Self-storage, as an investable property type, emerged in the US several decades ago. It is now a fully mature sector, with four major REITs in the space and average investment volumes of $14 billion per annum.

The sector is more nascent in Europe, but since the pandemic, there has been a marked acceleration in its maturation, driven both by its operational resilience and by the engagement of new sources of institutional capital.

Consumers are feeling the need for convenient, affordable storage during this period of soaring housing costs.1 This consumer-driven demand is being complemented by high barriers to supply and a fragmented marketplace.2

In Europe, investors are now targeting development, conversion, and consolidation strategies, combining significant downside protection with all the upside rewards of an emerging sector.

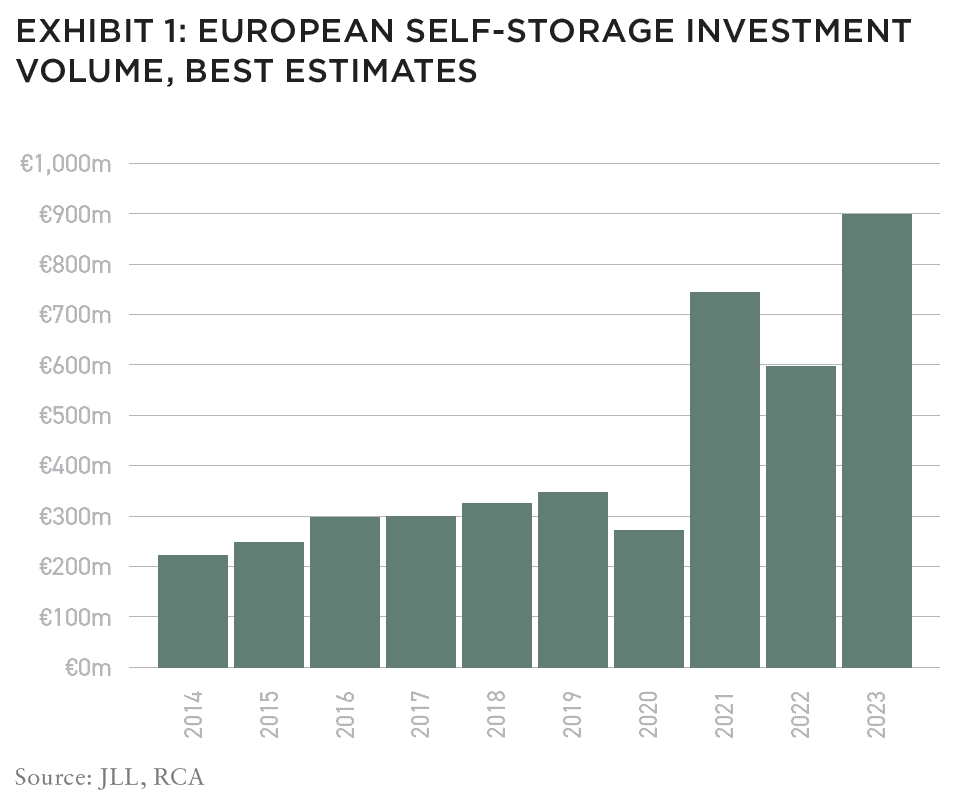

Institutional investment in the European market reached $1 billion (€0.9 billion) in 2023; prior to the pandemic, annual volumes less than half that total were typical (Exhibit 1).3

Having been active investors in European self-storage for almost two decades, we at Heitman believe that the sector is poised for rapid growth in the coming years. The market is still largely untapped, and the investment opportunity is enormous, spanning Western Europe.

Our experience with other specialty property types in Europe shows that those investors who engage with the sector today will stand to benefit from strong fundamentals and attractive returns, all while the sector moves along the path to institutionalization. In the past, specialty types such as rented residential in northern Europe and student housing in the UK have traced a similar path to maturation; the process of institutionalization is initially slow but accelerates rapidly.4 A close analysis of the self-storage market points to similar potential for convergence both in terms of operational sophistication and investor engagement.

