Uncertainty surrounding remote work and politics suggest a wide range of potential outcomes for big cities, which may upend the long-running megatrend toward urbanization.

The origin of the air conditioner can be traced back to the first US patent for mechanical refrigeration granted in 1851. The proverb “necessity is the mother of innovation” applied, as the recipient, Dr. John Gorrie, was a Floridian. A century later, the mass production of affordable home air conditioners began to reshape the country. The Sun Belt region population has more than tripled since the middle of last century as its share of the US total population rose from one-fi fth to one-third. Prominent Eastern and Midwestern metro areas declined over the same period. Eight of the ten largest US cities as of 1950, most of which were in the East and Midwest, have fewer residents today.

Detroit is the posterchild of that fall from grace. As the nation’s fifth largest city in 1950, its population of nearly two million exceeded that of Austin, Dallas, and Houston combined. The Motor City was home to General Motors, Chrysler, and Ford, plus a cluster of smaller fi rms servicing them. Detroit’s decline was set in motion in the 1950’s as automakers reacted to the unionization of their labor forces by shifting factories first to the suburbs and later to lower-cost locales. The city’s path toward financial ruin was paved by the failure of elected officials to cut spending in response to secular and cyclical economic challenges. Over the course of decades, they increased pension benefits, borrowed more, and raised taxes, triggering a fiscal death spiral. Detroit’s population and its total assessed value of property in today’s dollars has decreased by about two-thirds over the past seventy years.

The rise or fall of a city is tough to foresee and impossible to forecast with precision, but history suggests that investors keep an open mind about the future. This is particularly the case today as work-from-home (WFH), fiscal health, and politics may portend de-urbanization, which would carry implications for both gateway and Sun Belt markets, as well as urban/suburban dynamics within metro areas.

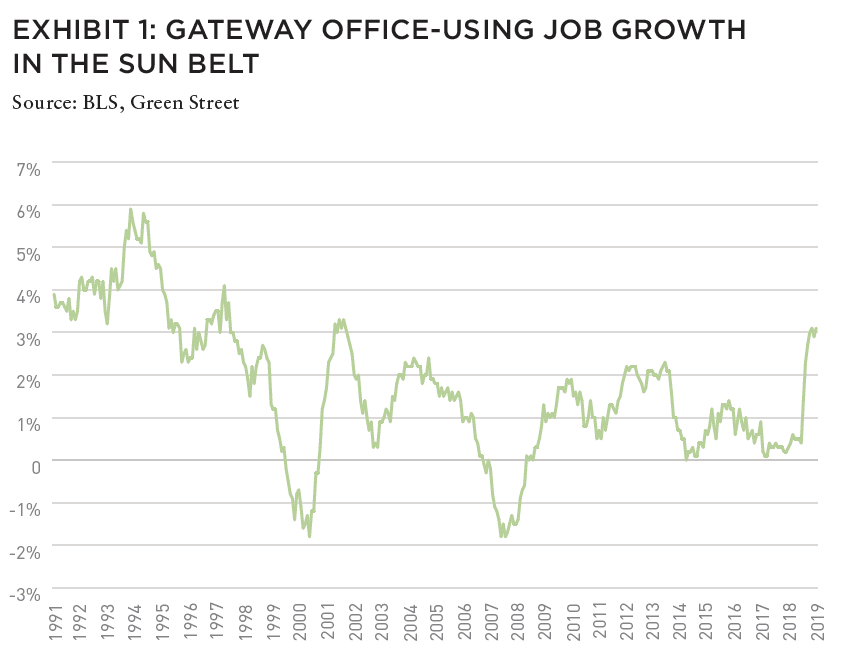

Post-COVID Flexible WFH policies will allow some employees to relocate to the suburbs, and others working remotely to move elsewhere. The WFH revelation has also increased comfort in operating a workforce distributed across multiple offices, as evidenced by an uptick in hedge fund and corporate headquarter relocations out of coastal cities. This anecdotal evidence is supported by employment data capturing migration. The spread between Sun Belt and gateway market office-using job growth spiked last year to its highest level in two decades. The biggest winners are places with high WFH utilization rates, based on our metric comparing the pre-COVID propensity to work remotely and an employee’s ability to do so.

