This article appears in Summit Journal (Summer 2020) | Download PDF

Infrastructure is a critical component of economic development, providing the backdrop onto which businesses and housing can be built. Because it’s ubiquitous, it’s easy to take infrastructure for granted. But when choosing metros for potential investment, understanding is essential.

Infrastructure is so ubiquitous in America that it is easy to take for granted because we have functioning transportation, water, energy, and schools almost everywhere. Consequently, infrastructure is often overlooked when investors consider which metros have the best prospects for growth.

Infrastructure is a critical component of economic development, providing the backdrop onto which businesses and housing can be built. In many metros, however, infrastructure is either old and in need of mending or underdeveloped, either of which can stymie growth.

“The economic stakes of America’s infrastructure system are high because its condition can either help or hurt the productivity of the economy,” the American Society of Civil Engineers (ASCE) wrote in a 2016 report entitled: “Failure to Act: Closing the Infrastructure Investment Gap for America’s Economic Future.”

The report argues that governments in the US underfund infrastructure by upwards of US$100 billion a year, and goes on to say:

“Poor infrastructure affects business productivity as well as every sector and region of the US because when one part of the infrastructure system fails, the impact can spread throughout the system and economy. The US economy relies on low transportation costs and the reliable delivery of clean water and electricity to businesses and households to offset higher wage levels and costs.”

Although there are aspects of infrastructure that are national, and the federal government funds many projects, planning and execution is often done at the state and local level. This creates important differences between regions and metros—not only in the physical conditions of infrastructure, but also in the commitment to fund and execute projects.

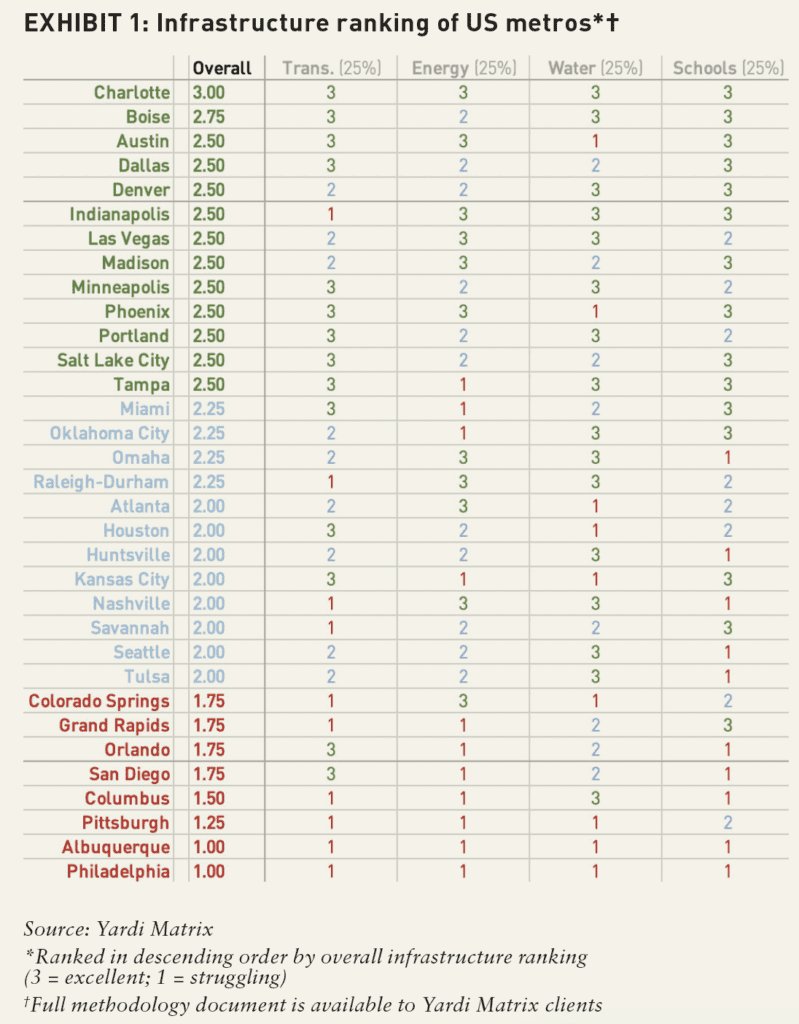

To get a handle on which metros have the most growth potential, Yardi Matrix created a scorecard in which we awarded grades to 33 secondary and tertiary metros based on a series of 29 metrics in four different categories: transportation, energy, water and schools. The scores were based on statistical and qualitative research in the 29 sub-categories.

