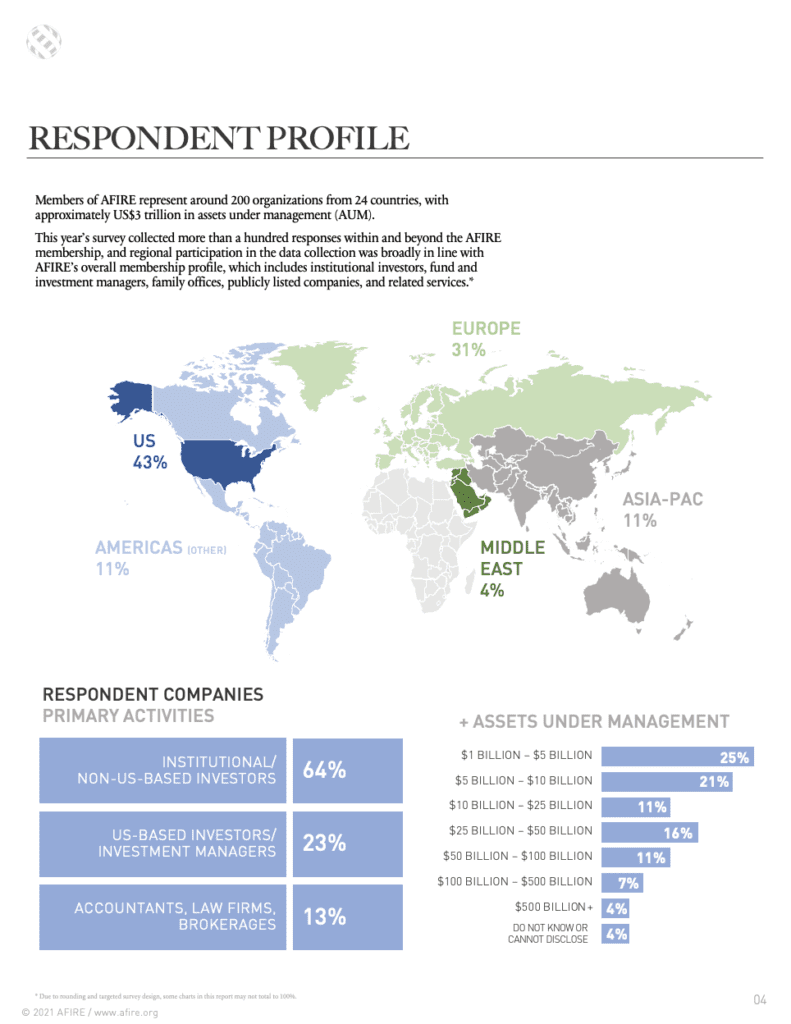

For thirty years, the AFIRE International Investor Survey has gathered the opinions of AFIRE’s members—representing almost 200 organizations from 24 countries, with approximately US$3 trillion in assets under management (AUM)—to construct a useful tool for investors, regulators, and the media to understand the goals, challenges, and impacts of international investments on US real estate opportunities.

The 2021 survey, conducted in March 2021 and underwritten by Holland Partner Group, reflects investor sentiment and was designed to help understand the goals, challenges, and impacts of international investments on US real estate opportunities. Key insights from the survey report show:

INVESTOR OUTLOOK IS POSITIVE

Three in four investors expect their volume of US real estate investment activity in 2021 to increase, with six in ten foreseeing revenue growth.