READ THE REST OF THIS ARTICLE AT GREENSTREET.COM

ALSO IN THIS ISSUE (SUMMER 2021)

NOTE FROM THE EDITOR / The Housing Issue

AFIRE | Benjamin van Loon

INVESTOR SENTIMENT / Shining Through Darkness

The 2021 AFIRE International Investor Survey underscores a sense of calculated optimism for CRE investment in the year ahead.

AFIRE | Gunnar Branson

ECONOMY / Revisiting Inflation

For commercial real estate investors, inflation fears are real— but are they rational?

Aegon Asset Management | Martha Peyton, PhD

DEURBANIZATION / Herd Community

Uncertainty surrounding remote work and politics suggest a wide range of potential outcomes for big cities, which may upend the long-running megatrend toward urbanization.

Green Street | Dave Bragg and Jared Giles

HOUSING / How to Rebuild

Could an idea to “bring back” New York after the pandemic work in other cities?

Aria | Joshua Benaim

HOUSING / Single Family, Multiple Questions

Institutional ownership in single-family rentals accounts for less than 5% of the segment, but answers to key questions could change start to change that balance.

Berkshire Residential Investments | Gleb Nechayev, CRE

HOUSING / Institutionalizing Single Family

Over the past two decades, the single-family rental industry has evolved into an institutional-caliber asset class—so where is the sector going next?

Tricon Residential | Jonathan Ellenzweig

HOUSING / Build-to-Rent Boom

The future is bright for build-to-rent and institutional investors are increasingly looking at investing in this sector.

Squire Patton Boggs | John Thomas and Stacy Krumin

OFFICE / Recovering the Office

While most agree that the office sector has a difficult road ahead, there is less consensus about future demand in the sector. What are the indicators investors should be tracking?

Barings Real Estate | Phillip Conner and Ryan Ma

OFFICE / London Calling

With Brexit and pandemic resolutions coming into focus, pricing disparities could dissipate based on improved cross-border liquidity and cap rate compression in the London office market.

Madison International Realty | Christopher Muoio

LOGISTICS / Supply Change

Urbanization, digitalization, and demographics are the key trends to watch for understanding the future of logistics real estate.

Prologis | Melinda McLaughlin and Heather Belfor

CLIMATE / Accounting for Environmental Risk

When it comes to guards against environmental risk, Boston, Indianapolis, Minneapolis, and Portland are some of the most prepared US cities. What makes them different?

Yardi Matrix | Paul Fiorilla, Claire Anhalt, and Maddie Harper

ESG / Putting People First

Though “impact investing” is no longer totally distinct from investing in general, investors still have a lot of work to do for fulfilling the social and governance aspects of ESG expectations.

Grosvenor Americas | Lauren Krause and Brian Biggs

MULTIFAMILY / Influencing Multifamily

As we come out of the pandemic to a new economy, it seems likely that the creator economy will continue to grow. This will have a major impact on the multifamily sector.

citizenM Hotels | Ernest Lee

TALENT AND RECRUITMENT / Enhancing Life Sciences

As the global life sciences sector continues to grow in real estate, highly specialized skills and experience will be the keys to success.

Sheffield Haworth | Max Shepherd and Jannah Babasa

EDUCATION / Real Estate Education Goes Global

The evolution of global real estate education over the past three decades will be integral to developing a rich pipeline of talent for the future of commercial real estate.

Georgetown University | Julian Josephs, FRICS

—

ABOUT THE AUTHORS

Dave Bragg is Co-Head of Strategic Research, and Jared Giles is a Senior Research Associate, at Green Street, the preeminent provider of actionable commercial real estate research, news, data, analytics, and advisory services in the US and Europe.

—