Midway through 2024, a moderating macro environment and softening logistics fundamentals at the national level reinforce four themes that inform logistics markets today.

From market views to asset subtypes, understanding the matrix of intersecting and overlapping themes in the logistics sector is key to prudent asset selection and accurately identifying opportunities to enhance asset functionality and capture long-term value.

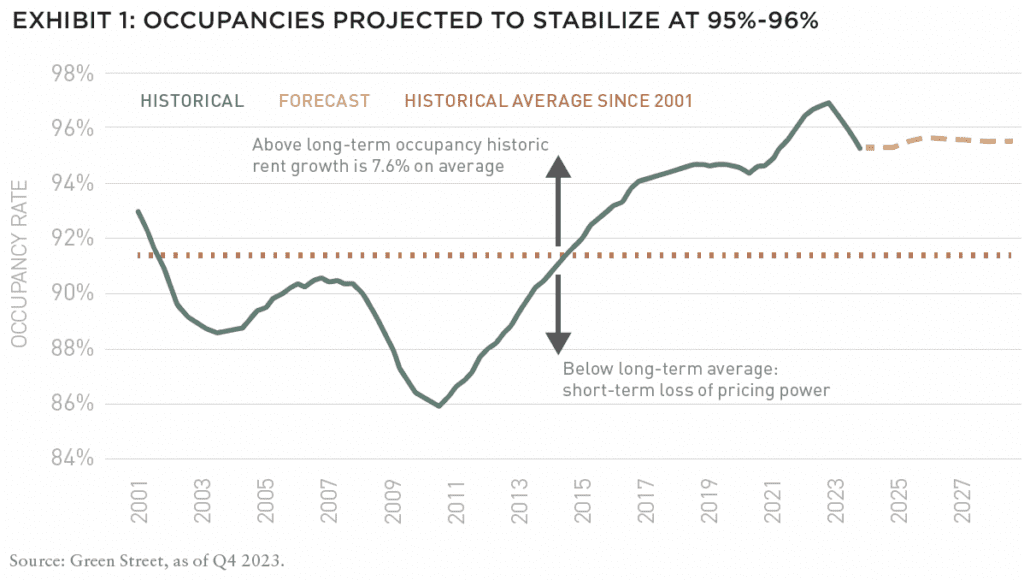

- From a secular perspective, we view the US logistics sector as well-positioned for robust pricing power as occupancies stabilize and as expiring leases create substantial mark-to-market opportunities.

- In 2023, logistics reached a critical inflection point in demand with the continued rise of e-commerce. This new demand cycle has been further supported by the revival of US manufacturing amid ongoing supply chain and global trade realignment.

- US gateway markets, such as Southern California, Northern New Jersey/New York, and South Florida, with their dense populations and major airports and seaports, are likely to capture the greatest share of these long-term demand trends.

- The pace of supply will vary greatly gateway markets, regional high-growth markets, and logistics infrastructure markets. High-barrier, infill gateway markets are seeing more limited development that will likely bolster performance on an absolute and relative basis.

THEME 1: GLOBAL ECONOMIC FACTORS ENHANCE STABILITY

Globalization, the steady rise of e-commerce, the reshaping of supply chains, and the recent trend towards reshoring advanced manufacturing have created strong, enduring drivers for growth in logistics real estate.

Despite strong secular tailwinds, this growth has led to some degree of oversupply both geographically and within specific product types. At this stage in the cycle, the opportunity to secure long-term value lies in carefully choosing both the location and type of properties for investment, highlighting the strategic choice between specialization and diversification.

When we invest in real estate, we inherently focus on medium- to long-term horizons, deriving value from a combination of income and appreciation. In our view, many challenges currently seen in real estate are short-term, and emerging from one of the longest real estate cycles in history requires a degree of resetting assumptions and expectations. A deep analysis of individual geographies, submarkets, and different asset classes reveals unique sets of headwinds and tailwinds.

Notably, sectors such as industrial logistics, warehouses, and advanced manufacturing continue to demonstrate remarkable resilience and positive long-term demand drivers.