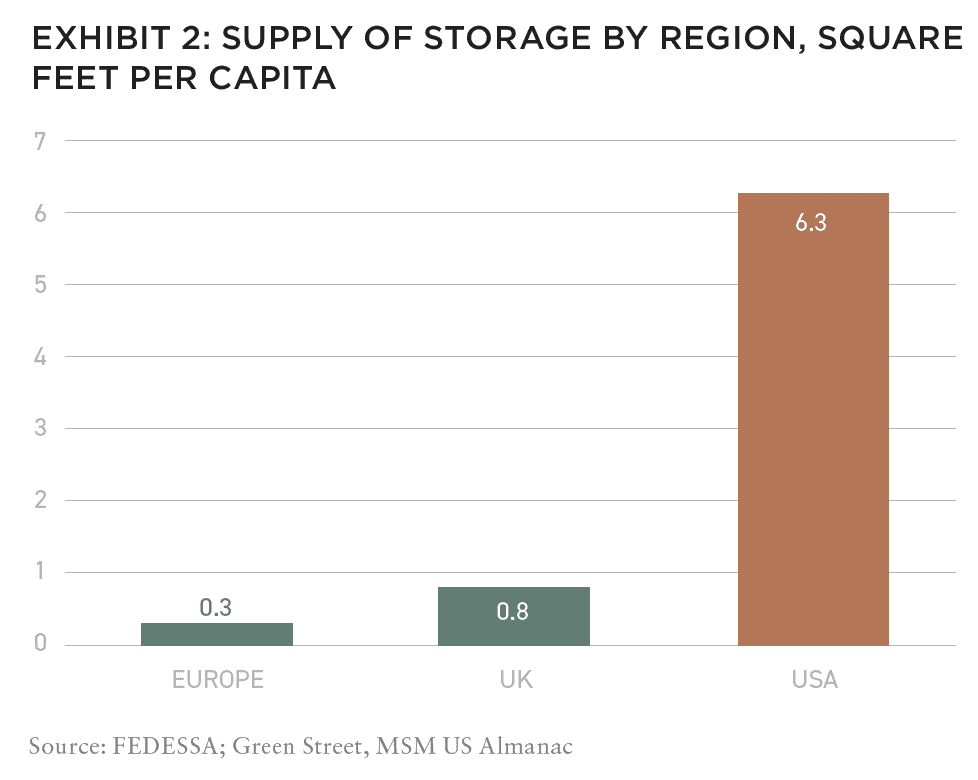

Before we examine the investment case for self-storage in detail, a survey of current conditions can provide useful context. In 2023, total self-storage stock in Europe stood at 150 million square feet (14 million square meters).5 This stock services a population of nearly half a billion people.6 The US, by contrast, with a population that is a third smaller, has gross leasable area (GLA) of 2.1 billion square feet (195 million square meters).7 Per-capita stock is about 0.3 square feet in Europe, or less than one-twentieth the value in the US (Exhibit 2).8 The UK has dominated the market, with 40% of all stock in the region and 33% of all stores. Europe’s largest countries by population—Germany, France, Italy, and Spain—are all notably undersupplied, even though they are comparable to the UK on key demand metrics.9

SOLID FUNDAMENTALS DECOUPLED FROM CYCLICAL VOLATILITY

Demand for self-storage is primarily driven by life events, often summarized as the four D’s: Death, Divorce, Dislocation, and Downsizing.10 Such drivers are diverse and tend to have low correlation with the economic cycle, making the sector more resilient than commercial property types.11

Instead, storage demand can be better predicted through metrics like population density and mobility, household incomes, and housing market dynamics.12 Western Europe as a whole is a heavily urbanized region; in sub-regions such as Benelux (Belgium, Netherlands, and Luxembourg), the urban share of the population exceeds 95% (compared to only 83% in the US).13 Even in Scandinavia, an expansive region marked by low population density, the urbanization rate is 87%.14 Moreover, the largest European cities, such as London, Paris, and Madrid, are two to three times more densely populated than comparable American cities such as Los Angeles or New York.15

