How does the Consumer Price Index (CPI) account for the cost of housing?

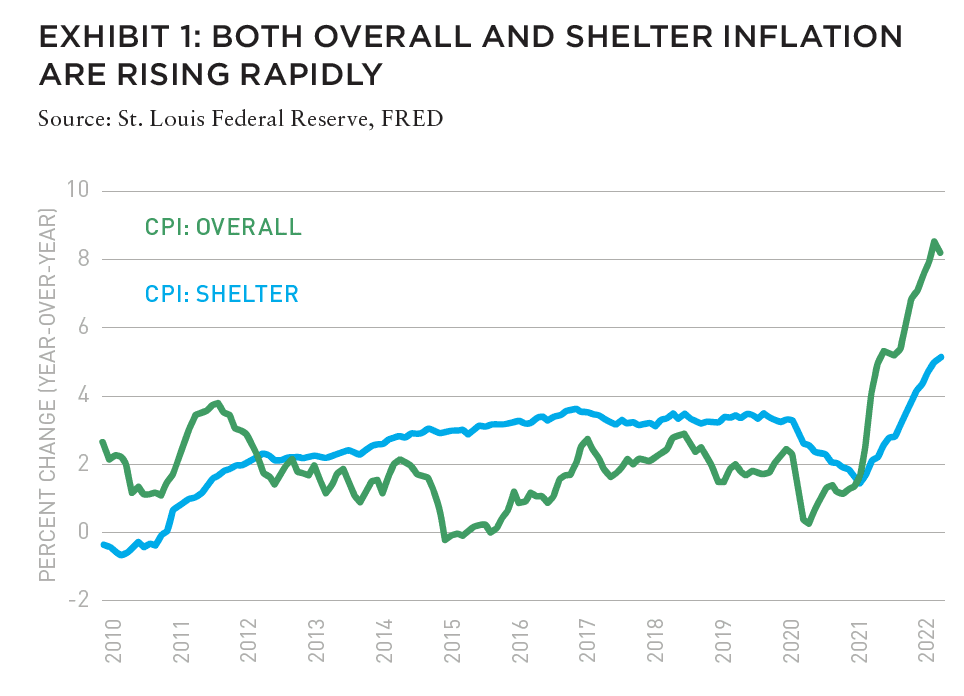

Housing represents about a third of the value of the market basket of goods and services that the Bureau of Labor Statistics uses to track inflation in the Consumer Price Index. A rise in the price of shelter, the US Bureau of Labor Statistics label for housing, contributed to the increase in inflation in early 2022. Measuring changes in shelter costs is more difficult than measuring changes in the prices of, say, apples or tires. This post explains how the US Bureau of Labor Statistics currently measures changes in the cost of housing for both renters and homeowners.

HOW DOES US BUREAU OF LABOR STATISTICS CALCULATE THE PRICE OF SHELTER?

For tenant rent, the US Bureau of Labor Statistics counts cash rent paid to the landlord for shelter and any utilities included in the lease, plus any government subsidies paid to the landlord on the tenant’s behalf.

If a housing unit is occupied by the owners, the US Bureau of Labor Statistics computes what it would cost the owner to rent a similar place, known as Owners’ Equivalent Rent (OER). The cost of utilities paid by homeowners is measured separately in the CPI.

WHY DOES THE US BUREAU OF LABOR STATISTICS USE OWNERS’ EQUIVALENT RENT (OER) INSTEAD OF HOME PRICES?

The CPI is intended to capture the price changes over time of the goods and services consumed by households. For housing, the US Bureau of Labor Statistics is trying to measure the cost of the consumption value of a home—the shelter services provided—not the change in the value of the house. Thus, the US Bureau of Labor Statistics uses the OER to measure the cost of shelter for homeowners.

To give a concrete example, if a family buys a house for $300,000 in 2022 and lives there for the next ten years, their housing-related cost of living is not $300,000 in 2022 and zero in the subsequent ten years. Rather, their housing-related cost of living is the amount they would have had to spend to consume the same amount of housing services provided by their owner-occupied home.

WHERE DOES THE US BUREAU OF LABOR STATISTICS GET THE DATA FOR SHELTER PRICES?

