Conventional commercial real estate orthodoxy suggests that adaptive reuse is not an economical investment—but the facts tell a different story.

Today’s conventional wisdom in commercial real estate says that adaptive reuse is not an economical investment. It’s inefficient. It costs an arm and a leg. And it doesn’t work on 1960’s to 1980’s vintage behemoths that make up the bulk of the vacancy due to the depth of the floorplate.

Fortunately for investors, our cities, and the planet, these received truths are mostly wrong.

At my company, Aria, we have adapted everything from a 1960’s Edward Durrell Stone office building with 40,000-square-foot floor plates to an IMF dorm to the former Kansas City Athletic Club; think handball courts into lofts and a grand ballroom. It’s difficult, but it’s doable. And it’s necessary.

While much of the nation suffers from an affordability crisis, there’s 100 million square feet of vacant office in New York alone. Hybrid work models have hit aging office stock hard, leaving their mark on downtowns across the country. A recent McKinsey study projected a decline of 13% in office demand by 2030 in supercities across the globe. Residential demand, meanwhile, is projected to increase, making adaptive reuse a must-have in any forward-looking real estate investor’s arsenal.

Adaptive reuse is not for the faint of heart and can often lead first-timers astray. Based on longtime experience and the school of hard knocks, this article outlines few key points for a financially successful adaptive reuse project.

PICK THE RIGHT LOCATION

Like all real estate, adaptive reuse is local. Is your project close to transit, groceries, bars, and restaurants? The good news is that most office buildings are close to other office buildings. Future residents might be able to walk to work, which is a huge lifestyle benefit, and saves money.

The hidden advantage of adaptive reuse is often an irreplaceable or high barrier-to-entry location. Well-located converted urban apartments can compete favorably with newer, more expensive high-rise construction, as well as hold their own against similarly priced stick-built garden apartments farther out of downtown areas, requiring a longer commute. Don’t sell location short.

Suburban locations can also work well, provided they are desirable for young professionals, empty nesters, families, or others likely to become renters. Many suburban office buildings offer more height and views beyond what is available in local garden-style construction. That said, people need to want to live in those places. A good rule of thumb is: if rents are high enough to support ground-up construction in the location, adaptive reuse should also be feasible. If nearby apartment buildings have more than a 95% occupancy rate, that’s a great sign. Don’t be seduced, however, by the siren song of a great asset in a mediocre location.

ACHIEVE DENSITY WITH CREATIVE FLOOR PLANS AND UNIT MIX

Don’t try to apply cookie-cutter Class A apartment floorplans to office conversions. It won’t work. Aria has spent a decade designing different units that work in deep floorplates, in order to generate enough density to make adaptive reuse work.