High urban density thus provides a solid foundation for self-storage demand, irrespective of economic conditions. Demand for self-storage is also positively correlated with population mobility.16 As shown by Eurostat data, countries in northern Europe, especially the UK and Scandinavia, have high rates of mobility, which contributes to their success as self-storage markets.17 Other important drivers include employment and income growth,18 and on both these metrics, European countries (and especially their largest cities) have performed strongly since the pandemic.19

Relative to population demand, housing supply has failed to keep pace in the major cities.20 The housing crunch was apparent even before COVID struck, but since the pandemic, factors such as tougher financing, construction cost inflation, and scarcer labor have compounded pre-existing challenges such as zoning restrictions and regulatory bottlenecks.21

The persistent shortage of housing has driven up accommodation costs as a share of household expenditure, both in the form of rents and mortgages.22 In hotspots such as London, Stockholm and Dublin, renters now pay between 44% and 48% of their income as rents.23 As rents continue to rise inexorably (e.g., +11% year-over-year in London in March 2024), they are likely to eat up an ever-rising share of household earnings.24

High housing costs have positive implications for self-storage. Families who are unable to afford homes large enough to meet their needs will need to look at alternative space solutions. Pre-pandemic data showed that new homes in Europe were already among the smallest in the Western world. The average size of a new-build home in Britain (76 square meters) was only a third of the size of a new-build in the US.25 We conclude that even after accounting for differences in household size, Europeans are “under-housed” by developed world standards. Now that home-working patterns have become established, Europe’s small homes put even more pressure on their inhabitants to optimize living spaces.26 This trend, in our view, provides additional support to the household component of storage demand.

European operators also benefit from robust business demand to an extent that is not seen in the US. Retailers, tradespeople, and startups account for 30% of self-storage take-up in Europe; in the UK, the share is 35%.27 This helps to diversify the customer base and reduces reliance on a single source of demand. The pandemic provided an excellent example of this principle in action. Although the economy had gone into deep freeze, health services and e-commerce vendors suddenly found themselves swamped with orders, and many turned to self-storage as a solution for their urgent space needs.28 The major self-storage REITs thus sailed through the pandemic with very high occupancy and rent collection metrics—between 95% and 100% in the case of the latter—compared to commercial sector rent receipts that fell below 50%.29

Clearly, there are multiple societal and economic forces supporting long-term demand for self-storage in Europe. By contrast, supply is low and the stock that does exist is unevenly distributed. For example, Germany, with a 17% share of Europe’s population, only has a 6% share of storage stock, while the figures for Italy are 12% and 2%, respectively.

Rapid growth of stock in some countries (e.g., Poland, Norway) is countered by slow growth or stagnation in other major markets (e.g., France, Benelux).30 In these latter countries, existing portfolios tend to be mature and average occupancy is high, typically around 90%.31 By contrast, countries in Eastern Europe, with greater availability of land and fewer restrictions on building, have some of the newest, highest quality stock on the continent.32

The potential for future growth remains significant. Due to geographical and cultural factors, we do not expect self-storage penetration in Europe to match that in the US or Australia, even though Europe is one of the world’s wealthiest regions.33 But the bar need not be that high. In order to come up to even UK levels of per-capita penetration, self-storage stock in Western Europe would need to triple in size.34 However, given the myriad constraints listed above, we expect that buildup of the sector will only proceed at a moderate pace.

STRONG RETURNS UNDERPINNED BY ROBUST YIELDS AND LOW LEAKAGE

The lower supply risk in Europe provides a backstop to the sector’s performance and a strong support for new investment. It stands in sharp contrast to the US market, where overbuilding can lead to a glut of stock and weaker performance metrics.35

In 2023, average monthly rents for a self-storage unit in the US fell by -13% year-over-year, largely driven by softer occupancy.36 Europe, on the other hand, continues to see annual rent growth above the rate of inflation. In 2023, Europe’s largest REITs, Shurgard and Big Yellow, reported same-store rent growth between 6% and 7% year-on-year, based on 87% and 81% occupancy rates respectively.37 The anticipated recovery in European housing markets is likely to raise these figures even higher.