The US Bureau of Labor Statistics collects the data on rent for about 50,000 residences through personal visits or telephone calls. One sixth of the sample is replaced each year to keep it representative. Since rents do not change frequently, the rent of each unit is sampled every six months.

The CPI measures price growth for the same basket of goods and services over time, so the US Bureau of Labor Statistics adjusts for changes in quality of the properties it observes. The adjustments account for the age of the property, neighborhood improvements, and physical renovations to the home like the number of bathrooms or new air conditioning systems.

Because the US Bureau of Labor Statistics only observes rent for renter-occupied units, they impute owner’s equivalent rent for owner-occupied homes using the average rents paid for comparable rental housing within the same area.

WHAT ARE THE POTENTIAL PROBLEMS WITH THE MEASUREMENT OF THE OER?

Finding rental housing that is comparable to an owner-occupied unit can be difficult. Predominantly renter-occupied neighborhoods are often geographically separate from owner-occupied ones—for example, a city center versus a suburb.

Even within the same geographic area, housing characteristics can vary widely across rental and owner-occupied units—for example, the owner-occupied units in a neighborhood may be single-family homes, while the rental units may be multi-family buildings. Finding comparable rental housing is particularly difficult for large, expensive single-family houses.

WHY DO I SEE HEADLINES ABOUT RENTS RISING MUCH FASTER THAN THE CPI MEASURE?

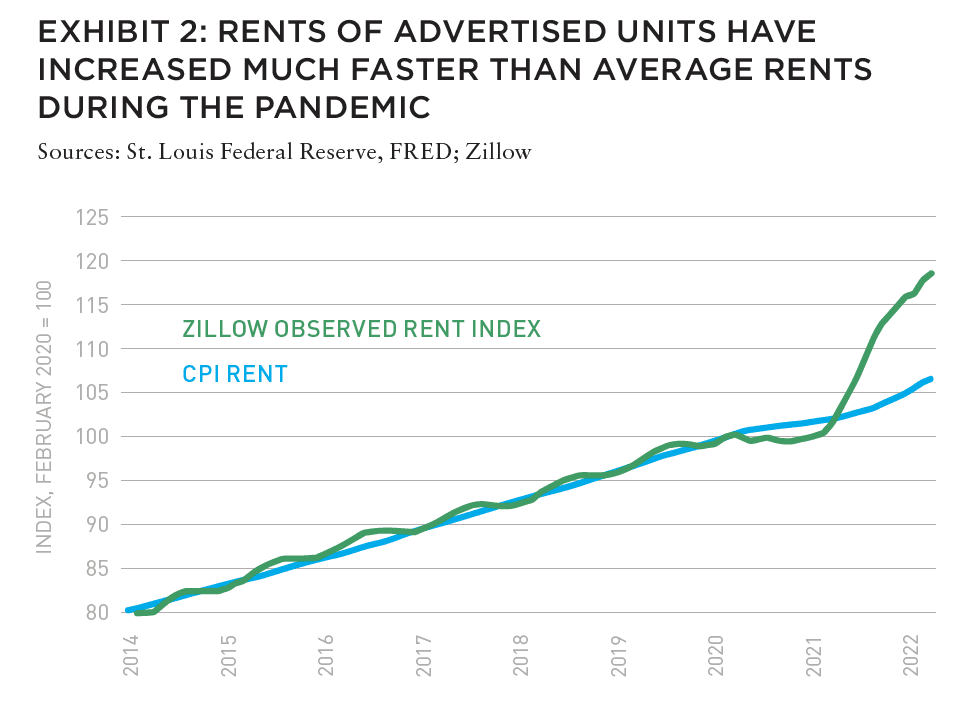

Well-known indexes of market rents—like the one published by Zillow—capture rents of units currently advertised on the open market, and don’t capture rents for units occupied by continuing renters like the CPI does. Rents change when leases expire, which typically happens annually. This can lead to a lag between changes in indexes like Zillow’s and those in the US Bureau of Labor Statistics’s rent measure.

From the perspective of the CPI, this lag isn’t a problem as the CPI is accurately capturing what households actually pay in rent. It does suggest that the CPI’s shelter inflation will likely increase in coming months as the tight housing market shows through to rents on all rental units.