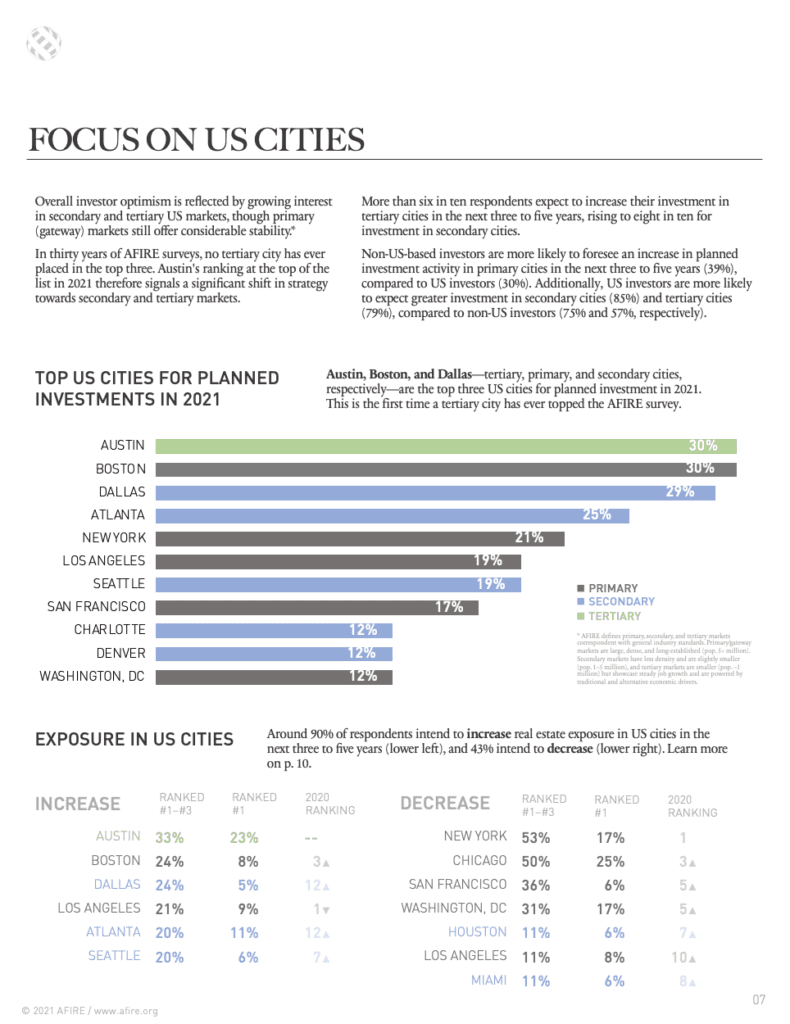

AUSTIN, BOSTON, AND DALLAS

Are the top three US cities for planned investment this year and for intended investment exposure increase in the next three to five years.

MULTIFAMILY AND INDUSTRIAL

Multifamily property remains most favored property type, with 86% intending to increase exposure in the next three to five years, followed by industrial at 79%.

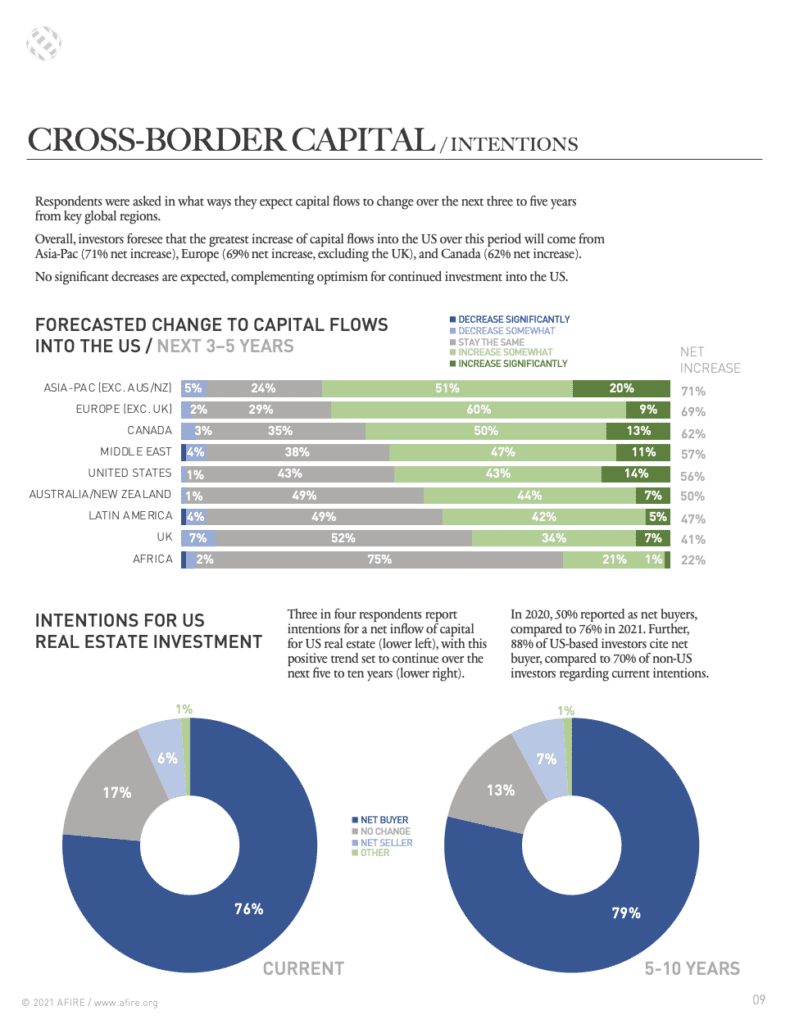

ASIA-PAC, EUROPE, AND CANADA

Are the top three regions for increased capital flow into the US in the next three to five years, though most of the capital for US investment (35%) also originates in the US.

ECONOMICS AND CLIMATE CHANGE

Changes in tenant demand, economic inequality, climate change, and economic growth feature are among the key areas of concern impacting US real estate activity.