Private sector performance data comes from the European industry association FEDESSA and specialty analysts like Green Street Advisors. The consensus view among these bodies is that occupancy in mature markets ranges between 85% and 90%, while rent growth is around 5% year-over-year.38

Two key aspects of this rent growth deserve mention. The first is granularity. Not unlike a large residential block, a typical storage building has hundreds of units and hundreds of customers. This granular user base, consisting of both households and businesses, diversifies revenue and reduces undue exposure to any specific sector of the economy.

Secondly the duration of rental contracts in self-storage is measured in weeks or months rather than in years. Customers typically pay one month in advance and are free to terminate at any time. This feature is unique to self-storage and has proved to be a robust bulwark against inflation in the post-pandemic period. Because of the shorter duration of tenancy, self-storage achieves fuller pass-through of inflation, compared to almost any other property sector.39

EXPLORE THE NEW ISSUE

NOTE FROM THE EDITOR: WELCOME TO #15

Benjamin van Loon | AFIRE

MID-YEAR CRE MARKET OUTLOOK: AFIRE

Benjamin van Loon and Gunnar Branson | AFIRE

MULTIFAMILY OUTLOOK: AMERICAN REALTY ADVISORS

Sabrina Unger and Britteni Lupe | American Realty Advisors

MULTIFAMILY GAP CAPITAL: BARINGS REAL ESTATE

Dags Chen, CFA and Lincoln Janes, CFA | Barings Real Estate

SINGLE-FAMILY RENTAL OUTLOOK: CERBERUS CAPITAL MANAGEMENT

Kevin Harrell | Cerberus Capital Management

SINGLE-FAMILY RENTAL SUPPLEMENT: YARDI

Paul Fiorilla | Yardi

LOGISTICS OUTLOOK: BRIDGE INVESTMENT GROUP

Jay Cornforth, Jack Robinson, PhD, Morgan Zollinger, and Cole Nukaya | Bridge Investment Group

DATA CENTER OUTLOOK: PRINCIPAL ASSET MANAGEMENT

Casey Miller and Ben Wobschall | Principal Asset Management

SELF-STORAGE OUTLOOK: HEITMAN

Zubaer Mahboob | Heitman Europe

COLD-STORAGE OUTLOOK: NEWMARK

Lisa DeNight | Newmark

OFFICE OUTLOOK: CUSHMAN & WAKEFIELD

David Smith | Cushman & Wakefield

RETAIL OUTLOOK: MADISON INTERNATIONAL REALTY

Christopher Muoio | Madison International Realty

HOSPITALITY OUTLOOK: JLL

Zach Demuth | JLL

+ LATEST ISSUE

+ ALL ARTICLES

+ PAST ISSUES

+ LEADERSHIP

+ POLICIES

+ GUIDELINES

+ MEDIA KIT (PDF)

+ CONTACT

In addition to inflation-protected income, we deem several other features of self-storage returns to be attractive to investors, e.g., high cash component; upside potential to current EBITDA; low capex needs; low energy usage and greenhouse gas (GHG) emissions; and multiple avenues of value creation at the physical, operational, and platform levels.