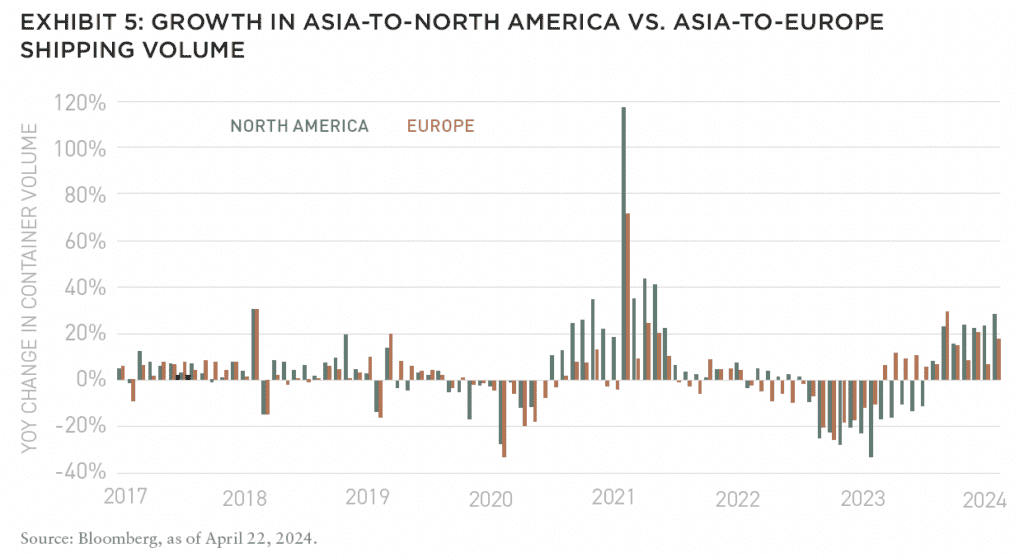

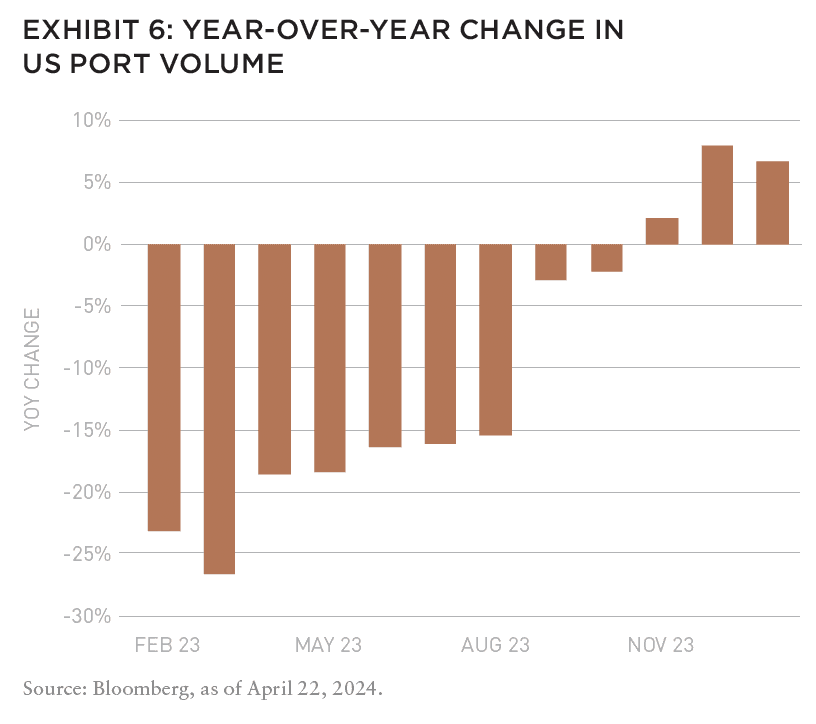

What makes the logistics sector particularly attractive, in our view, is its exposure to the global economy. As global economies have demonstrated resilience throughout a prolonged period of high inflation, global trade volumes have rebounded accordingly, particularly from Asia-Pacific to the US and Europe, which is significantly increasing demand for logistics services at major ports.

For example, over the past year, shipping volumes to the US have surged. The Port of Los Angeles has seen a 20% increase in container volume. Some ports have even reported spikes in volume of 50% to 60% at various points throughout the year, boosting the need for robust inland distribution networks and prompting logistics providers to expand their capabilities beyond ports to accommodate this demand.1

From a domestic growth perspective, we anticipate continued tailwinds for the sector following robust economic performance over the past year. Reflecting on the abrupt shift to tighter monetary policies and higher rates beginning in 2022, initially there was widespread concern about the Federal Reserve’s capacity to hike rates without causing prolonged damage to the economy.