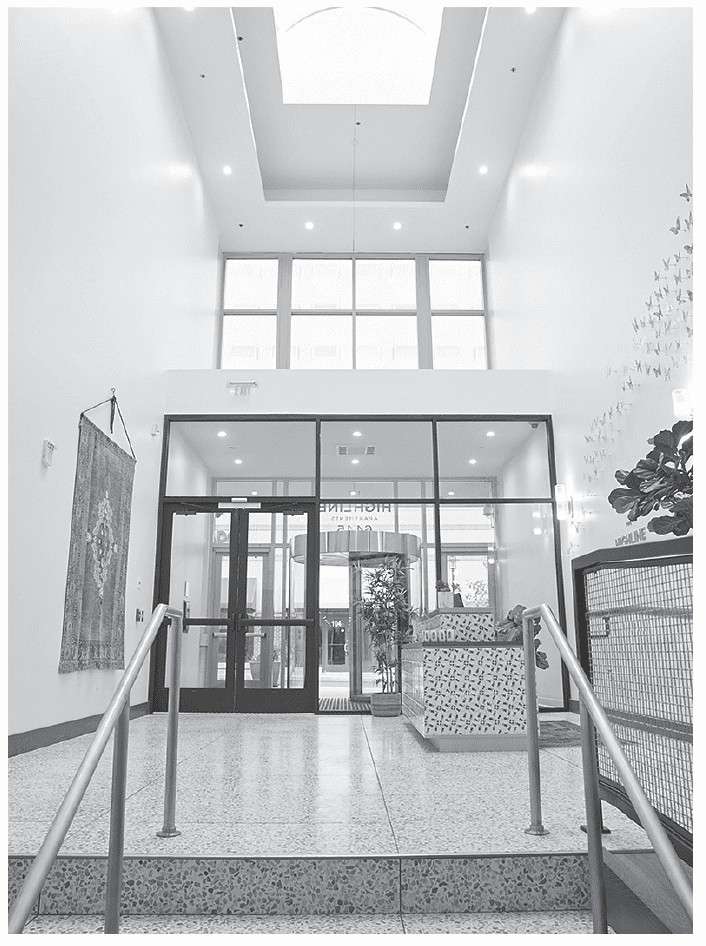

At one of our office-to-residential conversions outside DC, the Highline Hyattsville, which we converted in partnership with The Bernstein Companies, we had to deal with football-field-sized floor plates. We collaborated with the architects to design innovative unit types, including alcove studios, “junior one-bedrooms,” “junior two’s,” micro-units, and even the tastily named “strudel” unit. Opinion was divided as to whether these units would be a success. (P.S. The 24 “strudel” units sold out within weeks of the project opening.)

It’s also important to recognize that in tight times, people often share apartments to save money. Thoughtfully designed roommate apartments—often considered co-living—can be a bargain for the tenant and a boon for the investor. That’s because two people with two incomes can share a space marginally larger than a one bedroom, especially utilizing that deep floorplate. At The Bond apartments in DC, we took a floorplate of five one-bedrooms and four studios utilized as extended-stay hotel/dormitory for the International Monetary Fund, and converted it into four two-bedrooms, three one-bedrooms and three studios.

Our economical small two-bedrooms are designed to be shared and are very livable. After touring in person, people are often shocked to learn the actual square footage of the units. As my partner David Arditi has noted, not all square feet are created equal.

The market has spoken and these diverse unit types are a hit. Density is required to make the numbers work. The two go hand in hand. If you try to use conventional architecture here, you’ll end up with 1,000 SF one-bedrooms and your pro forma on life support.

DON’T BE AFRAID OF UGLY

Do bay windows shaped like a supersonic airplane cockpit sound like a good idea? Yeah, it was the 1960’s. Roll with it. Don’t forget, people live in the inside of the building, not the outside. For the most part people will only look at the ground floor anyway. Pink marble elevators? Turn it into a retro design statement.

The truth is that many of the best candidates for office-to-residential conversion are obsolete buildings that aren’t about to win any Architectural Digest awards. For every exquisite historic jewel box with perfect floorplates, there are a dozen leviathans from the 1960’s. But for the right price, people will live in anything to get a prized location. So don’t sweat the small stuff. Anything is convertible at the right price with the right design approach.

DON’T OVERPAY

There is real risk associated with adaptive reuse. It’s important to strategically mitigate this risk while seeking outsized returns. Chief among our risk-mitigation strategies is investing at a low basis, which provides a “margin of safety” in case costs run high or market conditions change.

It’s important not to be fooled by a seemingly low price. While it is tempting to buy a twenty-story building for the price of a New York condo, the feasibility of a project is based on many detailed architectural factors, the number of exposures that have adequate light and air, and other factors. These factors combined with the construction costs will determine the price per pound of the building once renovated. That’s what makes or breaks the deal; not the sticker price going in. Like good advice, as the old joke goes, in some cases the building costs nothing and is worth the price.

Adaptive reuse projects at the right price are most readily available through special situations. Illiquid assets may be often secured at a lower basis than a ready-made trophy asset because they’re distressed, underperforming, or otherwise overlooked by the competition. Mind the basis, on the way in and on the way out. It’ll make transforming an asset through adaptive reuse less risky and more rewarding.

WORK WITH GOVERNMENT AGENCIES

There are often a wide variety of incentive programs that are compatible with adaptive reuse. Environmental sustainability credentials (adaptive reuse is much more climate-friendly than ground-up construction), federal and state historic tax credit programs, or state and local affordability and tax abatement programs often combine to make the numbers work.