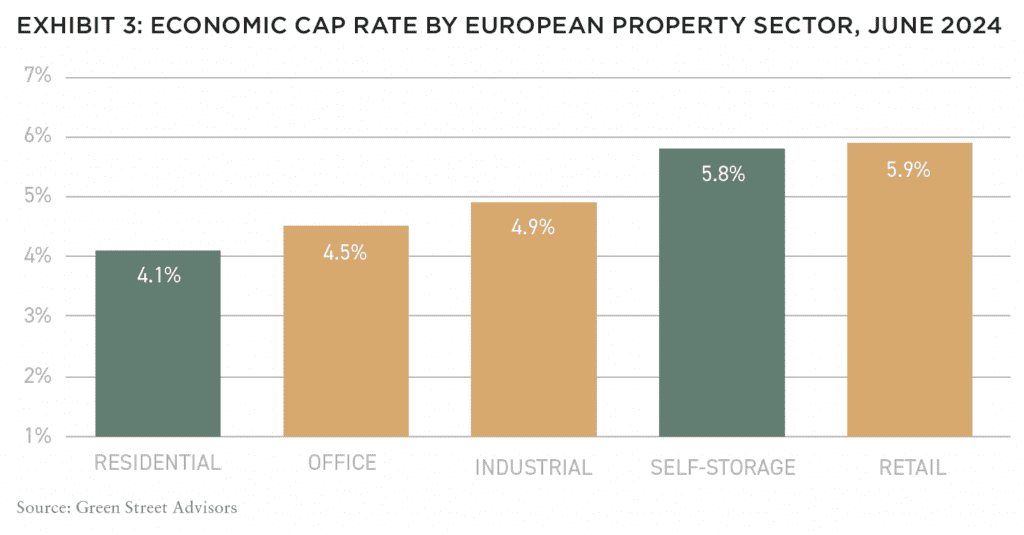

- Prime yields of 5.5–6.0% in the UK offer a strong cash component to investors.40 The movement of self-storage yields in the last couple of years has been instructive. Yields started off relatively high (4.5-5%) at the beginning of the rate-hike cycle in 2022.

By contrast, yields for industrial (the nearest comparable sector) had fallen to 2.9% in Europe.41 As interest rates were steadily cranked up over the next eighteen months, industrial yields pushed out by 220 basis points, reflected in large double-digit declines in capital values.42 However, yields in self-storage proved relatively immune, moving out by only a hundred basis points (Exhibit 3).43 The impact on storage valuations was thus comparatively more modest. - Significant upside potential in EBITDA derives from the highly fragmented state of the European market. This presents investors with both opportunities and challenges.

European operators are broadly divided into two categories. The large, professional, brand-name operators with national or pan-regional portfolios can maximize the use of technology in their facilities and operations, and adopt the latest tools in pricing, marketing and search engine optimization.44 But such firms are few in number; the top ten operators control less than a quarter of all stores.45

Most European operators are small, independent, family businesses that typically manage portfolios of fewer than five buildings.46 These businesses are often sub-scale, and unlike the REITs, they have limited access to finance, technology, and training. In our experience, they typically manage toward maximizing occupancy or rental rate, rather than optimizing income and EBITDA.

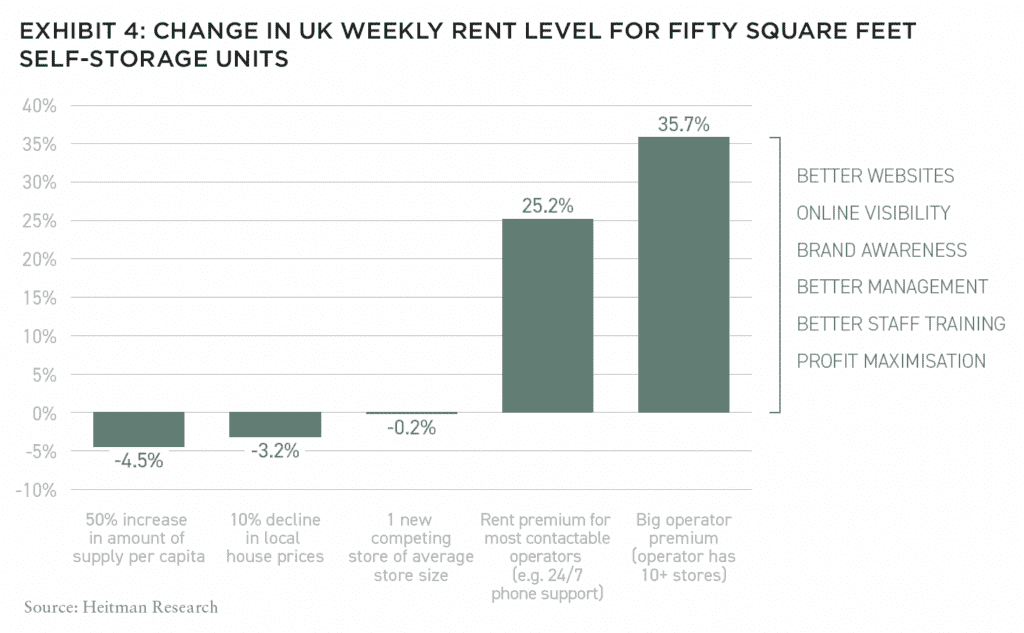

Investors can contribute much-needed capital and expertise to remedy these shortcomings. Value creation at the operational level often begins with “low-hanging fruit” such as training frontline staff in handling calls, minimizing the response time to an inbound query, cross-selling insurance and other products, and deploying dynamic pricing software.47

