and energy transition funds dominate with several of them in the mid- and small-market. Digital infrastructure is now a distant second, which is surprising given the ongoing sizable investment activity in data centers.

Most generalist funds in the market list digital infrastructure as one of their target areas. Multi-region funds continue to be the norm. An interesting development in Q1 2024 is the close of several APAC strategies which accounted for 36% of all capital raised, according to Infrastructure Investor.2

DEAL PIPELINES

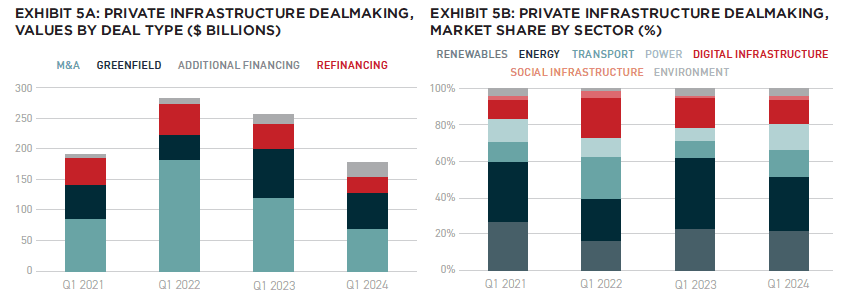

Similar to fundraising, the number of closed infrastructure deals in Q1 2024 stalled to their lowest level in five years (Exhibit 5). This reflects the significant gap between buyers’ and sellers’ expectations over the preceding quarters. While more clarity on central banks’ next moves is still desired, the investment pipeline shows signs of revival. Since the start of 2024, Infralogic’s database lists more than seven hundred infrastructure transactions that moved forward in the investment process; out of them, more than 300 deals are M&A transactions worth $91 billion.

Investors are watching large-ticket deals in the digital infrastructure space, such as the sale of Global Switch’s Australian data center portfolio or the potential disposal of the AUD 15 billion Australian data center business AirTrunk.

The lure to gain data center exposure is attracting a wide range of investors, boosted by reports of the bulging generative artificial intelligence (GenAI) demand. In less than two quarters in 2024, greenfield activity in data centers equaled the total annual activity in 2022.

In the first quarter of 2024, there were several closed or announced deals in European airports. French toll road conglomerate Vinci acquired a 50% stake in the Edinburgh Airport for an estimated EV/EBITDA multiple of just over 20x. Except for Sydney Airport, there has been very little M&A activity in airports since the pandemic. The new deals—including an announced sale of a stake in Italian 2i Aeroporti—could help price discovery.

In terms of the number of transactions, solar photovoltaics (PVs) ranked first, followed by onshore wind and data centers. Battery storage is also picking up momentum with larger project sizes lining up financing.3

POWER AND UTILITIES

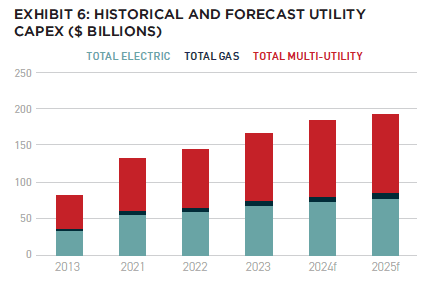

Required CapEx on power infrastructure is hitting records across the globe, driven by rising electricity demand; the need to connect clean energy generation; electric vehicles adoption; and domestic manufacturing growth.

Data centers and GenAI are becoming a rapidly growing source of power loads. Regulatory Research Associates (a subsidiary of S&P Global Commodity Insights) estimates 11% higher spending levels in 2024 compared to the previous year for a sample of large, publicly listed US energy utility companies (Exhibit 6).4 The European Union’s Action Plan on Grids considers a 60% increase in power demand by 2030 and outlined approximately €584 billion of required grid investments this decade.

Infrastructure companies are also investing to increase resilience to physical climate risks. In the US, the National Oceanic and Atmospheric Administration (NOAA) released its outlook for the 2024 Atlantic hurricane season, predicting higher-than-normal hurricane activity.

NOAA forecasts a range of seventeen to twenty-five total named storms, which might incur direct costs to utilities and power plants in high-risk areas. Key in the assessment of utilities is the regulatory recovery mechanisms and whether they allow full or near-full recovery of storm-related costs.

In Europe, power prices have fallen rapidly materially changing the short-term outlook. As the penetration of renewables increases, so does day-hour power price volatility and the need for flexible generation, providing structural support for battery energy storage (BESS). Governments and grid utilities increasingly recognize the crucial role of energy storage and incorporate targets in their National Energy and Climate plans. The business models that are emerging contain a high degree of market-sensitive trading and ancillary revenues; however, proposals in Europe suggest the introduction of more predictable capacity market auctions and offtake contracts.