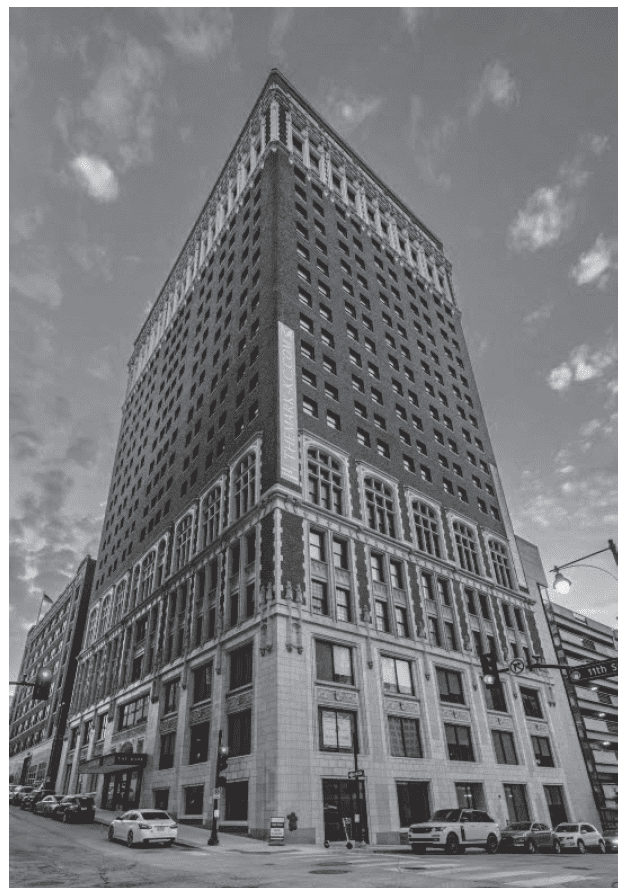

In Kansas City, our restoration and conversion of the former KC Athletic Club benefitted from historic credits which helped offset the cost of the construction work. The preservation guidelines overseen by the State Preservation Office do not come cheap, but in this case, they helped preserve a historic ballroom that adds character to the development and will bring wedding and event revenue. Adaptive reuse often fulfills goals for the municipality as well as the investor, so be on the lookout for a win-win with public agencies.

EXPLORE NONTRADITIONAL SOURCING AND PARTNERSHIPS

Often the most interesting adaptive reuse candidates are sourced through nontraditional relationships. These could be folks who have done it before, lenders or attorneys with insight, scrappy construction wizards, or just owners who see the potential for a conversion but want someone to do it with them.

Making these deals work is difficult because they bring together so many disciplines that don’t always come together naturally—an eye for value, appreciation of history, a knack for floor plans, willingness to roll up your sleeves in construction, along with complex financial and legal structuring. Best to try it with seasoned hands; it gets easier each time.

BRING IT TO LIFE WITH AMENITIES

This is where the human touch is needed to bring an obsolete office building to life. Our 1960’s office building was occupied since inception by the IRS. We took the glassy, former entryway and turned it into a Moroccan-inspired sunroom. During the COVID-19 pandemic, a young couple ended up getting married in it!

We took some of the extra deep space and made a lounge, gym, vintage-design rockstar room with musical equipment, co-working offices for WFH, and an “alone together” room based on the insight of the architect that people enjoyed doing solo work or schoolwork with others around, though not necessarily together.

You know you’ve succeeded when people who toiled in the building for 30+ years come into the new space and start looking around funny. They can’t believe they’re looking at the same soul-crushing office they’ve clocked into every day for decades—they think they’ve walked into the wrong building!

DISPELLING MYTHS

I hope to have dispelled some of the myths around adaptive reuse. Yes, it can be difficult, expensive, time-consuming, and a pain in the neck if you do it the wrong way. But it can also be very profitable when done right. To paraphrase (or should I say, “adaptively reuse?”) Churchill’s famous quip about democracy: adaptive reuse is the worst form of construction, except for all those others that have been tried in the course of time.