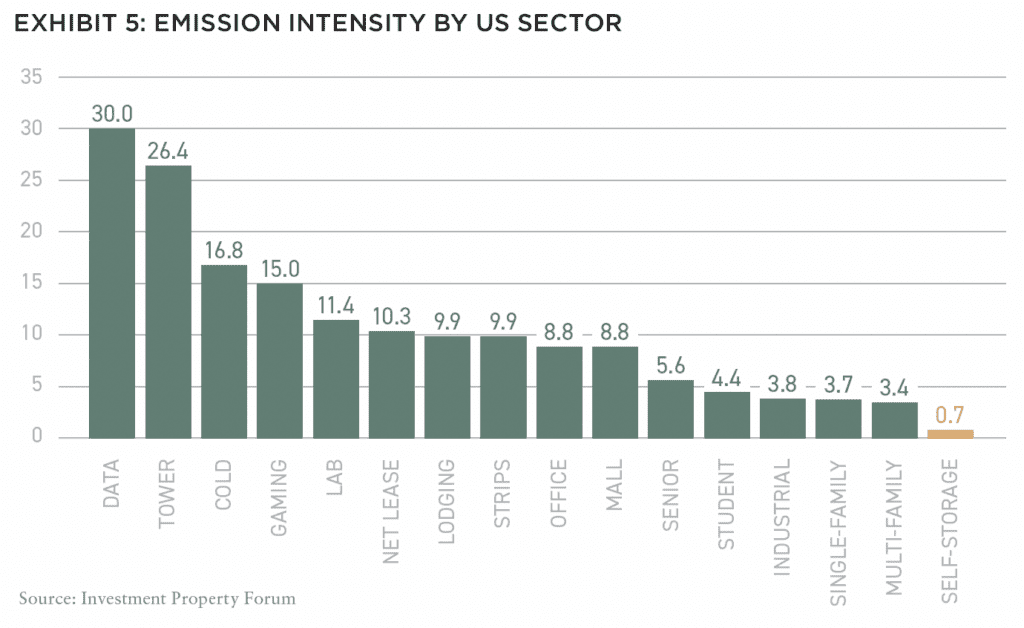

The boost to EBITDA is immediate: a 2021 paper on UK self-storage shows that stores run by large professional operators in the UK typically achieve a 35% premium in rents compared to smaller competitors, even after controlling for market factors like supply, demographics, and affluence (Exhibit 4).48 - Low leakage to net operating income (NOI) results from the low maintenance and capex needs of self-storage buildings. Green Street Advisors estimates this leakage at only 8% of NOI, compared to 13% in industrial and 29% in offices. Carbon usage is also very low at only 0.7 kgCO2e/sqft (Exhibit 5). Industrial buildings typically emit five times more carbon and data centers forty-three times more (30 kgCO2e/sqft). In our view, such low carbon intensity will minimize the need for future expenditure on adaptation and mitigation measures.

- Further value creation potential from market consolidation and platform-building. Scarcity of suitable stock means that buyers of self-storage are willing to pay a premium to gain access at scale. The recent acquisition of Lok N Store by Shurgard indicated a 16% premium above the former’s share price.49

Europe has very few mid-sized firms with modern portfolios of 20–50 stores that achieve a wider regional or cross-border footprint.50 The challenge—and the opportunity—for investors is to bridge this gap, to bring forth the “missing middle,” either by developing from scratch or by supporting the conversion/expansion plans of suitable operating partners.

