Through the rest of this year, investors forecast challenges for global capital, but thoughtful investors are forging ahead.

Does anyone really look forward to investing when it appears that the proverbial “Four Horsemen” might be over the horizon? With global political tensions high, environmental crises becoming more recurrent, and the worldwide economy combatting inflation, recession, and other challenges, it can sometimes feel as if the Horsemen have already arrived.

But some investors are looking beyond the horizon—and marching forward with confidence.

THE AFIRE MID-YEAR PULSE SURVEY

Despite the notes of optimism covered in our mid-year report from the AFIRE members (which represent nearly 200 organizations from 25 countries, with $3 trillion AUM in the US)—all are well aware of the current market challenges. They know, for example, that since January 2022, US inflation rose by more than 9%; the Fed hiked interest rates by more than they have in almost thirty years; we crossed a global threshold of more than six million people dead from COVID since the start of the pandemic; supply chains remain in disarray; July 2022 was the 451st consecutive month with temperatures above the twentieth-century average; wildfires have punished countries around the world; water supplies are dwindling to perilous levels in some parts while others are underwater with historic floods. And of course, Russia started a war in Ukraine.

For many real estate investors, packing up and going home would seem like an appealing option in this sort of landscape. But it is not an option if “going home” means going into the middle of any of the above crises. Instead, governments, investors, and ordinary people must acknowledge what is going on, accept that there are no resets, and adapt to our new and continuously evolving reality.

Institutional investors are particularly good at adaptation, especially those that invest globally. In this report, conducted in July 2022 with support from PwC Research, AFIRE gained some insight about the investment landscape and how capital markets are changing—especially in comparison to any predictions and sentiments forecasted in our early AFIRE 2022 Annual Investor Survey, released in April 2022.

Not surprisingly, this group of 111 global respondents—each representing the point of view of their respective organizations—listed inflation, geopolitics, war, and interest rates as their greatest investment threats. But at the same time, they are also able to extract opportunity from these seemingly unprecedented challenges.

FUTURE THINKING/OVERVIEW

The future is a critical topic for AFIRE members, the majority of which focus on long-term, multi-generational investments. Much of their thinking about the future informs the decisions they make right now, which is why it’s important to understand the sentiments expressed deeper in this survey through the lens of investor prognostication.