Charlotte and Boise led the 13 metros with the highest grades. These metros had the highest scores in most categories, and none of the 13 garnered the lowest score in more than one category. The worst scores were awarded to Philadelphia, Albuquerque, and Pittsburgh.

It should be stressed that infrastructure is only one aspect of the investment picture. Demand for commercial space is complex and based on a host of factors. Investment decisions should not be made based solely on these infrastructure rankings, but neither should investors ignore the potential of a metro to handle future growth.

TRANSPORTATION

Transportation infrastructure impacts urban development, human life, and the accessibility of a city, and as a result, it plays a significant role in economic and population growth. To estimate how well a city’s infrastructure meets the current and potential future needs of residents and businesses, we looked at characteristics of local surface transportation (e.g., roads and bridges), aviation, and public transportation. All transit infrastructure was evaluated based on qualitative research of each metro’s effort to improve and develop its public transportation systems.

Road conditions, commute times, and bridge deficiencies were the metrics used to determine the state of surface transportation. We measured the capabilities of public transportation networks to study connectivity, frequency of service, and access to local jobs. Additionally, we considered aviation infrastructure, which plays a vital part in facilitating economic growth by providing a key network of short and long transportation. We looked at the availability of international flights, airport status as a major airline hub, total number of departure flights in 2019, and the rate of on-time departure and arrival flights.

ENERGY

Efficient and reliable energy infrastructure is critical for growth, particularly as increasing populations raise the rate of energy consumption and the need for readily available energy. The ability to cope with potential future growth was evaluated based on metrics that provide insight into the production, distribution, and transmission capabilities in each locality.

Our energy metrics included costs, power outages, and commitment to funding. We looked at the state average cost per unit of residential electricity, natural gas, and regular gasoline. High energy costs can illustrate lack of production and/or infrastructure constraints, both of which can limit growth. The number of outages measures whether a metro’s energy infrastructure is reliable and resilient to factors such as weather, while a high average outage duration can indicate infrastructure that needs major improvements and modernization to speed restoration. We also measured current or future projects in each metro that might improve energy infrastructure capabilities.

WATER

Whether a metro has the infrastructure to provide enough water for growing populations is a crucial issue, particularly in the rapidly growing desert of the Southwest. We looked at metrics related to costs, the quality and quantity of water resources, and the condition of physical water infrastructure components, such as distribution pipelines and treatment facilities.

We also looked at the average water bill and water pressure to determine the health of a metro’s water system and its potential risks. High costs can indicate poor water conditions or lack of supply. Water pressure problems can be an indicator of strained supply. Unsustainable depletion of nonrenewable water sources could be a factor in future development and growth of a city, discouraging high urban density as supplies dwindle. We also considered the condition of each city’s water infrastructure and whether efforts are underway to make improvements.

SCHOOLS

Infrastructure isn’t merely mechanical. For example, public school education is an aspect of social infrastructure. High-quality public-school systems translate into more skilled and productive workers that fuel economic growth. In order to comprehensively evaluate the quality of each city’s schools and the ability to support growth, we factored in metrics at the state and local level that include safety, funding, graduation rates, test scores, and utilization of facilities. Because most schools are funded by multiple jurisdictions, in some cases we evaluated by county or state rather than local level.

Metrics we considered include the county-level high school graduation rates, student-teacher ratios, and availability of charter schools in the city’s largest school district. Public charter schools can expand school choice for low-income families, and some believe the competition they create can spur improvements in public schools.

School infrastructure was also evaluated based on the capacity and utilization of schools in the city’s largest school district, in addition to funding and/or programs to accommodate growth. Overcrowded schools can have a negative impact on quality of education and stresses teachers.

RANKING THE METROS

After assigning grades for each of the metrics, each metro was given a grade, which we separated into three levels by color. A green ranking signifies metros whose infrastructure is best prepared to handle future development, red signifies metros that are least prepared, and metros in the middle are yellow.