RENEWABLES

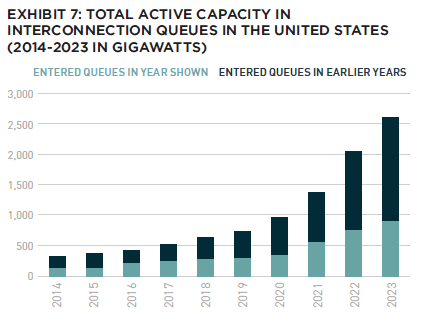

Worldwide policy stimuli are giving boost to renewable capacity. According to the Lawrence Berkeley National Laboratory, over 1,200 gigawatts (GW) of solar, storage, and wind capacity have requested interconnection in the US following the passage of the Inflation Reduction Act.

The additional tax incentives are leading to increased developer interest in clean energy. The wait times, however, are increasing. The typical project built in 2023 took nearly five years from the request to connect to reach commercial operation. US regional utilities have a hard task as the interconnection queues are expanding and currently stand at twice the installed power plant capacity nationwide (Exhibit 7). This will prompt regulatory agencies to improve data transparency, coordinate interconnection and transmission planning as well as ease permitting requirements.

Market demand is a strong factor as well. Big Tech’s drive for zero emission power is gaining speed. Talen Energy sold its hyperscale data center campus to Amazon Web Services while simultaneously entering into a long-term power purchase agreement (PPA) to supply the data center with nuclear energy from one of Talen’s power plants. In another example, Microsoft signed a framework agreement with Brookfield Renewable Partners for 10.5 GW of renewable power. This improves the market sentiment for renewable development and the project economics as hyperscale off-takers often agree to premium PPA prices.

Climate policies are front and center in election campaigns and 2024 as a major election year will test the energy transition ambitions. The European Union is voting for members of the European Parliament in June 2024 and the US general elections are scheduled for November.

Climate policies such as the EU Green Deal and the US Inflation Reduction Act are being implemented at a time of rising energy costs, a war in Ukraine, concerns about a cost-of-living crisis and the efforts of governments to bring clean energy manufacturing home. A recent trade ban on Chinese solar panels by the US is an example of the latter. While protecting local manufacturers, the ban is exacerbating the oversupply of solar components in Europe.

NEW: SUMMIT #16

NOTE FROM THE EDITOR: ISSUE #16

Benjamin van Loon, CAE | AFIRE

GLOBAL CONSUMPTION: APAC DATA CENTER INVESTMENT STRATEGIES IN THE AGE OF DIGITIZATION

Michelle Lee, Eugene Seo, and Wayne Teo | CapitaLand Investment

DISTINCT VERTICALS: AI IS CHANGING THE REAL ESTATE INDUSTRY ON TWO DISTINCT PATHS

Daniel Carr and Andrew Peng | Alpaca Real Estate

DIVERGING FORTUNES: ARE COMPARISONS BETWEEN OFFICE AND RETAIL STILL WARRANTED?

Brian Biggs, CFA and Ashton Sein | Grosvenor

OCCUPYING FORCE: INSTITUTIONAL OFFICE PROPERTIES FEELING THE PAIN

Nolan Eyre, Scot Bommarito, and William Maher | RCLCO Fund Advisors

VALUE-ADD VS. CORE: COMPARING CORE AND NON-CORE STRATEGIES WITH NEW DATA

Yizhuo (Wilson) Ding | Related Midwest and Jacques Gordon, PhD | MIT Center for Real Estate

FAVORABLE CONDITIONS: STRUCTURAL CHANGES TO THE MARKET FAVOR NONBANK CRE LENDERS

Mark Fitzgerald, CFA, CAIA, and Jeff Fastov | Affinius Capital

INFRASTRUCTURE VIEWPOINT: INTEREST RATE CHANGES COULD UNLOCK NEW INFRASTRUCTURE INVESTMENTS

Tania Tsoneva | CBRE Investment Management

MISSING MIDDLE: WORKFORCE AND AFFORDABLE HOUSING IN THE US

Jack Robinson, PhD and Morgan Zollinger | Bridge Investment Group

NARROW SPACES: CHOKED STRAITS AND IMPLICATIONS FOR GDP, INFLATION, AND CRE

Stewart Rubin and Dakota Firenze | New York Life Real Estate Investors

OPCO-PROPCO OPPORTUNITY: EMERGING MODELS AND THE KEYS TO STRUCTURING PARTNERSHIPS

Paul Stanton | PTB and Donal Warde | TF Cornerstone

TRANSFORMING LUXURY: UNLOCKING VALUE IN LUXURY HOSPITALITY REAL ESTATE

Alia Peragallo | Beach Enclave and AFIRE Mentorship Fellow, 2024

SOLAR VALUATION: IS SOLAR ENERGY A VALUATION GAME-CHANGER?