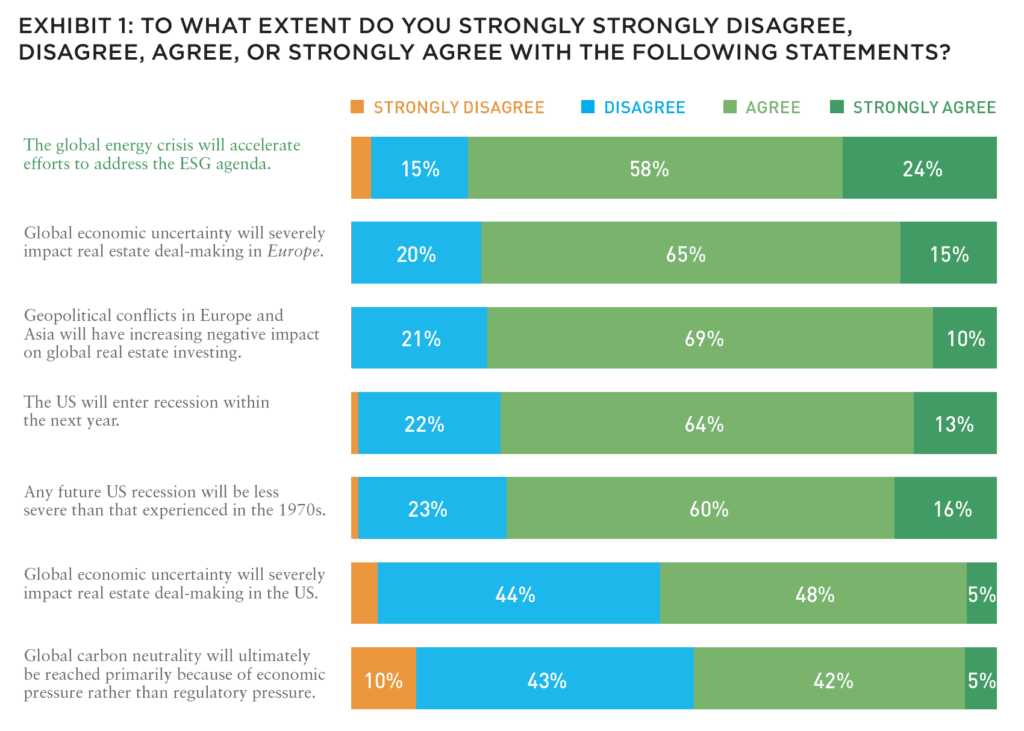

As seen in Exhibit 1, economic uncertainty is also front-of-mind, with both US-based and non-US-based investors forecasting challenges to dealmaking in both the US and Europe—the latter to a greater degree. In both regions, non-US-based investors are more pessimistic, but still more optimistic about US real estate prospects compared to European prospects. Alternately, US-based investors are more pessimistic about the inevitability of a US recession (92%) compared to investors from elsewhere (67%).

Outside of these agree/disagree responses, respondents also identified several other critical threats and opportunities, including war, market volatility, and energy independence.

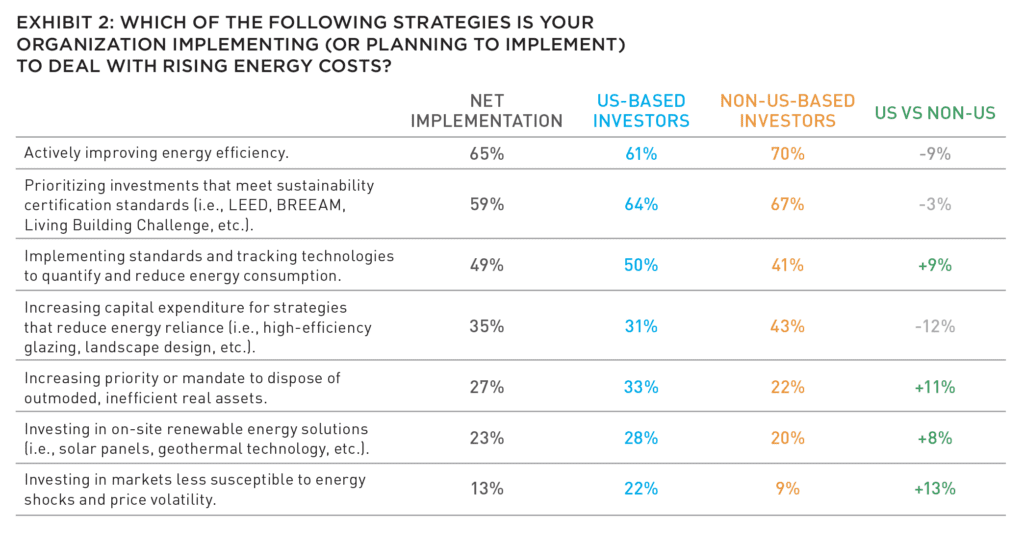

With energy poised to be one of the greatest challenges in the coming decade for real estate investment, nearly two-thirds of respondents are already engaged in actively improving their energy efficiency (Exhibit 2), and 59% are prioritizing investments that already meet specific sustainability certifications standards (e.g., LEED, BREEAM, Living Building Challenge, etc.). Non-US-based investors are more likely to focus on capital expenditure for sustainability improvements (43%) compared to US-based investors (31%), though the latter group has more of a priority to dispose of outmoded or inefficient assets.

CROSS-BORDER STRESSES

A lot has changed in 2022, especially as rosier views of inflation earlier in the year, including a popularly held opinion that it was transitory, have since given way to the reality that it’s here to stay (in some sectors more than others). As such, questions asked about inflation six months ago generate different answers when asked in July.