Despite these concerns, the US economy has thus far weathered the storm, benefiting from a strong labor market and robust consumer activity. As a result, the US remains a key destination for global capital targeting commercial real estate, buoyed by a strong economic outlook, prospects of more manageable inflation, and the liquidity of US assets. We are confident in the ability of logistics real estate to generate long-term value, especially in a market where opportunistic acquisitions and resetting asset prices are occurring.

As a core thesis, we believe US logistics real estate is poised for robust pricing power in the coming years. The sector includes warehouses that help move goods to end consumers, and continued acceleration in e-commerce suggests a rising need to build out distribution networks. The primary occupiers of US logistics buildings include firms that either provide outsourced shipping services or transport their own products, and we anticipate these companies will concentrate leasing on markets with new and expanding manufacturing plants.

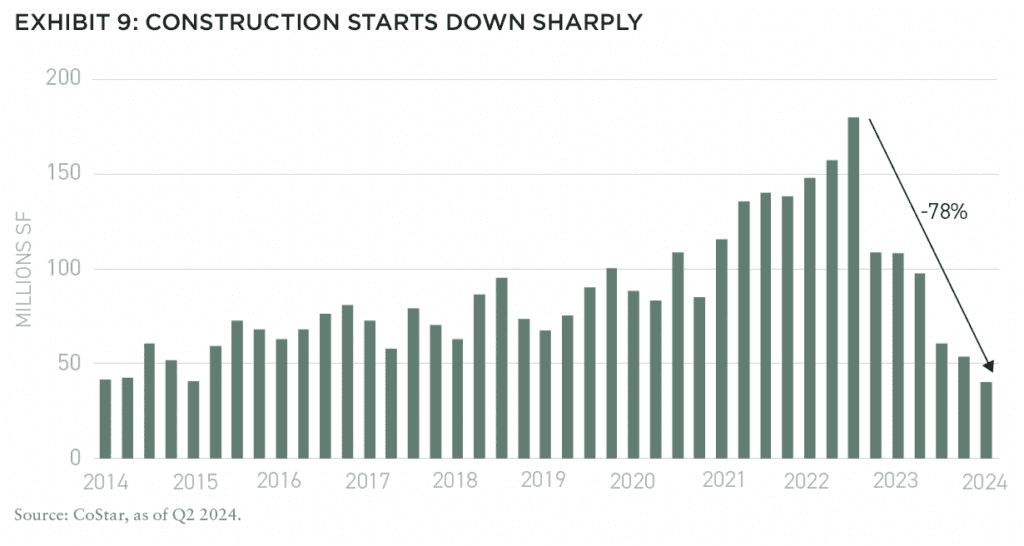

These demand drivers are intersecting with a rapid pullback in construction completions—down 50% from 2023 and heading to well-below historical averages in 2025.2 As a consequence, with moderate economic growth, we expect occupancies to stabilize at healthy demand levels supporting strong inflation-adjusted rent growth well into the future.

THEME 2: MACRO DEMAND DRIVERS

The US logistics sector is entering a new demand cycle supported by two distinct catalysts: the rise of e-commerce and a realignment of domestic supply chains as manufacturers increase US productive capacity.