IN THIS ISSUE

NOTE FROM THE EDITOR: WELCOME TO #13

Benjamin van Loon | AFIRE

OFFICE TROUBLES: FINANCIAL RISKS AND INVESTING OPPORTUNITIES IN US CRE

Dr Alexis Crow | PwC + Byron Carlock

THE UNDERPERFORMANCE PARADOX: WHY INDIVIDUAL INVESTORS FALL BEHIND DESPITE BUYING LOW

Ron Bekkerman | Cherre + Donal Ward | Tenney 101

CLIMATE THREAT: EXTREME WEATHER IS THE NEW NORMAL FOR REAL ESTATE

Jacques Gordon, PhD | MIT

CLIMATE OPPORTUNITY AWAITS: HOW REAL ESTATE CAN INVEST IN CLIMATE ADAPTATION

Michael Ferrari, PhD and Parag Khanna, PhD | Climate Alpha

PREMIUM PRICE TAGS: INSURABILITY THROUGH PROPERTY RESILIENCE DATA

Bob Geiger | Partner Engineering & Science

REAL ESTATE WEB3: THE EMPEROR’S NEW CLOTHES OR THE NEXT BIG THING?

Zhengzheng Tan, Alice Guo, and Naveem Arunachalam | MIT

ADAPTIVE TO REUSE: COULD BUILDING CONVERSIONS BE DIFFICULT, EXPENSIVE . . . AND STILL PROFITABLE?

Josh Benaim | Aria

RENOVATE, REBRAND, REPOSITION: ADDING VALUE TO MULTIFAMILY THROUGH REVITALIZATION

Robert Kilroy, CFA | The Dermot Company + Will McIntosh, PhD | Affinius Capital

REDEFINING THE PROGRAM: A CONVERSATION WITH ARCHITECT DAVID THEODORE

Peter Grey-Wolf | Wealthcap + David Theodore | McGill University

SENIOR HOUSING UPDATE: EMERGING OPPORTUNITIES THROUGH DEMOGRAPHIC TAILWINDS AND DIMINISHING SUPPLY OUTLOOK

Robb Chapin, Jack Robinson, Andrew Ahmadi, and Morgan Zollinger | Bridge Investment Group

SENIOR HOUSING UPDATE: UNPRECEDENTED DEMOGRAPHIC ACCELERATION MAY DRIVE STRONG OPERATING FUNDAMENTALS AMID ECONOMIC SLOWDOWN

Tom Errath | Harrison Street

HOLIDAY FROM HISTORY: REASONS FOR US OPTIMISM IN A CHANGING GLOBAL ENVIRONMENT

Charlie Smith | Newmark

CRADLE TO CRADLE: AN ALLOCATOR’S VIEW ON IMPLEMENTING ESG INITIATIVES

Christopher Muoio and Katie Cappola | Madison International Realty

FREE LUNCH: MULTI-DIMENSIONAL DIVERSIFICATION IS A FULL-COURSE FREE MEAL

Elchanan Rosenheim and Tali Hadari | Profimex

CAMPAIGN MESSAGING: CFIUS, AFIDA, AND EXPANDING FEDERAL AND STATE RESTRICTIONS ON FOREIGN INVESTMENT IN US REAL ESTATE

Caren Street, John Thoms, and Anya Ram | Squire Patton Boggs

—

ABOUT THE AUTHOR

Joshua Benaim is Founder and CEO of Aria, an award-winning real estate company focused on next generation multifamily, value investment and special situations investing, and creative real estate development.

—

THIS ISSUE OF SUMMIT JOURNAL IS PROUDLY UNDERWRITTEN BY

For more than 20 years, Yardi has developed real estate investment management software that helps managers of global assets valued at trillions of dollars make informed investment decisions. Yardi Investment Suite clients include many of the world’s premier investment management funds, start-ups and partnerships of all types and sizes.

Real estate investments grow on Yardi. That’s because the Yardi Investment Suite automates complex investment management processes and provides full transparency, from the investor to the asset. Through interactive dashboards, investors can view documents and have access to reports and metrics. Collaboration is easy when your advisor or accountant is given access to view your accounts, reducing the need for emailing sensitive information.

The Yardi Investment Suite leads the real estate industry through innovation and value with fully integrated investment management, property management and accounting functionality. Fund managers and their customers can manage assets with superior efficiency and ease. Learn more.