The COVID-19 crisis highlights the advantages of single-family living and appears to have accelerated an existing trend of migration to less dense, more affordable areas.

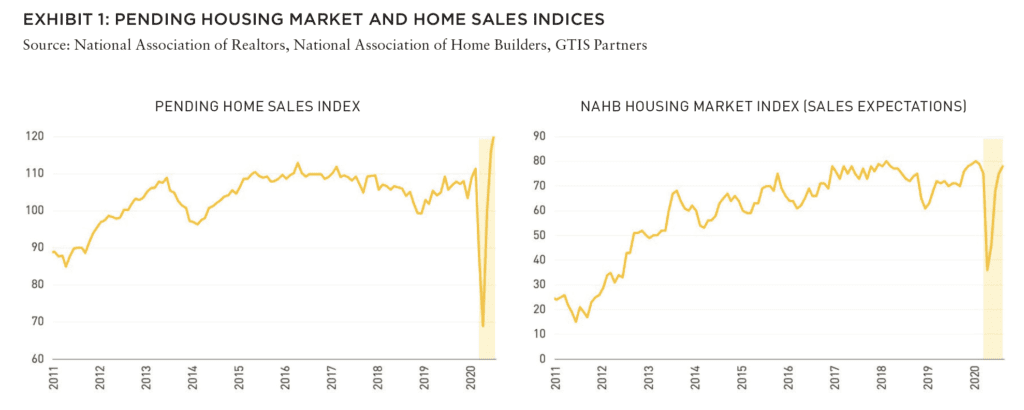

The US housing market began 2020 with favorable demographics-driven housing demand, balanced new supply, healthy home appreciation, and responsible mortgage lending. However, the unexpected COVID-19 pandemic led to the worst economic disruption in history, with more than 22 million lost jobs between February and April 2020.[1]

In response, the US government approved nearly US$3 trillion in fiscal stimulus while the Federal Reserve cut interest rates to zero and rolled out an unprecedented scale of support to restart the financial system. Combined, government responses to the COVID-19 crisis helped to stabilize the economy and the housing market has emerged as a bright spot in the recovery.

The resilience of the housing market can be explained by structural factors that persisted before and during the economic crisis:

• Long-term demographic tailwinds, supported by the millennial population’s greater housing needs as they enter family-formation years.

• Balanced supply/demand fundamentals, strengthened by the sector’s lack of institutional influence and players taking a differentiated approach to residential investing.

• Credit markets gap, created by liquidity challenges facing undercapitalized private developers and operators.

Meanwhile, institutional real estate managers have largely focused on distress in the hospitality and retail sectors, with limited groups considering a differentiated approach to residential real estate investing. In addition to the pandemic-driven boost to single-family housing demand, it is important to focus on long-term market tailwinds that are likely to persist through the “normalization” of the broader economy.

LONG-TERM DEMOGRAPHIC TAILWINDS

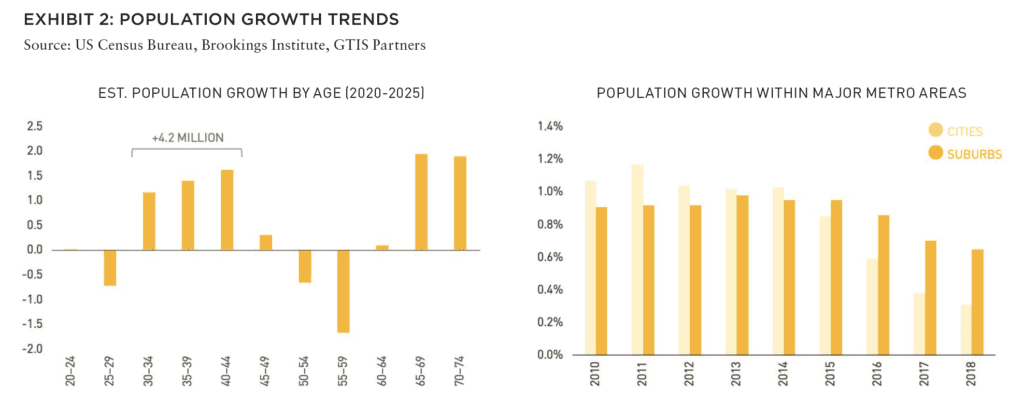

One of the longstanding demand drivers is the large and influential millennial population cohort. When millennials first reached adulthood over a decade ago, they drove a prolonged rally in high-density urban multifamily housing demand. Millennials are now entering their 30s and 40s, a period that is typically marked by family formation and having children. Transitioning to a family-centric living arrangement usually corresponds with a move towards family-oriented suburban neighborhoods, which offer relatively more space, safety, and higher-quality schools compared to urban living.