Driven by Demographics

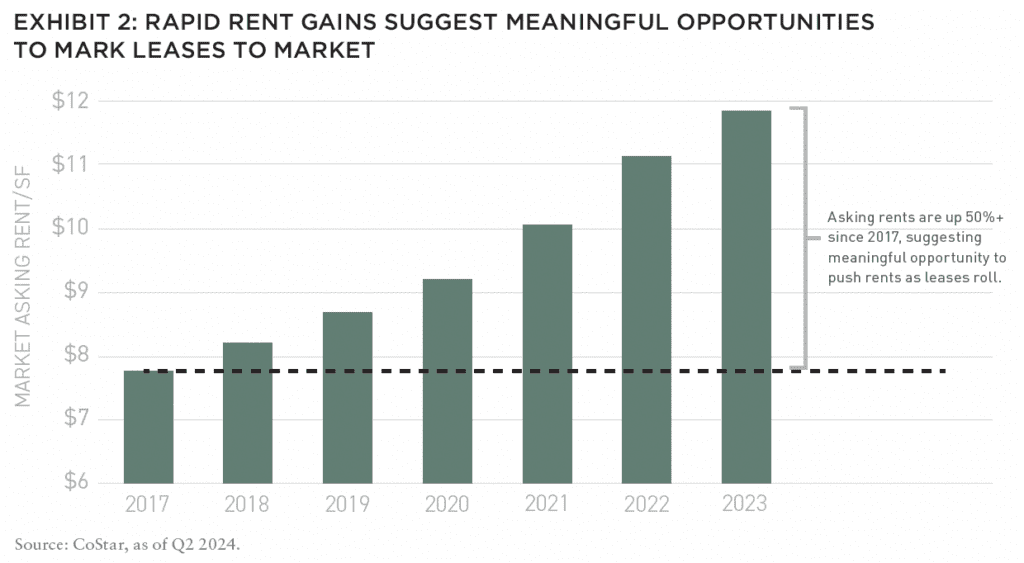

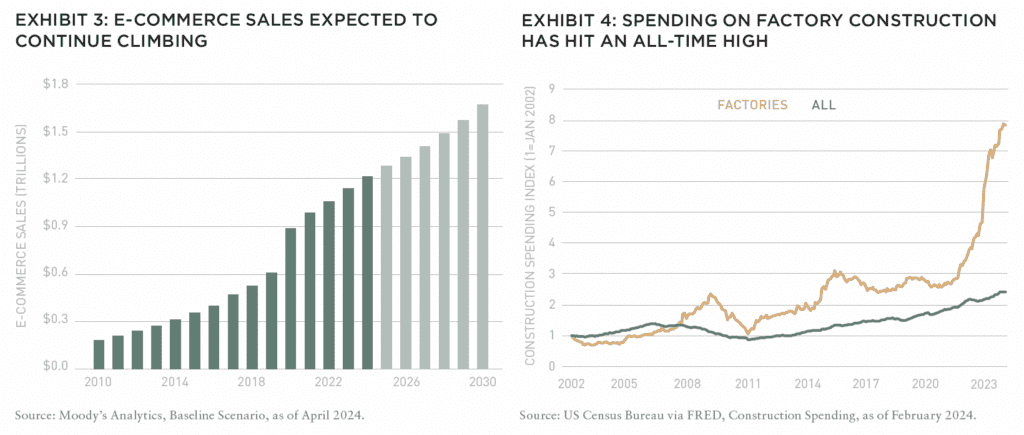

Four years since the depths of the pandemic in 2020, e-commerce spending continues to sustain a steady upward trajectory, driving demand for modern, efficient warehouses. E-commerce has seen activity more than double since 2018 and surpass $1.1 trillion in annual sales for the first time, and as shoppers increasingly direct their purchases online, we expect digital outlets to continue to take market share from brick-and-mortar retailers.3 As a result, e-commerce sales are projected to expand a robust 5.6% per year through the end of the decade,4 and each dollar of sales captured online provides an incremental boost to logistics needs—because of a need to maintain a wider and deeper inventory of products, e-commerce requires approximately three times as much warehouse space as traditional retail.5

Though some space occupiers are hesitant to commit to long-term leases currently amid an evolving macro environment, we anticipate that e-commerce growth could generate demand for an additional 650 million SF of warehouses by 2030.6

Proximity to Producers

A fundamental realignment of domestic supply chains is further powering industrial demand as manufacturers bring productive capacity back to the US. Whether seen as efforts to “re-shore” critical-path manufacturing or to create optionality in a “China-plus-one” strategy, manufacturing investment has seen a meaningful leg-up in the last few years, revamping shipping networks as seen in China’s declining share of the US import market.7