Independent analysts Green Street appear to share our view of strong prospects for outperformance in Europe. In a recent report, they forecasted that long-term risk-adjusted returns in Continental European self-storage would exceed those in US self-storage by 120 basis points per annum, with 50 basis points of outperformance in the UK.51

THE STORAGE INVESTMENT UNIVERSE IS STEADILY EXPANDING

Perhaps the most noticeable change in the European storage market post-pandemic is in the deeper engagement of the investor community. Prior to 2020, investment activity was typically sporadic. The thin buyer pool was dominated by REITs and experienced managers like Heitman, and the majority of deals took place in the UK.52 Annual volumes ranged between $300 million and $400 million in any given year.53

Since COVID, this picture has changed. In 2023, investment volumes touched $1 billion, and deals on offer in 2024 promise a similar total.54 The REITs are still a key part of the buyer pool, but numerous transactions also have the backing of private capital and, increasingly, institutional investors.55 This is unsurprising, as the opportunity is compelling and as investors seek to rotate out of underperforming traditional asset classes.

Several factors are supportive of growing volumes. Development projects help to expand and deepen the quantity of investable stock.56 Many existing brands in family ownership are facing up to the need for proper exit plans, as evidenced by the recent sale of Pickens in Germany, and Space Station and Kent Space in the UK.57 Lenders, who were previously cautious of the sector, are gaining familiarity with the strong fundamentals of self-storage;58 this should help to unlock financing for future deals.

Some important transactions have gone through in the past year, including the takeovers of two smaller REITs. Nuveen’s take-private acquisition of SSG, a Norwegian REIT, was announced in September 2023, at a price of €330 million ($350 million).59 Then, in April 2024, Shurgard announced the takeover of Lok N Store, a UK-focused REIT, in an all-cash deal worth £378 million ($475 million).60 The latter came hot on the heels of Shurgard’s buyout of two smaller German platforms (Top Box and Pickens) which added a dozen stores to their previous total of twenty-five stores in Germany.61

What would the further maturation of the European sector entail? Public awareness of self-storage is a key predictor of demand,62 but it is still relatively low and only increases gradually.63 In our experience, the development of new facilities plays an important role in raising awareness, especially in previously underserved markets. The comparatively small size of storage assets and portfolios can be a hindrance to the deployment of large amounts of capital, but this too may be changing.64 The SSG and Lok N Store deals were clearly of an exceptional size, but the market is starting to see more mid-sized deals of $50 million to $100 million—essential for attracting the interest of established institutional investors.65

LOW DOWNSIDE, ABUNDANT UPSIDE

In spite of the challenges that come with an emergent property type, we view European self-storage as an exciting opportunity that should reward investors with strong risk-adjusted returns in a relatively nascent, high-growth sector with steep barriers to supply.

Inflection points in the property cycle are often a good time to put capital to work and, where possible, take advantage of liquidity constraints existing in sub-scale, non-institutional platforms.66 Such a strategy, in our view, enables smart investors to extract significant upside through growth by exploiting synergies, efficiencies, and scale, and to generate true alpha via conversion and development—a strategy successfully employed by Heitman across all of its self-storage positions.

Indeed, even if the recovery in capital markets is slower than anticipated, we strongly believe that European storage still offers multiple routes to driving value that are independent of the macro environment, an attractive feature to those investors seeking opportunities away from high-beta traditional real estate.

—

—

ABOUT THE AUTHORS

Zubaer Mahboob is a Senior Vice President of Research for Heitman Europe.

—

THIS ISSUE OF SUMMIT JOURNAL IS GENEROUSLY SPONSORED BY

Founded in 1992, Cerberus is a global leader in alternative investing with approximately $65 billion1 in assets across complementary credit, private equity, and real estate strategies. We invest across the capital structure where our integrated investment platforms and proprietary operating capabilities create an edge to improve performance and drive long-term value. Learn more.

Principal Real Estate is the dedicated real estate investment team of Principal Asset Management, the global investment solutions business for Principal Financial Group®. As a top 10 global real estate manager, with over $98 billion in assets under management and more than 60 years of experience, we provide clients with access to opportunities across both public and private equity and debt. Learn more.