Not surprisingly, the strengthening of single-family housing demand over the past five years has coincided with the start of a demographic shift of millennials entering their 30s. From 2014 to 2019, an additional 2.2 million adults entered the 30–39 age cohort, compared to only 900,000 adults between 2010 and 2014.2 Over the next five years, more than 4.2 million adults are projected to enter the 30–44 age cohort.[3] This demographic trend has led to a shift from city to suburban-dominant growth, and COVID-19 has magnified this trend due to the need for more space as weekday activities that once took place outside the home—dining, sports, entertainment, and education— have since been moved within the home.[4]

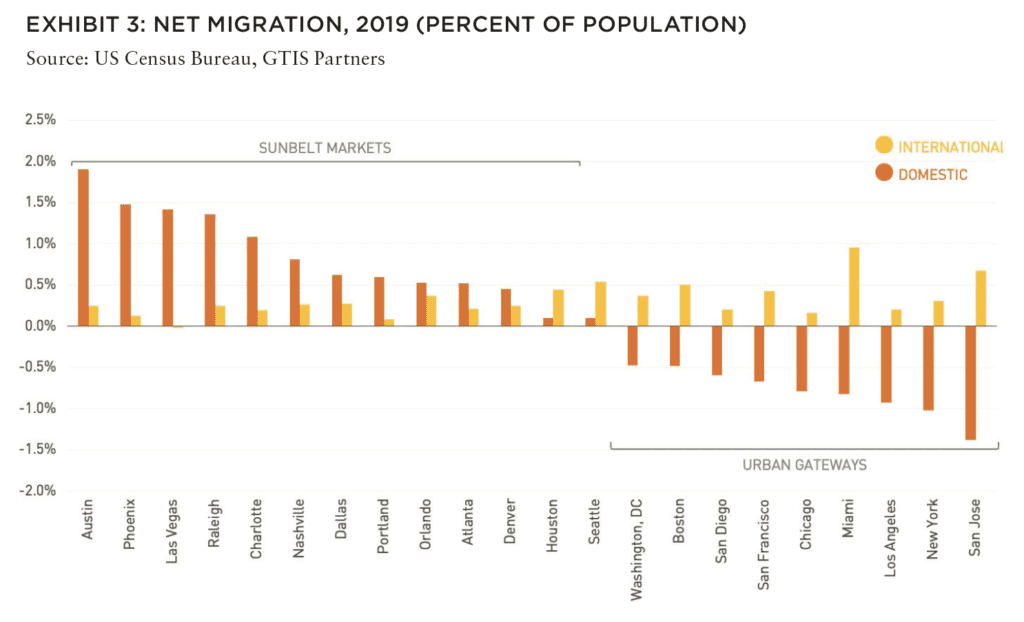

Migration data also suggest that households are increasingly moving away from high-cost urban gateway markets in the Northeast and California to more affordable, high-growth Sunbelt markets. Sunbelt markets such as Austin and Phoenix are among the leaders in net domestic migration in recent years, while urban gateway markets, such as New York, have experienced net migration outflows offset by immigration.5 Many of the highgrowth Sunbelt markets have entered a positive feedback loop: population growth contributes to local economic growth, which prompts employers to move or expand in the market, further pulling more jobseekers and employers into the Sunbelt.