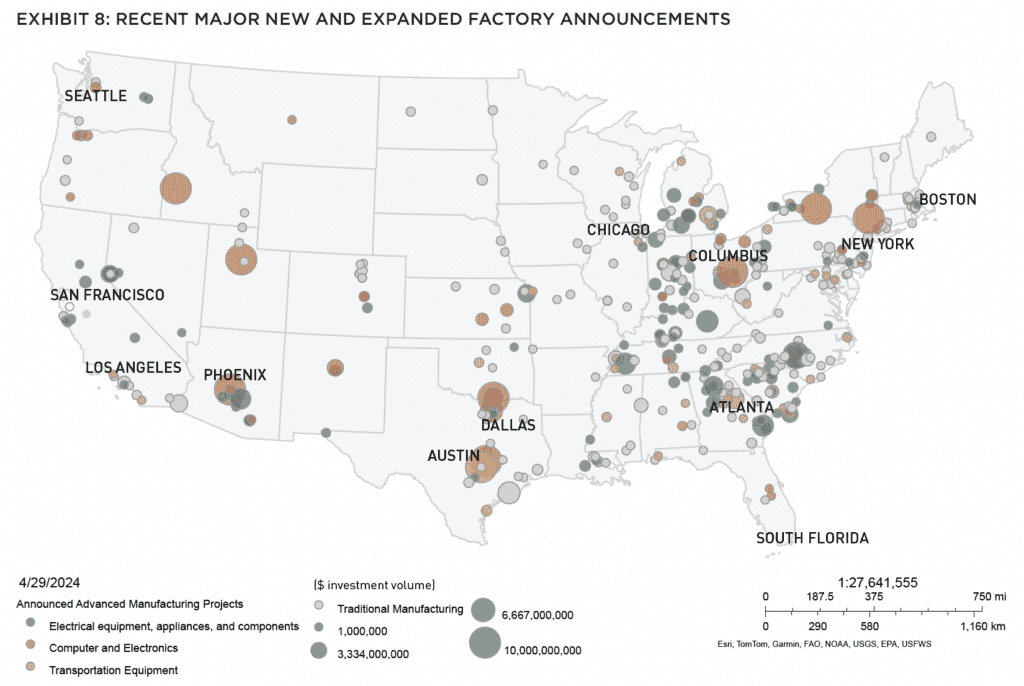

Meanwhile, construction spending on US factories has nearly tripled since 2018,8 far outpacing the growth in construction expenditures across all building types. Through a rigorous analysis of unstructured but publicly available data, we have identified more than 400 new or expanded factories announced over the past two years.9 We believe this trend is indicative of forward momentum that is likely to continue to power an upswing in US manufacturing activity, and as parts suppliers follow anchor factories to new locales and occupy nearby warehouses, we expect to see multiplier effects in local logistics markets.

EXPLORE THE NEW ISSUE

NOTE FROM THE EDITOR: WELCOME TO #15

Benjamin van Loon | AFIRE

MID-YEAR CRE MARKET OUTLOOK: AFIRE

Benjamin van Loon and Gunnar Branson | AFIRE

MULTIFAMILY OUTLOOK: AMERICAN REALTY ADVISORS

Sabrina Unger and Britteni Lupe | American Realty Advisors

MULTIFAMILY GAP CAPITAL: BARINGS REAL ESTATE

Dags Chen, CFA and Lincoln Janes, CFA | Barings Real Estate

SINGLE-FAMILY RENTAL OUTLOOK: CERBERUS CAPITAL MANAGEMENT

Kevin Harrell | Cerberus Capital Management

SINGLE-FAMILY RENTAL SUPPLEMENT: YARDI

Paul Fiorilla | Yardi

LOGISTICS OUTLOOK: BRIDGE INVESTMENT GROUP

Jay Cornforth, Jack Robinson, PhD, Morgan Zollinger, and Cole Nukaya | Bridge Investment Group

DATA CENTER OUTLOOK: PRINCIPAL ASSET MANAGEMENT

Casey Miller and Ben Wobschall | Principal Asset Management

SELF-STORAGE OUTLOOK: HEITMAN

Zubaer Mahboob | Heitman Europe

COLD-STORAGE OUTLOOK: NEWMARK

Lisa DeNight | Newmark

OFFICE OUTLOOK: CUSHMAN & WAKEFIELD

David Smith | Cushman & Wakefield

RETAIL OUTLOOK: MADISON INTERNATIONAL REALTY

Christopher Muoio | Madison International Realty

HOSPITALITY OUTLOOK: JLL

Zach Demuth | JLL

+ LATEST ISSUE

+ ALL ARTICLES

+ PAST ISSUES

+ LEADERSHIP

+ POLICIES

+ GUIDELINES

+ MEDIA KIT (PDF)

+ CONTACT

THEME 3: MARKET-LEVEL DEMAND DRIVERS

While macro-level demand enhances the attractiveness of nearly every logistics market across the US, we view some metros as particularly well-positioned to capture these new tailwinds due to the convergence of market-level demand drivers.