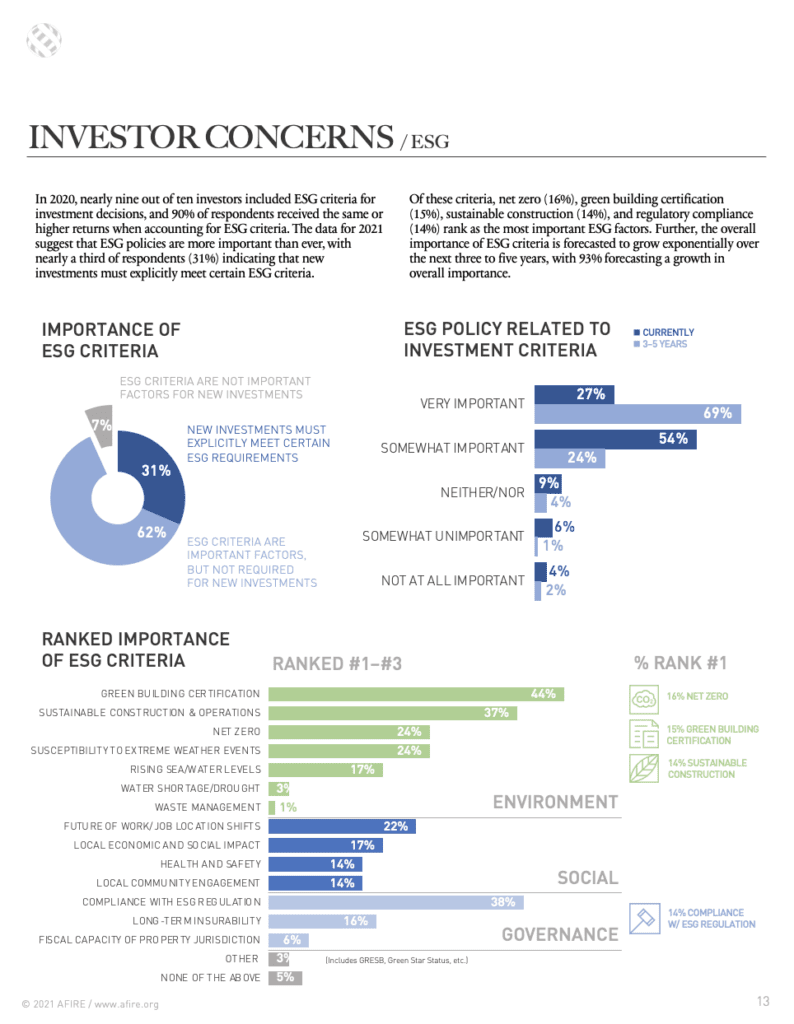

ESG URGENCY

Nine in ten investors view ESG as increasingly imperative over the next three to five years, and three in ten already require new investments to meet established criteria.

POPULATION AND INNOVATION

Innovation, demographic forecasting, economic and geopolitical stability, and supportive investment policies will be key for success in US real estate over the next decade.

ENTER YOUR INFORMATION BELOW TO DOWNLOAD THE REPORT

Reports will be sent within 12-24 hours of request, or sooner.

All information contained in this report is the intellectual property of AFIRE. No sale or sub-licensing of the data is permitted; nor shall any data be altered or overwritten in this report.

Reprints and/or redesigns are permitted, with the following source attribution in all instances: “Source: As of March 2021; 2021 AFIRE International Investor Survey, underwritten by Holland Partner Group; www.afire.org.”

Please contact Benjamin van Loon, Communications Director, bvanloon@afire.org, for hi-res graphics, data sets, reprints, and other uses.

ABOUT THE 2021 AFIRE INTERNATIONAL INVESTOR SURVEY REPORT

The annual survey has been conducted for three decades and is used by institutional investors, investment managers, and non-US-based investors to understand sentiment, trends, and capital flows for global institutional investment in real estate. The 2021 survey was collected in Q1 2021 from the AFIRE membership, which represents close to 200 organizations with approximately US$3 trillion AUM, and the global institutional investor community. The report is underwritten by Holland Partner Group and was facilitated by PwC Research.

ABOUT AFIRE

AFIRE is the association for international real estate investors focused on commercial property in the United States. Headquartered in Washington, DC, AFIRE was established in 1988 to provide an essential forum for real estate investment thought leadership. AFIRE membership is exclusive, granted by invitation only, and currently includes more than 200 organizations from around the world representing institutional investors, investment managers, and service providers representing approximately US$3 trillion in assets under management. Learn more at afire.org.

ABOUT HOLLAND PARTNER GROUP

Founded in 2000, Holland Partner Group (HPG) based in Vancouver, Washington, is a fully integrated real estate investment company. HPG principals’ development and acquisition volume exceeds $15 billion, representing 50,000 apartment homes located in the Western United States’ most sought after markets. Our company accomplishes our investment objectives in strategic alignment with our capital partners through our five integrated operating companies, including development, construction, acquisition, redevelopment and property management. Our vertically integrated focus has developed the real estate industry’s most consistent and reliable delivery platforms. Our combined business volume is expected to exceed $2 billion annually through our 750-member team. Learn more at hollandpartnergroup.com.

—