Charlotte and Boise and had the highest totals. For example, authorities in Charlotte have been proactive in upgrading infrastructure. The city is shifting to usage of renewable energy sources; is collaborating with Duke Energy Carolinas to upgrade the power grid; is investing US$3 billion to expand its airport; and has created a long-term plan for streetcars and light rail. Similarly, Boise has implemented forward-thinking water renewal facilities, a comprehensive school renovation program, highway upgrades, and clean electricity plans.

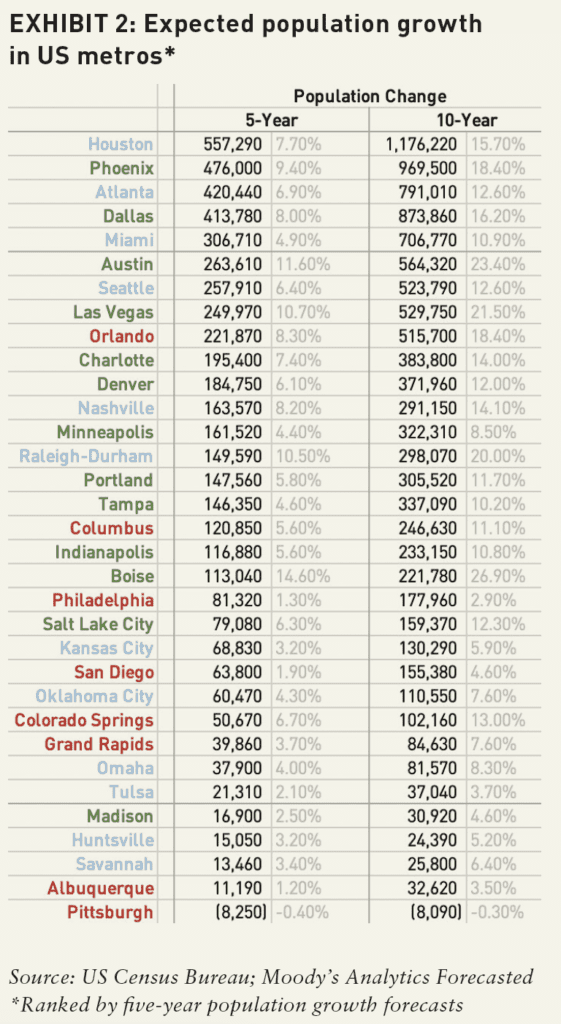

Metros that ranked higher in the list also tend to be growing faster than those that graded poorly. Six of the top 10 metros that are forecast by the US Census Bureau to have the fastest population growth over the next fi ve years—Boise (14.6%), Austin (11.6%), Las Vegas (10.7%), Phoenix (9.4%), Dallas (8.0%) and Charlotte (7.4%)—are in the top third of our infrastructure ranking. Meanwhile the three metros with the lowest infrastructure grades are projected to have weak population growth—Pittsburgh (-0.4%), Albuquerque (1.2%), and Philadelphia (1.3%).

The extent of the correlation can be debated, because infrastructure preparedness is only one component of in economic growth. Metros grow for any number of reasons, including a business climate that fosters jobs, the availability of skilled talent, housing costs, geography, weather, lifestyle preference, and more. Whatever role infrastructure plays, though, it is fair to say that growth is not possible without a framework in place to support businesses and housing.

DON’T IGNORE INFRASTRUCTURE

The data in this study was compiled before COVID-19, so metrics such as airport traffic and delay times, and the commute times of office workers, have been temporarily disrupted. The study is looking at long-term development potential, and we assume that eventually those metrics will go back to pre-COVID levels. Others may assume future transportation and workforce trends will change more dramatically.

We stress that our goal is not to create a definitive measure of infrastructure’s impact on commercial real estate. Investors may have different views as to which categories are most important, how to weigh them, or even how important infrastructure is in producing future growth. That said, we believe that infrastructure is an underrated and oft-ignored aspect of growth—one that investors should take more seriously when determining where to allocate capital.

—

ABOUT THE AUTHORS

Claire Anhalt is Senior Research Analyst and Paul Fiorilla is Research Editorial Director for Yardi Matrix, which offers the industry’s most comprehensive market intelligence tool for investment professionals, equity investors, lenders, and property managers.

—