David Wei and Michael Conway | SolarKal

GROUND LEVEL: THE CASE FOR GROUND LEASES AND LONG-TERM CAPITAL

Shaun Libou | Raymond James

LEGAL UPDATE / DRIVING FORCE: UNDERSTANDING SYNDICATED LOANS AND MULTI-TIERED FINANCING

Gary A. Goodman, Gregory Fennell, and Jon E. Linder | Dentons

LEGAL UPDATE / ENHANCED PROTECTION: LEVERAGING THE SAFETY ACT FOR ENHANCED LIABILITY PROTECTION IN REAL ESTATE

Andrew J. Weiner, Brian E. Finch, Aimee P. Ghosh, Samantha Sharma, and Sarah Hartman | Pillsbury

+ EDITOR’S NOTE

+ ALL ARTICLES

+ PAST ISSUES

+ LEADERSHIP

+ POLICIES

+ GUIDELINES

+ MEDIA KIT

+ CONTACT

TRANSPORT

Transport volumes are holding up despite the adverse macroeconomic impacts on consumer disposable incomes. Travel demand is being driven by leisure and in aviation, the opening of China’s international routes.

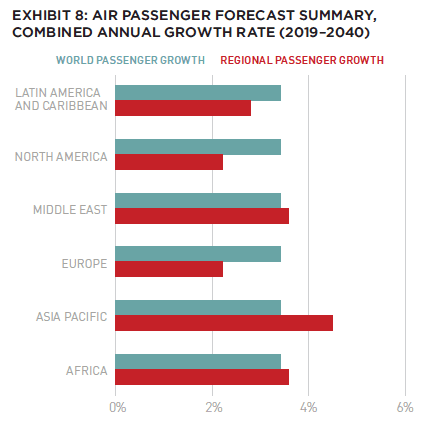

According to the International Air Transport Association (IATA), air passenger growth will continue to increase albeit at a slower rate compared to the years of pandemic recovery.5 The agency expects that passenger journeys will double from the 2019 level to 7.8 billion by 2040 (Exhibit 8).

APAC is leading the growth, and India in particular, is forecasted to achieve a growth rate of 6% over the next twenty years. The short-term uncertainties revolve around the passenger demand if jet fuel becomes more costly, or sticky inflation and mortgage rates pressure disposable income. In the longer term, the carbon footprint and related costs of aviation could cool consumer demand. IATA expects the industry to increase the use of sustainable aviation fuels (SAF) and use more carbon emissions offsets.

Ports are facing a slowdown in world trade (as measured by the ratio of world exports to GDP) and a change in trade patterns due to geopolitical conflicts. The onshoring of supply chains and trade disruptions are slowing world trade while friendshoring—manufacturing and sourcing from countries that are geopolitical allies—is affecting regional port dynamics. Energy flows that were originally aimed for Europe are now redistributed to BRIC countries and trans-shipment hubs in the Red Sea are still disrupted due to the conflict in the Middle East.

The investment outlook for transport is positive given the urgent need to decarbonize; transport accounts for nearly one-quarter of global energy related carbon emissions, according to the International Energy Agency.6 The major contributor of emissions is road travel and in particular medium and heavy vehicles. The electrification of transport is proceeding at a rapid pace; battery prices continue to decline and improve the parity with internal combustion engines. In March 2024, the Transport for London (TfL) launched a concession to upgrade the EV charging infrastructure which will support its operational fleet of approximately 1,000 zero emission vehicles.7

The decarbonization of transport will need to look beyond electrification as there are segments such as maritime shipping that are hard-to-abate. A number of transition fuels are being explored, from green hydrogen to renewable gas but they are in different stages of technological readiness, efficiency and production cost. In May 2024, the Portuguese government launched an auction for green hydrogen and biomethane to incentivize their production by purchasing €14 million over a period of ten years (Infralogic).

