WELCOME TO THE HOUSING ISSUE

Whenever we issue a call for submissions for Summit Journal, we never pursue a specific theme. Instead, we listen to what thought leaders across the commercial real estate industry are saying, and then we put those ideas to work.

For this issue of Summit, we also had a slight advantage. In March 2021, we released our 2021 Annual International Investor Survey (see “Shining Through the Darkness”), underwritten by Holland Partner Group, which details a cautious optimism for investors into US real estate for the rest of this year.

This positive sentiment is refreshing after a difficult and uncertain pandemic year, but it is ultimately couched in broader macro-level concerns on topics ranging from social and political unrest and ESG concerns to economic inequality and migration patterns across the US, which are addressed from various perspectives in this issue.

“Revisiting Inflation” discusses inflation concerns for the year, while “Supply Change” and “Herd Community” focus on other trends affecting consumer habits and emerging migration patterns. “London Calling” and “Recovering the Office” provide some fresh takes on the ongoing office question, and “Accounting for Environmental Risk” suggests a unique ranking system for determining different types of environmental risks in several US cities.

In other words, the broad concerns mapped by respondents to the March 2021 survey are playing out at all levels of the real estate value chain, some of which have proven more resilient than others throughout the pandemic.

It is perhaps not surprising, then, that housing—single-family, multifamily, rentals, and everything in between—is front-of-mind for contributors to the real estate investment conversation being led by Summit and the broader AFIRE membership. For this reason, we’re proud to declare this the first themed issue of Summit. Four unique perspectives from Aria, Berkshire Residential, Tricon Residential, and Squire Patton Boggs detail the fundamentals, opportunities, and risks to watch for the sector—which is only growing in demand.

Welcome to the Housing Issue!

Benjamin van Loon

Communications Director, AFIRE

Editor-in-Chief, Summit

bvanloon@afire.org

+1 202 312 1405

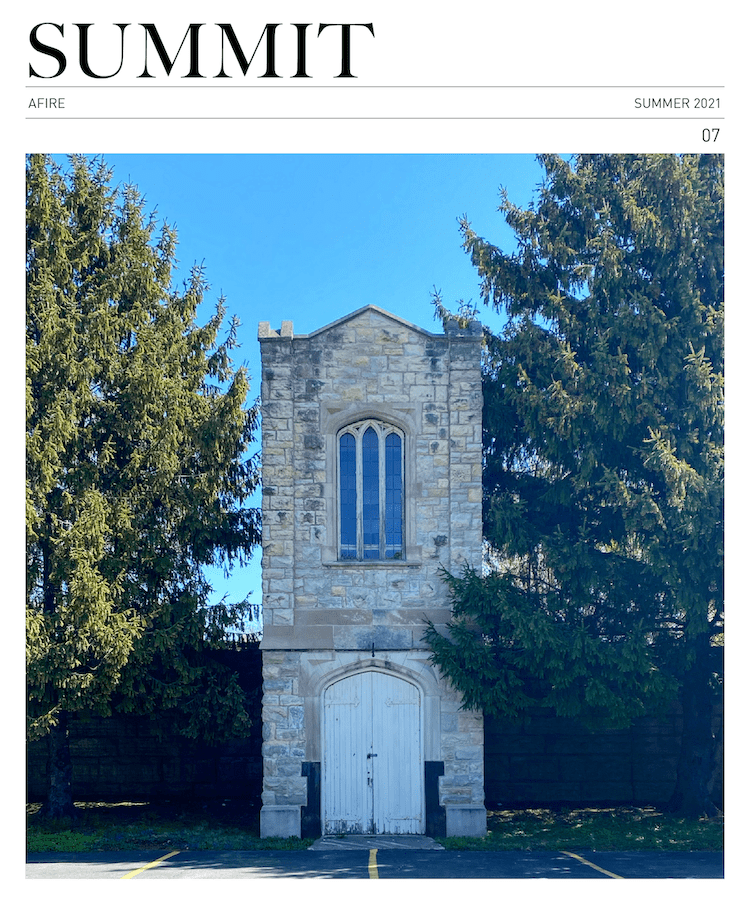

About the cover: An outbuilding at Chicago’s historic, 350-acre Rosehill Cemetery, built in 1864, once situated on sweeping farmland. Today it is surrounded by large residential districts and nearby commercial corridors. Photo by instagram.com/benvanloon.jpg.

