VISIBILITY INTO THE UNDERLYING CASH-FLOW STREAMS IN REAL ESTATE ENABLES INVESTORS TO APPLY A 360-DEGREE APPROACH TO THEIR PROPERTY STRATEGY

A universal approach to property allocation can offer investors superior risk-adjust returns throughout the property cycle, but applying this approach to suit the real estate asset class demands full visibility into underlying cash-flow streams.

Fortunately, the unique characteristics of the property market make it possible to build a true, 360-degree approach to property strategy and portfolio allocations.

SEEKING EFFICIENCY IN AN INEFFICIENT MARKETPLACE

Real estate assets are fixed and heterogeneous, and the acquisition process for direct property investments is both expensive and time-consuming, especially based on requirements for due diligence requirements (e.g., physical asset technical inspection, legal review, etc.).

The capital-intensive nature of property has led to the development of four quadrants of property investment: public, private, debt, and equity. The liquidity of each quadrant often varies and, regardless of strategy, a desired investment may not be readily available on the open market. This dynamic is accentuated at the inflection points in the property cycle, when a large bid-ask spread causes liquidity in some market segments to dry up. However, these points are precisely when some of the best investment opportunities can arise in the private market. Market participants who have a deep understanding and broad reach in a local market can often benefit from a first-mover advantage to reset pricing.

Because direct property is not traded on a centralized exchange, there are a number of data and market transparency complexities compared to most equity and fixed-income investment alternatives. The result is a real estate marketplace comprised of relatively low transparency and asymmetric information, which can provide a source of relatively high risk-adjusted returns to investment managers who have access to “quality” information through local exposures.

Additionally, a lack of frequent transaction data for the analysis of return distributions often necessitates the use of appraisal-based valuations, which tend to underscore the disconnect between the timing of data release and what is actually occurring in the transactional market (although there is a growing trend of transaction-based indices in the most liquid global markets). Combined with the cyclical nature of occupancy, these factors tend to create a relatively inefficient marketplace with accretive, relative-value investment opportunities.

FOCUS ON RISK-ADJUSTED RELATIVE VALUE

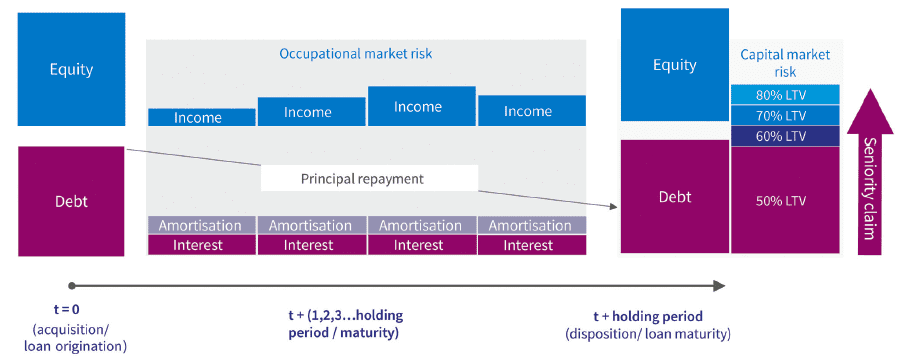

Optimal positioning of a property investment within the capital stack – to either take advantage of upside potential, or to protect against downside risk – based upon an assessment of the position within the full property cycle is at the root of the 360-degree approach. The ability to assess market pricing for the prospective cash flow streams of a given investment is integral to this approach.

These prospective cash flows can be segmented into recurring rental income during the holding period, and sale proceeds at the time of disposition for equity investment. This is visualized in Exhibit 1, which also shows that, in the case of debt, cash flows would take the form of interest payments and loan repayments at maturity date.

The 360-degree approach consists of looking at the four quadrants of property investment in a given market or region to assess the underlying risk-reward characteristics, as well as market pricing for the entirety of the capital stack and various investment vehicles.

Horizontal relative-value strategies consider investment alternatives across either debt or equity instruments, while vertical comparisons look up and down the capital stack for relative attractiveness of debt versus equity investment in a given market. Traditionally, each quadrant is priced in isolation, with specific capital sources driving pricing based on regulatory constraints. For example, market participants often price a property investment relative to other asset classes, rather than comparing debt and equity pricing on the same underlying property or, if applicable, to comparable quality-listed property company stocks or bonds. The result of this isolated approach to investing in the real estate asset class is property-market pricing which is disconnected with the inherent risk-reward relationship up and down the property capital stack and across instruments.

(The cash flow, risks, and capital structure depicted are for illustrative purposes only. The actual capital structure, cash flows, and risks associated with a particular real estate investment will depend on the terms and structure of such investment and may differ materially from the above.)