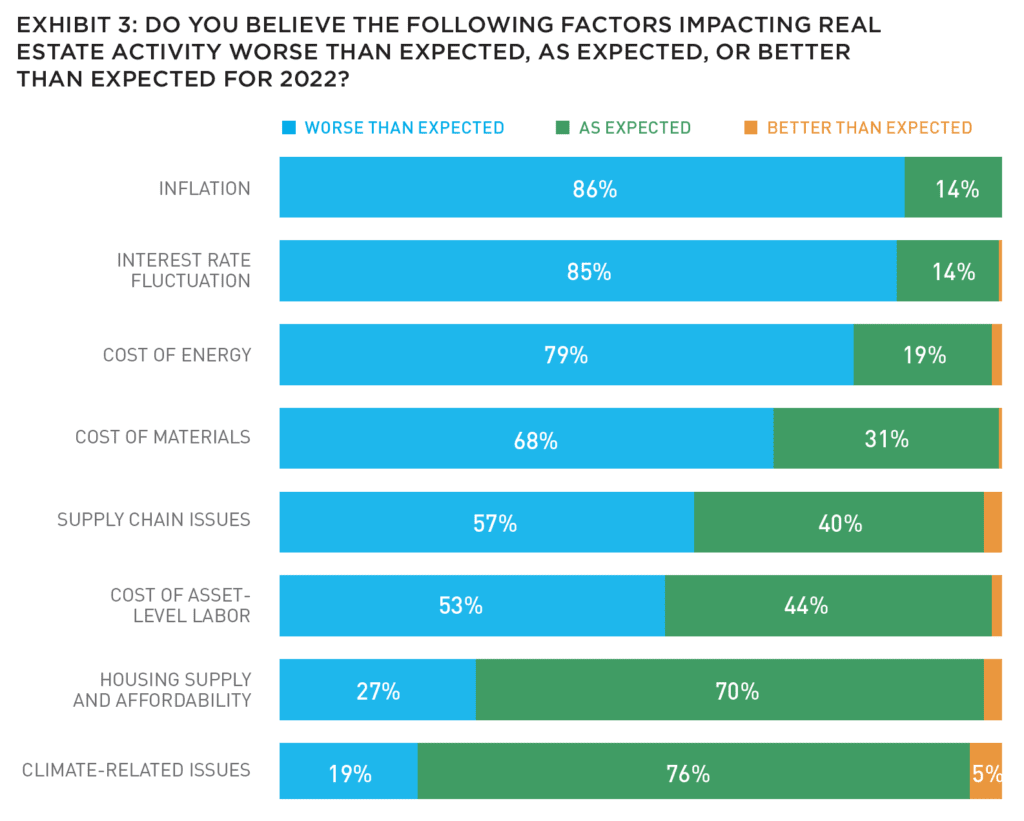

As seen in Exhibit 3, to underscore this change, around 86% of respondents indicated that inflation in 2022 has actually been worse than expected, compared to where we were at the beginning of the year. That change is echoed by similar sentiment for changes in interest rates (85% worse than expected) and the cost of energy (79%) and materials (68%).

Alternately, since the beginning of the year, concerns about housing supply and affordability and climate-related issues have generally unfolded as expected for investors—or even better, in some cases.