ABOUT SUMMIT JOURNAL | SUBMISSIONS | SPONSORSHIP/MEDIA KIT

IN THIS ISSUE

NOTE FROM THE EDITOR / The Housing Issue

AFIRE | Benjamin van Loon

INVESTOR SENTIMENT / Shining Through Darkness

The 2021 AFIRE International Investor Survey underscores a sense of calculated optimism for CRE investment in the year ahead.

AFIRE | Gunnar Branson

ECONOMY / Revisiting Inflation

For commercial real estate investors, inflation fears are real— but are they rational?

Aegon Asset Management | Martha Peyton, PhD

DEURBANIZATION / Herd Community

Uncertainty surrounding remote work and politics suggest a wide range of potential outcomes for big cities, which may upend the long-running megatrend toward urbanization.

Green Street | Dave Bragg and Jared Giles

HOUSING / How to Rebuild

Could an idea to “bring back” New York after the pandemic work in other cities?

Aria | Joshua Benaim

HOUSING / Single Family, Multiple Questions

Institutional ownership in single-family rentals accounts for less than 5% of the segment, but answers to key questions could change start to change that balance.

Berkshire Residential Investments | Gleb Nechayev, CRE

HOUSING / Institutionalizing Single Family

Over the past two decades, the single-family rental industry has evolved into an institutional-caliber asset class—so where is the sector going next?

Tricon Residential | Jonathan Ellenzweig

HOUSING / Build-to-Rent Boom

The future is bright for build-to-rent and institutional investors are increasingly looking at investing in this sector.

Squire Patton Boggs | John Thomas and Stacy Krumin

OFFICE / Recovering the Office

While most agree that the office sector has a difficult road ahead, there is less consensus about future demand in the sector. What are the indicators investors should be tracking?

Barings Real Estate | Phillip Conner and Ryan Ma

OFFICE / London Calling

With Brexit and pandemic resolutions coming into focus, pricing disparities could dissipate based on improved cross-border liquidity and cap rate compression in the London office market.

Madison International Realty | Christopher Muoio

LOGISTICS / Supply Change

Urbanization, digitalization, and demographics are the key trends to watch for understanding the future of logistics real estate.

Prologis | Melinda McLaughlin and Heather Belfor

CLIMATE / Accounting for Environmental Risk

When it comes to guards against environmental risk, Boston, Indianapolis, Minneapolis, and Portland are some of the most prepared US cities. What makes them different?

Yardi Matrix | Paul Fiorilla, Claire Anhalt, and Maddie Harper

ESG / Putting People First

Though “impact investing” is no longer totally distinct from investing in general, investors still have a lot of work to do for fulfilling the social and governance aspects of ESG expectations.

Grosvenor Americas | Lauren Krause and Brian Biggs

MULTIFAMILY / Influencing Multifamily

As we come out of the pandemic to a new economy, it seems likely that the creator economy will continue to grow. This will have a major impact on the multifamily sector.

citizenM Hotels | Ernest Lee

TALENT AND RECRUITMENT / Enhancing Life Sciences

As the global life sciences sector continues to grow in real estate, highly specialized skills and experience will be the keys to success.

Sheffield Haworth | Max Shepherd and Jannah Babasa

EDUCATION / Real Estate Education Goes Global

The evolution of global real estate education over the past three decades will be integral to developing a rich pipeline of talent for the future of commercial real estate.

Georgetown University | Julian Josephs, FRICS