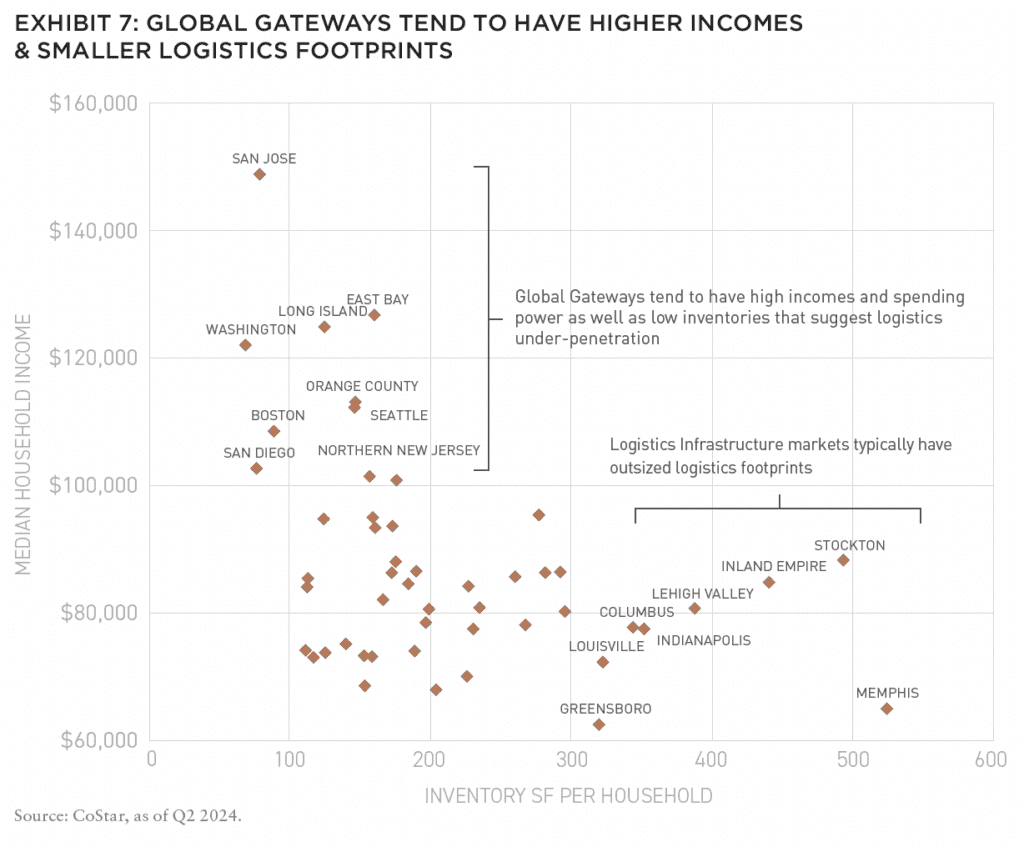

We expect the impact of the driven-by-demographics catalyst, for example, will be most pronounced in gateway markets with substantial barriers to new supply, observed in markets such as Southern California and Northern New Jersey/New York. These high-density markets are home to sizable consumer bases because of some of the largest populations in the country. Many gateway markets also have diversified employment bases with household income levels well above the US average. The combination of sizeable populations and healthy incomes typically translates into increased spending and consumption activity that, whether online or in traditional stores, spurs demand for more robust supply chains to transport merchandise to end-consumers.

Despite the critical need for logistics real estate in gateway markets, however, these markets tend to have relatively smaller logistics footprints on a per-household basis because of high barriers to new development, which we believe is indicative of pent-up demand that translates directly to logistics assets’ pricing power. The barriers to new development are multifaceted. Undeveloped land tends to be a scarce commodity in gateway markets, particularly for parcels with zoning that allows warehouse development because of municipal and resident concerns about traffic and noise. When buildable parcels do become available, industrial developers often face stiff competition from other land uses that bids up the price of the land. As a result, gateway markets are likely to continue to experience limited inventory growth, setting the stage for steadier occupancy rates.

We anticipate that the driven-by-demographics trend will also prove key in evaluating logistics demand trendlines in regional high-growth markets. Many of these metros, such as Orlando and Austin, have attracted a large influx of new residents over the past few years as the pandemic rearranged employment patterns in support of remote working.