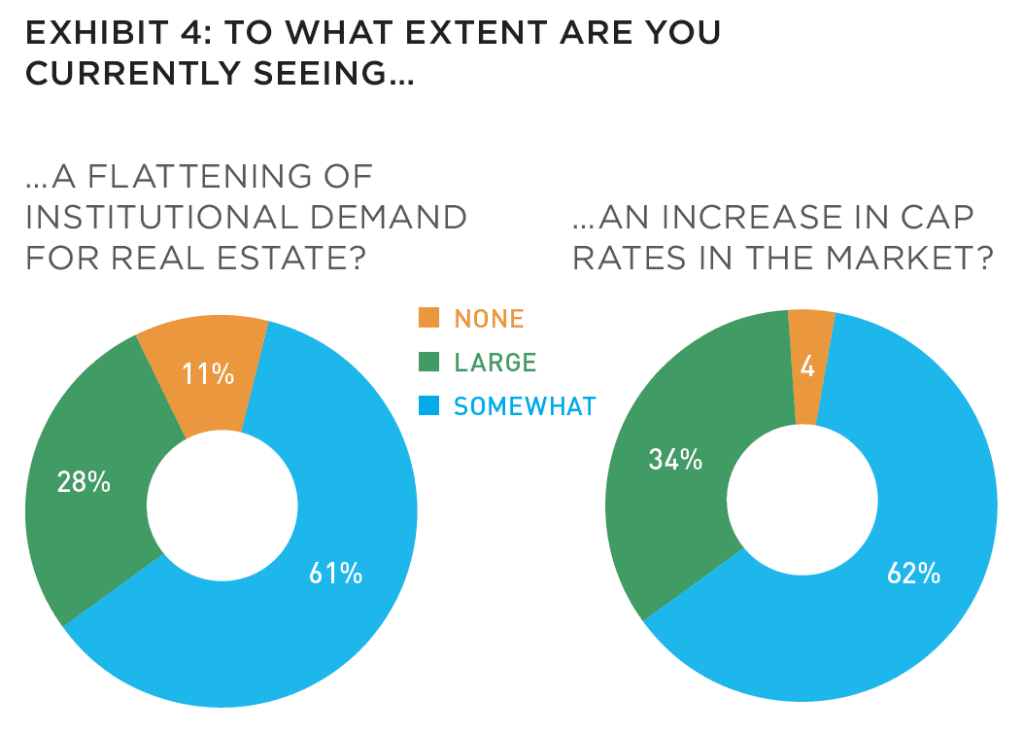

When asked about the extent to which investors are seeing an increase in cap rates (Exhibit 4), or a flattening of institutional demand, six in ten respondents are observing both to be the case. US-based investors appear more likely to currently see flattening of institutional demand (33%) compared to non-US-based investors (26%).