Source: AXA IM – Real Assets

APPLYING A 360-DEGREE APPROACH TO PORTFOLIO CONSTRUCTION

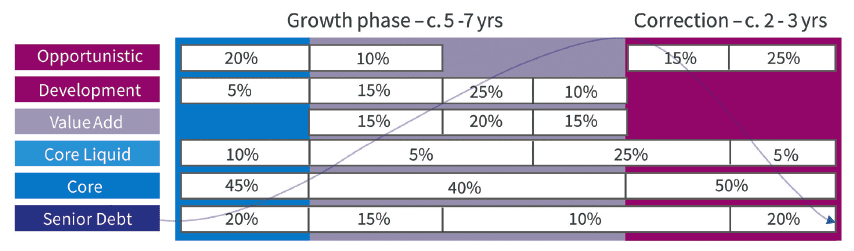

Within the broader context of portfolio construction, this 360-degree approach can be used to calibrate an overall real estate allocation across the property cycle, based on an investor’s underlying risk threshold.

A core holding of direct, unleveraged core properties should be at the foundation of a property portfolio, because a 100% fee ownership affords property owners the ability to control their own destiny with the asset. Outside of core property holding, value-add and development risk would be added during the growth phase of the property cycle to exploit the higher property-level returns available when the market is expanding, and rents are growing.

Opportunistic and senior debt investments can offer better investment opportunities and liquidity during the adjustment phase of the property cycle, particularly when distressed assets provide deal fl ow for opportunistic strategies, and when loan-to-value ratios drop – and lending margins widen – on depressed real estate values. The core liquid real estate investment is used as a tool to maintain full exposure to underlying property performance via the listed space, with the added benefit of daily liquidity, which can be used to fill gaps between the times it can take to enact the various private market strategies.

Exhibit 2 shows a hypothetical example of how an investor targeting an 8% per annum property return could utilize the 360-degree approach in practice to calibrate a property portfolio throughout the property cycle. Additionally, investors can also tailor their property portfolios towards a specific industry segment mix, or towards particular macroeconomic growth themes, because property performance is often directly correlated with local economic market prospects — some of which are geared towards a specific industry segment (e.g., the exposure of Silicon Valley real estate to the technology sector).

(Allocation depicted is for illustrative purpose only and is intended to show the strategy that AXA IM – Real Assets would adopt if it was a low risk investor looking to design its own real estate portfolio. Such allocation is not intended to be investment advice to the recipient and does not take into account particular needs of the recipient. Definition of investment styles is based on AXA IM Real Assets’ own subjective interpretation of each such investment style.)

Source: AXA IM – Real Assets

HONING THE APPROACH

By considering opportunities across the four quadrants of property investment, including the entirety of the capital stack and all real estate investment instruments, investors can leverage 360-degree insights for a more targeted strategy approach. For example, investors looking to build a targeted property portfolio that capitalizes on strong convictions or global trends (e.g., demographics, e-commerce trends, Millennial influence, etc.) may find it difficult to source transactions directly on the private real estate markets. The universe of listed real estate may actually offer immediate access for an existing portfolio and in-place management platform. By incorporating a more holistic approach to real estate allocations, investors and managers may be able to overcome some of the pitfalls associated with a traditional, siloed approach to investment.

By applying a 360-degree approach to portfolio construction throughout the property cycle, and constantly monitoring relative-value pricing across the four quadrants, investors have the potential to optimize their overall risk-adjusted return profiles. This approach is anchored on a manager’s ability to perform fundamental research and read the cycle in order to find relative value trades up and down the capital stack, and across the various investment instruments.

Additionally, the 360-degree approach to property could also be used to create blended real estate products that seek to circumvent some of the inherent difficulties in building property allocations while remaining rooted in offering underlying property-level investment performance.

Deploying capital into direct property takes time, and traditionally involves a significant commitment period that can sometimes take more than fi ve years to implement. By utilizing a 360-degree approach to the asset class, investor allocations can be tailored to an investment target, be it return-oriented, catering to liquidity needs, risk threshold, or a wider combination of objectives. By working with investment managers that offer the full suite of property investments, such tailor-made portfolio solutions can be more readily implemented and monitored over the course of the property cycle.

—

ABOUT THE AUTHOR

Justin Curlow is Global Head of Research and Strategy for AXA IM – Real Assets, which is fully part of AXA Investment Managers, the asset management arm of the AXA Group, a world leader in global insurance and financial protection.

THIS ARTICLE ORIGINALLY APPEARED IN SUMMIT: ISSUE #2

—