BALANCED SUPPLY/DEMAND FUNDAMENTALS

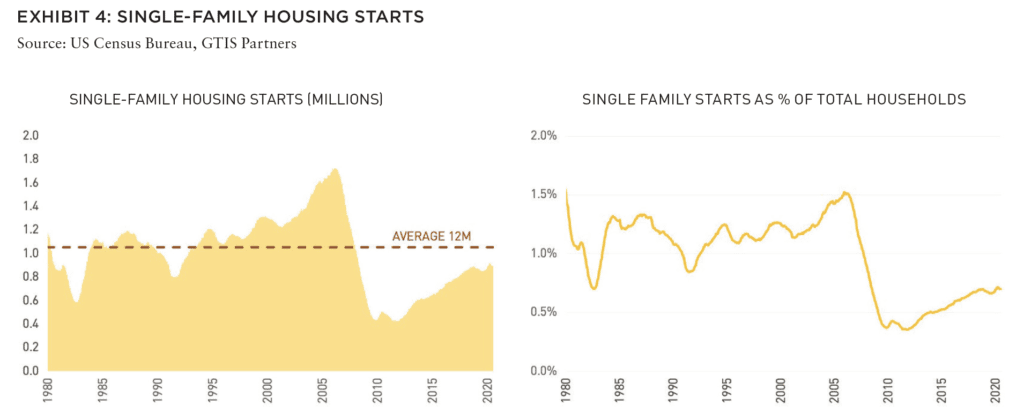

Positive long-term housing demand factors have been matched with muted new supply. Historically, approximately 15.3 million new single-family and multifamily housing units were produced in each decade between 1970 and 2009, according to the US Census Bureau. However, in the ten years between 2010 and 2019, only 9.2 million new housing units were produced despite the recovery in household growth.6 Within the single-family housing sector, housing starts continue to remain below the long-term average, despite the decade-long recovery since the GFC. Adjusted for population size, single-family housing starts comprise only 0.7% of total households, compared to 1.1% between 1980 and 2000.[7]

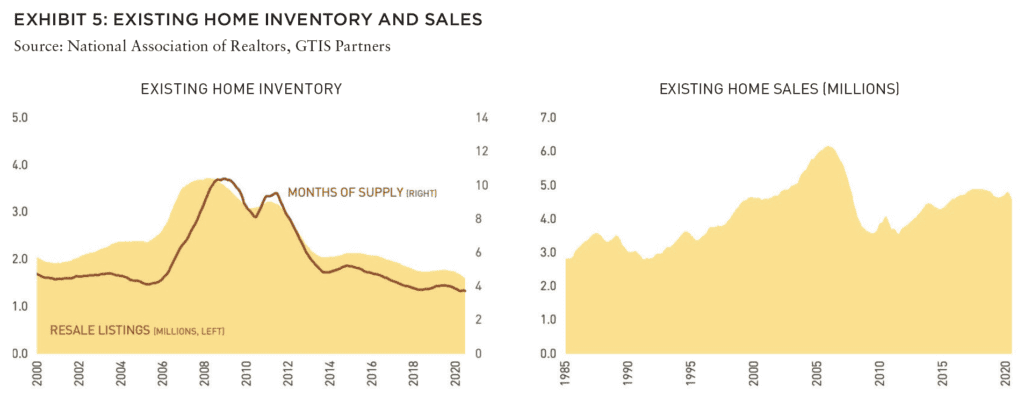

The prolonged period of limited new single family housing supply, coupled with healthy demand, has resulted in a tight housing market with declining existing home inventory. The number of existing home listings fell to a record low 1.28 million homes in 2020 while existing single-family home sales remained strong with 5 million sales throughout 2020, equating to 3.2 months of supply (as of November 2020), compared to a balanced supply of roughly six months.[8]

ALSO IN SUMMIT (SPRING 2021)

GREAT LAKES / Tightening the Belts: How are shorthand labels like the “Sun Belt” and the “Rust Belt” shaping investment decisions? Should they?

AFIRE | Gunnar Branson and Benjamin van Loon

SOCIAL ISSUES / The Great Real Estate Reset: A data-driven initiative to remake how and what we build.

Brookings | Christopher Coes, Jennifer S. Vey, and Tracy Hadden Loh

SOCIAL ISSUES / Confronting the Myth: The events of the past year have driven businesses to confront racial inequity, but some still shy away from the challenges needed to make real progress.

Alfred Dewitt Ard Consulting | Shumeca Pickett

INDUSTRY OUTLOOK / CRE Prospects Post-COVID-19: How is commercial real estate set to perform in the post-COVID world?

Aegon Asset Management | Martha Peyton

HOSPITALITY / Time to Check In: If history is a guide, the time to invest in hotels is when things look bleak. This appears to be one of those times.

Barings Real Estate | Jim O’Shaughnessy

HOSPITALITY / Hoteling 2.0: The pandemic has impacted the hospitality, but a growing wave of non-traditional investors has shown heightened interest in the evolving industry.

JLL Hotels & Hospitality Group | Gilda Perez-Alvarado

RESIDENTIAL / Safe as Houses?: The future of residential investments is all about demographics—and the forces behind them.

American Realty Advisors | Sabrina Unger

RESIDENTIAL / Housing for Goldilocks : The pandemic highlights the advantages of single-family and appears to have accelerated migration to less dense, more affordable areas.