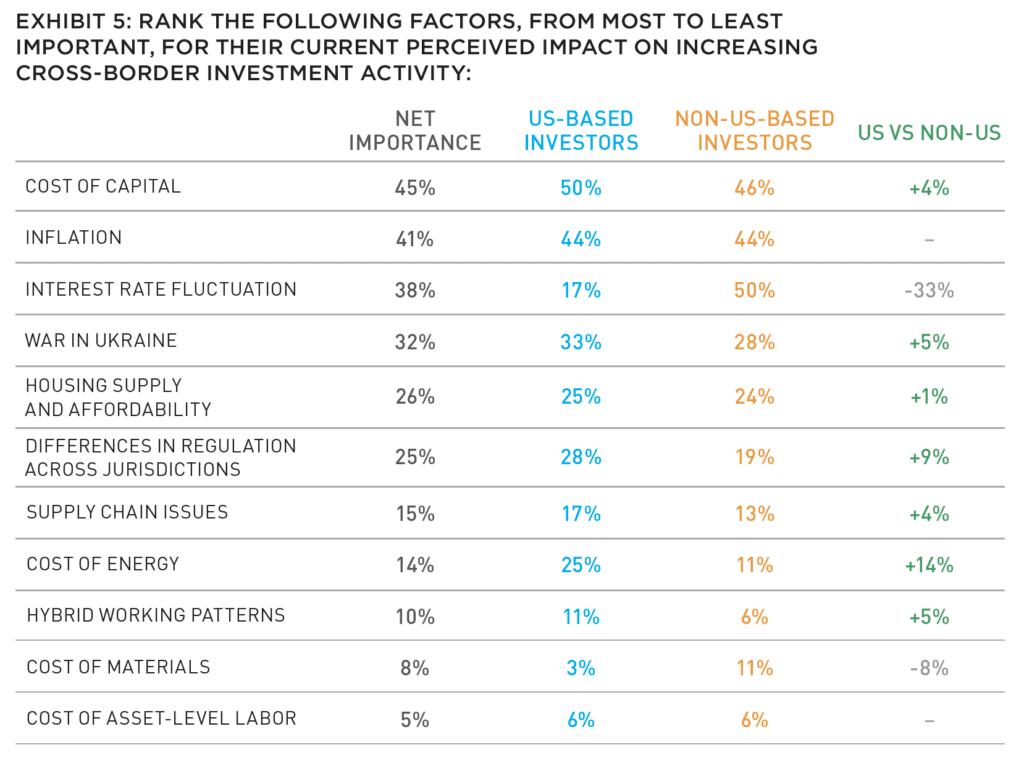

Asked to rank a set of eleven factors for their role in perceived increases in current cross-border investment activity (Exhibit 5), respondents indicated that the cost of capital, inflation, and interest rate fluctuation are the most impactful.

Nearly half of respondents (45%) cite the cost of capital as the most critical factor, with US-based and non-US-based investors ranking this factor similarly. However, half of non-US-based investors rank interest rate fluctuations in their top three, compared to only 17% of US-based investors. US-based investors rated the cost of energy higher (25%) compared to non-US-based investors, and differences in regulation across jurisdictions is ranked higher for increasing investment activity among US-based investors (28%) compared to 19% for non-US-based investors.

Asked to rank the same set of eleven factors for their role in perceived challenges to reducing cross-border investment activity, respondents indicated that the interest rate fluctuation, cost of capital, and inflation at the top of the list. This closely mirrors the same factors that are increasing cross-border activity—which suggests that a challenge for one is an opportunity for another.

CAPITAL, LENDING, AND DEBT

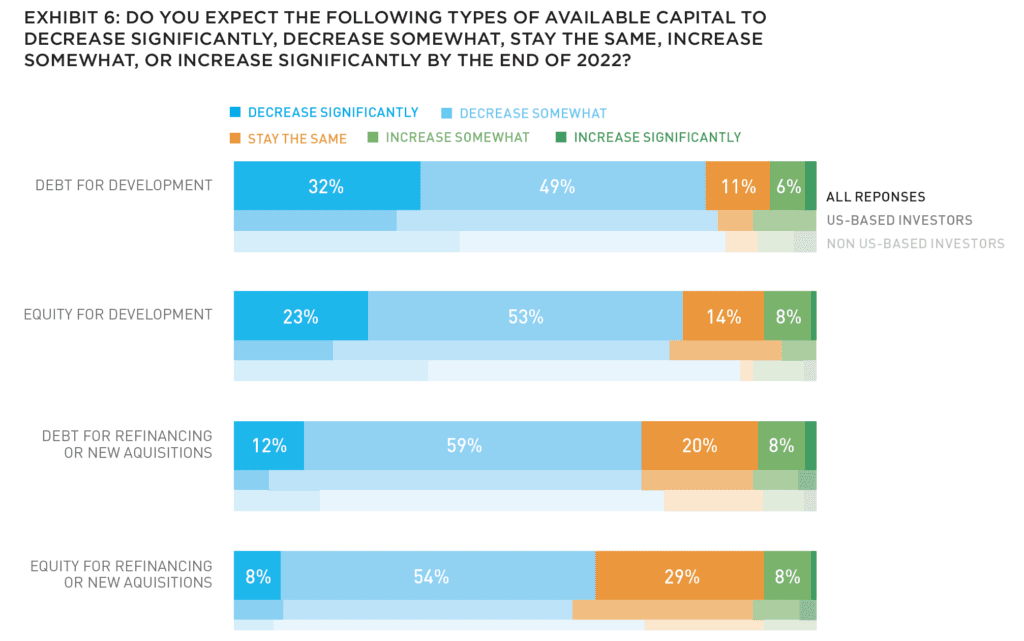

Given the sundry economic challenges facing capital markets, the availability of capital for development, refinancing, and acquisitions is expected to decline across the board for the rest of 2022, with debt for development expected to decrease by the greatest amount.