Though the pace of population gains via household migration has moderated since 2020-2021 highs, many regional high-growth markets are expected to continue to register rapid household formation in coming years as lower costs of living and ample job opportunities draw in new residents from other parts of the country. With swelling populations, we expect that these markets will continue to drive demand for new logistics space to facilitate local distribution networks with the capacity to serve new customers.

While demographic drivers play out principally in gateway and regional high-growth markets, the proximity-to-producers tailwind is unfolding across the country and reshaping the geography of US manufacturing. As can be seen in Exhibit 8, plans for new and expanded factories can be found in nearly every corner of the country, even as some regions develop specialties in particular product types with growing ecosystems of interrelated components fabricators and suppliers. Amid the push for electrification of the auto industry, established manufacturing hubs in the South and Midwest are garnering an outsized share of investment in plants that produce electric vehicle batteries. New clusters of vehicle production are also emerging further to the south, such as in Georgia and the Carolinas.

New semiconductor fabrication facilities are landing across an even wider array of locations, with no single market establishing itself as a clear frontrunner for this subset of advanced manufacturing. Phoenix, Dallas, and Columbus, OH have attracted major new chips plants that will cost billions to construct and so have tertiary locales in upstate New York. Austin has not traditionally been known as a manufacturing hub, but the Texas capital has also reeled in multibillion-dollar commitments to boost semiconductor production.

THEME 4: SUPPLY BY SUBTYPE INFORMS NEAR-TERM DECISIONS

We believe it is crucial to acknowledge that the pace of supply will feature as a key differentiator of performance across property subtypes. After a surge in development activity saw deliveries peak in Q3 2023, the logistics sector has transitioned to the backslope of the supply wave. New construction starts have receded 78% from recent highs to the lowest pace of activity in a decade, while the amount of space under construction is also staging a quick retreat, particularly for speculative projects without a tenant in tow.10

Even as these dynamics suggest that the sector is likely to post modest inventory gains starting in late 2024 and early 2025, we still see attractive opportunities for new development on a selective basis. As the demand drives discussed above accelerate, some markets will continue to register strong demand for well-located assets that support high throughput and productivity. Amid the sector-wide pullback in construction activity, we expect that the smaller number of projects that do break ground in the coming months are likely to arrive in a less competitive leasing environment.

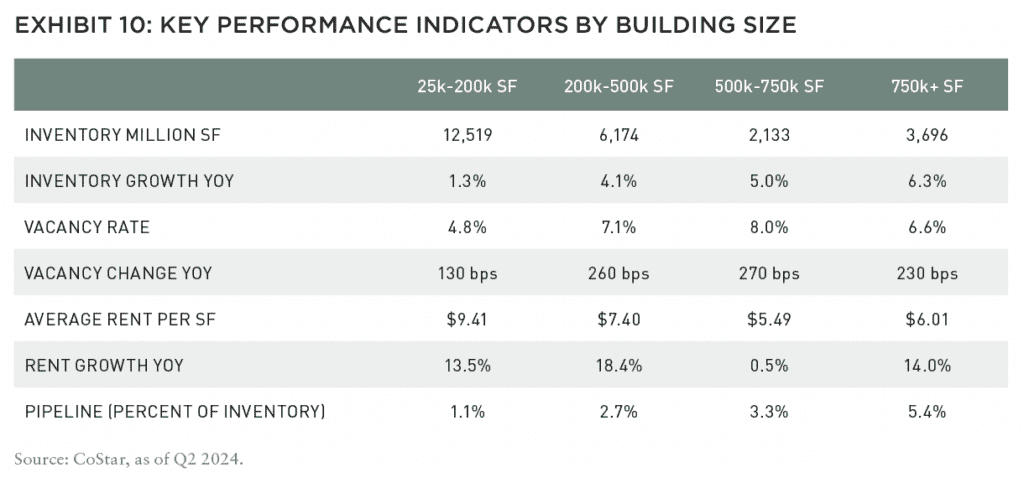

While the broader development slowdown is likely to support fundamentals across the sector, we expect small buildings (typically between 25,000 and 200,000 square feet) in US gateway markets will see steadier performance, navigating toward supply-demand equilibrium relatively quickly.