GTIS | Eliot Heher and Robert Sun

DATA CENTERS / Data Centers, Stage Center: Data center investments have proven resilient in periods of volatility—and they’re only going to become more essential and important into the future.

Principal Real Estate Investors | Bob Wobschall

CLIMATE CHANGE (WHITE PAPER) / Rather Than the Flood: A comprehensive look at climate-induced water disasters and their potential impact on CRE in the US.

New York Life Real Estate Investors | Stewart Rubin and Dakota Firenze

LOGISTICS / Reforging the Supply Chain: The only way to deliver on the service promises of a booming logistics sector requires a complete reimagination of the supply chain.

Stockbridge | David Egan

DEBT AND LEVERAGE / Leveraging Control: Though leverage is an important part of capital funding, it’s important to ask LPs if (and how) they should take control of their real estate leverage.

RCLCO Fund Advisors | William Maher and Ben Maslan

DEVELOPMENT / Recasting Risk and Return: The investment community can have an active role in economic recovery—but it will require recasting the traditional risk/return framework.

Standard REI | Shubrhra Jha

CORPORATE TRANSPARENCY ACT / Transparency Rules: Non-US-based investors face the disclosure regime of the Corporate Transparency Act. What do you need to know?

Pillsbury | Andrew Weiner

PENSIONS (WHITE PAPER) / Rising Pressures: The latest joint, in-depth report from Praedium and SitusAMC looks at rising fiscal pressures on state and local governments.

Praedium Group and SitusAMC Insights | Russell Appel, Peter Muoio, and Cory Loviglio | SitusAMC Insights

TALENT AND HR / Plugging the Skills Gap: Several trends are forcing change in the global commercial real estate industry, driving demand for new skills. How is the industry responding?

Sheffield Haworth | Max Shepherd

ESG / Operationalizing the Sustainability Agenda: During a time of unprecedented disruption, how should businesses approach the “new metrics” ESG of performance?

AccountAbility | Sunil A. Misser

Limited supply has made it challenging for potential buyers to find the right home and, as a result, they have bid up prices for homes on the market. Despite the economic disruption caused by COVID-19, home price appreciation accelerated to 7.9% year-over-year (as of October 2020) from 2.8% growth in 2019.9 Importantly, home price increases appear to be supported by fundamentals such as demographics-driven demand and limited supply, while mortgage lending standards have remained reasonable.[10]

Positive underlying housing supply/demand fundamentals are further complemented by record-low mortgage rates further enhancing housing demand through better affordability. Freddie Mac reported that average 30-year mortgage rates fell to a record-low 2.65% nationally as of January 7, 2021, compared to 3.6% at the same point in 2020.[11] Lower mortgage rates generally have a meaningful impact on housing affordability in the near-term. According to JBREC, a 100 BPS decline in mortgage rates results in a 12% increase in purchasing power for consumers as measured on a monthly payment basis.