Non-US-based investors appear more pessimistic (Exhibit 6), with a higher proportion forecasting a decrease in availability of all types of capital this year. This is most notable for equity for refinancing or new acquisitions (70% decrease among non-US-based investors compared to 58% for US-based investors) and equity for development (87% compared to 75%).

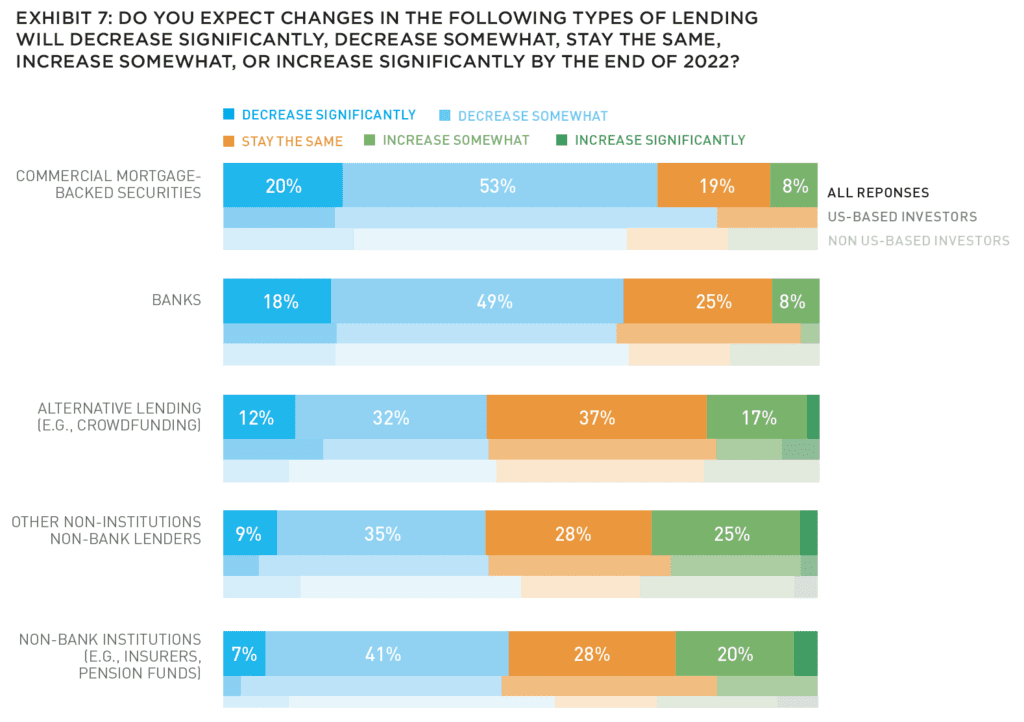

Most types of lending are also expected to decline through the rest of 2022 (Exhibit 7). Four in ten respondents foresee a decrease in lending among alternative platforms rising, and seven in ten expect a reduction in commercial mortgage-backed securities (CMBS). US-based investors are more likely to suspect this CMBS decrease (83%) compared to non-US-based investors (69%). However, more than half of respondents foresee an increase in lending from non-bank institutions, such as pension funds and insurance companies.