DIGITAL INFRASTRUCTURE

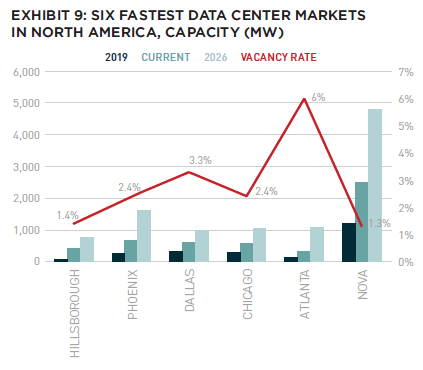

Data centers remain thematically well positioned and command strong investor demand. According to CBRE, the six fastest-growing data center markets in North America have doubled in capacity since 2019 while the vacancy rates are sub-par to market with very low speculative build (Exhibit 9).

Colocation capacity is driven by the hypsercale cloud, AI, and enterprises using multi-cloud providers. GenAI requires larger facilities in size—50MW to 100MW—and more complex design in terms of hybrid cooling and reliability. At the same time, the latency (closeness to the client) is less important for training large language models (LLMs) and, therefore, secondary and emerging markets are becoming more appealing if they offer powered land and electricity at attractive prices.

With power-hungry AI applications, the attention has turned to the quantity and type of power used by data centers. Google recently said that they are matching 64% of their data center power consumption against hourly carbon-free energy; this compares to their target of 90% matching by 2030. Machine learning can increase efficiency by optimizing the servers’ adaptability to different operating scenarios. GenAI workloads are variable with higher peaks than traditional loads. Intelligent systems and software can dynamically adjust the power supply to different racks or zones in a data center as well as shift power loads to times with lower carbon intensity.

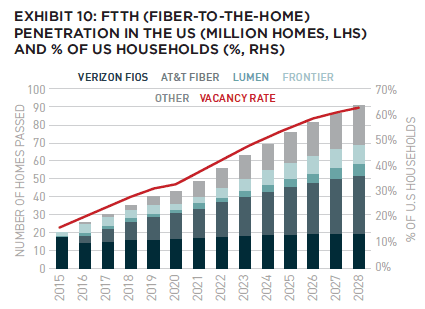

Fiber-to-the-home (FTTH) has entered a late stage with slowing penetration and increased competition in urban areas. The fragmentation in many markets, the challenging business environment and inadequate project economics might usher in sector consolidation. The rate of FTTH growth will moderate as it becomes more costly to build in less densely populated markets, especially when considering labor shortages and the elevated cost of equipment.

FTTH penetration in the US has reached almost 50% (Exhibit 10) and is expected to plateau at about 60% by 2028. The traditional broadband operators (cable, telecom, and satellite) face elevated competition from fixed wireless access (FWA) which has gained strong traction in the US over the past two years. FWA offers speeds that are typically faster than copper wireline and a marginal cost advantage.

CHANGES COMING

In the first quarter of 2024, policy rate uncertainty was still a drag on risk sentiment and dealmaking in private markets, including infrastructure. We are on the cusp of central banks making their next moves on interest rates which we believe will unlock capital and support the closing of a strong pipeline of infrastructure investments. Despite the atypically low investment volumes in Q1 2024, infrastructure sectors such as energy transition and data centers continued to attract high levels of funding from diverse investors. The strong currents of digitalization are spilling over into the power infrastructure sector and driving the need for grid capacity and emissions-free power sources.

—

NOTES

1. EDHEC Infra & Private Assets. “EDHEC Infra & Private Assets.” EDHEC Infra & Private Assets – the Quants of Private Markets, August 21, 2024. https://scientificinfra.com/.

2. Bentley, Zak. “Infrastructure Investor | Global Infrastructure Deals and News.” Infrastructure Investor, July 4, 2024. https://www.infrastructureinvestor.com/.

3. All values are based on Infralogic data.

4. SNL Financial LC. “Regulatory Research Associates (RRA) | SNL Financial LC,” n.d. https://www.capitaliq.spglobal.com/Sectors/Energy/RRA.aspx.

5. International Air Transport Association. “International Air Transport Association.” Accessed August 27, 2024. https://www.iata.org/.

6. “IEA – International Energy Agency,” n.d. https://www.iea.org/.

7. Matters, Transport for London | Every Journey. “Keeping London Moving.” Transport for London, n.d. https://tfl.gov.uk/.

—

ABOUT THE AUTHORS

Tania Tsoneva is Head of Infrastructure Research for CBRE Investment Management.

—

THIS ISSUE OF SUMMIT JOURNAL IS GENEROUSLY SPONSORED BY

Leverage the only investment management suite that automates complex processes and ensures transparency from investor to asset operations, integrating investment and debt management, capital raising, investment, financial, and operational metrics through a branded investor portal. Learn more.