CAPITAL MARKETS GAP

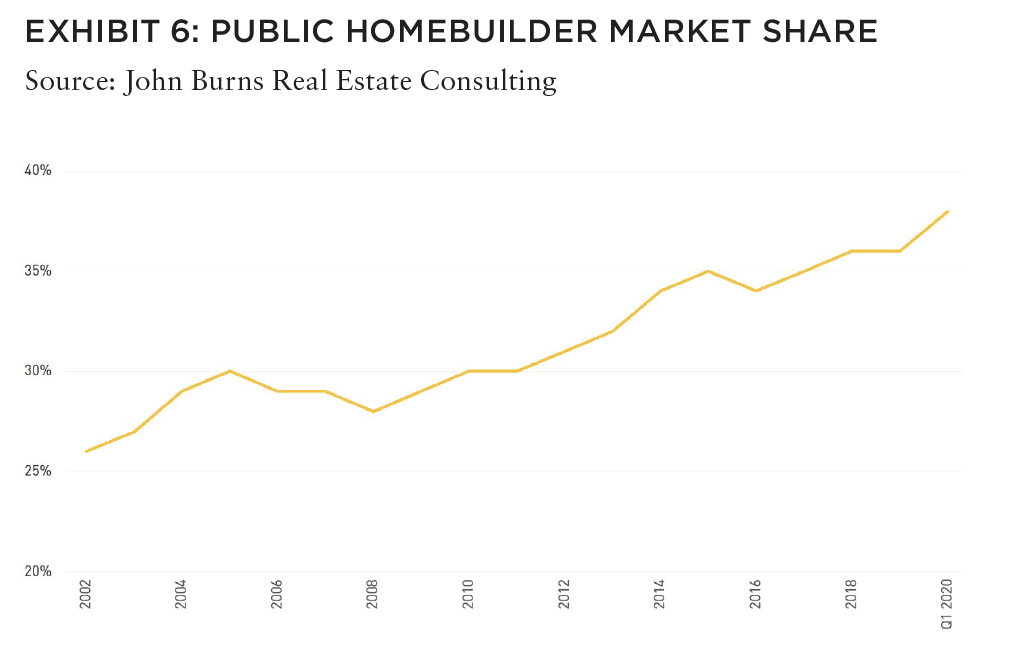

Homebuilders typically operate on an asset-light basis and focus on return on equity in this capital-intensive industry. Since the GFC, homebuilders have pursued a capital-efficient just-in-time land strategy by acquiring finished lots from land developers and sourcing capital on an as-needed basis. However, single-family housing is not viewed as an institutional asset class with a dedicated allocation within a broader real estate portfolio despite its total market size of $33 trillion, which is double the entire CRE market.[12] Institutional investors have traditionally gained exposure to single-family housing through investing in publicly-traded debt and equity securities issued by homebuilders, which does not allow sophisticated investors to take a targeted approach in investing in specific markets or new home communities.

As a result, large public builders with well-capitalized balance sheets often source financing through corporate debt and equity issuances as well as JV-level, off-balance-sheet financing to fund project capital requirements. However, many private builders and public builders with weaker balance sheets lack access to the corporate bond and equity markets and typically rely on higher-cost alternative financing sources to fund ongoing capital needs, even during a strong economy.

GTIS believes that the COVID-19 crisis has further expanded the demand for capital from underbanked and private homebuilders as alternative lenders such as private equity funds, hedge funds, and debt funds have pulled back and/or refocused on corporate credit and other asset classes.

“GOLDILOCKS” SCENARIO FOR THE HOUSING MARKET

The economic and social changes that have been created by the pandemic will have important implications for the investment landscape. While the longer-term economic outlook remains uncertain, the housing market appears to be relatively less impacted compared to other sectors. In addition to positive market fundamentals such as long-term demographics, limited supply, and reasonable mortgage lending standards, shelter retains a symbolic importance at a time when a substantial share of the population is both living and working at home. The COVID-19 crisis highlights the advantages of single-family living and appears to have accelerated an existing trend of migration to less dense, more affordable areas.

In contrast to the hospitality and retail real estate sectors, which have been characterized by severe dislocation and are the main targets of distressed-focused capital raised during COVID-19, GTIS believes that the housing market remains strong and is being overlooked. GTIS believes that this combination of resilient demand, balanced new home supply, record-low mortgage rates, and industry capital scarcity may therefore present a “Goldilocks” investment opportunity for the housing market—one that’s “just right” for the post-pandemic period.

—

ABOUT THE AUTHORS

Robert Sun is responsible for product development and corporate strategy and Eliot Heher is responsible for research and strategy at GTIS Partners, a leading real assets private equity firm in the Americas, investing in the US and Brazil.

NOTES

1. US Bureau of Labor Statistics, June 2020, bls.gov

2. GTIS calculation of data from the US Census Bureau, census.gov

3. GTIS calculation of the 2017 National Population Projections data from the US Census, census.gov

4. William Frey, “American cities saw uneven growth last decade, new census data show,” Brookings. 26 May 2020, brookings.edu/research/new-census-data-show-an-uneven-decade-of-growth-for-us-cities/

5. Estimates of the Components of Resident Population Change for Metropolitan Statistical Areas in the United States: April 1, 2010 to July 1, 2019 (CBSA-METEST2019-COMP), US Census Bureau, Population Division, March 2020, census.gov

6. GTIS calculation of data from the US Census Bureau, census.gov

7. GTIS calculation of data from the US Census Bureau, census.gov

8. Meredith Dunn, “Inventory and Months’ Supply,” National Association of Realtors, January 22, 2020, nar.realtor/blogs/economists-outlook/inventory-and-months-supply

9. S&P Dow Jones Indices, spglobal.com/spdji/en/

10. “Burns US Housing Analysis and Forecast,” John Burns Real Estate Consulting, July 17, 2020, realestateconsulting.com/our-company/research/us-housing-analysis-and-forecast/

11. Freddie Mac, “30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US],” Federal Reserve Bank of St. Louis; Last Accessed, January 7, 2021. red.stlouisfed.org/series/MORTGAGE30US

12. Nareit, reit.com