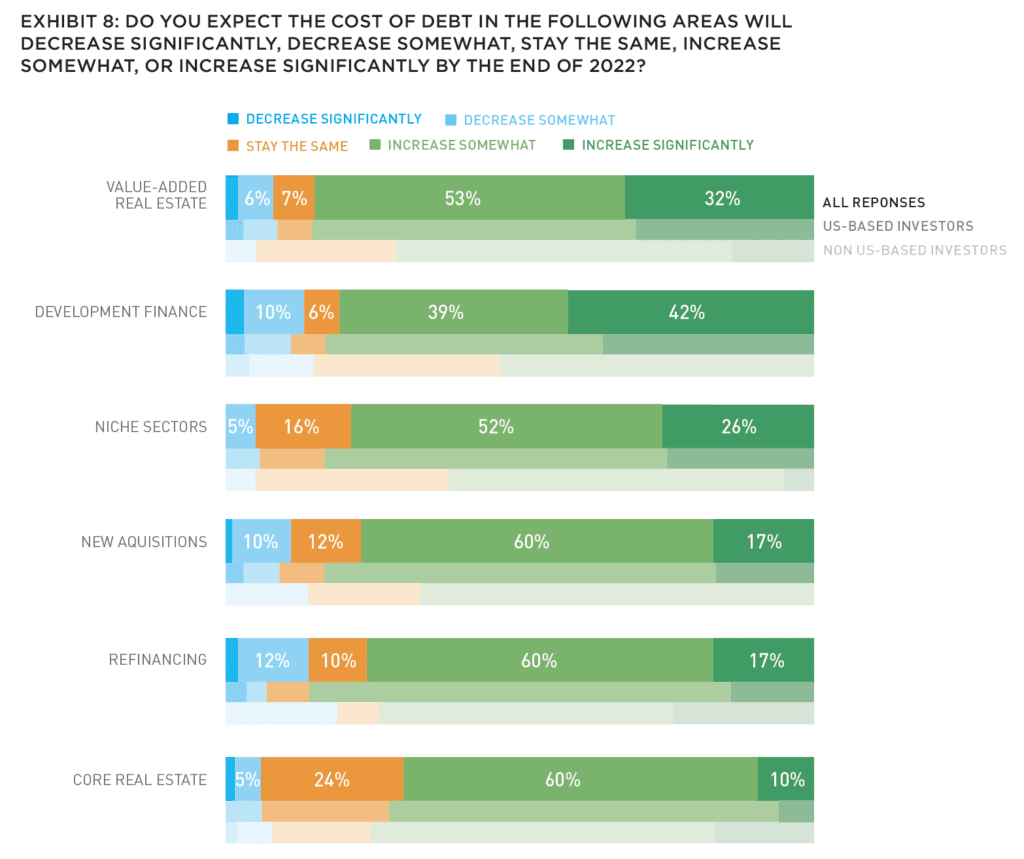

In line with tempered forecasts around lending and available capital, the cost of debt is expected to increase across the board in the next year, with the greatest rise forecast for value-added real estate (85%) and development fi nance (81%) (Exhibit 8). Debt for core real estate is expected to rise as well (69%), but not as steeply as debt for refinancing, new acquisitions, and niche sectors.

Indicatively, US-based investors are more likely to expect an increase in the cost of refinancing in the coming year (86%) compared to non-US-based investors (74%). A similar difference appears for new acquisitions, with an 83% increase expected by US-based investors compared to 78% for non-US-based investors.

PLANNING AHEAD

This past year has not shaped up to be a year for the faint of heart. For example, 56% of respondents believed that the industry was behind allocations for US real estate investments in 2022, while more than 80% communicated that the impact of inflation and rising interest rates was worse than expected.

Meanwhile, the availability of capital is expected to decline for the rest of the year both in debt and equity, while the cost of both expected to increase. Not surprisingly, more than three-quarters (77%) of respondents believe that the US will enter a recession within the next year.

But even if the rising cost of capital is affecting new cross-border investments, it may also increase cross-border activity in new areas and markets. Roughly 77% of respondents believe that the recession—if it happens—will not be as severe as it was in the 1970’s. This will lead to unique opportunities in strategic and niche markets, improvements in ESG practices, and a deepening focus on multifamily, single-family, and affordable housing.

As expected, investors in Europe are a bit less positive than their colleagues in the US, but collectively, there continues to be belief and continued investment in the US property markets from global institutions.

For now, the Horsemen have not yet crossed the horizon.

The world is not ending—it’s changing.

—

ABOUT THE AUTHORS

Gunnar Branson is the CEO of AFIRE and the publisher of Summit Journal. Benjamin van Loon is Senior Communications Director for AFIRE, and Editor-in-Chief of Summit Journal.

—

EXPLORE THE LATEST ISSUE

CAPITAL MARKETS PULSE

Through the rest of this year, investors forecast challenges for global capital, but thoughtful investors are forging ahead.