HOW DO HOUSE PRICES AFFECT THE CPI MEASURE OF HOMEOWNERSHIP COSTS?

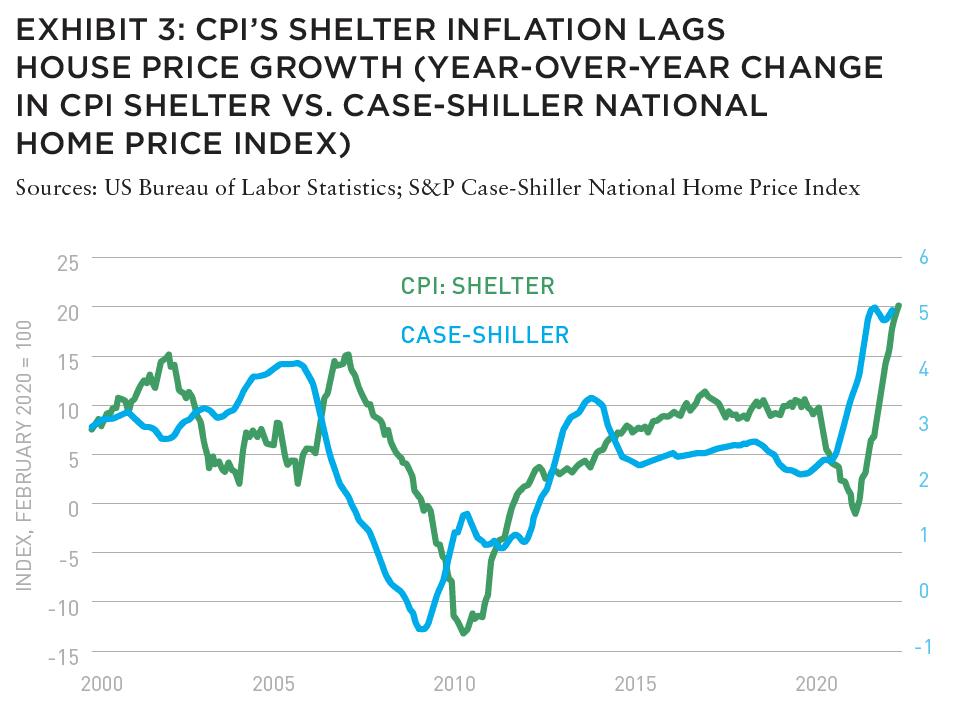

House prices and rental prices are determined by supply and demand factors that don’t always move in tandem. For example, if demand for homeownership rises because mortgage rates fall, house prices will rise but rents will not. If home construction costs increase, on the other hand, the price of both rental and owner-occupied housing would likely rise.

Over time, changes in house prices do predict changes in rents—although the relationship is far from 1-to-1 and occurs with long lags. Xiaoqing Zhou and Jim Dolmas of the Dallas Fed find house price growth’s correlation with OER inflation peaks at about 0.75 after sixteen months; the correlation with rent inflation peaks at after eighteen months.

WHAT IS LIKELY TO HAPPEN TO THE CPI MEASURE OF SHELTER COSTS IN THE COMING YEAR?

The tightening of the housing market during the pandemic led to a divergence between housing market prices and CPI measures of shelter inflation. “Despite record growth in private market-based measures of home prices and rents,” economists Marijn A. Bolhuis, Judd N. L. Cramer, and Lawrence H. Summers note, “government measured residential services inflation was only four percent for the twelve months ending in January 2022.”

Given recent trends in rents and house prices, however, analysts anticipate the shelter component will boost the CPI inflation measure in coming months. If the historical relationship between housing prices and rent inflation hold true, both Bolhuis, Cramer, and Summers and researchers at the San Francisco Fed project (as of February 2022) that rent inflation will increase by about 7% in 2022 and 2023, almost twice the pre-pandemic five-year average. With shelter making up about a third of the CPI, these fi ndings imply that housing will boost headline CPI inflation about 1.1 percentage points above its historical average by the end of 2022.

—

ABOUT THE AUTHORS

David Wessel is Director of the Hutchins Center on Fiscal and Monetary Policy and a Senior Fellow for Economic Studies at the Brookings Institution. Sophia Campell is a former Senior Research Assistant for the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution.