Development activity has been minimal for small buildings, and as a result, inventory is up only 1.3% year-over-year, stabilizing vacancy rates below 5%.11 Small properties are most common in more mature Global Gateway markets with older inventory, particularly in urban neighborhoods that face a shortage of buildable land. These infill locations also offer easy access to consumers, which is crucial for quick last-mile package deliveries as underscored by Amazon’s plans announced in April to double its network of smaller, same-day delivery sites.12

In contrast to relative steadiness in smaller buildings, mid-sized (500,000-750,000 square feet) and larger (>750,000 square feet) buildings could experience more volatility over the next several quarters because of greater exposure to supply-side risk.

Industrial development activity last cycle was heavily concentrated in larger-footprint buildings such as bulk warehouses that are typically located at the fringes of major metropolitan areas—often regional high-growth or logistics infrastructure markets—and inventory growth for these property subtypes ranges between 5%-6% year-over-year.13

While these expansive buildings are often conducive to the needs of the modern logistics tenants, supply additions have pushed vacancy rates higher, and relatively large pipelines suggest mid-sized and larger properties could see vacancies edge still higher in coming months.14

AN EVOLVING LANDSCAPE

As we navigate through the evolving landscape of the logistics sector in 2024, the trends we have identified underscore a complex and dynamic market. With the moderating macro environment and the changing logistics fundamentals, the critical importance of asset selection and the ability to enhance or develop operational functionality becomes increasingly apparent. The logistics sector’s potential is bolstered by key drivers such as the continued expansion of e-commerce and the resurgence of US manufacturing, both of which signal a new demand cycle that promises substantial growth opportunities.

The strategic focus on US gateway markets, along with the nuanced understanding of different asset subtypes, will be crucial in leveraging these opportunities. The current phase in the economic cycle demands a keen eye for detail in identifying the right locations and property types where limited supply and rising demand intersect to create significant value. As the sector experiences shifts in occupancy and rent dynamics, the capacity to adapt and the emphasis on specialization will differentiate successful players in the logistics real estate market.

By prioritizing areas with strong demographic drivers and proximity to expanding manufacturing clusters, investors can position themselves advantageously in a landscape marked by rapid technological advancements and shifting economic conditions. The path forward is clear: embracing asset selectivity and specializing in functional enhancements will be key to navigating the complexities of the logistics sector and capturing long-term value.

—

NOTES

1. Bloomberg, as of April 22, 2024.

2. CoStar, as of Q2 2024.

3. Moody’s Analytics, Baseline Scenario, as of April 2024.

4. Moody’s Analytics, Baseline Scenario, as of April 2024.

5. Green Street, Industrial Sector Update: Proceed with Caution, November 29, 2023.

6. CBRE, E-commerce’s Impact on Industrial Real Estate Demand.

7. US Census Bureau, US International Trade in Goods and Services (FT900), as of February 2024.

8. US Census Bureau via FRED, Construction Spending, as of February 2024.

9. Various company statements and press releases, national and local press reports, local chambers of commerce, state economic development and other government agencies, Industry Select, Semiconductor Industry Association.

10. CoStar, as of Q2 2024.

11. CoStar, as of Q2 2024.

12. Amazon, CEO Andy Jassy’s 2023 Letter to Shareholders, April 11, 2024.

13. CoStar, as of Q2 2024.

14. CoStar, as of Q2 2024

—

ABOUT THE AUTHORS

Jack Robinson is the Chief Economist and Head of Research at Bridge Investment Group, where he oversees teams specializing in finance, economics, and data science, formulating in-house macro views in support of strategic firm initiatives. Morgan Zollinger is the Head of Market Research at Bridge Investment Group, responsible for cross-sector property market research. Cole Nukaya is an associate on the Bridge Investment Group research team, providing market analytics with a focus on logistics. The authors would like to acknowledge and thank Jay Cornforth, CEO of Bridge Logistics Properties for his comments that informed the direction of this article.

—

THIS ISSUE OF SUMMIT JOURNAL IS GENEROUSLY SPONSORED BY

Founded in 1992, Cerberus is a global leader in alternative investing with approximately $65 billion1 in assets across complementary credit, private equity, and real estate strategies. We invest across the capital structure where our integrated investment platforms and proprietary operating capabilities create an edge to improve performance and drive long-term value. Learn more.

Principal Real Estate is the dedicated real estate investment team of Principal Asset Management, the global investment solutions business for Principal Financial Group®. As a top 10 global real estate manager, with over $98 billion in assets under management and more than 60 years of experience, we provide clients with access to opportunities across both public and private equity and debt. Learn more.