Gunnar Branson and Benjamin van Loon | AFIRE

ON/OFF SWITCH

While the market rarely sends clear investing signals, current market conditions are replete with clues, but as timing for corrections is difficult, a move to risk-off strategies could be useful.

Joseph L. Pagliari | University of Chicago

MOBILE ZONING

Mobile information technology has upended US land use regulation, and the ramifications of this technological upheaval are finally coming into view.

Robert Seldin | Madison Highland Live Work Lofts

GET SMART

As buildings become increasingly technologized, especially after the pandemic, cyber-attacks can put entire properties at risk and require a firmwide security approach.

Noëlle Brisson and Michael Savoie | CyberReady, LLC

HEDGE TRIMMING

The rapid rise in consumer prices has rekindled the old debate about whether commercial real estate provides a long-term hedge against inflation (hint: look at multifamily).

Gleb Nechayev, CRE | Berkshire Residential Investments

THE NEW SCIENCE

While the real estate industry has long understood the need for data, it still struggles with connecting information to decision making. New strides in data science could change that.

Brian Biggs and Ashton Sein | Grosvenor

BRACE FOR IMPACT

The practice and expectations of investing across all industries is undergoing major upheaval and the key to stability will mean looking beyond profit for profit’s sake.

Michael Cooper and Richard Florida | Dream Unlimited Corporation

TRANSITION PLANS

Forecasts about the future of the office sector are often wildly conflicting, but the looming high tide of generational leadership transitions could change the script.

Sabrina Unger and Britteni Lupe | American Realty Advisors

WHAT DRIVES LOGISTICS?

The logistics sector was the winner of the pandemic recession—but is its rise built to last?

Hugues Braconnier and Dr. Megan Walters | Allianz Real Estate

RENEWED PURPOSE

From retail to office to abandoned factories and warehouses, owners of real estate are rethinking—and reinventing—the future of their investments.

John Thomas and Stacey Krumin | Squire Patton Boggs

DATABASICS

Data centers have become an increasingly institutionalized property class over the past several years, but finding success in the sector depends on talent and expertise.

Max Shepherd, Jannah Babasa, and Isabel Ruiz Halter | Sheffield Haworth

COOPERATIVE INVESTMENT

As insurance costs of residential and commercial spiral out of control, a 1400-year-old tradition is poised to offer long-term, sustainable growth for real estate investments.

Ishmam Ahmed | Georgetown University & AFIRE

DOMESTIC MIGRATION TRENDS

Dive into the report to understand if and how COVID impacted domestic migration patterns on a state, city, and zip code level.

Ethan Chernofsky | Placer.ai

UP FRONT

How does the Consumer Price Index account for the cost of housing?

David Wessel and Sophia Campbell | The Brookings Institution

THIS ISSUE OF SUMMIT JOURNAL IS PROUDLY SUPPORTED BY

Aegon Asset Management is an active global investor that manages and advises on assets of $328 billion* for global pension plans, public funds, insurance companies, banks, wealth managers, family offices, and foundations. Aegon AM’s Real Assets platform focuses on delivering yield-oriented and total return solutions spanning the risk/return spectrum.

With an over 35-year history and $25 billion* in AUM/AUA, the Real Assets business is built on a cycle-tested platform, deep and broad market access, and long-term relationships.

Our real assets debt and equity strategies seek to deliver strong relative value and returns through a research-intensive process. The process encompasses thoughtful top-down research and intelligent bottom-up analysis deployed by an experienced multidisciplined team of over 110 investment professionals.*

Each capability is underpinned by dedicated, in-house support and service teams including applied research, engineering and environmental, valuation, accounting, client service, legal and risk management.

*As of June 30, 2022. The assets under management/advisement described herein incorporates the entities within Aegon Asset Management brand as well as the following affiliates: Aegon Asset Management Holding B.V., Aegon Asset Management Spain, and joint-venture participations in Aegon Industrial Fund Management Co. LTD, La Banque Postale Asset Management SA, and Pelargos Capital BV.