—

EXPLORE THE LATEST ISSUE

CAPITAL MARKETS PULSE

Through the rest of this year, investors forecast challenges for global capital, but thoughtful investors are forging ahead.

Gunnar Branson and Benjamin van Loon | AFIRE

ON/OFF SWITCH

While the market rarely sends clear investing signals, current market conditions are replete with clues, but as timing for corrections is difficult, a move to risk-off strategies could be useful.

Joseph L. Pagliari | University of Chicago

MOBILE ZONING

Mobile information technology has upended US land use regulation, and the ramifications of this technological upheaval are finally coming into view.

Robert Seldin | Madison Highland Live Work Lofts

GET SMART

As buildings become increasingly technologized, especially after the pandemic, cyber-attacks can put entire properties at risk and require a firmwide security approach.

Noëlle Brisson and Michael Savoie | CyberReady, LLC

HEDGE TRIMMING

The rapid rise in consumer prices has rekindled the old debate about whether commercial real estate provides a long-term hedge against inflation (hint: look at multifamily).

Gleb Nechayev, CRE | Berkshire Residential Investments

THE NEW SCIENCE

While the real estate industry has long understood the need for data, it still struggles with connecting information to decision making. New strides in data science could change that.

Brian Biggs and Ashton Sein | Grosvenor

BRACE FOR IMPACT

The practice and expectations of investing across all industries is undergoing major upheaval and the key to stability will mean looking beyond profit for profit’s sake.

Michael Cooper and Richard Florida | Dream Unlimited Corporation

TRANSITION PLANS

Forecasts about the future of the office sector are often wildly conflicting, but the looming high tide of generational leadership transitions could change the script.

Sabrina Unger and Britteni Lupe | American Realty Advisors

WHAT DRIVES LOGISTICS?

The logistics sector was the winner of the pandemic recession—but is its rise built to last?

Hugues Braconnier and Dr. Megan Walters | Allianz Real Estate

RENEWED PURPOSE

From retail to office to abandoned factories and warehouses, owners of real estate are rethinking—and reinventing—the future of their investments.

John Thomas and Stacey Krumin | Squire Patton Boggs

DATABASICS

Data centers have become an increasingly institutionalized property class over the past several years, but finding success in the sector depends on talent and expertise.

Max Shepherd, Jannah Babasa, and Isabel Ruiz Halter | Sheffield Haworth

COOPERATIVE INVESTMENT

As insurance costs of residential and commercial spiral out of control, a 1400-year-old tradition is poised to offer long-term, sustainable growth for real estate investments.

Ishmam Ahmed | Georgetown University & AFIRE

DOMESTIC MIGRATION TRENDS

Dive into the report to understand if and how COVID impacted domestic migration patterns on a state, city, and zip code level.

Ethan Chernofsky | Placer.ai

UP FRONT

How does the Consumer Price Index account for the cost of housing?

David Wessel and Sophia Campbell | The Brookings Institution

THIS ISSUE OF SUMMIT JOURNAL IS PROUDLY SUPPORTED BY

Aegon Asset Management is an active global investor that manages and advises on assets of $328 billion* for global pension plans, public funds, insurance companies, banks, wealth managers, family offices, and foundations. Aegon AM’s Real Assets platform focuses on delivering yield-oriented and total return solutions spanning the risk/return spectrum.

With an over 35-year history and $25 billion* in AUM/AUA, the Real Assets business is built on a cycle-tested platform, deep and broad market access, and long-term relationships.

Our real assets debt and equity strategies seek to deliver strong relative value and returns through a research-intensive process. The process encompasses thoughtful top-down research and intelligent bottom-up analysis deployed by an experienced multidisciplined team of over 110 investment professionals.*

Each capability is underpinned by dedicated, in-house support and service teams including applied research, engineering and environmental, valuation, accounting, client service, legal and risk management.

*As of June 30, 2022. The assets under management/advisement described herein incorporates the entities within Aegon Asset Management brand as well as the following affiliates: Aegon Asset Management Holding B.V., Aegon Asset Management Spain, and joint-venture participations in Aegon Industrial Fund Management Co. LTD, La Banque Postale Asset Management SA, and Pelargos Capital BV.